Your free paid group leader

- Daily market outlooks

- Some education

- Fueling my gambling addiction by chasing altcoins and sharing them on Twitter

4 subscribers

How to get URL link on X (Twitter) App

First of all, if we zoom out and forget about dates, time frames, and the exact shape of these moves,

First of all, if we zoom out and forget about dates, time frames, and the exact shape of these moves,

1. Introduction

1. Introduction

1. Bitcoin top & Profit taking

1. Bitcoin top & Profit takinghttps://x.com/damskotrades/status/1943620080211783855

1. Market timing

1. Market timing

1. Bitcoin

1. Bitcoin

(bookmark it → it's gonna be a good one)

(bookmark it → it's gonna be a good one)

Some quick notes before unleashing a dirty amount of bullish propaganda:

Some quick notes before unleashing a dirty amount of bullish propaganda:

The dilution.

The dilution.

1. Last part of the cycle

1. Last part of the cycle

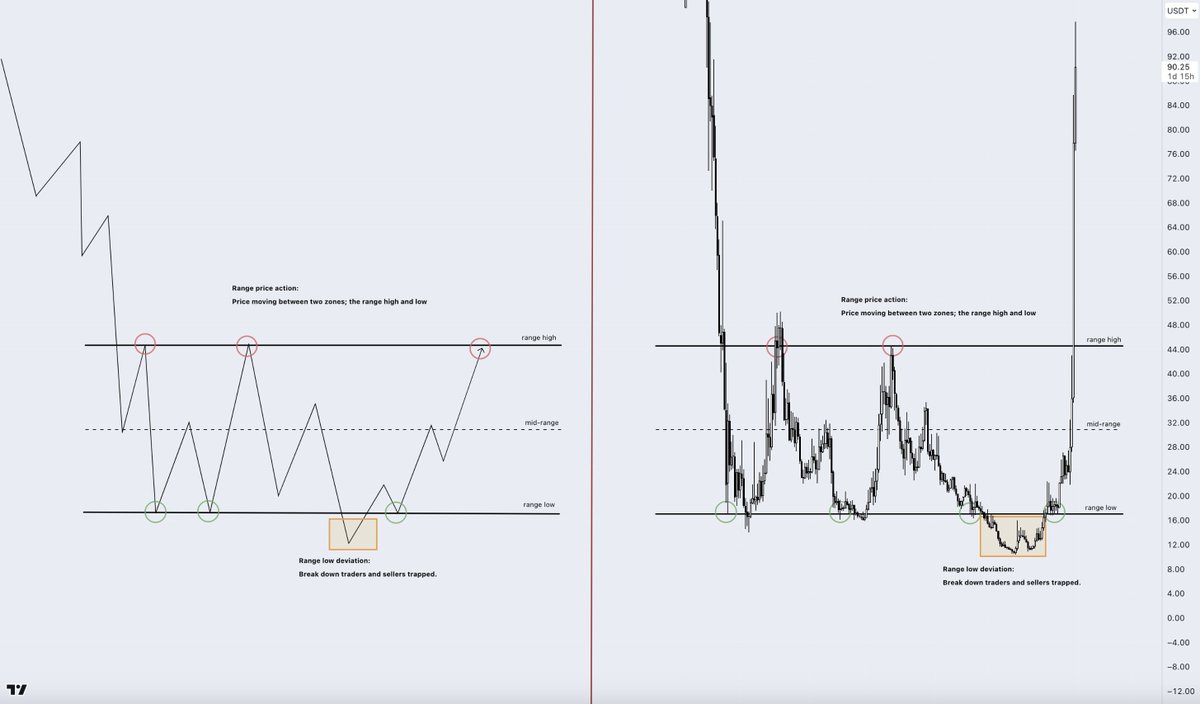

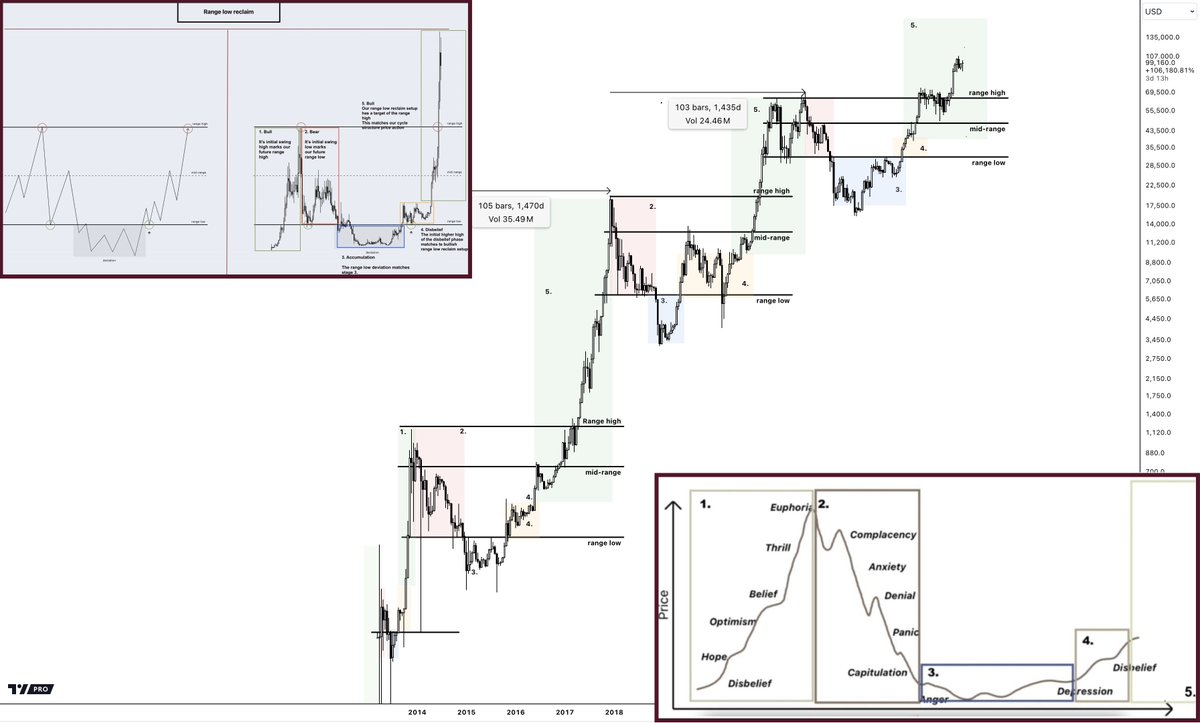

Range price action: A non-trending market where price moves between two zones.

Range price action: A non-trending market where price moves between two zones.

https://twitter.com/damskotrades/status/1921297831840621006

Index thread:

Index thread:

