Wolfpack Research is a short-biased activist research and due-diligence firm founded by Dan David. For personal/political views follow @Dan_David44

How to get URL link on X (Twitter) App

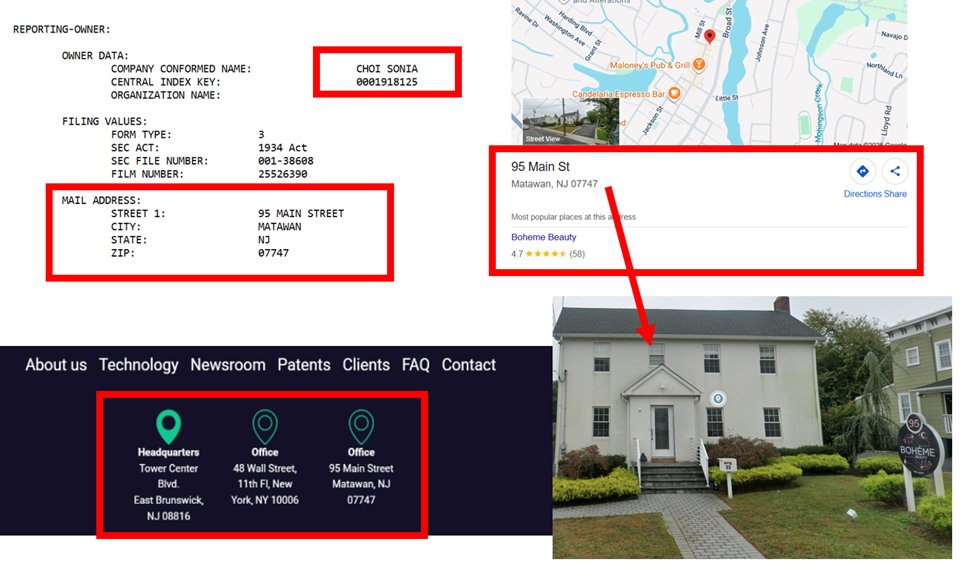

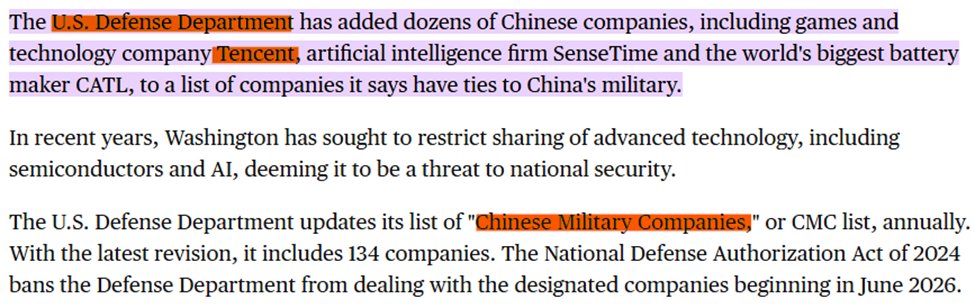

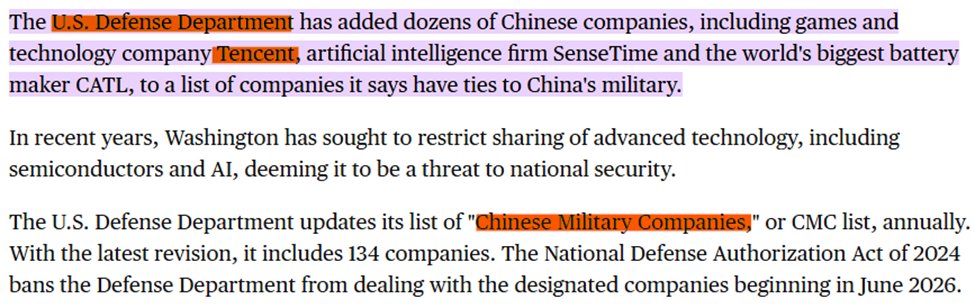

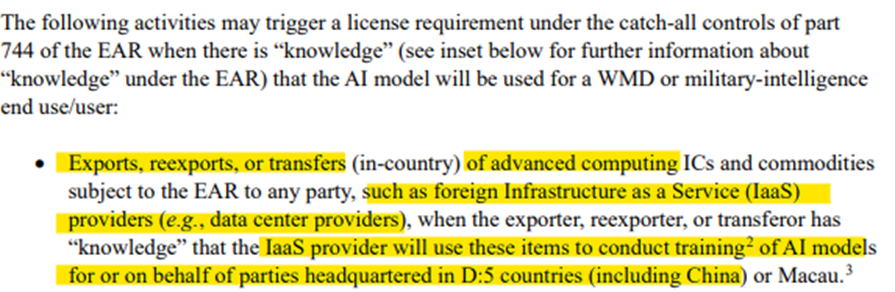

We learned from multiple sources that it is common knowledge in the industry that Datasection's mystery customer is China-based. We were told Datasection let the cat out of the bag that Tencent was its backer while it was pursuing financing from Japanese banks, and that the banks quickly shut their doors due to the horrendous reputational risk. We suspect Chinese involvement was also the reason Datasection changed auditors from PwC Japan to a small, relatively unknown auditor.

