In this THREAD I will explain KILLZONES.

1. What are “KILLZONES”?

2. ICT Killzones

3. High probability setups with Killzones

4. How to trade Killzones

5. Protective SL

🧵(1/7)

1. What are “KILLZONES”?

2. ICT Killzones

3. High probability setups with Killzones

4. How to trade Killzones

5. Protective SL

🧵(1/7)

1. What are “KILLZONES”?

The Killzones are periods of intense market activity where the price action is at its most volatile.

This volatility can lead to significant price movements, which provide traders the opportunity to make profits.

The Killzones are periods of intense market activity where the price action is at its most volatile.

This volatility can lead to significant price movements, which provide traders the opportunity to make profits.

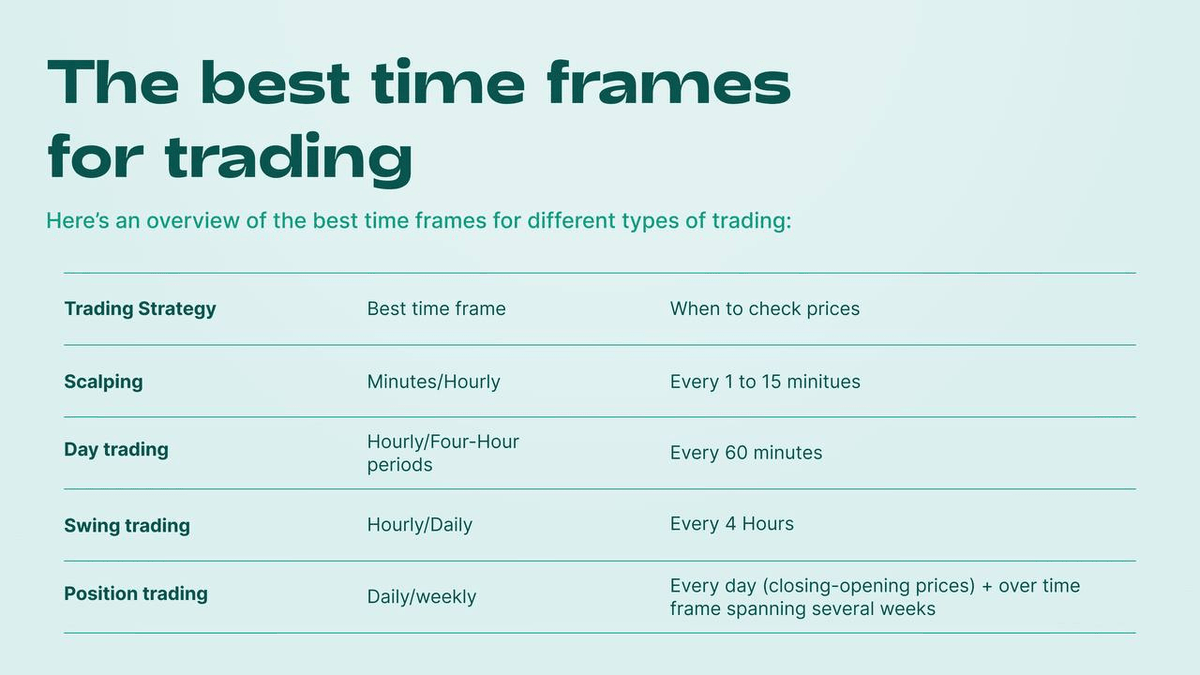

2. ICT Killzones (Indices and FX)

The FX market operates 24H a day but is divided into several major sessions.

Each with its own characteristics and levels of activity.

These sessions are the Asian, London, and NY sessions.

The FX market operates 24H a day but is divided into several major sessions.

Each with its own characteristics and levels of activity.

These sessions are the Asian, London, and NY sessions.

3. High probability setups with Killzones:

- Mark and label the Killzones and trade ONLY within that time window.

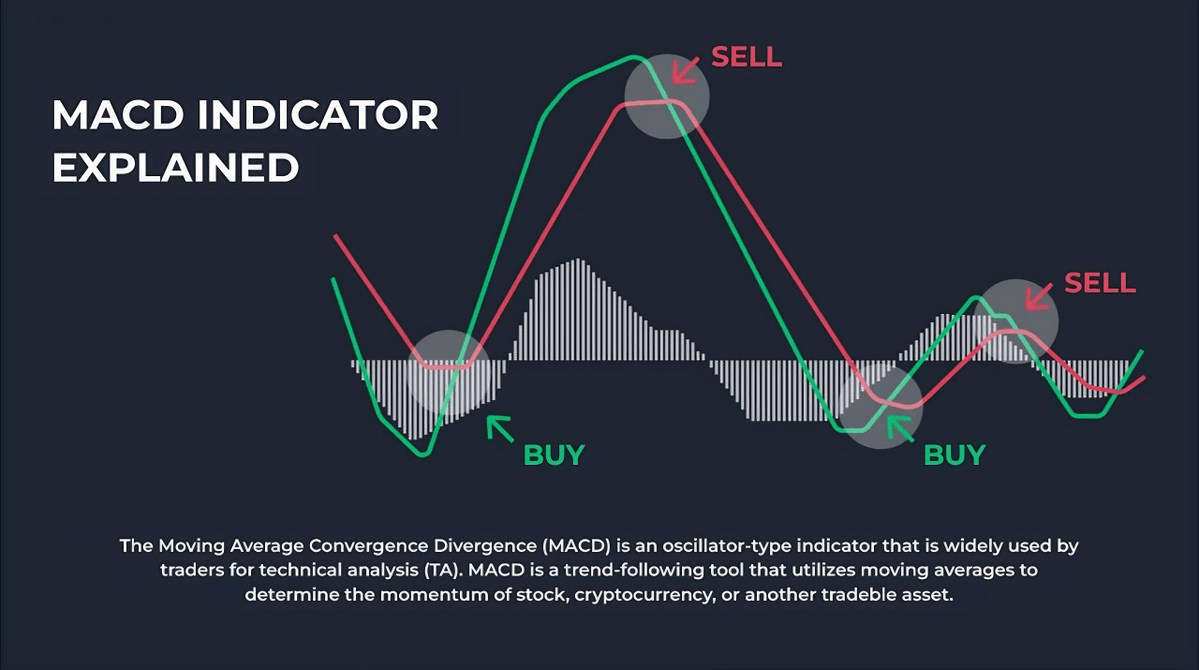

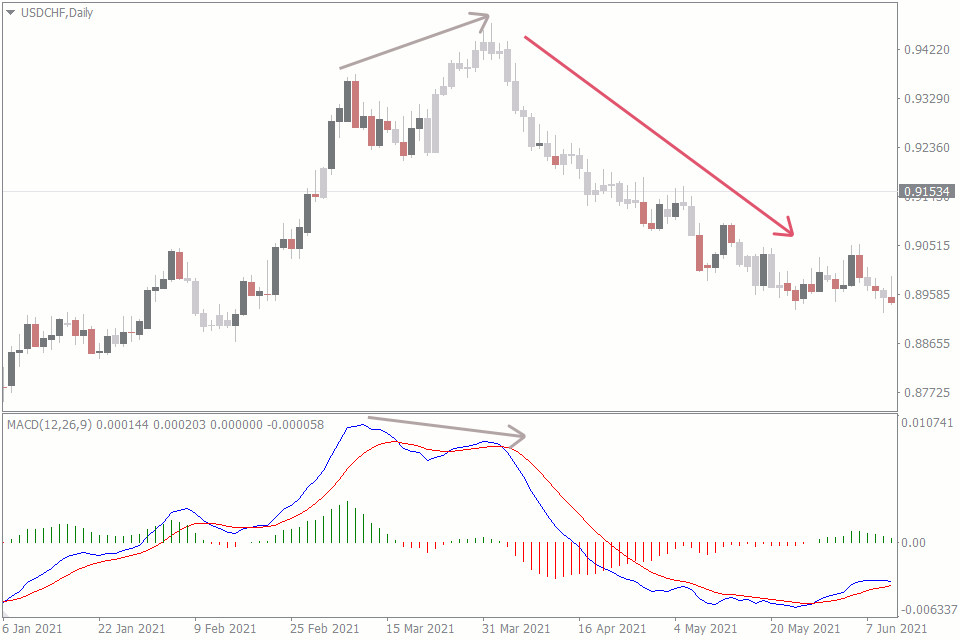

- Identify the trend of the current market

