🔥Renault Group almost tricked me. In this thread I briefly discuss why the shown 8.1% (H2 23) operating profit margin is 🐴💩 and Renault didn't report a "record breaking" margin. The reported H2 23 margin is actually a rather disappointing 1.5% based on reported H2 operating income of just €389M and €25,527M in revenue. Renault will not show you this number anywhere in their materials! For the FY2023, Renault only gets to 4.7%! This number too Renault won't show you anywhere.

My original post;

1/ Renault showed this slide with a relatively high 7.6% and 8.1% operating margin for H1 and H2 2023 respectively.

My original post;

1/ Renault showed this slide with a relatively high 7.6% and 8.1% operating margin for H1 and H2 2023 respectively.

https://x.com/alojoh/status/1758137115614052637?s=20

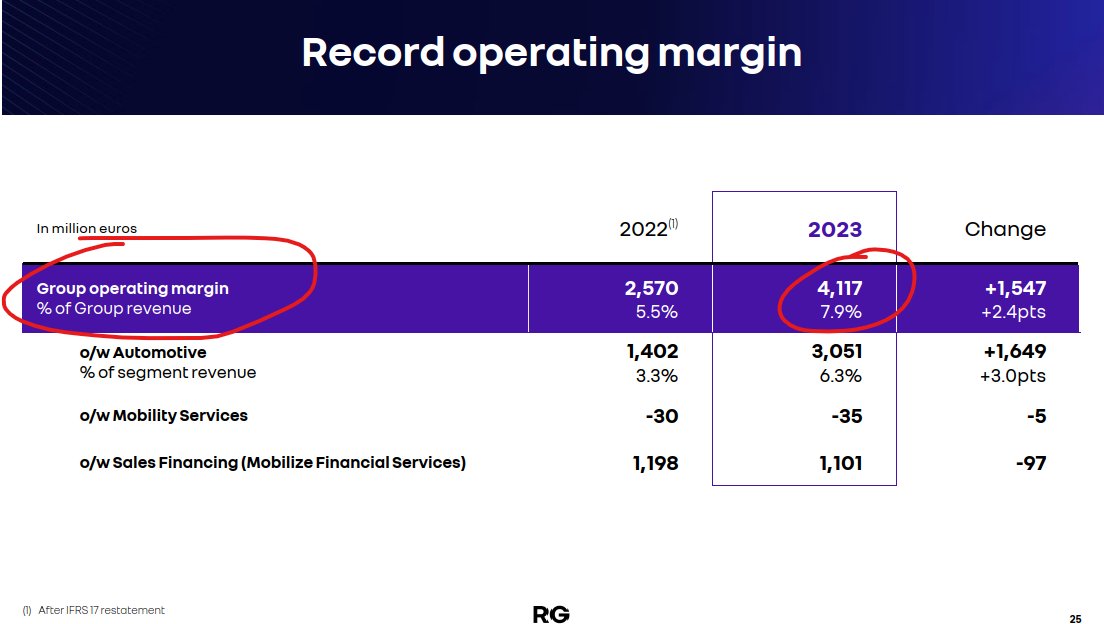

2/These number result in a full year 2023 margin of 7.9% and 'operating profit' of €4,117M (remember those numbers, they become important later)

3/The shown bridge shows a walk from 2022 'operating profit' to 2023. What Renault doesn't tell you is that both numbers are upward adjusted by combined €2,011M (FY22 €379M and FY23 €1,632M!).

4/This shows you just one of the bigger adjustments: 'Horse' with a FY23 impact of €482M. But the €482M explains only 30% of the €1,632M in to get from the shown 'Operating income of €4,117M' to...

5/...the actual reported operating income number of €2,485M. Renault had the audacity to call this item "EBIT" in the presentation. This is factually incorrect as we'll see later. They probably looked at this slide and thought it's too obvious if we call both operating income and people might get confused and may ask questions.

6/This is now a look into the earnings report. Here, the €2,485M is correctly labelled as 'Group operating income'. You will not find this anywhere in the presentation! In the presentation they even use the term "Group operating income", which I find misleading.

7/And then ultimately, voila, we see in the P&L the correct operating income of €2,485M. Some people may think: why the fuss, it's normal to show adjusted numbers. My answer:

First, at what point does it become idiotic when, like in Renault's case, the adjusted numbers over the last few years exceeded actual reported operating income numbers from the P&L by freaking 75%!

Second, good companies provide a full bridge from adjusted to reported (from presentation to P&L). Renault never does.

First, at what point does it become idiotic when, like in Renault's case, the adjusted numbers over the last few years exceeded actual reported operating income numbers from the P&L by freaking 75%!

Second, good companies provide a full bridge from adjusted to reported (from presentation to P&L). Renault never does.

8/Bottomline: Renault's operating profit numbers are bogus. If anyone wants to compare companies, I'd highly recommend to use the numbers as reported on the income statement!

Lastly, you can see from the income statement number €2,485M and €52,376M that the reported operating margin was only 4.7%.

Lastly, you can see from the income statement number €2,485M and €52,376M that the reported operating margin was only 4.7%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh