> AI season is warming up.

> You want to find the tokens that are in stage 4 or 5.

Here are 3 AI altcoins that look primed to go higher.

Charts below; 👇

> You want to find the tokens that are in stage 4 or 5.

Here are 3 AI altcoins that look primed to go higher.

Charts below; 👇

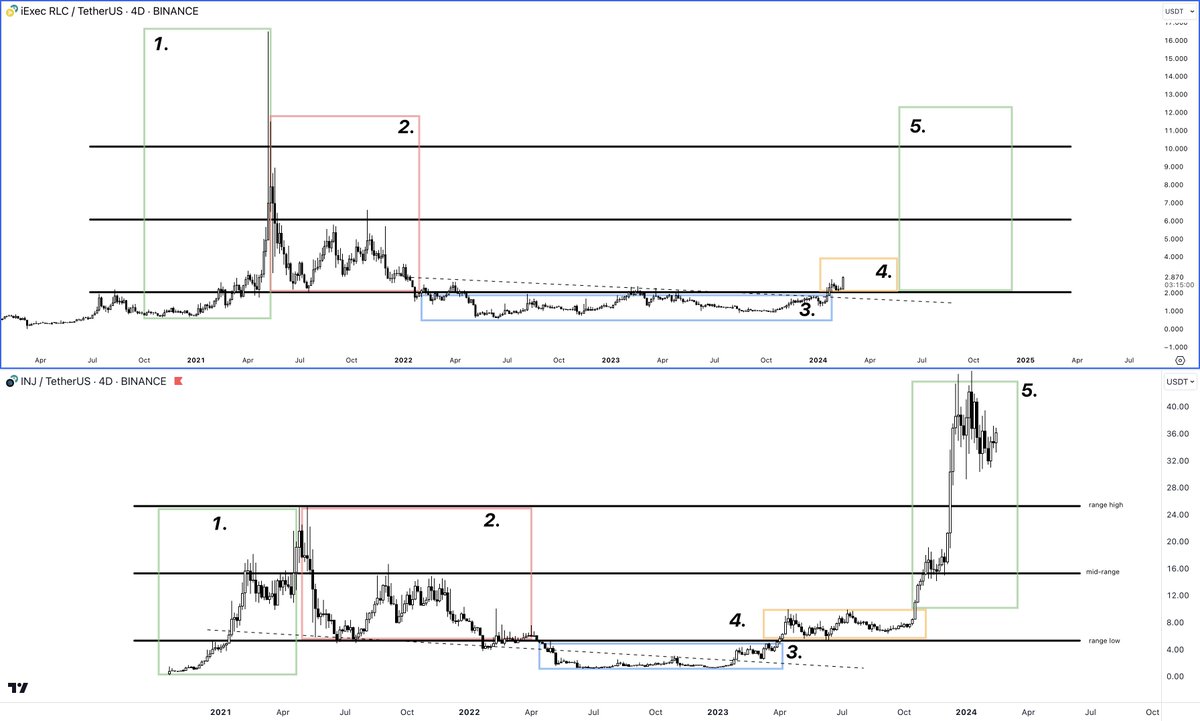

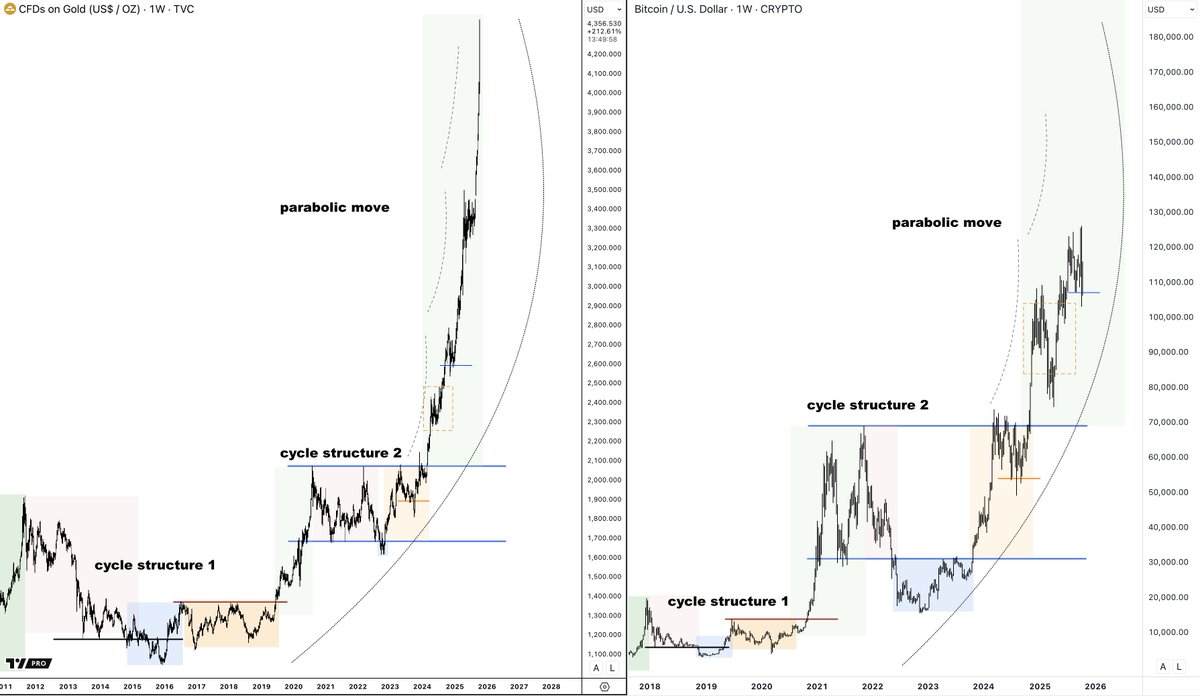

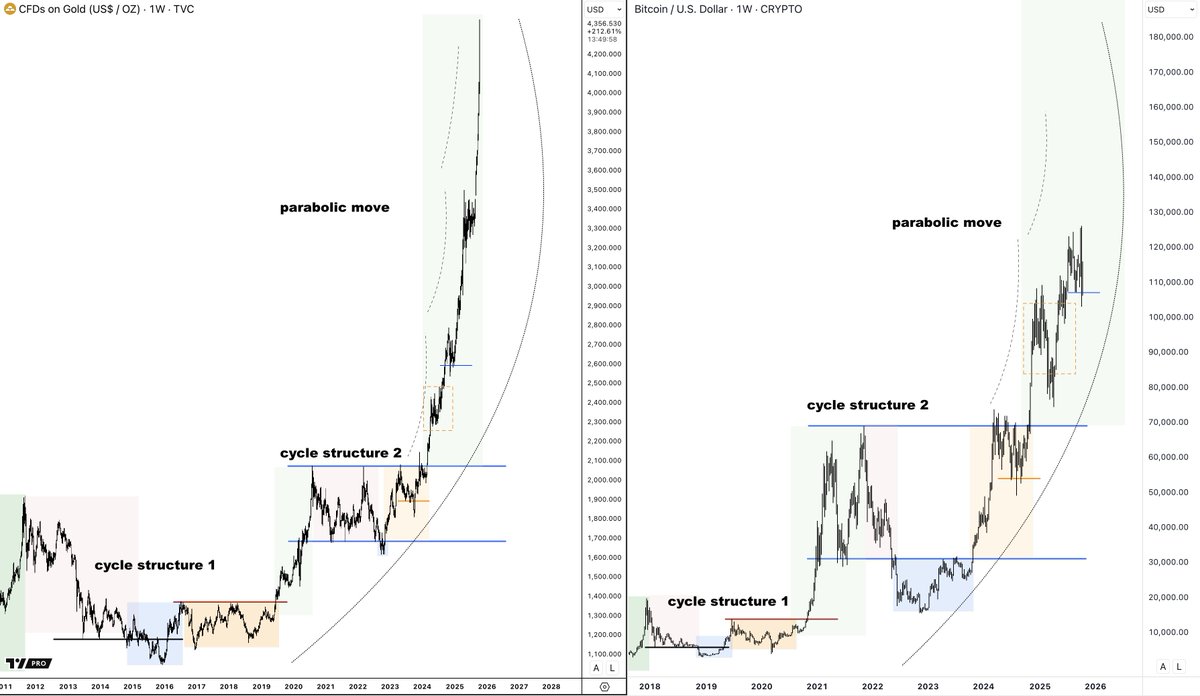

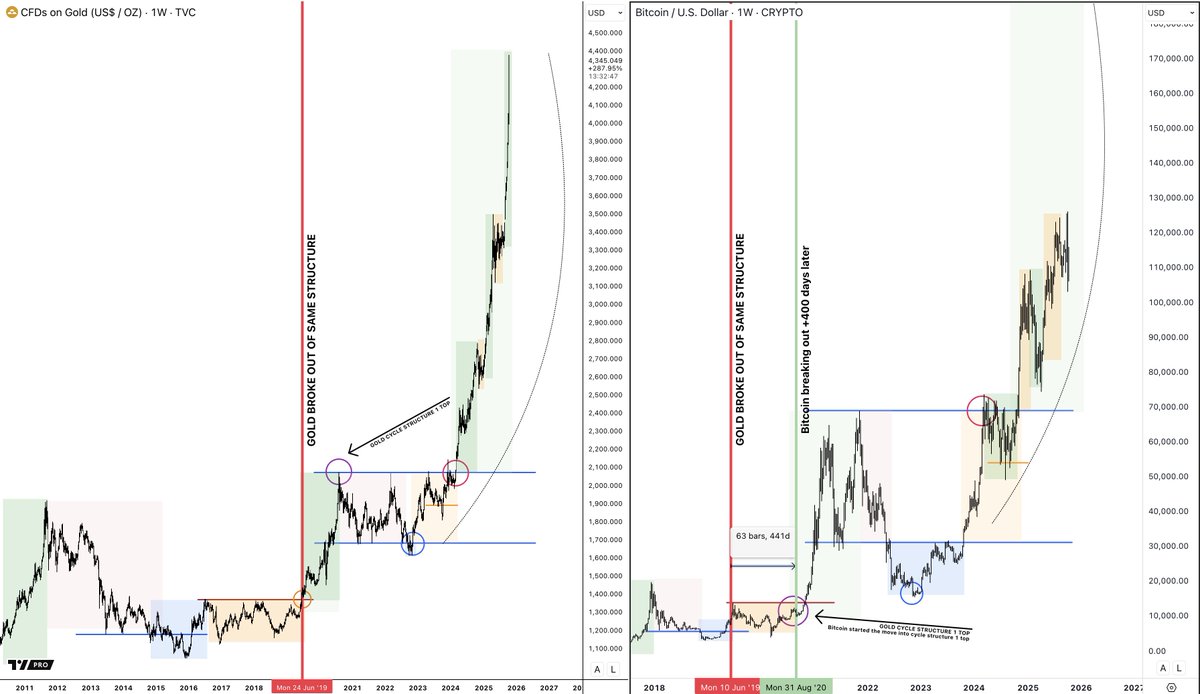

I'm looking for AI tokens that are either in their cycle stage 4 or in stage 5.

These are the two stages worth holding with vertical price action.

These are the two stages worth holding with vertical price action.

Next, I'm using the higher time frame range.

Stage 4 range set up: Range low deviation.

Fake out -> reclaim lows -> target range high.

Stage 4 range set up: Range low deviation.

Fake out -> reclaim lows -> target range high.

Stage 5 range set up: mid-range fake out.

