To make a point that Michael Pettis also makes, China is going to have trouble "reshaping global trade on its own terms" so long as the US and the EU are the ultimate course of most of its trade surplus

1/

ft.com/content/c51622…

1/

ft.com/content/c51622…

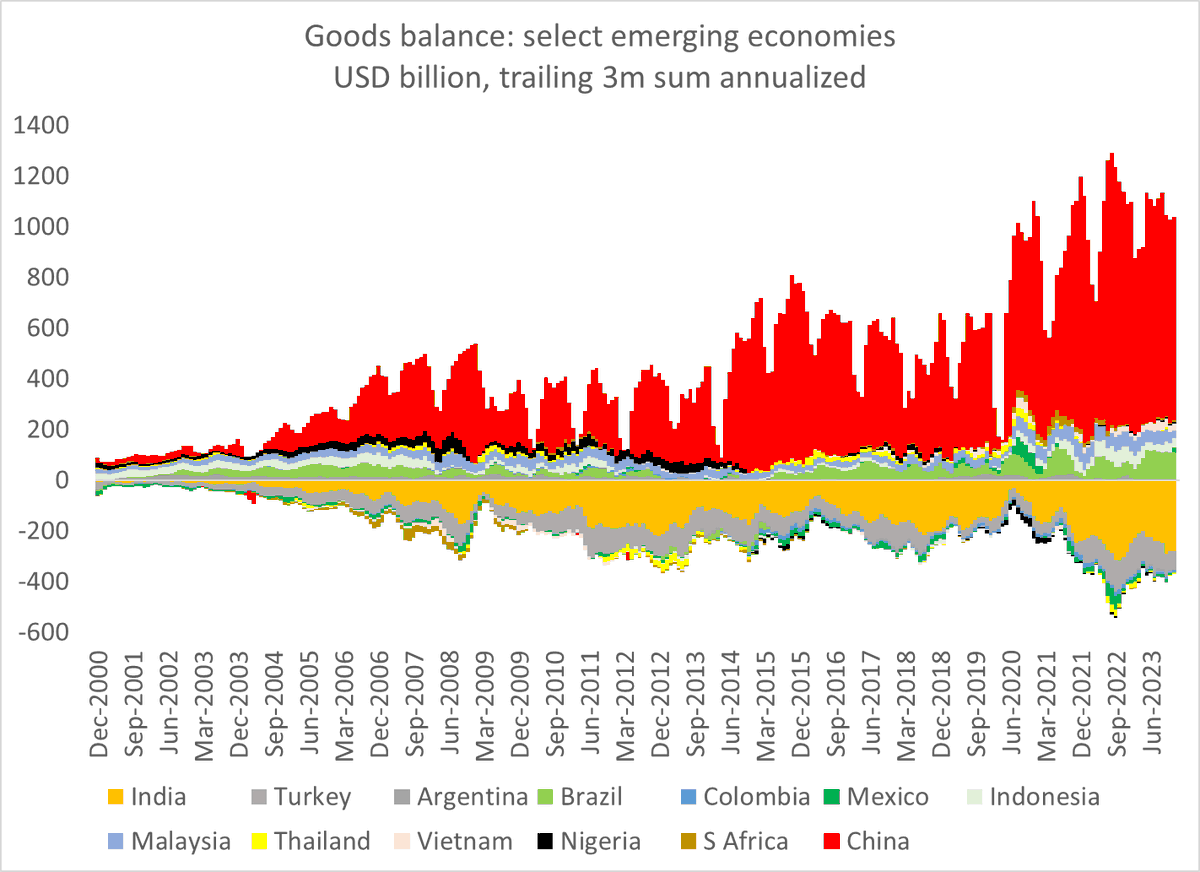

The countries in China's RCEP all run global surpluses (or at least most do). So in addition to being a rather thin agreement, it isn't actually close to a self contained block.