Post-index

Post-index

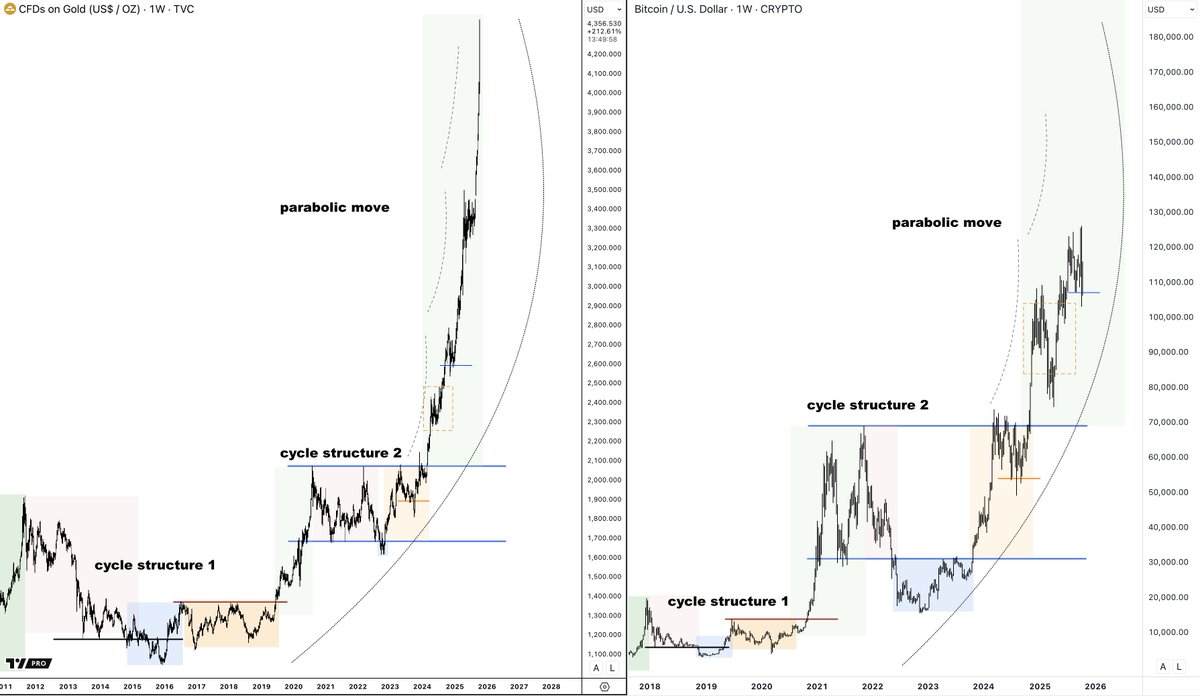

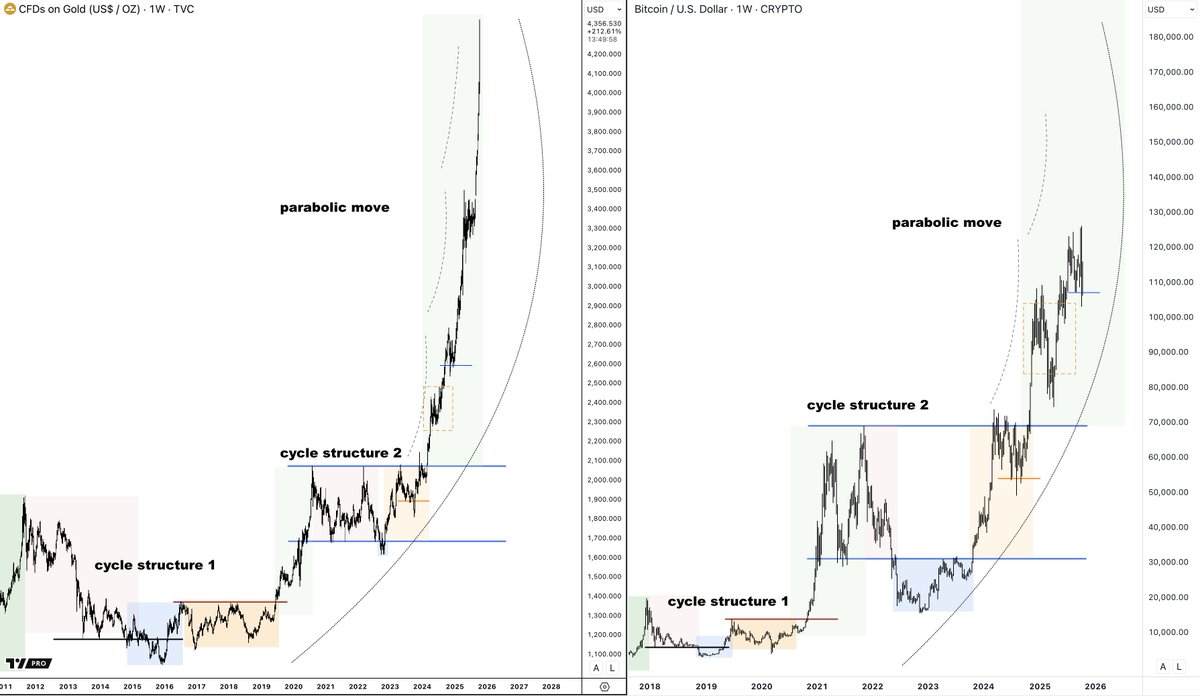

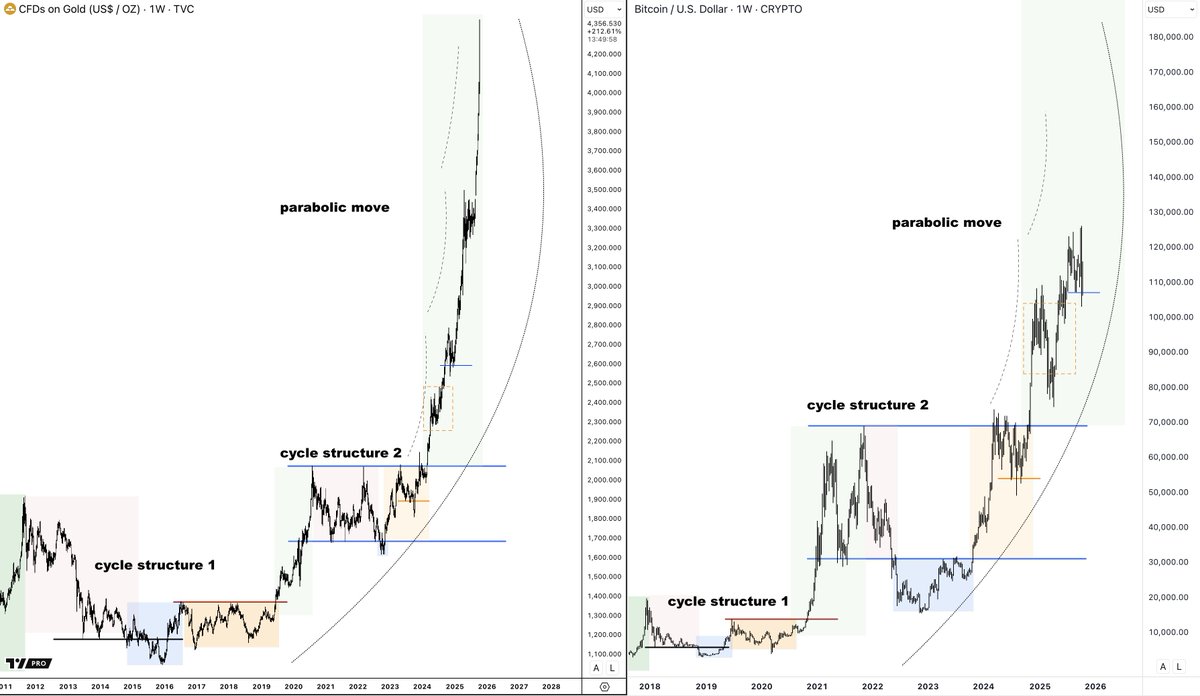

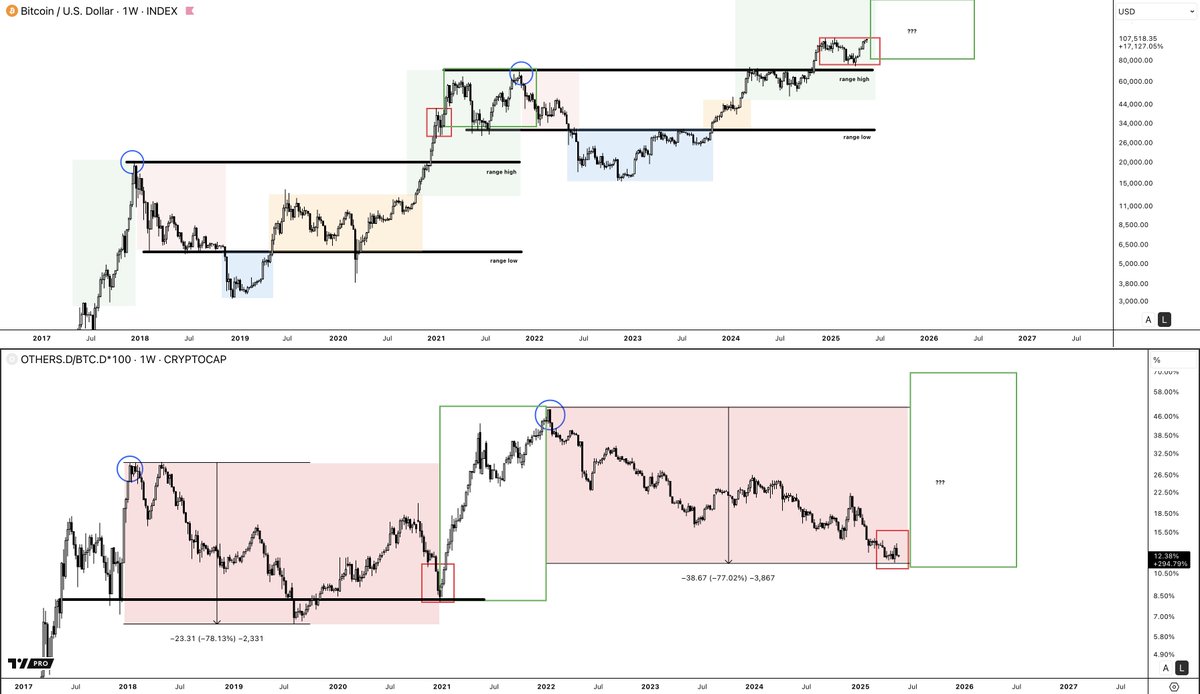

1. Higher time frame cycle

1. Higher time frame cycle

This isn’t usually my thing, but I’ll take a look since my comments are flooded with QE talk.