Break above mid-range -> fake out below -> another reclaim and deviation -> target range high (and above)

By combining these two you find strong odds of vertical upside with the ability to find a clear setup.

Break above mid-range -> fake out below -> another reclaim and deviation -> target range high (and above)

By combining these two you find strong odds of vertical upside with the ability to find a clear setup.

2) $OCEAN | USD

OCEAN is currently breaking out of the stage 4 consolidation by flipping the 0.25 (range quarter) resistance into support.

I think it's time for her to run hard soon.

$INJ comparison below.

OCEAN is currently breaking out of the stage 4 consolidation by flipping the 0.25 (range quarter) resistance into support.

I think it's time for her to run hard soon.

$INJ comparison below.

disclaimer; been in $ocean with the @Altcointraders_ fam since $0.35 via the range low reclaim entry.

https://x.com/damskotrades/status/1719457897107673293?s=20

3) $FET | USD

Always leading the AI wave.

She just executed a very clear mid-range deviation while being in stage 5. I think she's ready for the range high and more.

Dips into the mid-range are for buying imo.

Posted a few days ago:

Always leading the AI wave.

She just executed a very clear mid-range deviation while being in stage 5. I think she's ready for the range high and more.

Dips into the mid-range are for buying imo.

Posted a few days ago:

https://x.com/damskotrades/status/1755931007423754450?s=20

> These are charts, not setups.

> Never trade without a plan.

> Feel free to dm me any questions about the cycle and range deas. You can also ask them in the @Altcointraders_ chat.

> Never trade without a plan.

> Feel free to dm me any questions about the cycle and range deas. You can also ask them in the @Altcointraders_ chat.

• • •

Missing some Tweet in this thread? You can try to

force a refresh