AI will be one of crypto's top performing sectors this bull run.

But instead of buying random AI coins, I'm focused on one key beneficiary: DePIN.

It's projected to be a $3.5T industry by 2028, and you have a chance to be EARLY.

🧵: My ULTIMATE DePIN guide (+ top picks).👇

But instead of buying random AI coins, I'm focused on one key beneficiary: DePIN.

It's projected to be a $3.5T industry by 2028, and you have a chance to be EARLY.

🧵: My ULTIMATE DePIN guide (+ top picks).👇

In this thread, I'll cover:

• How DePIN works

• Why DePIN is poised for significant growth in 2024 (and beyond)

• The specific DePIN projects I'm investing in

Let's dive in.

• How DePIN works

• Why DePIN is poised for significant growth in 2024 (and beyond)

• The specific DePIN projects I'm investing in

Let's dive in.

Firstly, what is DePIN?

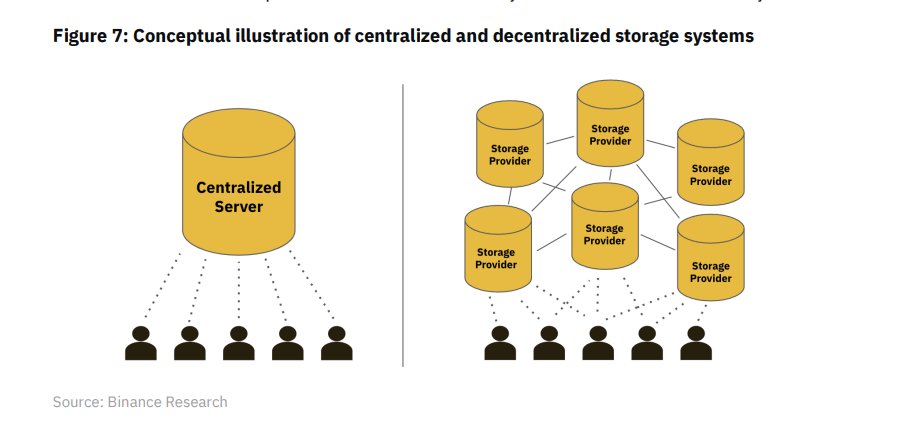

DePIN stands for 'Decentralised Physical Infrastructure'.

These are blockchain protocols that incentivise decentralised communities to build & maintain physical hardware.

Users supply hardware or software resources to the network & get token rewards.

DePIN stands for 'Decentralised Physical Infrastructure'.

These are blockchain protocols that incentivise decentralised communities to build & maintain physical hardware.

Users supply hardware or software resources to the network & get token rewards.

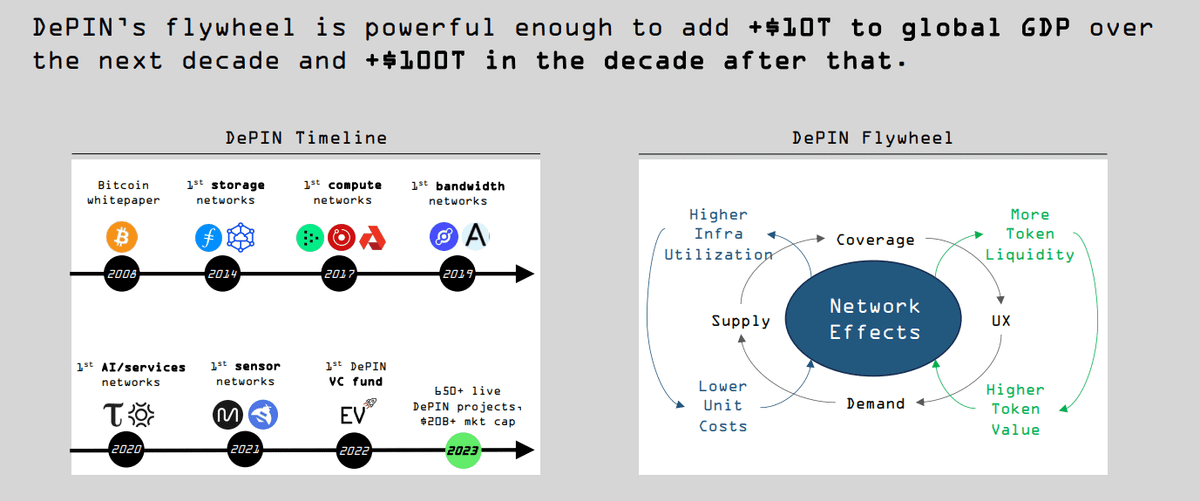

The DePIN landscape is vast, and spans across multi billion-dollar hardware sectors.

• Cloud storage

• Computing power

• Wireless sensor networks

Messari predicts that DePIN could add $10T to the global GDP in the next decade (and $100T the decade after). 👀

• Cloud storage

• Computing power

• Wireless sensor networks

Messari predicts that DePIN could add $10T to the global GDP in the next decade (and $100T the decade after). 👀

Physical infra has historically been a Big Tech monopoly.

It has significant capital & maintenance costs, out of reach for small players.

Giants like AWS capitalise on this by selling their services at a premium.

It has significant capital & maintenance costs, out of reach for small players.

Giants like AWS capitalise on this by selling their services at a premium.

However DePIN (decentralised physical infra networks) has many benefits over centralised solutions due to its ability to:

• Reduce costs

• Horizontally scale

• Reward network contributors

• Enhance security

• Reduce costs

• Horizontally scale

• Reward network contributors

• Enhance security

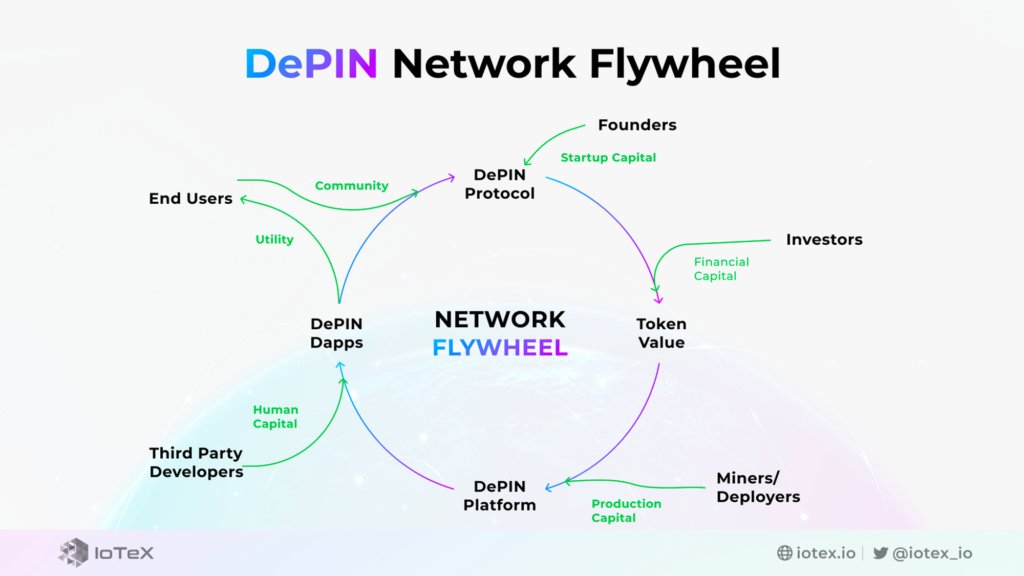

Here's how DePIN works:

• Supply-side users commit their resources for token rewards from the network.

• These rewards incentivise network participants to deploy more infrastructure.

• Supply-side users commit their resources for token rewards from the network.

• These rewards incentivise network participants to deploy more infrastructure.

Infra growth attracts more demand from end users, leading to increased network activity.