This isn’t usually my thing, but I’ll take a look since my comments are flooded with QE talk.

That said, the market is getting tougher—more metas, more altcoins, more chains.

That said, the market is getting tougher—more metas, more altcoins, more chains.

https://twitter.com/damskotrades/status/1880949859227767269

1. MEMES

1. MEMES

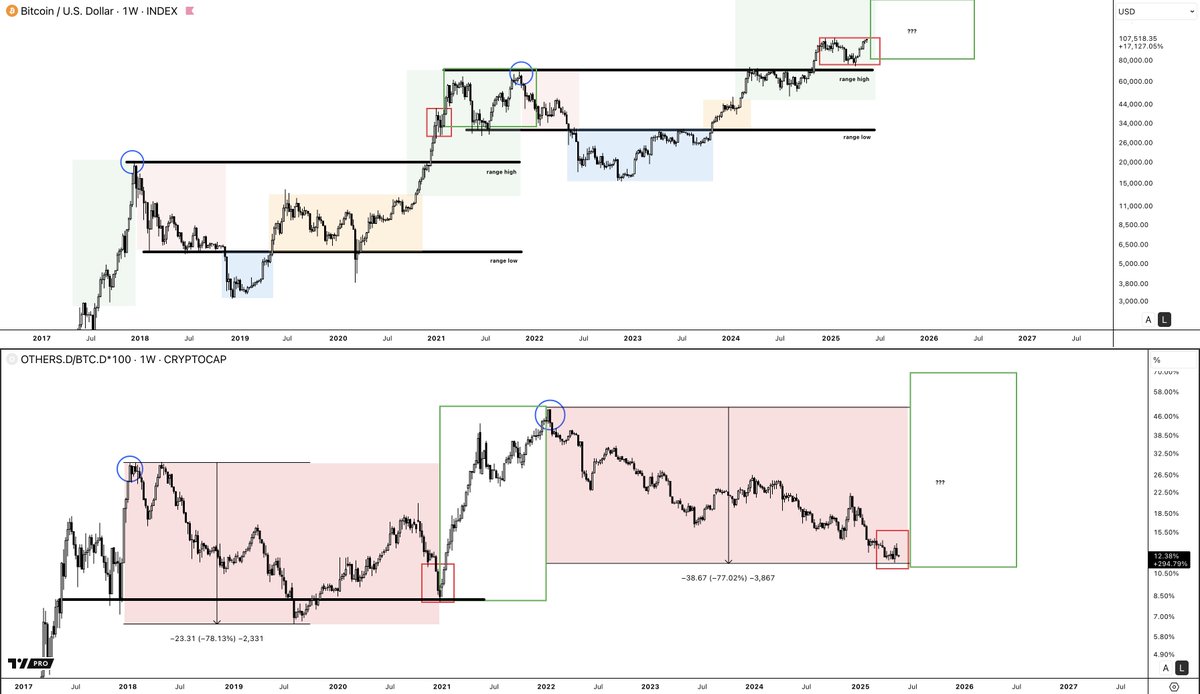

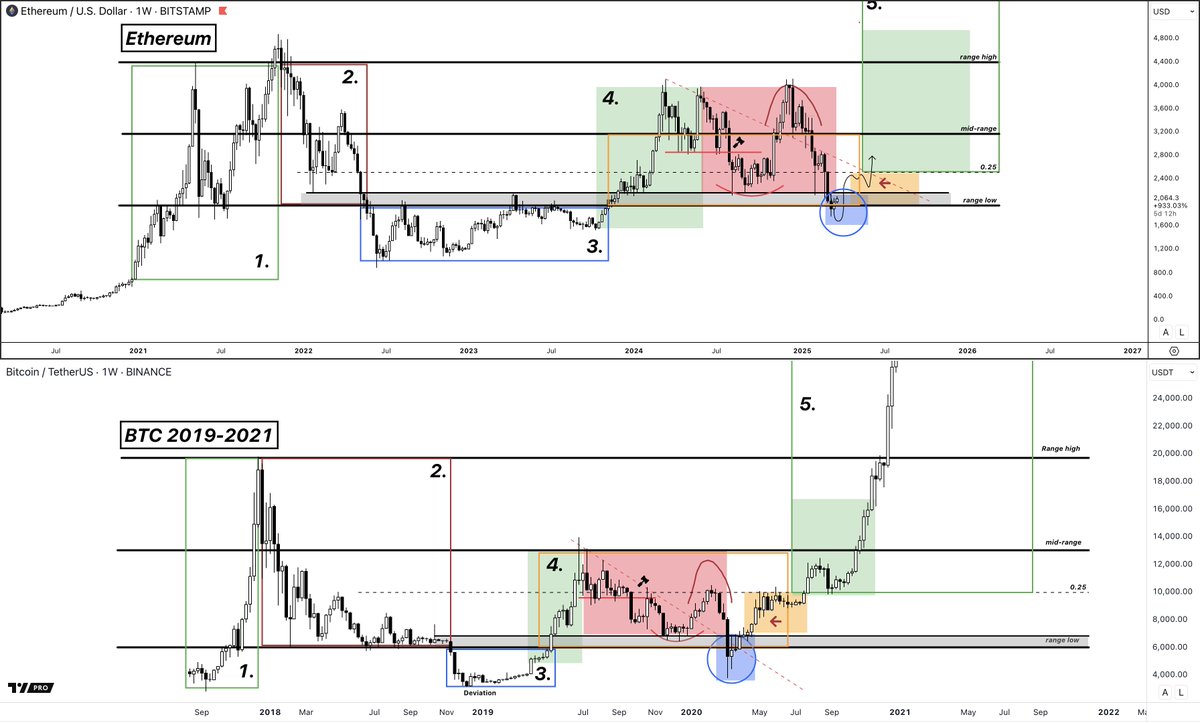

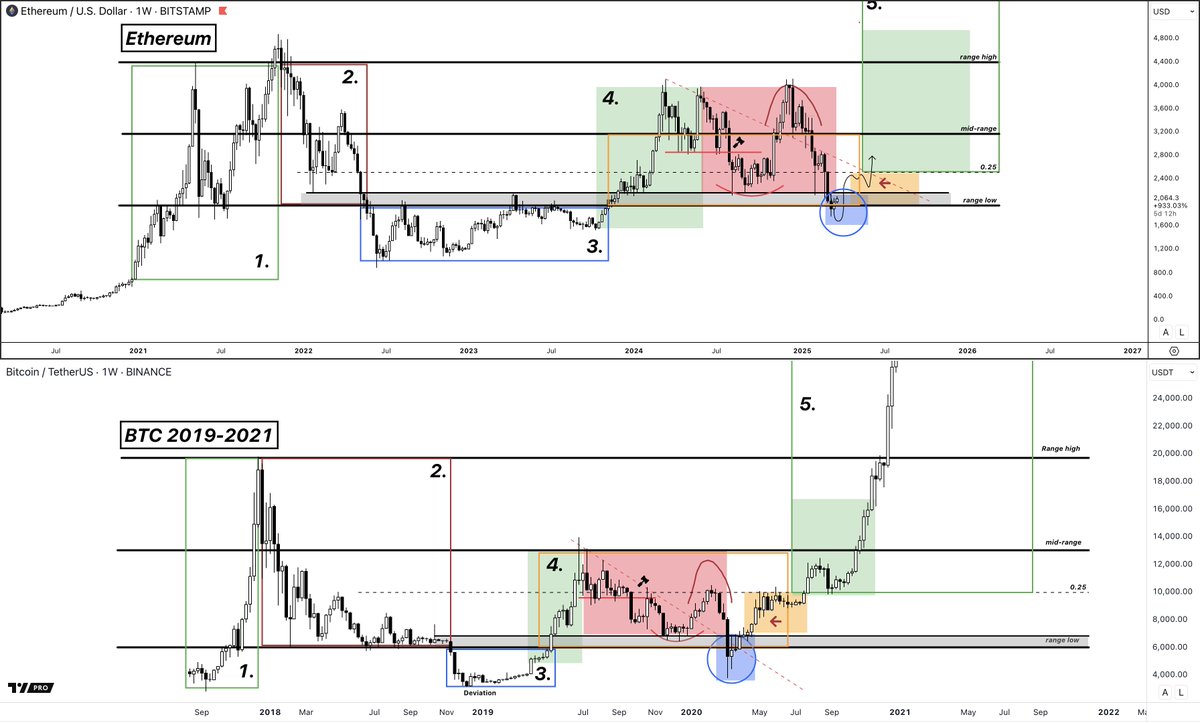

1. What cycle stage?

1. What cycle stage?

> The current Cycle as we know it

> The current Cycle as we know it

1. Favorite Altcoin Long Setup

1. Favorite Altcoin Long Setup