$NVDA is the clear frontrunner in the AI Gold Rush, leading with its H100 GPU that sets high standards for AI computation and sparking anticipation for the H200.

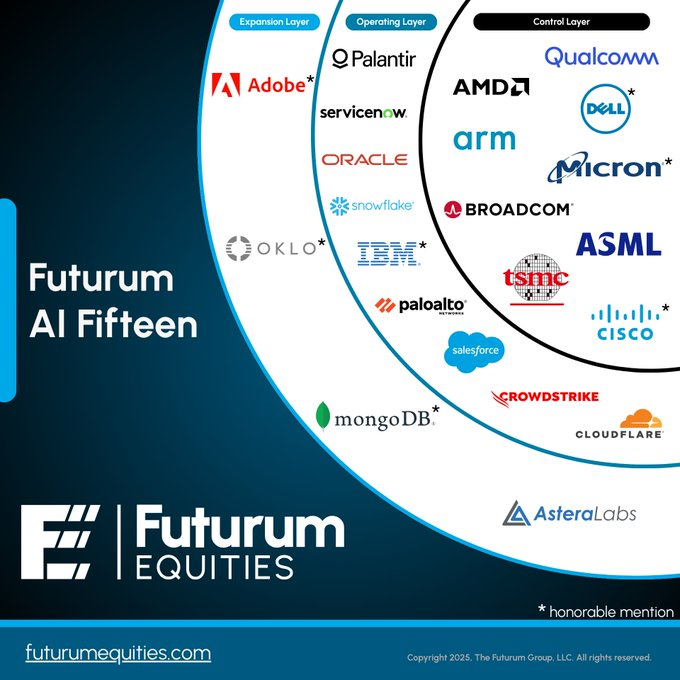

Let's also examine other key players who hold clear leadership positions in the new digital economy ⤵️

Let's also examine other key players who hold clear leadership positions in the new digital economy ⤵️

$INTC progress in AI accelerators & $AMD's MI300 chip launch are challenging $NVDA dominance in the GPU market.

AMD's chip merges CPU & GPU capabilities to excel in computing & AI tasks, while Intel's investments in AI-specific hardware aim to carve a niche in this market.

AMD's chip merges CPU & GPU capabilities to excel in computing & AI tasks, while Intel's investments in AI-specific hardware aim to carve a niche in this market.

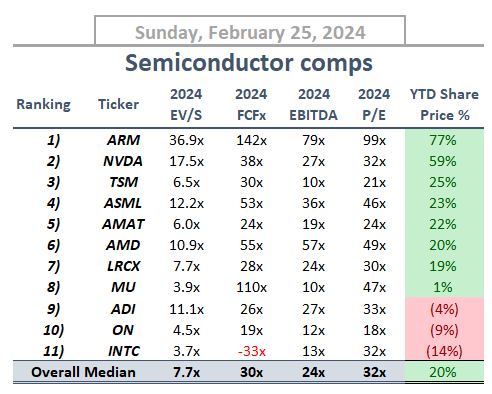

$ASML EUV lithography & $AMAT material engineering are essential for enabling the mass production of ultra-small, efficient chips critical for AI applications -- crucial to sustaining Moore's Law in the semiconductor industry.

As the world's largest semiconductor foundry, $TSM advanced fabrication processes, along with $LRCX etch & deposition systems, play a crucial for producing AI chips.

This facilitates the rapid evolution of AI technologies through chip scaling & complexity reduction.

This facilitates the rapid evolution of AI technologies through chip scaling & complexity reduction.

$KLAC, $AVGO & $MRVL provide essential AI ecosystem infrastructure, with KLA ensuring chip quality, Broadcom enhancing AI system data flow, and Marvell supporting the computing demands of AI with advanced storage and networking.

$ARM energy-efficient CPUs & $ADI precision analog chips are crucial for AI's proliferation into mobile and IoT devices, balancing low-power use with high performance and enabling AI's adoption across various platforms, from smartphones to industrial sensors.

$MU memory solutions & $ON power/sensing technologies are vital for AI's data management, enabling efficient processing and storage to meet the demands of complex AI computations.

To review ⤵️

• Hardware Foundation | $NVDA leads with AI chips, challenged by $AMD & $INTC.

• Chip Innovation | $ASML & $AMAT chip making, supported by $TSM & $LRCX.

• AI Infrastructure | $KLAC, $AVGO, $MRVL

• Design Efficiency | $ARM & $ADI

• Data Mgmt | $MU & $ON

• Hardware Foundation | $NVDA leads with AI chips, challenged by $AMD & $INTC.

• Chip Innovation | $ASML & $AMAT chip making, supported by $TSM & $LRCX.

• AI Infrastructure | $KLAC, $AVGO, $MRVL

• Design Efficiency | $ARM & $ADI

• Data Mgmt | $MU & $ON

• • •

Missing some Tweet in this thread? You can try to

force a refresh