Network growth leads to higher rewards, which incentivises more supply side users.

As you can see, DePIN has a built-in flywheel effect, helping projects gain traction as they expand.

Network growth leads to higher rewards, which incentivises more supply side users.

As you can see, DePIN has a built-in flywheel effect, helping projects gain traction as they expand.

According to @MessariCrypto, the DePIN sector is projected to reach $3.5 trillion in the next four years.

Longer term, I'm anticipating that number to go much higher, due to the strong aforementioned flywheel mechanics involved.

Longer term, I'm anticipating that number to go much higher, due to the strong aforementioned flywheel mechanics involved.

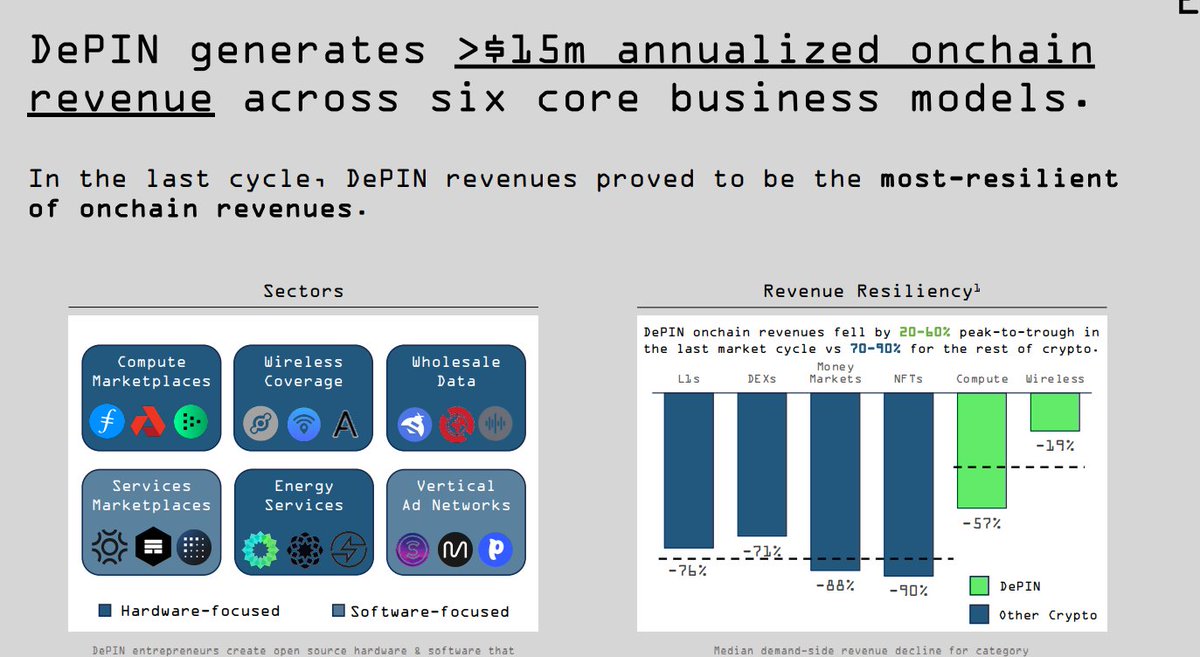

Unlike many other crypto sectors, it's a model that's already been generating revenue.

DePIN generates more than $15 million in annual on-chain revenue, and this number is set to grow rapidly in the coming years.

DePIN generates more than $15 million in annual on-chain revenue, and this number is set to grow rapidly in the coming years.

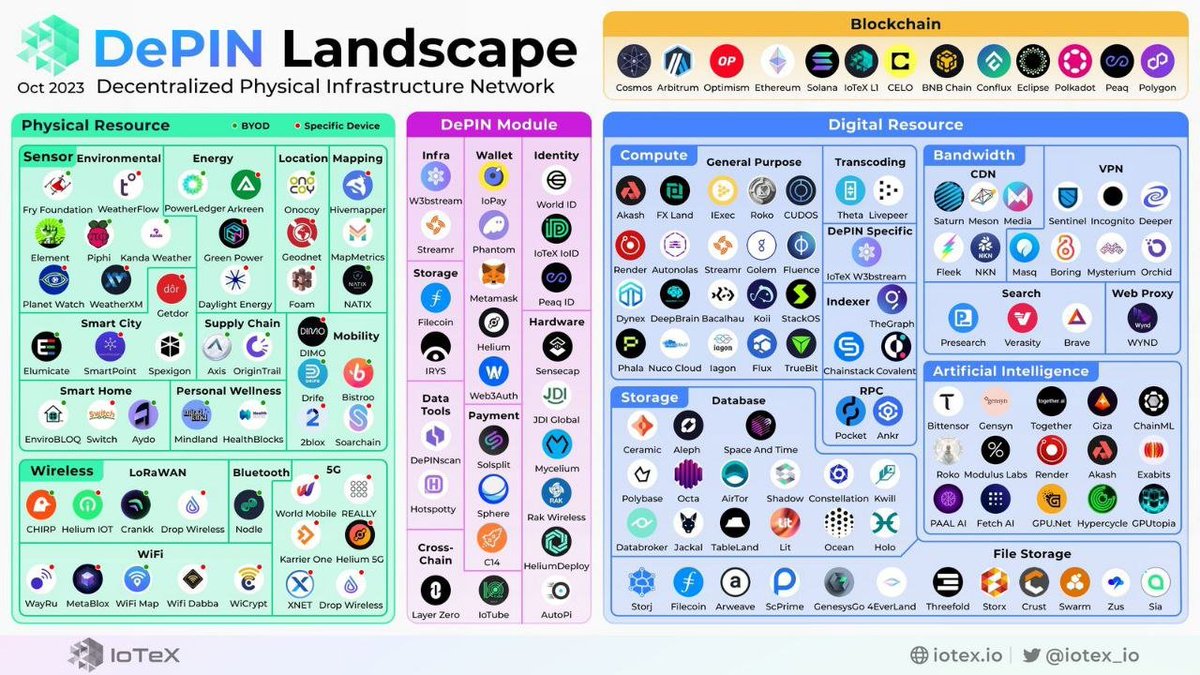

Broadly, DePIN projects can be grouped into:

• Physical Resource Networks (Sensor, Wireless)

• Digital Resource Networks (Compute, Bandwidth, AI, Storage)

• DePIN Module

Each sub-sector disrupts a $1T dollar industry, which means DePIN's upside potential is MASSIVE.

• Physical Resource Networks (Sensor, Wireless)

• Digital Resource Networks (Compute, Bandwidth, AI, Storage)

• DePIN Module

Each sub-sector disrupts a $1T dollar industry, which means DePIN's upside potential is MASSIVE.

Let's break down some of these sub-sectors even further.👇

1. Decentralised storage

These projects create a marketplace for unused storage capacity.

• Providers offer computing resources for token-incentives.

• Projects encrypt & split up client data across this network.

• Clients pay the network to store & retrieve their data.

These projects create a marketplace for unused storage capacity.

• Providers offer computing resources for token-incentives.

• Projects encrypt & split up client data across this network.

• Clients pay the network to store & retrieve their data.

Storage is a key adoption vertical for DePIN as it has the perfect product market fit.

Splitting data removes the single point of failure, improving accessibility & security.