We learned from multiple sources that it is common knowledge in the industry that Datasection's mystery customer is China-based. We were told Datasection let the cat out of the bag that Tencent was its backer while it was pursuing financing from Japanese banks, and that the banks quickly shut their doors due to the horrendous reputational risk. We suspect Chinese involvement was also the reason Datasection changed auditors from PwC Japan to a small, relatively unknown auditor.

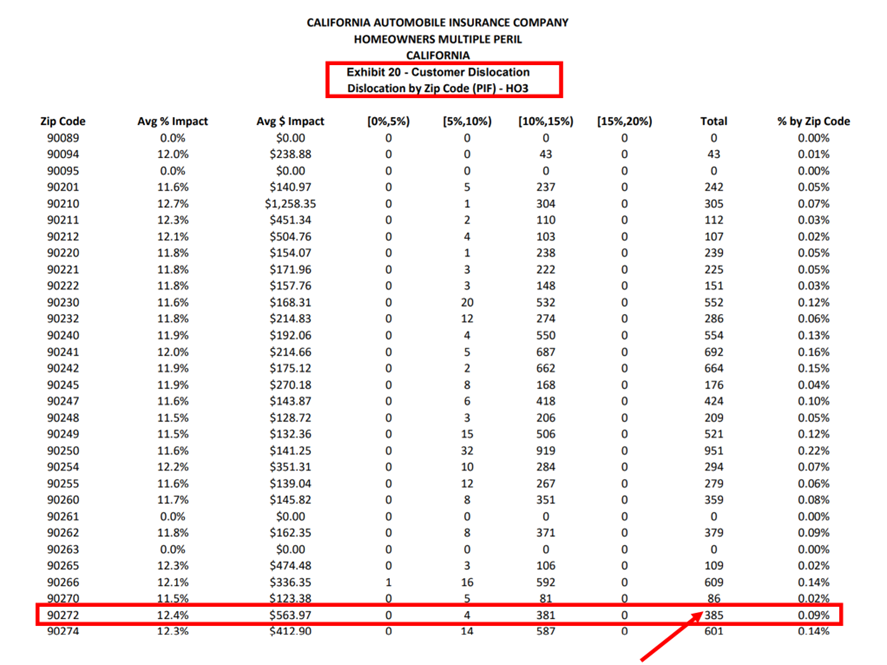

Using $MCY's rate filings, we see $MCY had ~1,300 home and landlord policies in force as of June 2024 between Altadena and the Pacific Palisades.

Using $MCY's rate filings, we see $MCY had ~1,300 home and landlord policies in force as of June 2024 between Altadena and the Pacific Palisades.

