Chief Market Strategist @FuturumEquities | Contributor @Reuters @Bloomberg @MarketWatch @Forbes | Not investment advice

17 subscribers

How to get URL link on X (Twitter) App

1. $AMZN | Amazon

1. $AMZN | Amazon

1. What the Bears Are Getting Wrong

1. What the Bears Are Getting Wrong

15. $ALAB | Astera Labs

15. $ALAB | Astera Labs

2. $AMZN | Amazon

2. $AMZN | Amazon

2. $TSLA | Tesla

2. $TSLA | Tesla

2. $ALAB | Astera Labs

2. $ALAB | Astera Labs

6. $MRVL | Marvell Technology

6. $MRVL | Marvell Technology

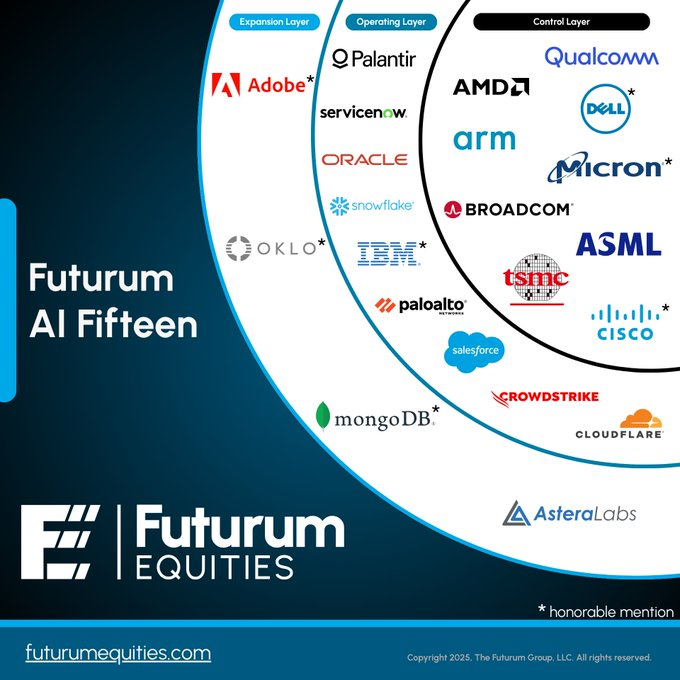

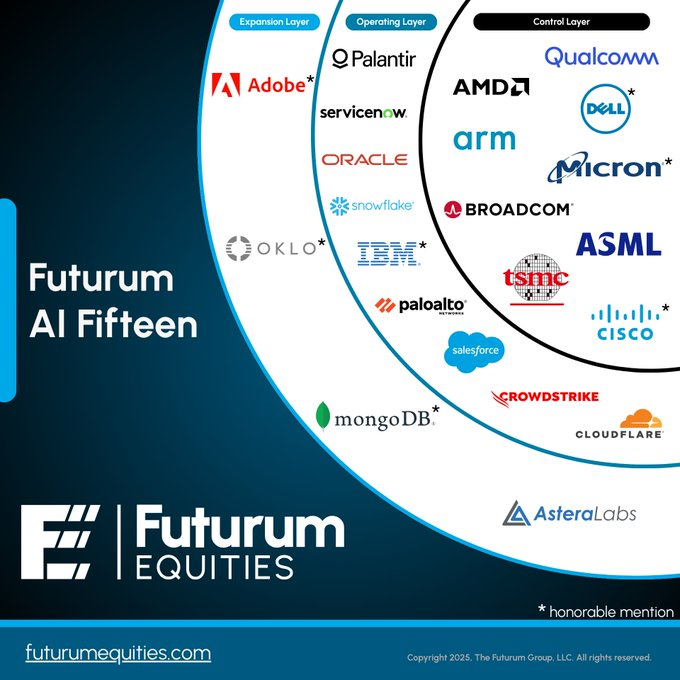

The Three Layers of Ontology: Semantic, Kinetic & Dynamic

The Three Layers of Ontology: Semantic, Kinetic & Dynamic

6. $MRVL | Marvell Technology

6. $MRVL | Marvell Technology