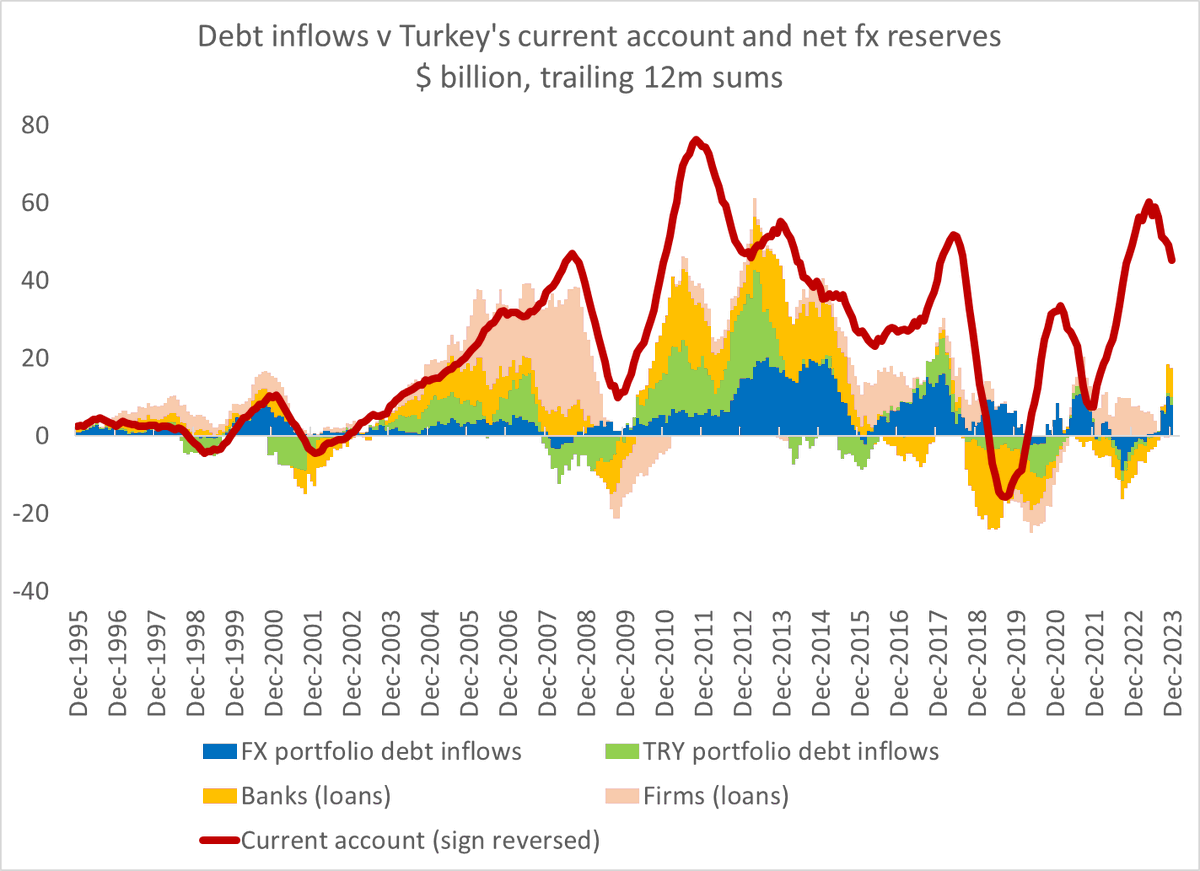

Some for now is true of any CNY payments network along the BRI ...

2/

ft.com/content/c51622…

Some for now is true of any CNY payments network along the BRI ...

2/

ft.com/content/c51622…

traditional trade reporting is very focused on bilateral trade deals and bilateral flows.