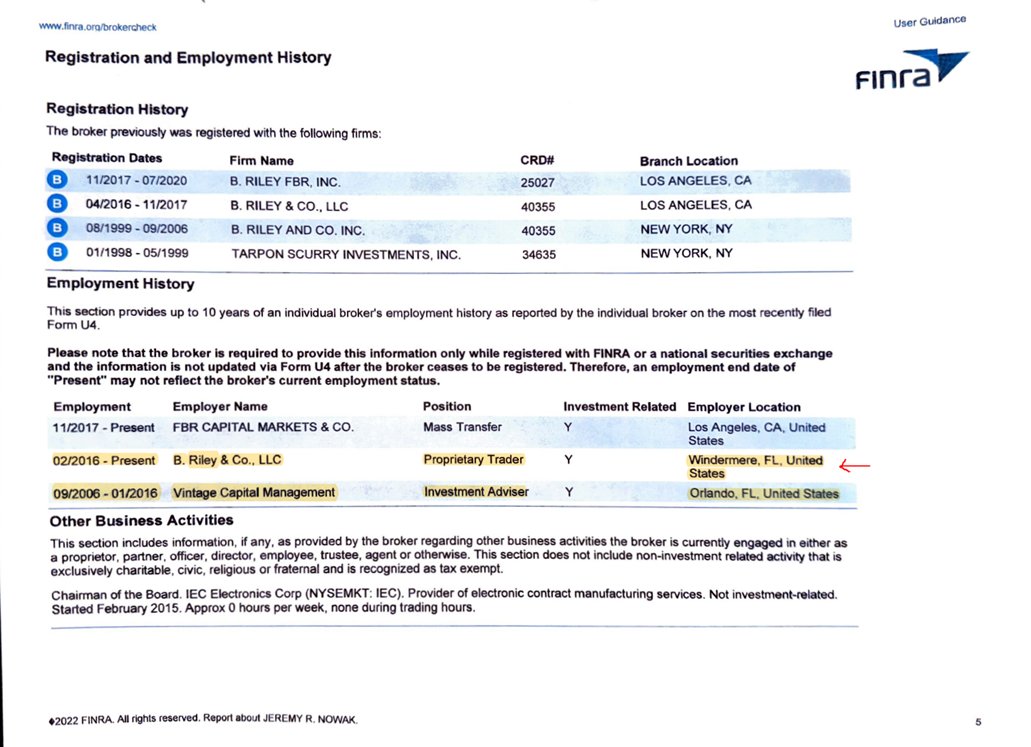

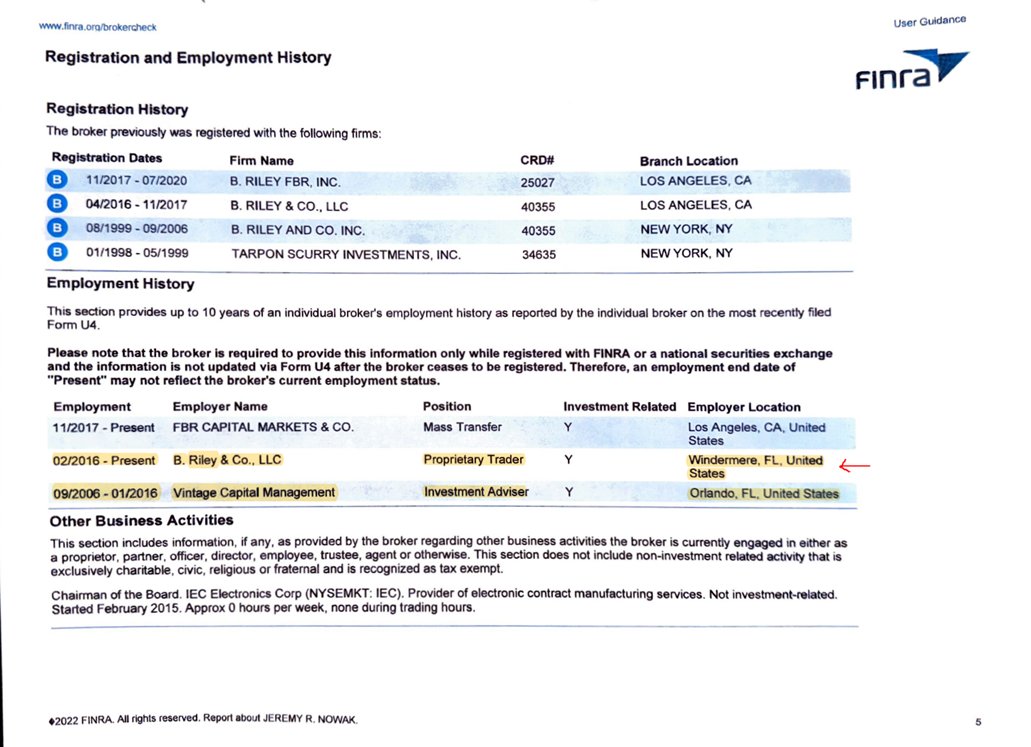

https://x.com/binanceriskmgmt/status/1738619627654234317?s=202/ Nowak’s FINRA employment history says he worked for Vintage Capital from 09/2006 – 01/2016, then began working as a prop trader for $RILY from 02/2016 to present. Interestingly, Nowak continued to work from Windermere FL – where Kahn lives – after supposedly leaving Vintage

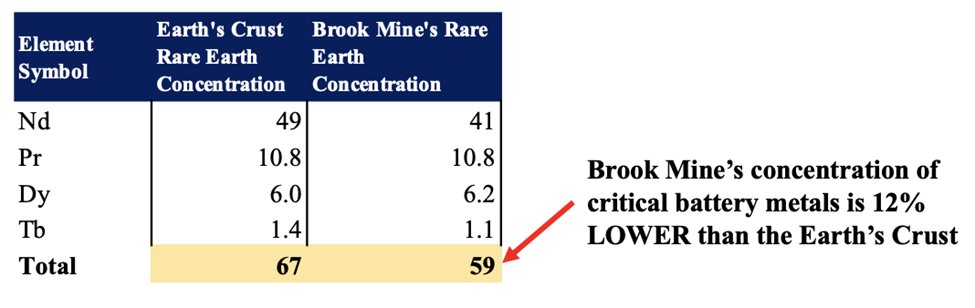

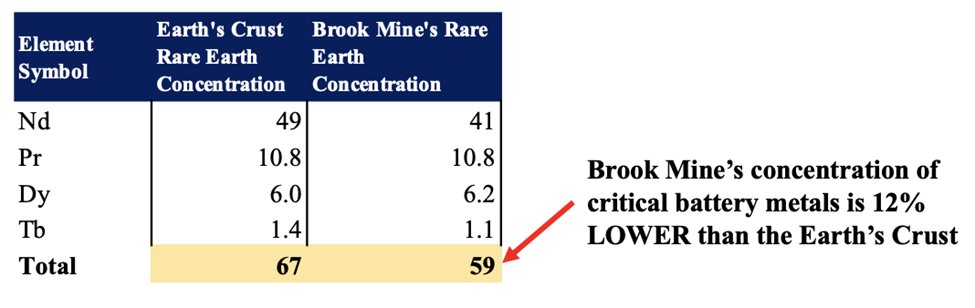

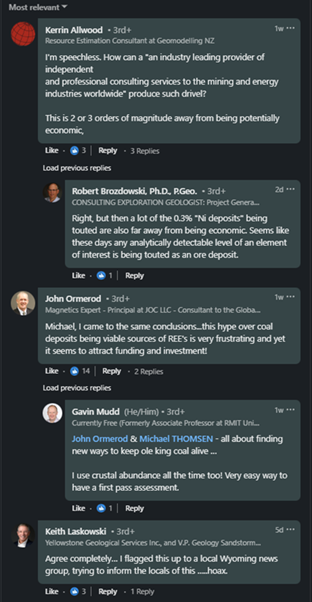

2/ A number of mining professionals appear to have identified the same problem with $METC claims:

2/ A number of mining professionals appear to have identified the same problem with $METC claims:

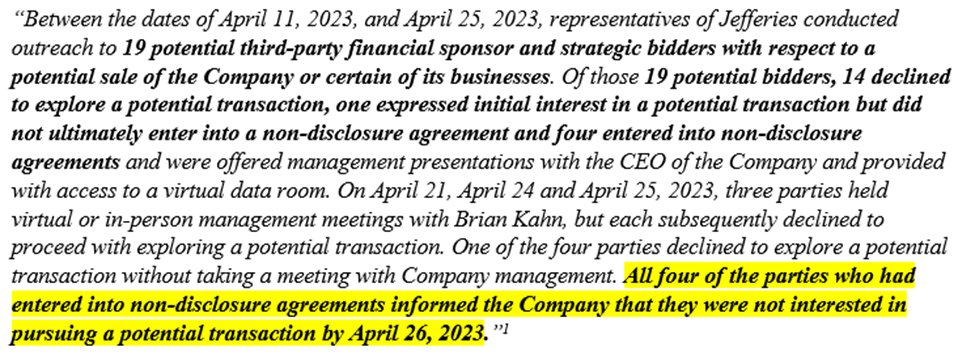

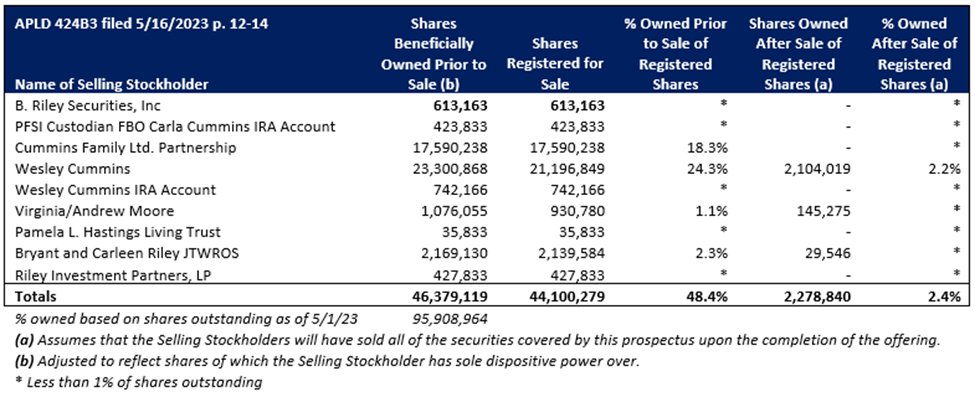

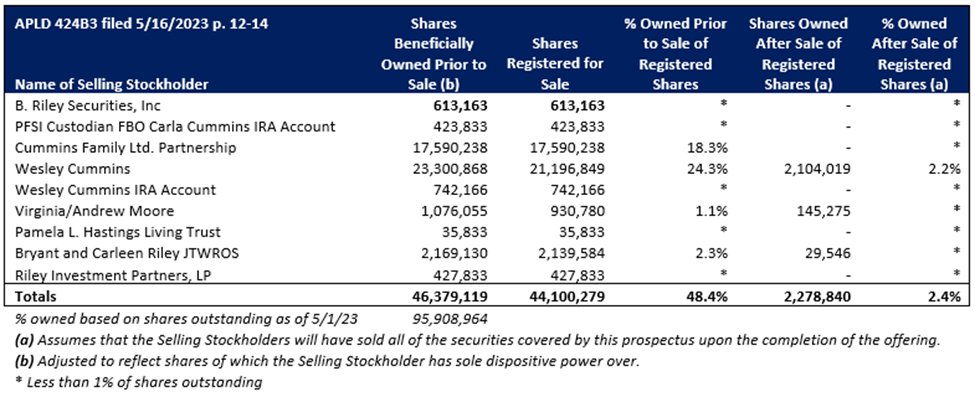

2/ $RILY should’ve known Kahn had been accused of misusing funds in a civil suit from 2022. Yet, $RILY negotiated directly with Kahn anyway in order to get a deal done to take his failing public company $FRG private at $30/share

2/ $RILY should’ve known Kahn had been accused of misusing funds in a civil suit from 2022. Yet, $RILY negotiated directly with Kahn anyway in order to get a deal done to take his failing public company $FRG private at $30/share