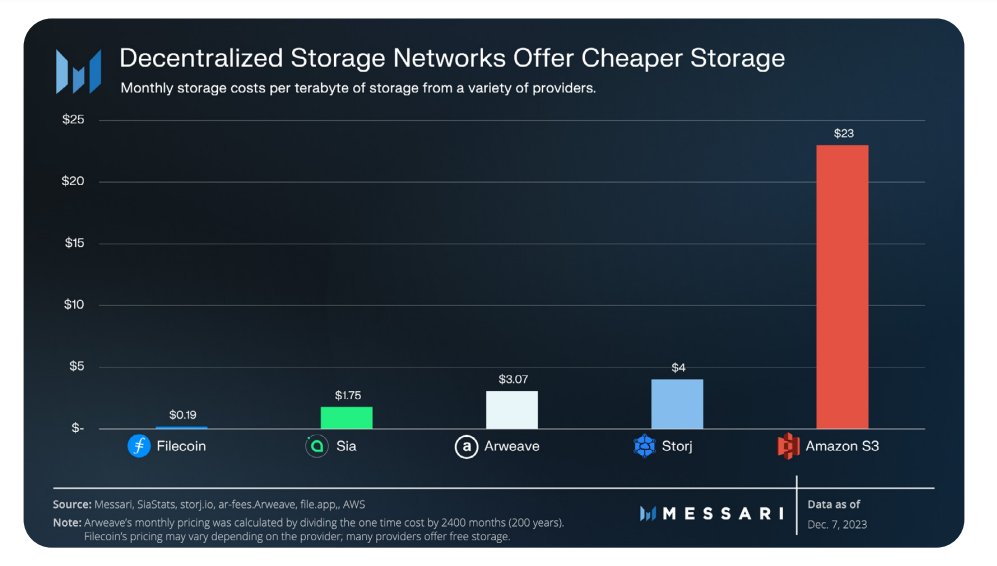

These networks are also ~78% cheaper than their centralised counterparts.

Splitting data removes the single point of failure, improving accessibility & security.

These networks are also ~78% cheaper than their centralised counterparts.

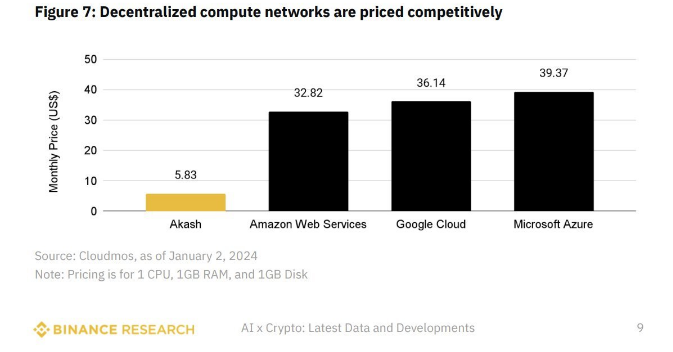

2. Decentralised computing

Decentralised compute networks let you to borrow GPU power to run complex computations on the cloud.

You can use it to power AI innovation, render cool scenes or run a blockchain node.

Decentralised compute networks let you to borrow GPU power to run complex computations on the cloud.

You can use it to power AI innovation, render cool scenes or run a blockchain node.

Legacy computing networks are currently at a $5T market cap.

Even if DePIN captures just 1% of this market, that's a potential 10x growth on utilisation rates.

Even if DePIN captures just 1% of this market, that's a potential 10x growth on utilisation rates.

