How to get URL link on X (Twitter) App

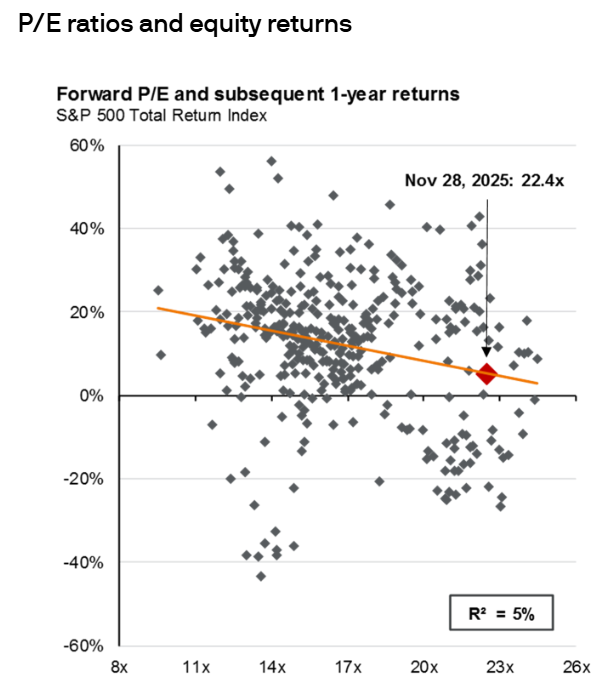

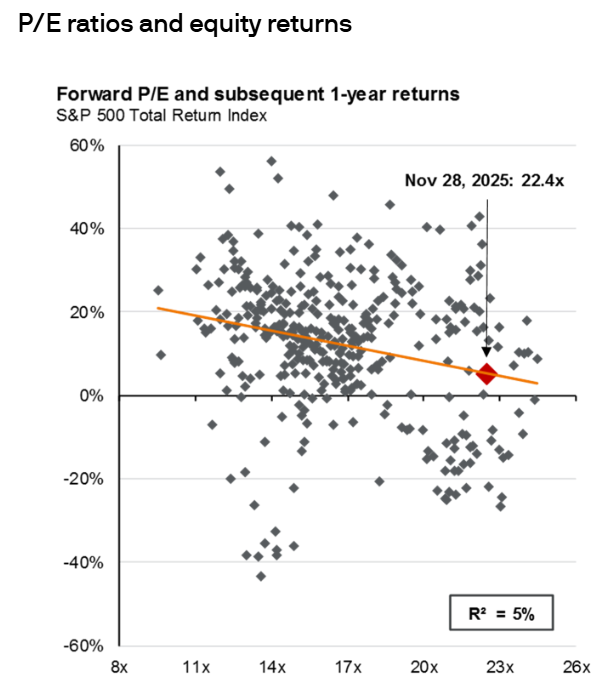

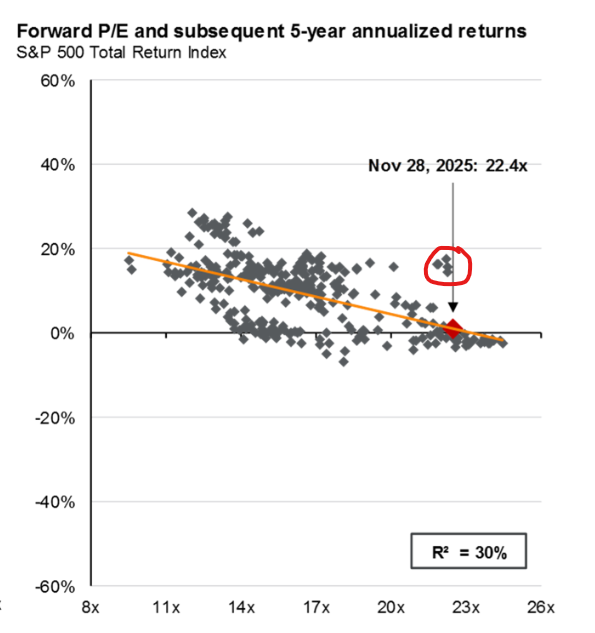

Red circle: High 5-year returns despite high P/E ratios.