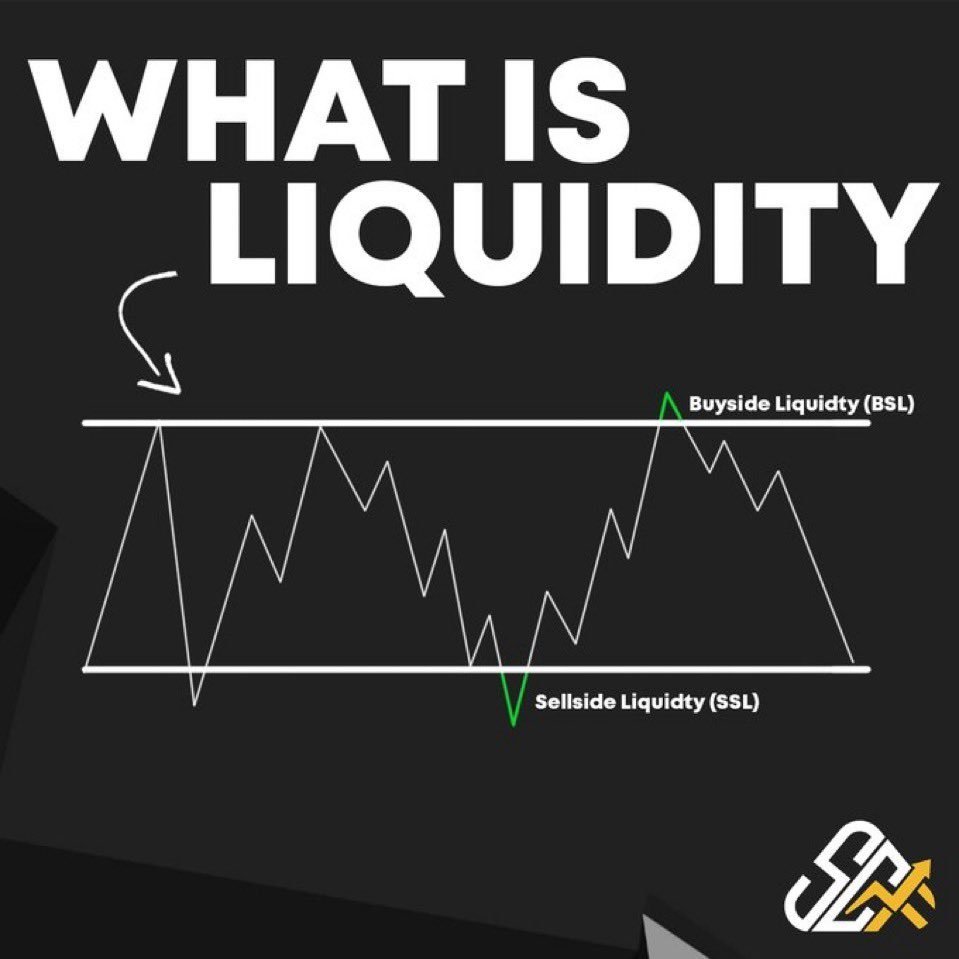

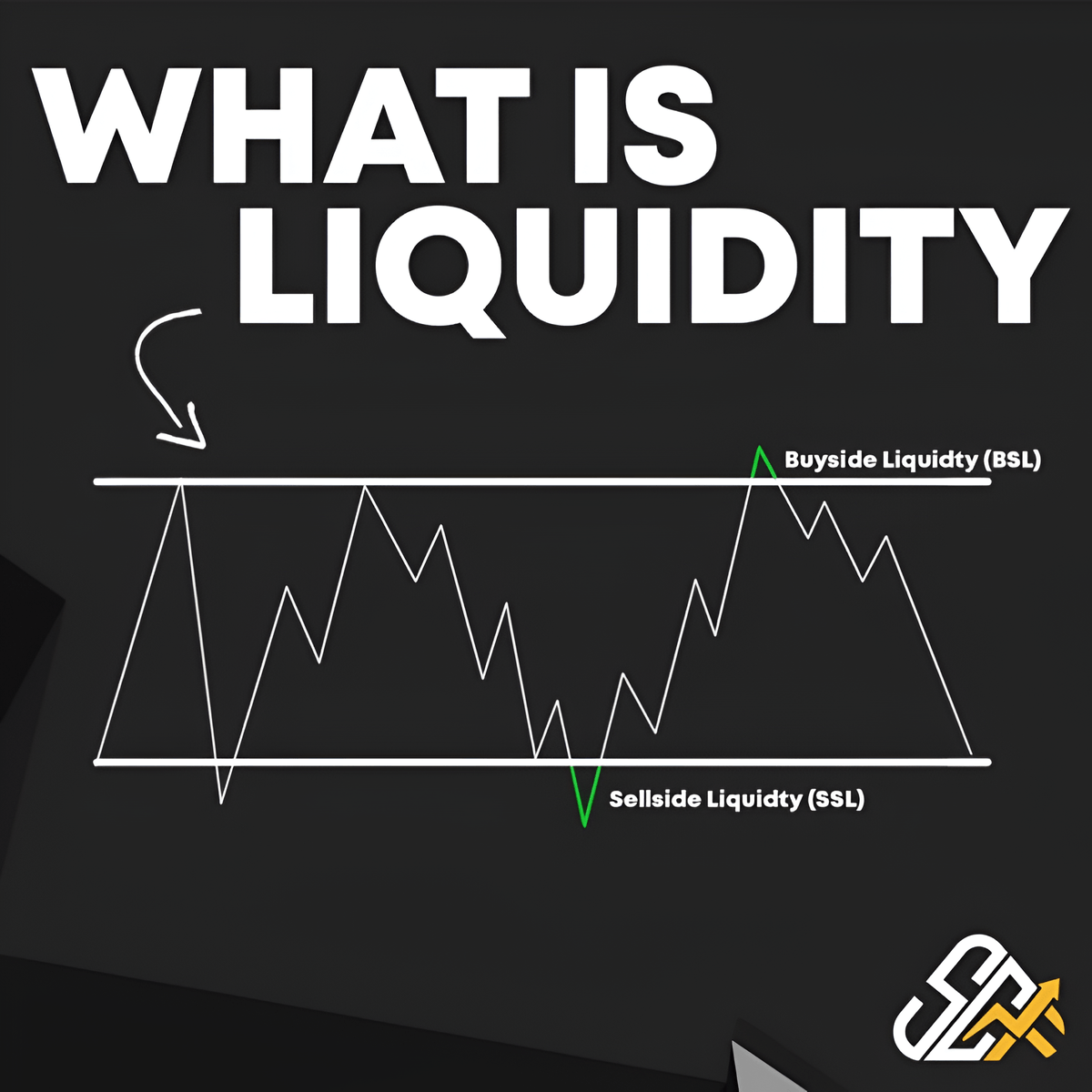

- Wait for the price to align with time. And liquidity/volume to kick in

- Enter trades only within that time window

- Mark and label the Killzones and trade ONLY within that time window.