https://twitter.com/412587524/status/1657732529498238978

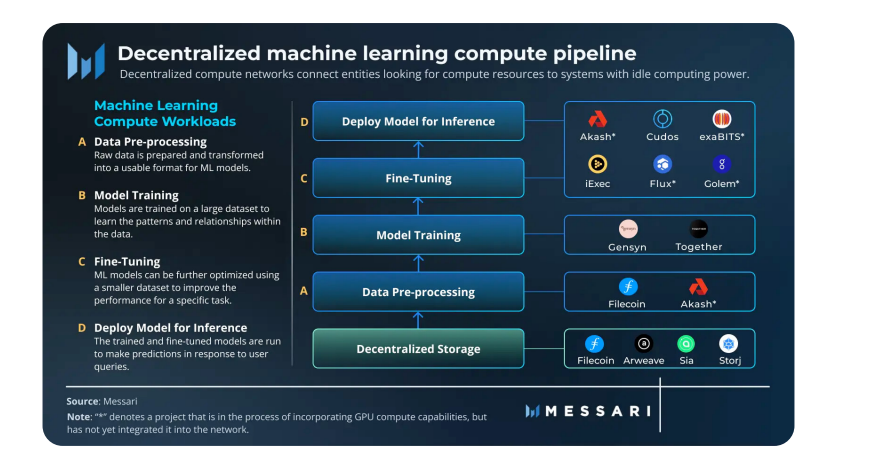

3. Artificial intelligence infrastructure

AI's exponential growth in the last decade has exposed some key scaling challenges:

• Lack of specialised hardware

• Lack of effective collaboration

• Ineffective data storage

DePIN can tackle these issues & more.

AI's exponential growth in the last decade has exposed some key scaling challenges:

• Lack of specialised hardware

• Lack of effective collaboration

• Ineffective data storage

DePIN can tackle these issues & more.

For instance, compute networks like $AKT can reduce the hardware crunch by crowdsourcing GPU power.

Similarly, $TAO gamifies research collaboration through crypto incentives.

These are just some examples, but DePIN has many applications across the ML pipeline.

Similarly, $TAO gamifies research collaboration through crypto incentives.

These are just some examples, but DePIN has many applications across the ML pipeline.

Honestly, we're just scratching the surface of AI + crypto. I'm excited to see more synergies and use cases emerge as the sector matures.

I'll elaborate more on the AI sector specifically in a future thread, so make sure you're following @milesdeutscher if you're interested.

I'll elaborate more on the AI sector specifically in a future thread, so make sure you're following @milesdeutscher if you're interested.

Now that you have a deeper understanding of what DePIN is (and how it works), let's dive deeper into the specific projects that interest me across the sector.👇

• @akashnet_

$AKT brands itself as the 'Airbnb for server hosting'.

You can buy and sell decentralised cloud storage on their marketplace.

The network is powerful, with capacity to host websites, blockchain nodes & video game servers. All at less than 1/6th the cost of Azure.

$AKT brands itself as the 'Airbnb for server hosting'.

You can buy and sell decentralised cloud storage on their marketplace.

The network is powerful, with capacity to host websites, blockchain nodes & video game servers. All at less than 1/6th the cost of Azure.

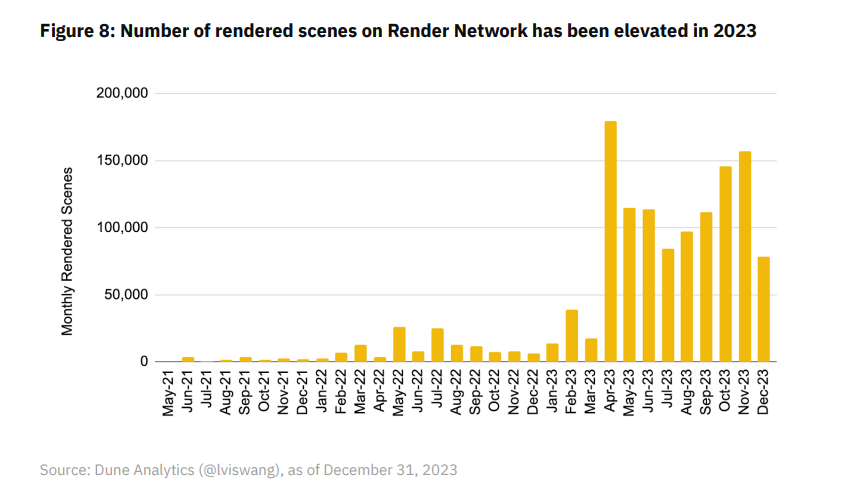

• @rendernetwork

$RNDR taps into unused GPU power to unlock the next-generation of artificial intelligence & 3D rendering.

Network activity has been in an uptrend MoM.