Red circle: High 5-year returns despite high P/E ratios.

Last year, at the same point in the fiscal year (April 2024), the deficit was $855 billion ($194 billion lower) and interest expense was $65 billion lower. Again, this is only for the first 7 months of the fiscal year for an apples-to-apples with the current fiscal year.

Last year, at the same point in the fiscal year (April 2024), the deficit was $855 billion ($194 billion lower) and interest expense was $65 billion lower. Again, this is only for the first 7 months of the fiscal year for an apples-to-apples with the current fiscal year.

5-8

5-8

Negative free cash flow was driven by a lack of operating cash flow (OCF). Hyundai's 2024 OCF was negative $4.2 billion.

Negative free cash flow was driven by a lack of operating cash flow (OCF). Hyundai's 2024 OCF was negative $4.2 billion.

This chart shows trailing 12 months China income: you can see how the decrease has been accelerating. VW Group's China JV income dropped to just $0.4B over the last 4 quarters.

This chart shows trailing 12 months China income: you can see how the decrease has been accelerating. VW Group's China JV income dropped to just $0.4B over the last 4 quarters.

5-8

5-8

2.

2.

1

1

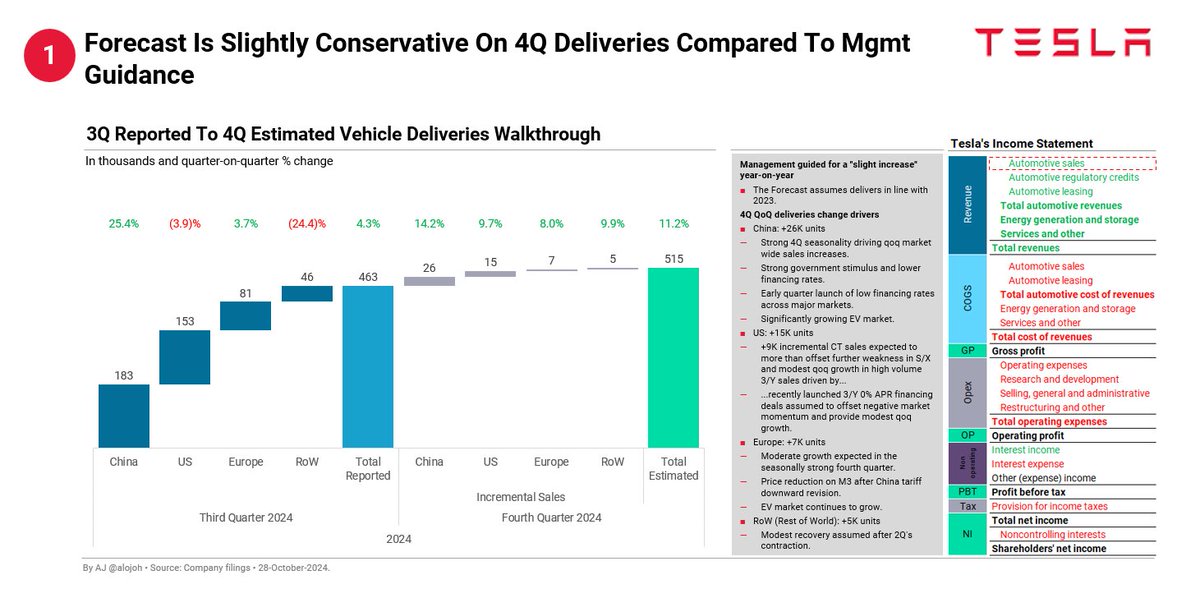

1. 3Q Deliveries At 463K Imply An Increase Of 6.4% YoY And 4.3% QoQ.