- Identify the trend of the current market

- Wait for the price to align with time. And liquidity/volume to kick in

- Enter trades only within that time window

4. How to trade Killzones:

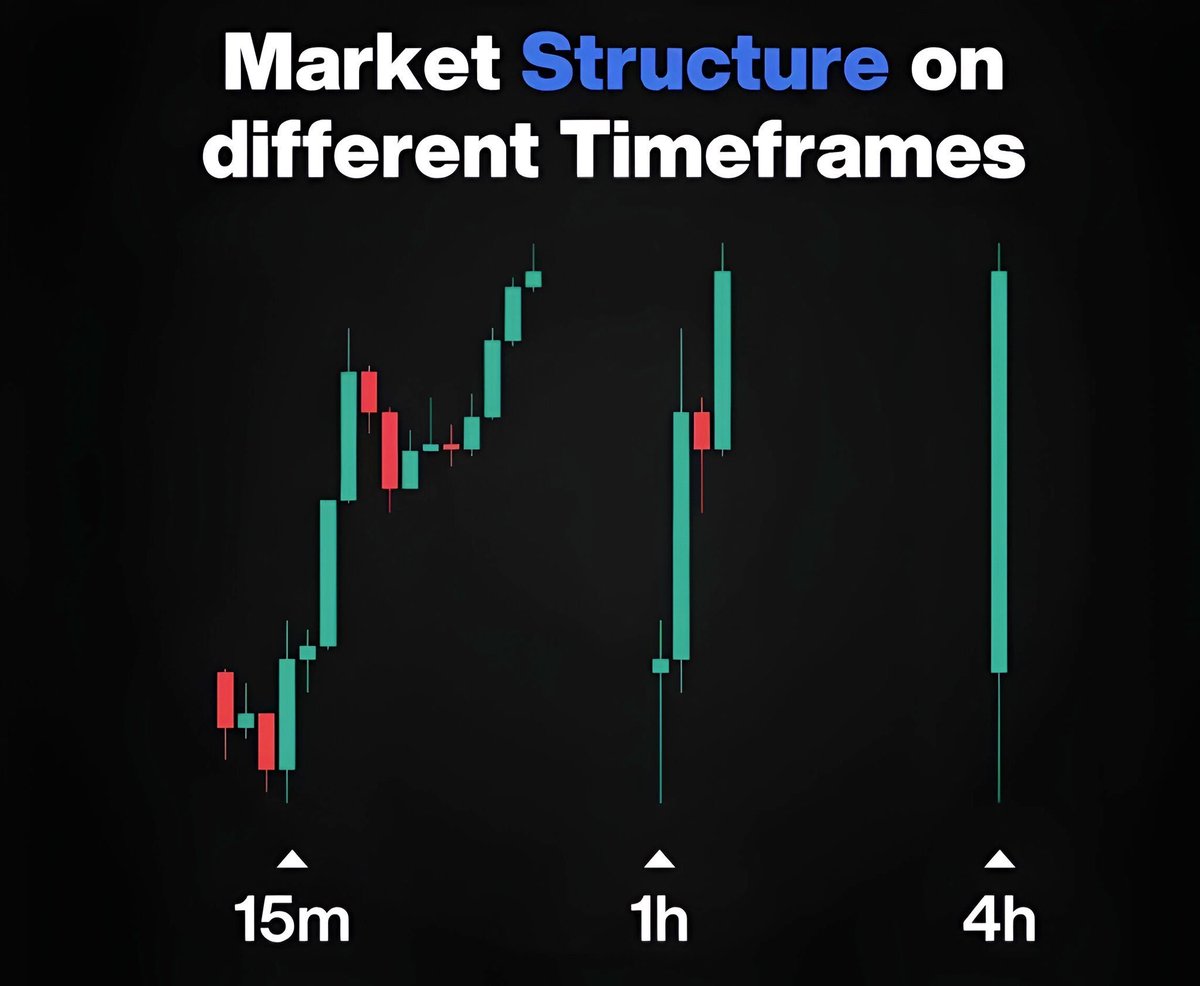

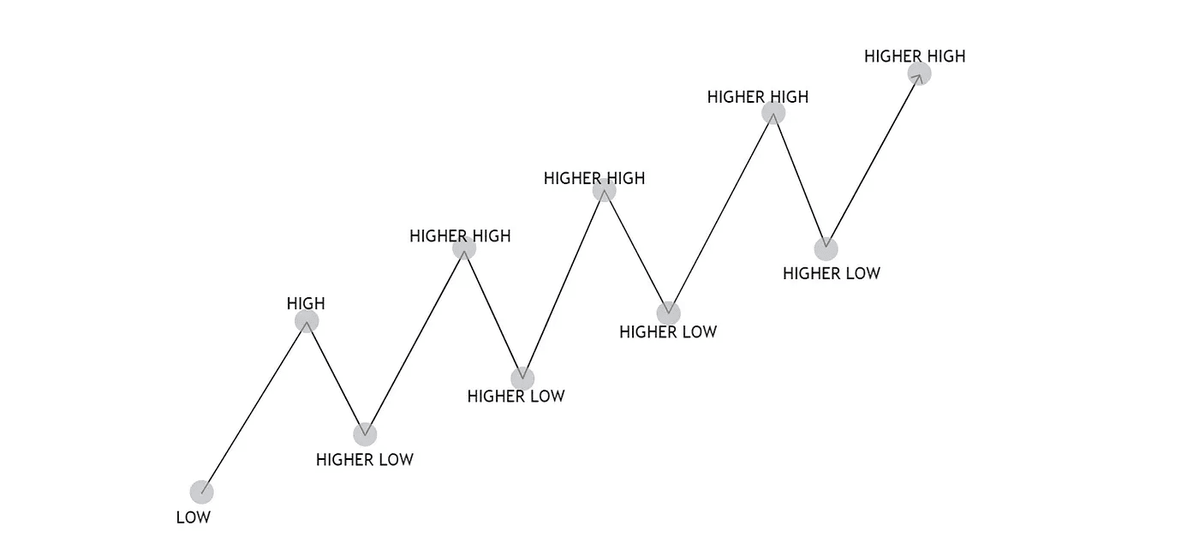

1. Identify the trend:

Determine the trend of the price. Bullish or bearish?