But in this case the global data is important, and tells the opposite story: namely China's global trade still cannot balance without the US

3/3

But in this case the global data is important, and tells the opposite story: namely China's global trade still cannot balance without the US

3/3

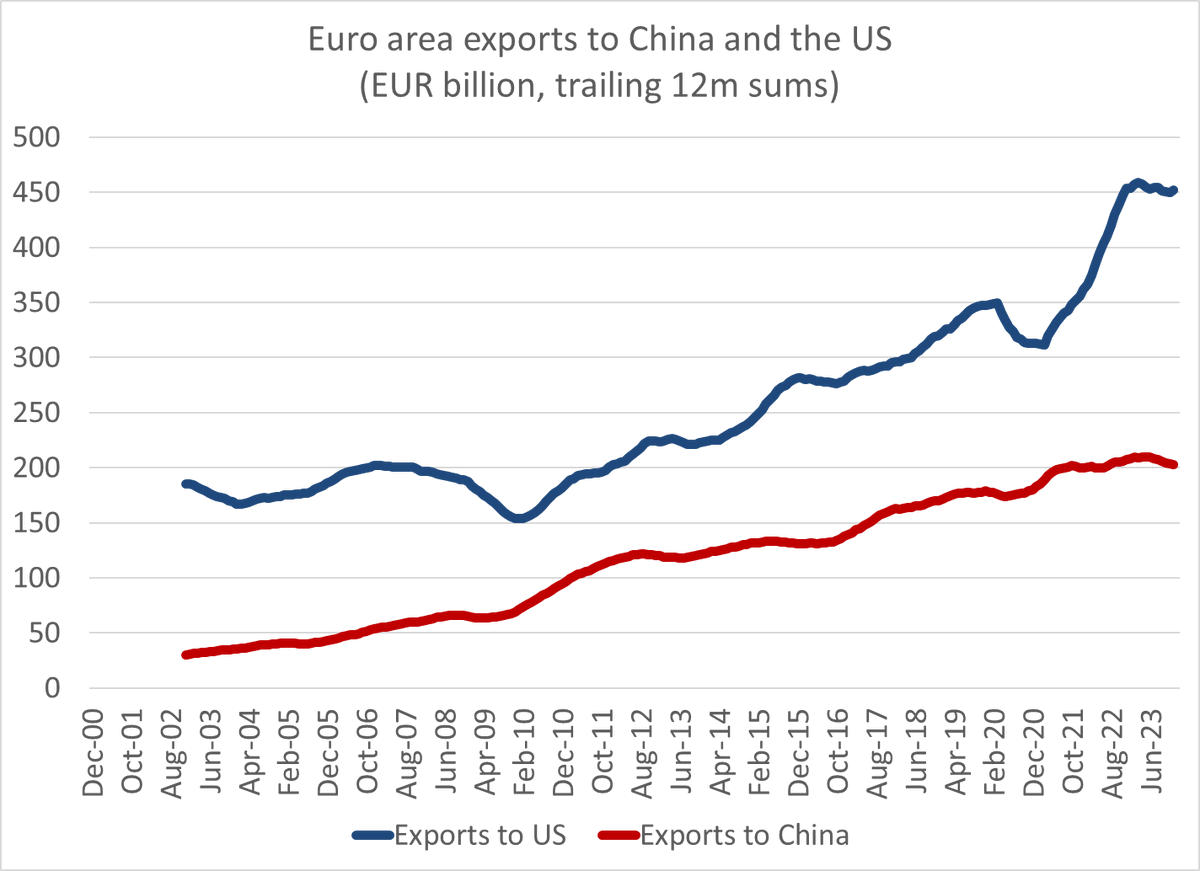

first post should read that the US and the EU are the ultimate "source" not "course" of China's surplus. The EU makes up for its structural deficit with China with a structural surplus with the US, leaving the US deficit to balance most of China's underlying surplus

@GlennLuk so I think folks who try to think of this without thinking of how overall trade balances are missing the forest. Chinese manufactured export are 2x its imports of manufacture these days; the surplus is actually critical to overall flow again

@GlennLuk and no doubt China is now a capital intensive exporter, not a labor intensive one -- and in clean tech a tech exporter as well. but driver of a lot of those exports = end demand in US and Europe ... which all the bilateral data misses

@GlennLuk but I don't think Pettis is wrong to note that the US has a comparative advantage in generating demand, and China still relies on that to some signficant degree -- despite all the things discussed in the FT's big read. It just seems to be a big omitted variable

• • •

Missing some Tweet in this thread? You can try to

force a refresh