$RNDR taps into unused GPU power to unlock the next-generation of artificial intelligence & 3D rendering.

Network activity has been in an uptrend MoM.

• @AethirCloud

Aethir is an upcoming launch that I'm extremely excited for.

They have:

• 20x more GPU’s than RNDR Network

• 45x more TFLOPS (compute power) than Akash Network

• 31x more infrastructure capital committed than Akash Network and RNDR Network combined

Aethir is an upcoming launch that I'm extremely excited for.

They have:

• 20x more GPU’s than RNDR Network

• 45x more TFLOPS (compute power) than Akash Network

• 31x more infrastructure capital committed than Akash Network and RNDR Network combined

They also have partnerships with major players across the telco, gaming and cloud computing space.

There are many major updates/announcements coming over the new few months.

I'll cover these updates as they occur to keep you in the loop.

There are many major updates/announcements coming over the new few months.

I'll cover these updates as they occur to keep you in the loop.

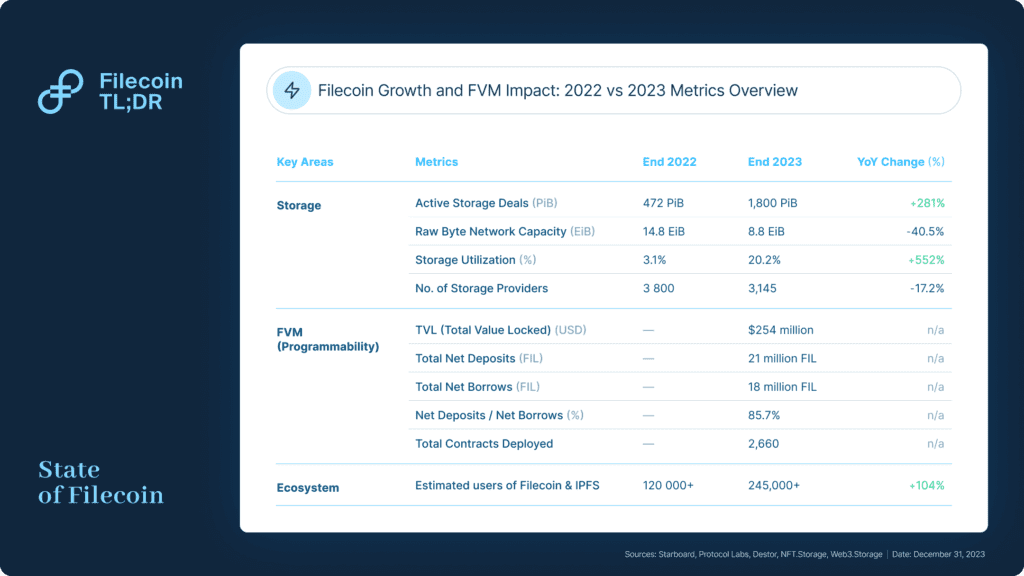

• @Filecoin

$FIL is my top decentralised data storage play, with 3 major growth verticals:

• Storage (2.8x YoY growth)

• FIL virtual machine ($254M TVL)

• Projects building on top of Filecoin (254K users)

FIL has some of the cheapest fees across the entire storage sector.

$FIL is my top decentralised data storage play, with 3 major growth verticals:

• Storage (2.8x YoY growth)

• FIL virtual machine ($254M TVL)

• Projects building on top of Filecoin (254K users)

FIL has some of the cheapest fees across the entire storage sector.

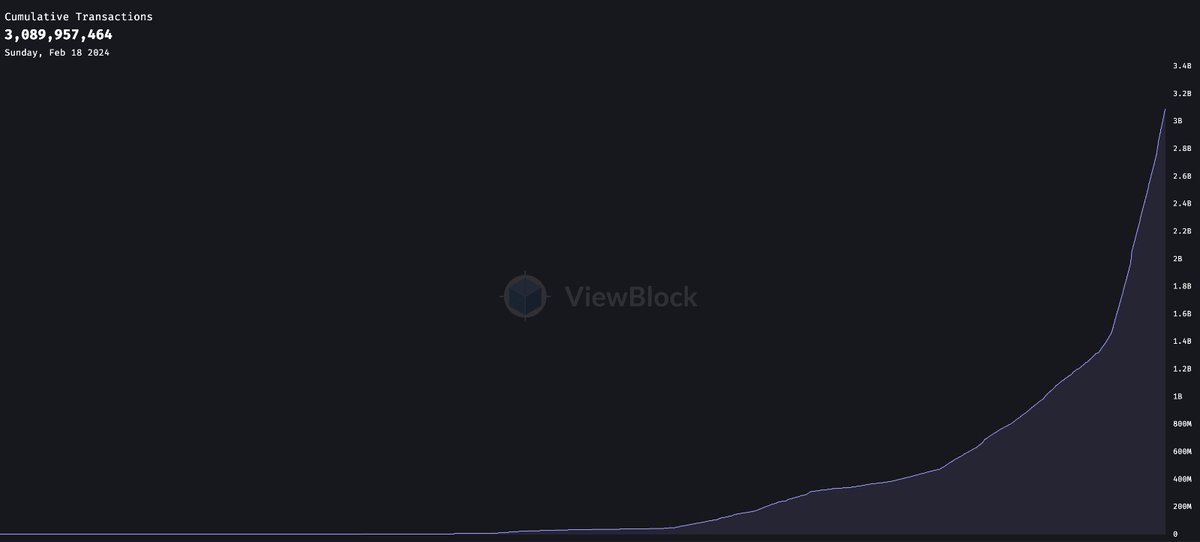

• @ArweaveEco

Arweave lets you store data permanently on the blockchain for a one-time fee. Ideal for metaverse, DeSci & social media projects applications that require data preservation.

The Arweave network just hit 3B transactions + 300 TPS.

Arweave lets you store data permanently on the blockchain for a one-time fee. Ideal for metaverse, DeSci & social media projects applications that require data preservation.

The Arweave network just hit 3B transactions + 300 TPS.

• @atorprotocol

$ATOR serves as a scalable privacy middleware for DePIN & other crypto projects.

They use relays to route application traffic through the TOR network, maintaining anonymity.

Their new hardware grants users complete privacy, whilst earning them rewards.

$ATOR serves as a scalable privacy middleware for DePIN & other crypto projects.

They use relays to route application traffic through the TOR network, maintaining anonymity.

Their new hardware grants users complete privacy, whilst earning them rewards.

https://twitter.com/1626376419268784130/status/1758165932365476250

Other notable mentions:

• @bittensor_

• @Helium

• @Hivemapper

• @storj

• @bittensor_

• @Helium

• @Hivemapper

• @storj

Note: This isn't an exhaustive list.

The DePIN sector is vast, and constantly evolving.

I'll keep you updated with any new exciting projects I come across in this niche.

Also, let me know in the comments if there are any projects you'd like me to research further.

The DePIN sector is vast, and constantly evolving.

I'll keep you updated with any new exciting projects I come across in this niche.

Also, let me know in the comments if there are any projects you'd like me to research further.

DePIN is a sector I am extremely excited about, as it is one where I can see clear scope of adoption with real world applications.

Long term, it's one of the most clear use cases for decentralisation, and thus, I'm expecting it to be one of the highest upside sectors in crypto.

Long term, it's one of the most clear use cases for decentralisation, and thus, I'm expecting it to be one of the highest upside sectors in crypto.

I hope you've found this thread helpful.

Follow me @milesdeutscher for more content like this.

Also, Like/Repost the quote below if you can. 💙

Follow me @milesdeutscher for more content like this.

Also, Like/Repost the quote below if you can. 💙

https://twitter.com/1530033576/status/1759256944840450178

• • •

Missing some Tweet in this thread? You can try to

force a refresh