1. 3Q Deliveries At 463K Imply An Increase Of 6.4% YoY And 4.3% QoQ.

2. Despite Overall Weakening Vehicle Sales, BEVSales In China Increased 19% YoY In August

2. Despite Overall Weakening Vehicle Sales, BEVSales In China Increased 19% YoY In August

In 2Q 2024, Xpeng's business provided only $157M in gross profits. This is not nearly enough to cover Xpeng's ongoing R&D and admin expenses.

In 2Q 2024, Xpeng's business provided only $157M in gross profits. This is not nearly enough to cover Xpeng's ongoing R&D and admin expenses.

2. Toyota Has Been Shrinking For ~6 Months Although At A Slow Rate

2. Toyota Has Been Shrinking For ~6 Months Although At A Slow Rate

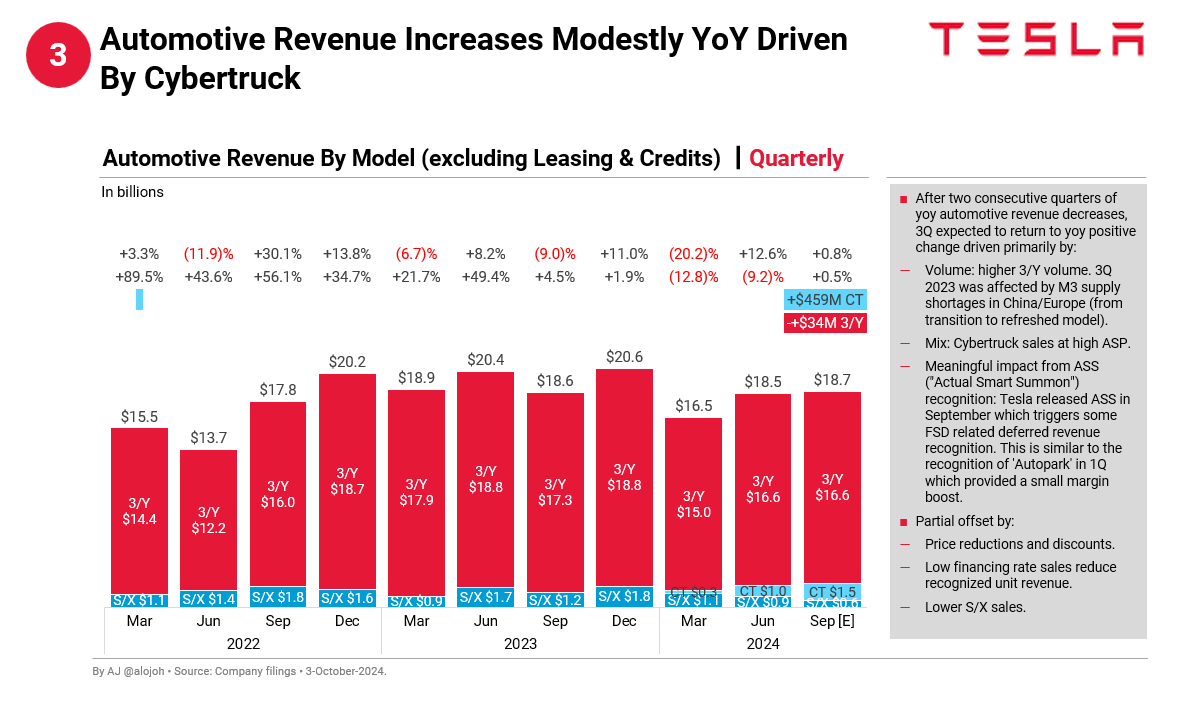

1. 3Q Revenue Estimated To Grow +16% QoQ To $34.7B

1. 3Q Revenue Estimated To Grow +16% QoQ To $34.7B

2. Gross Profit Increased +26% YoY To $4.5 Billion

2. Gross Profit Increased +26% YoY To $4.5 Billion