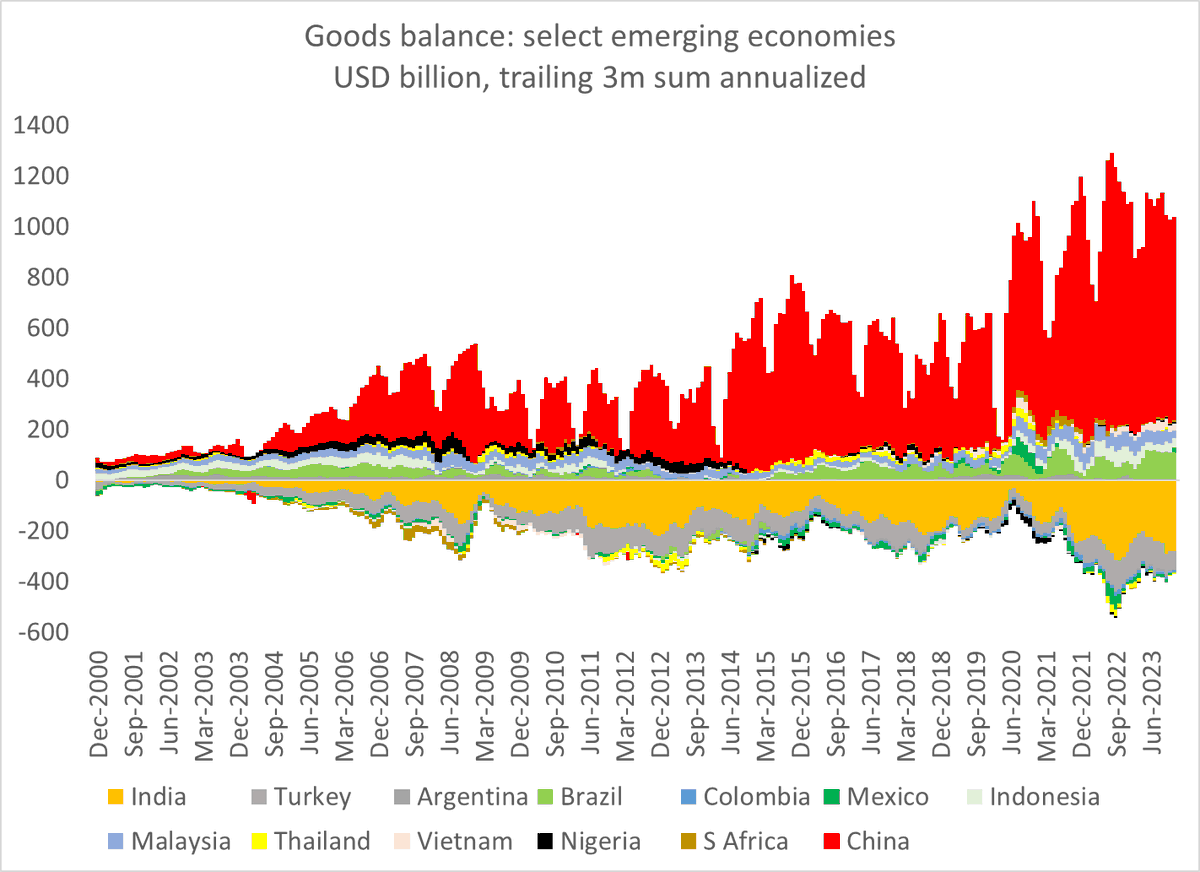

A chart that illustrates how it is fundamentally impossible for China to construct a block centered around the developing world that replaces the US/ EU ...

there is an obvious problem, namely the size of China's surplus

1/x

there is an obvious problem, namely the size of China's surplus

1/x

https://twitter.com/michaelxpettis/status/1762345913270313362

Here is the same chart without China -- it looks totally different. That's the point.

Note one other thing: the big deficits are in India and Turkey.

2/

Note one other thing: the big deficits are in India and Turkey.

2/

That is a real problem for a Sinocentric block that aims to replace the US and Europe as a source of end demand. India is absolutely not prepared to run bigger deficits with China -- and Turkey really needs to bring its deficit down.

3/

3/

India, remember, didn't join China's trade deal (unlike say Japan ... ) and is exceptionally worried that Chinese exports are undermining its own manufacturing sector. Turkey competes with China in the EU market and isn't gonna give up the EU for China ...

4/

4/

The bigger point of course is that the world cannot really decouple so long as there are enormous surpluses and deficits across different parts of the global economy (and different political blocks)

5/

5/

This point is I think obvious to @michaelxpettis, me/ & others who think about "global" demand and supply imbalances. But it is not at all intuitive to the world of trade and commercial diplomacy -- and to my surprise no longer obvious to the "it's all fiscal" IMF!

@michaelxpettis ps i think the goods data tells the story more cleanly/ with fewer distortions than the broader data showing the current account (note I don't trust the Chinese current account number & current account data is more distorted by tax). But the CA numbers say the same thing

@littlebigfis and BoP based thinking is a lost art -- sadly, even at the IMF, where the norm is now "it is all fiscal" ...

• • •

Missing some Tweet in this thread? You can try to

force a refresh