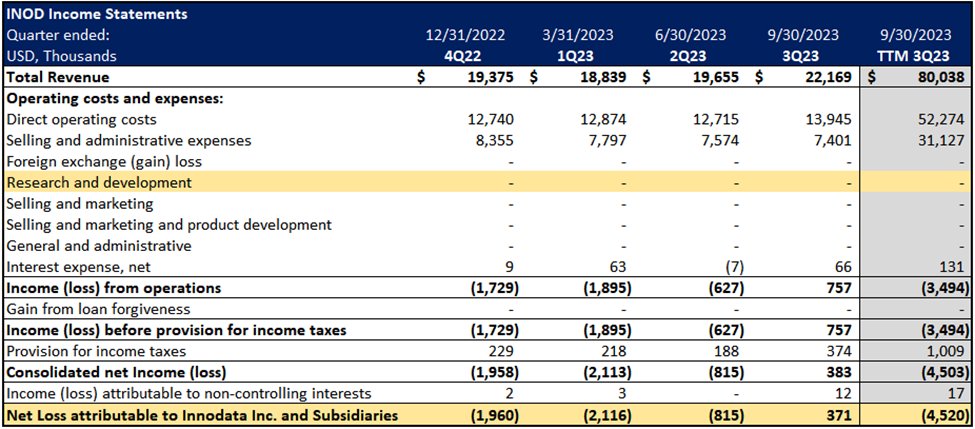

In this @zer0estv interview, which was recorded before $INOD reported its 3Q23 numbers, Dan lays out the case for why this deteriorating data entry company is more like Initech from the movie Office Space than a serious AI company. The numbers $INOD posted in 3Q23 only reinforce our opinion of $INOD – we will provide them below:

- Didn’t report any R&D expense in 3Q23

- 3Q23 cash: $14.8m ($5.1m held overseas)

- 3Q23 PP&E: $2.4m (-13% y/y)

- 3Q23 TTM net loss: ($4.5m)

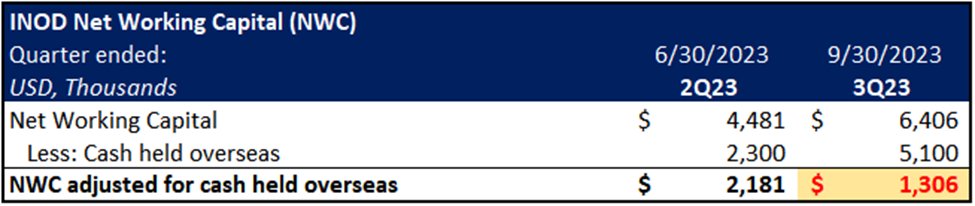

- 3Q23 NWC: $6.4m ($5.1m cash held overseas leaves only $1.3m of NWC available to the US parent co.)

- Didn’t report any R&D expense in 3Q23

- 3Q23 cash: $14.8m ($5.1m held overseas)

- 3Q23 PP&E: $2.4m (-13% y/y)

- 3Q23 TTM net loss: ($4.5m)

- 3Q23 NWC: $6.4m ($5.1m cash held overseas leaves only $1.3m of NWC available to the US parent co.)

All numbers above are from $INOD's 3Q23 earnings press release (), its 3Q23 10-Q () and previous SEC filings.

Additionally, at the time Dan made this recording, $INOD did not have any software engineer positions listed on its website.

In late January 2024, $INOD finally posted a job for a software engineer with experience in AI, although it doesn't appear to have been filled as the deadline to apply has already passed.

See ya sub $5, $INODbamsec.com/filing/1104659…

bamsec.com/filing/1410578…

Additionally, at the time Dan made this recording, $INOD did not have any software engineer positions listed on its website.

In late January 2024, $INOD finally posted a job for a software engineer with experience in AI, although it doesn't appear to have been filled as the deadline to apply has already passed.

See ya sub $5, $INODbamsec.com/filing/1104659…

bamsec.com/filing/1410578…

• • •

Missing some Tweet in this thread? You can try to

force a refresh