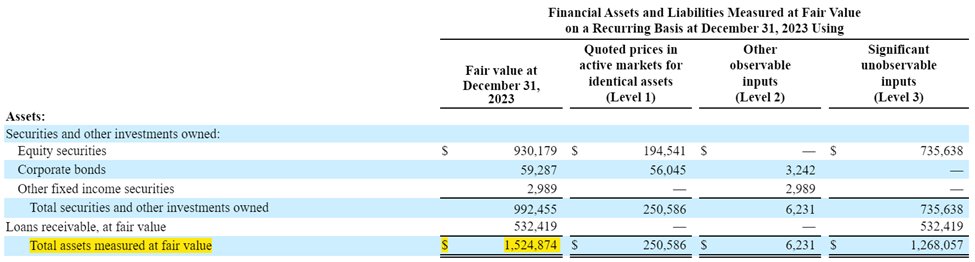

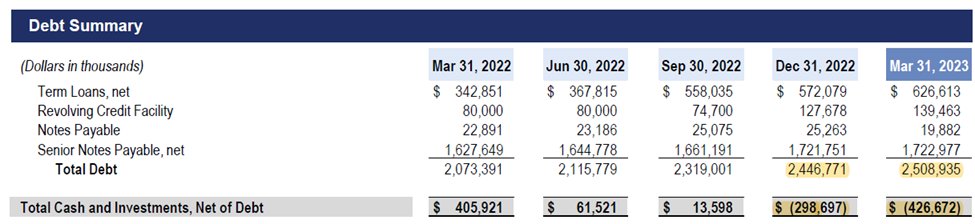

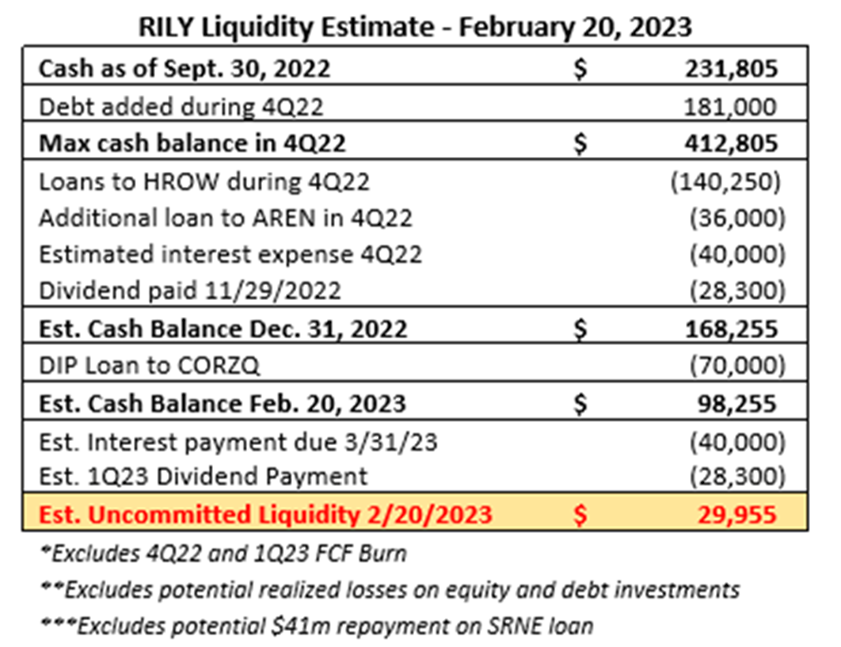

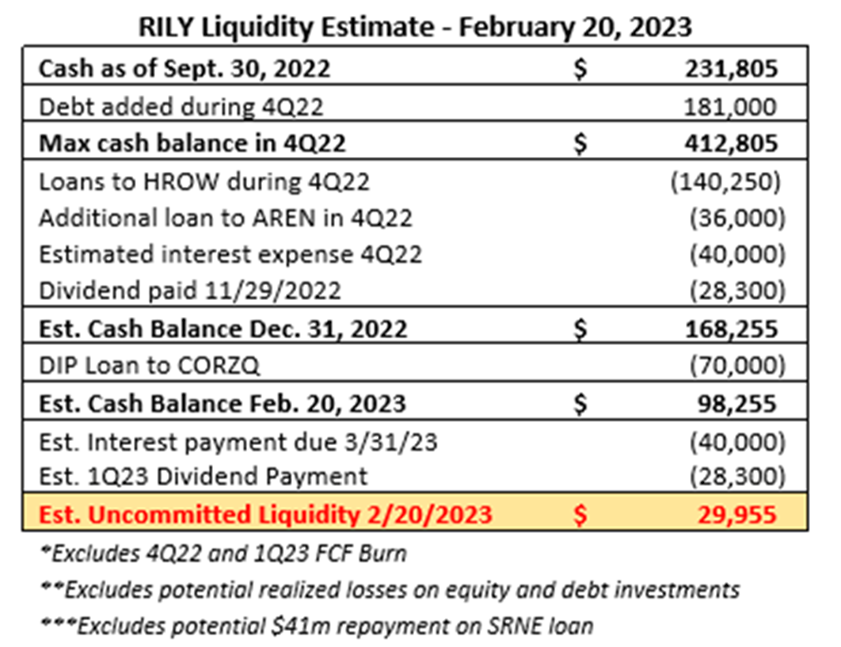

2/ Mgmt would have us believe $RILY is on the upswing, but a closer look at the numbers indicate that it is not:

2/ Mgmt would have us believe $RILY is on the upswing, but a closer look at the numbers indicate that it is not:

2/ The above analysis excludes $RILY's negative OCF & FCF. In the 1st 3 qtrs of 2022, $RILY generated OCF of -$14.9m, -$35m, and -$22.9m, sequentially. We believe these losses persisted in 4Q22 and are continuing today

2/ The above analysis excludes $RILY's negative OCF & FCF. In the 1st 3 qtrs of 2022, $RILY generated OCF of -$14.9m, -$35m, and -$22.9m, sequentially. We believe these losses persisted in 4Q22 and are continuing today