2. Identify the Asian Range:

Study the price movement during the Asian session

Notice if the price has formed a range, characterized by clear highs and lows.

1. Identify the trend:

Determine the trend of the price. Bullish or bearish?

2. Identify the Asian Range:

Study the price movement during the Asian session

Notice if the price has formed a range, characterized by clear highs and lows.

4.1 How to trade Killzones:

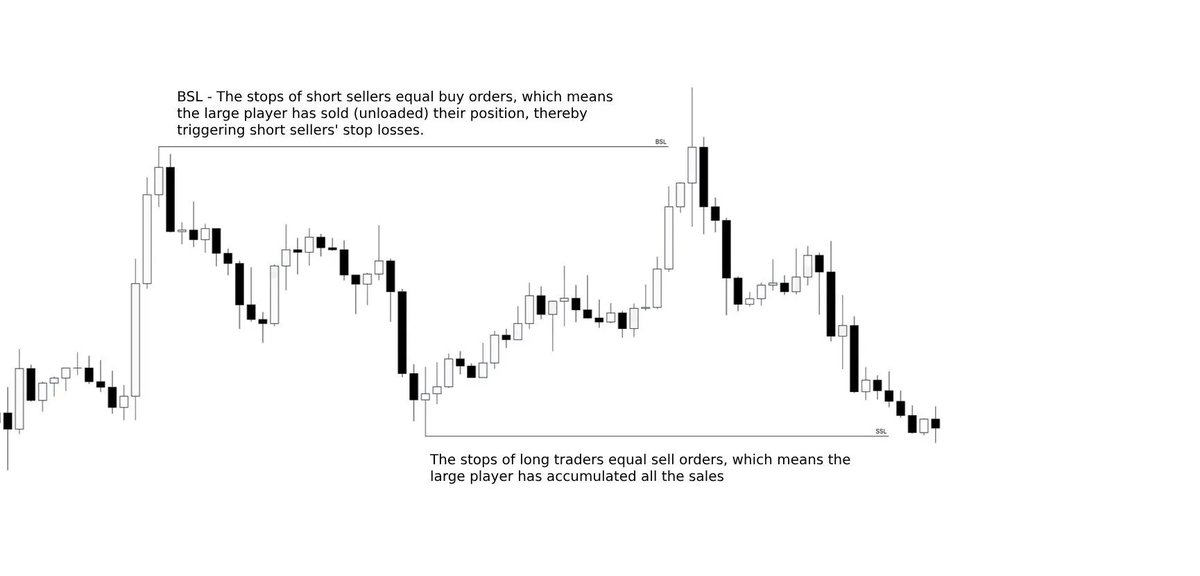

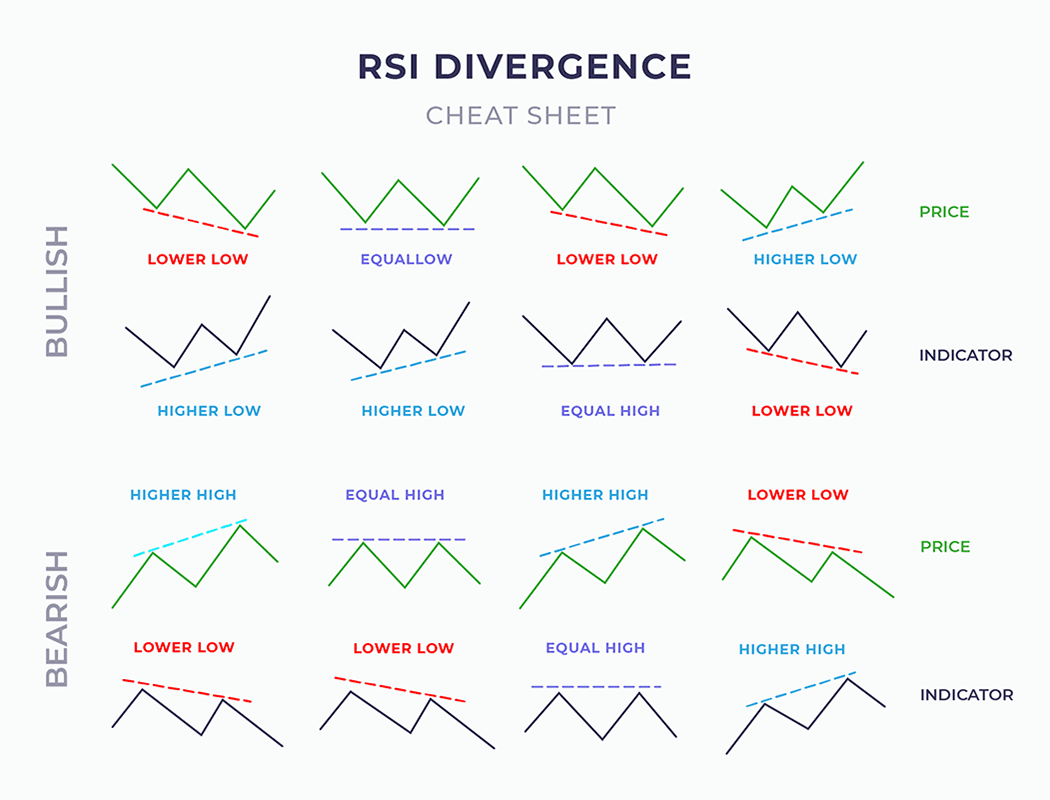

3. Look for false breakouts Against the Trend:

In the London or NY sessions, watch for price movements that breaks out of the Asian session’s range.

4. Take the trade:

After spotting a false breakout, take your trade during London or NY sessions.

3. Look for false breakouts Against the Trend:

In the London or NY sessions, watch for price movements that breaks out of the Asian session’s range.

4. Take the trade:

After spotting a false breakout, take your trade during London or NY sessions.

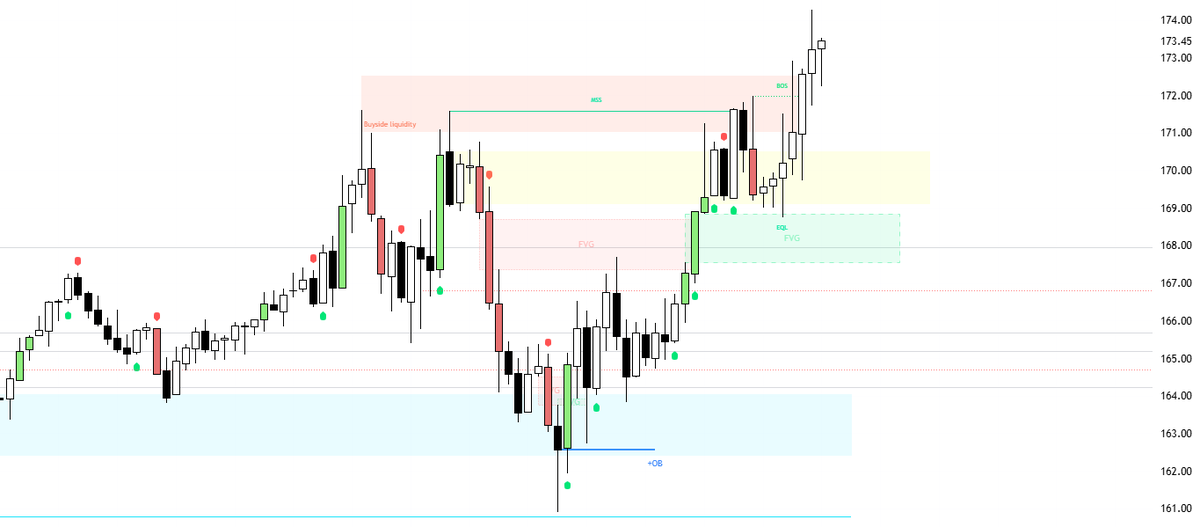

5. Protective SL:

It’s key to set a protective stop loss in kill zones, especially during stop hunting.

This technicals tools will help you determine the best placement for your stop loss:

- Order Block

- Supply and Demand Zone

- FVG

- Key Levels

- Swing Levels

It’s key to set a protective stop loss in kill zones, especially during stop hunting.

This technicals tools will help you determine the best placement for your stop loss:

- Order Block

- Supply and Demand Zone

- FVG

- Key Levels

- Swing Levels

• • •

Missing some Tweet in this thread? You can try to

force a refresh