In new NBER paper with @MA_Bolhuis, @juddcramer and Oskar Shulz, we argue that the unprecedented increase in borrowing costs is crucial to explaining the low consumer sentiment of the last two years. 1/N

nber.org/papers/w32163

nber.org/papers/w32163

With higher rates, mortgage payments, car payments, and other credit payments required to finance everyday purchases have risen as well. It is not surprising that this would affect how consumers feel about the economy. 2/N

Since Okun invented his misery index in the 1970s, economists have looked at unemployment and the inflation rate to gauge consumer sentiment. But now that unemployment is low and inflation has declined, consumer sentiment remains depressed. 3/N

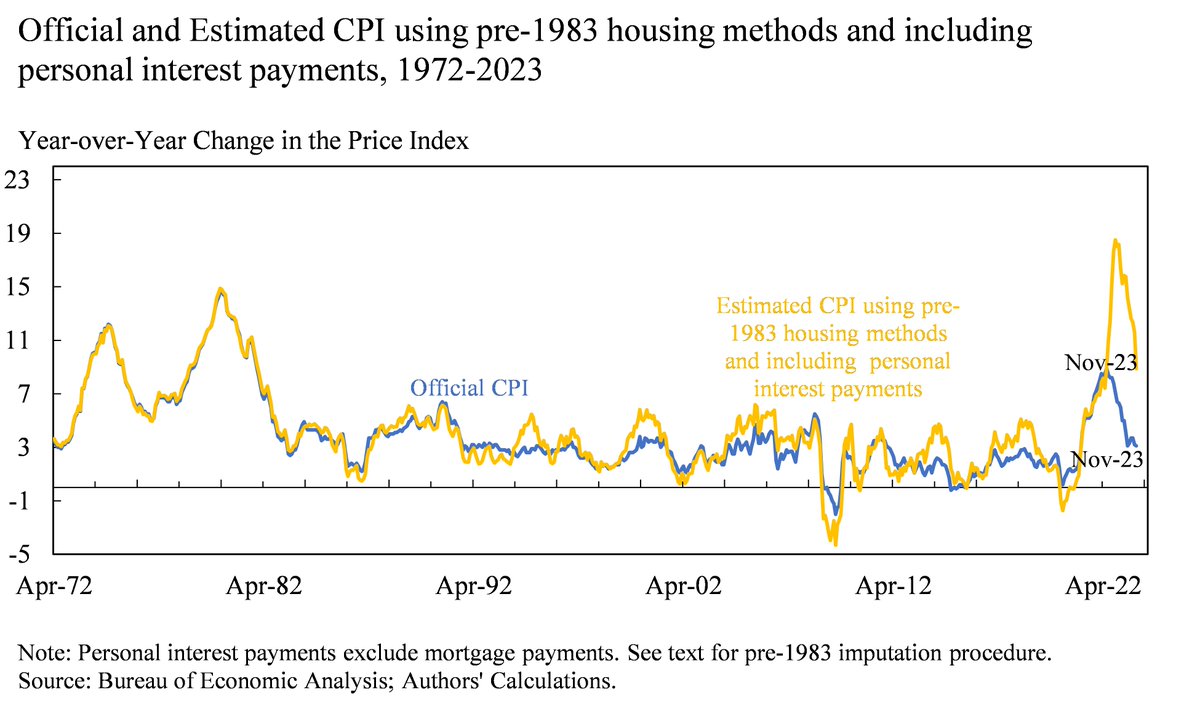

Pre-1983, mortgage costs were in the CPI as were car payments pre-1998. Now, price indexes do not include borrowing costs. Thus, when interest rates jumped last year, official inflation did not fully capture the effects it would have on consumer well-being. 4/N

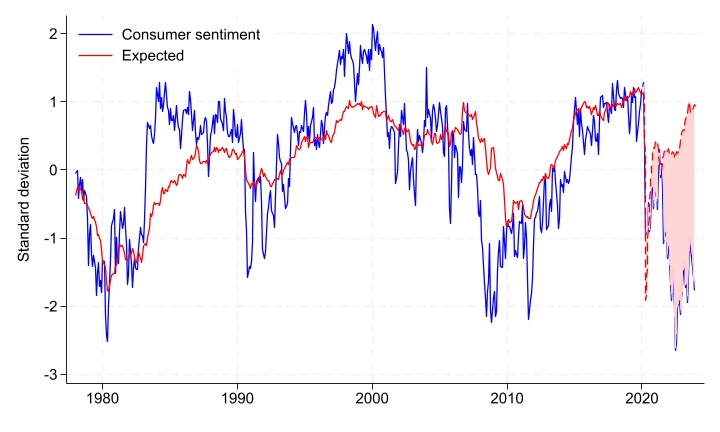

In the paper, we show that the variation in the current University of Michigan Index of Consumer Sentiment, which cannot be explained by official inflation and unemployment, has historically shown a strong correlation with proxies for borrowing costs. 5/N

We also show that the underlying questions in the survey provide direct evidence that concerns of consumers about borrowing costs are at historic highs, surpassed only by the Volcker-era. 6/N

We then develop alternative CPI measures that explicitly incorporate the cost of money. The CPI does not only exclude mortgage costs, but also personal interest payments, which increased by more than 50 percent in 2023. 7/N

We show that if we make an effort to reconstruct the CPI of Okun’s era—which would have had inflation peak last year around 18%, we are able to explain 70% of the gap in consumer sentiment we saw last year. 8/N

We also show the sentiment gap in 2023 was not only a U.S. phenomenon as rates have jumped around the world. Overall, our paper highlights how consumers care about the cost of money, with potential for consumer sentiment to rise significantly if and when interest rates decline. 9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh