I feel like oil investors don't understand the difference between highly depleted locations like Texas and much younger oil locations in Latin America.

My thesis is this, my Latin American countries are basically Texas in 1920s, i.e. decades of cheap conventional oil ahead. 🧵

My thesis is this, my Latin American countries are basically Texas in 1920s, i.e. decades of cheap conventional oil ahead. 🧵

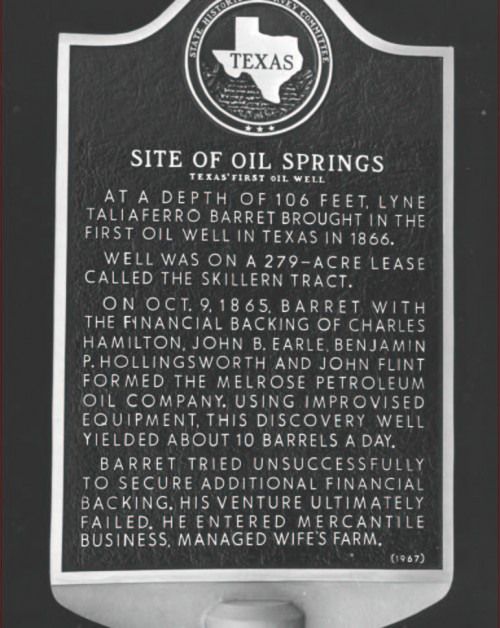

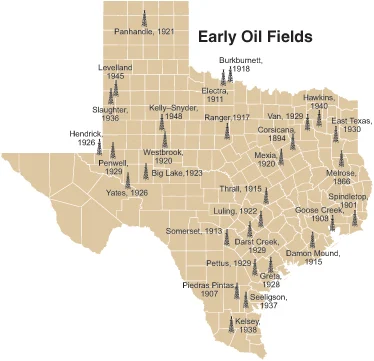

The Texan oil industry began its birth in 1866, just after the civil war, in a little town between Houston and Dallas called Nagodoches.

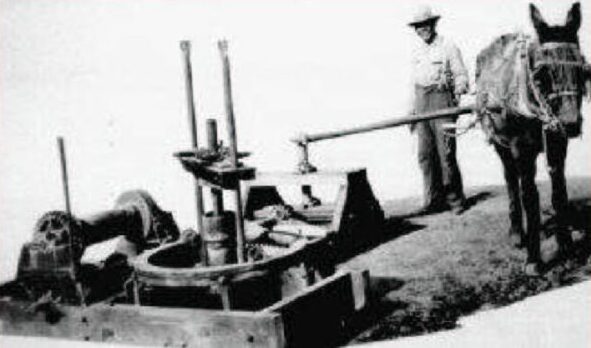

A man named Lyne T. Barret used an auger, fastened to a pipe to drill that first well.

A man named Lyne T. Barret used an auger, fastened to a pipe to drill that first well.

By 1890, Nagodoches, by this time called "Oil Springs", would have more than 40 oil wells.

By 1894, another major discovery had been made in nearby Corsicana, and the oil field operators built the first modern refinery, which would receive oil shipments by rail.

By 1894, another major discovery had been made in nearby Corsicana, and the oil field operators built the first modern refinery, which would receive oil shipments by rail.

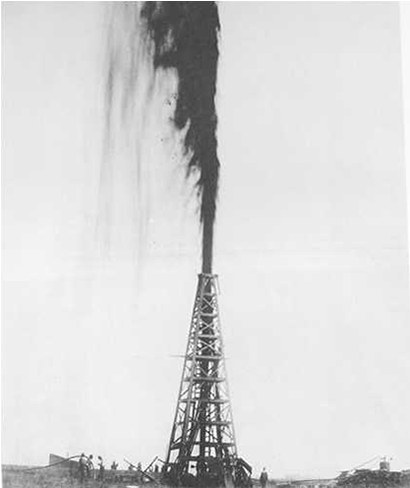

In 1901, Texas had truly become an oil state. Deeper, modern wells had so much pressure on them that they would be called "gushers" due to the massive amounts of crude that would uncontrollably shoot out of them.

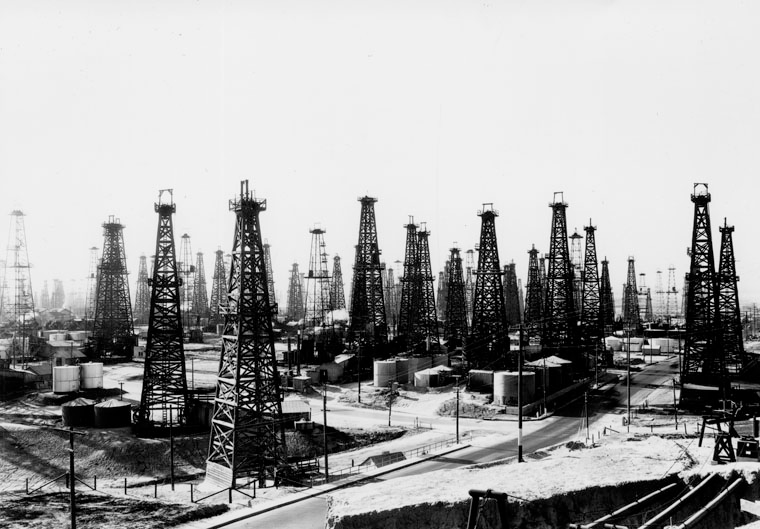

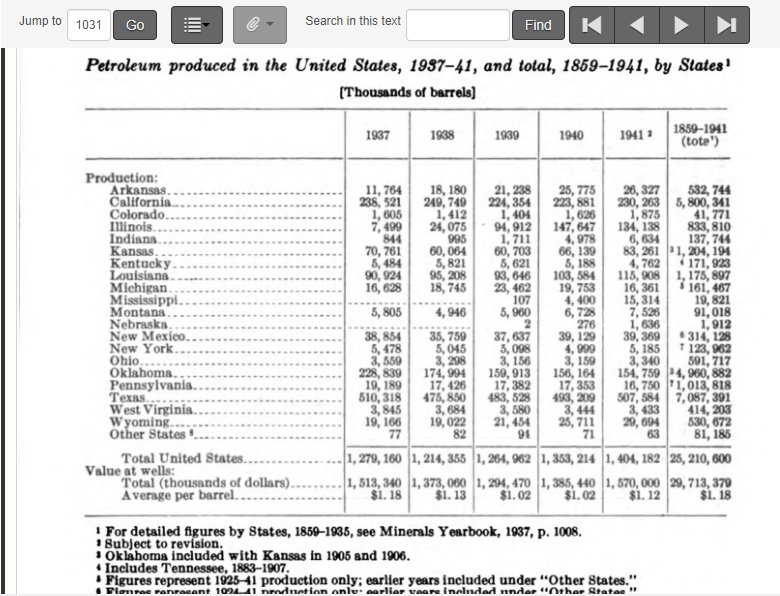

By 1930, the Texas economy was wholly dependent on oil, with many major conventional oil fields being discovered from 1900-1930.

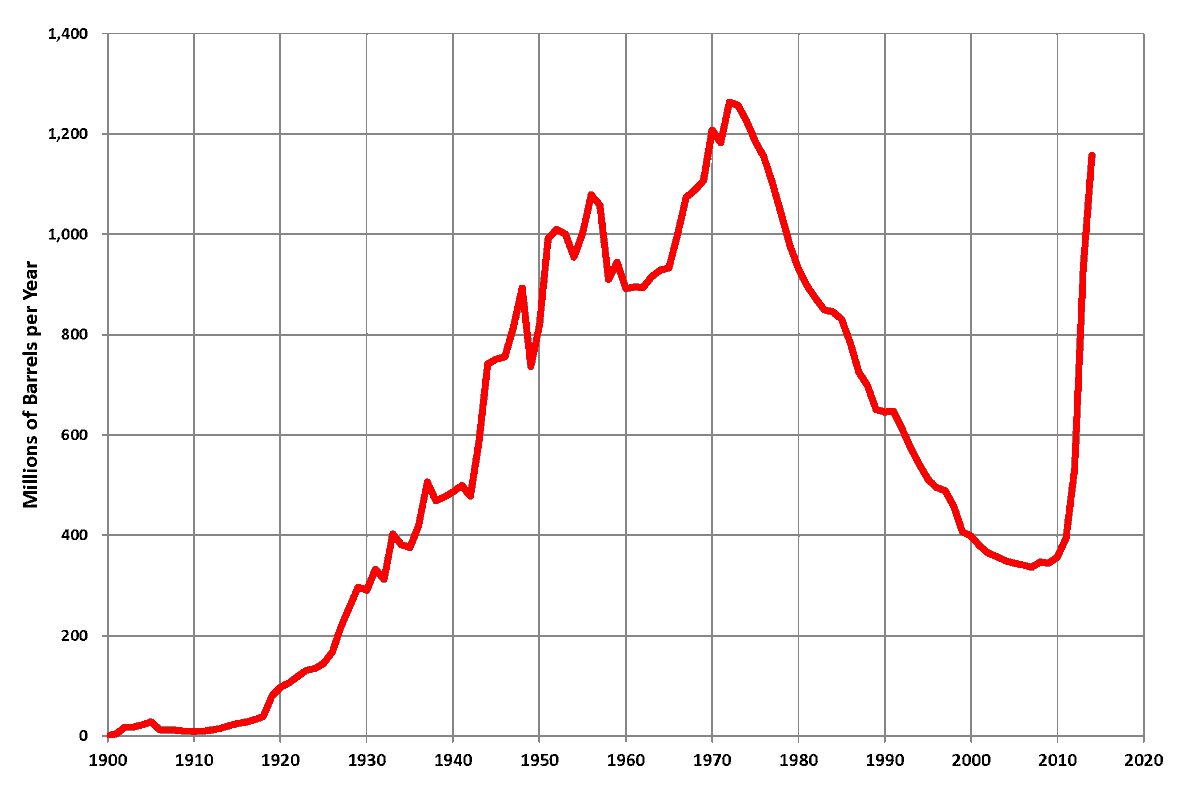

And yet at this time, the Texan oil industry was still young, with production just starting to take off.

It would be decades till production peaked.

And yet at this time, the Texan oil industry was still young, with production just starting to take off.

It would be decades till production peaked.

By the time WW2 rolled around, Texas was the nation's economic powerhouse. Despite its oil industry starting later, it had become the largest in the nation.

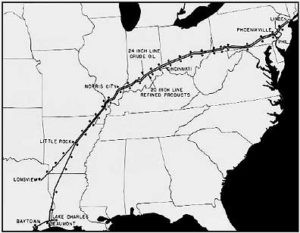

Pipelines from Texas going all over the country were being built. It was Texas oil production that helped win WW2.

Pipelines from Texas going all over the country were being built. It was Texas oil production that helped win WW2.

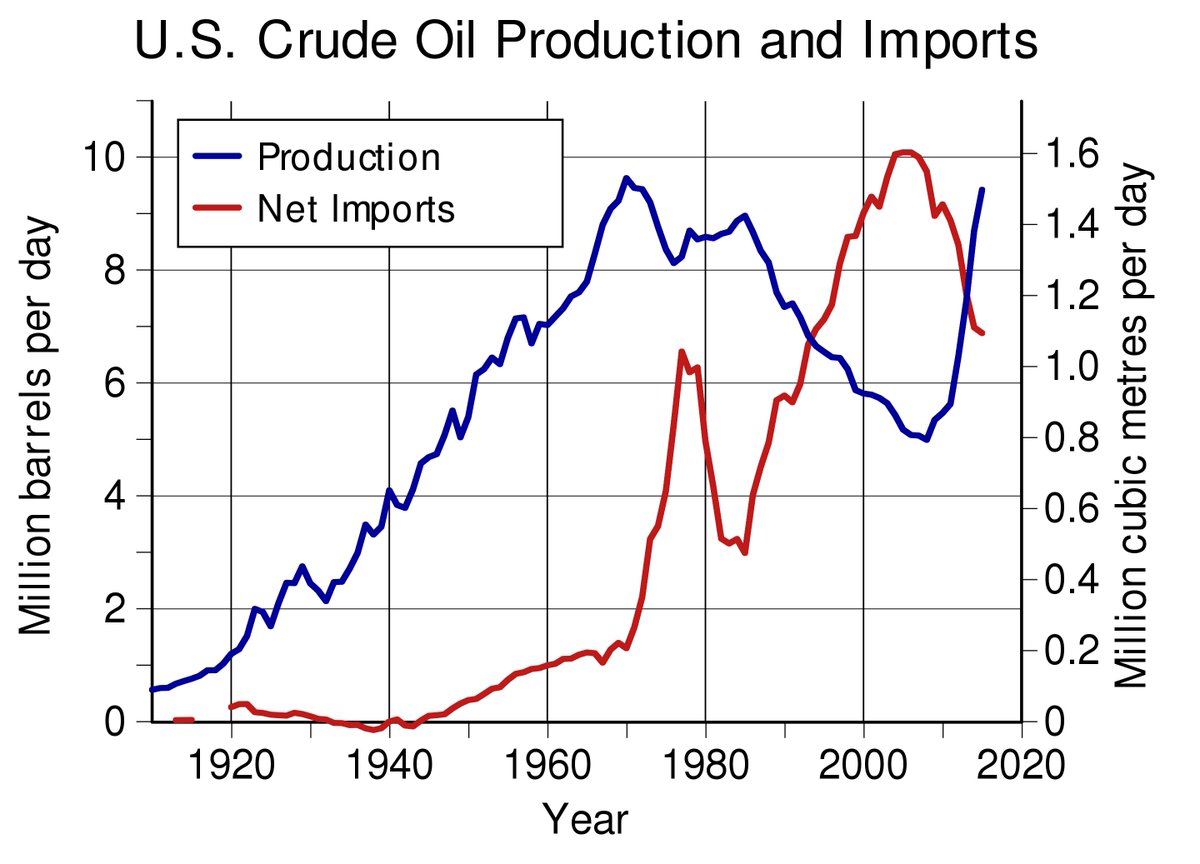

By 1971, conventional drillers were pulling nearly 3.5M barrels out of the ground every day in Texas.

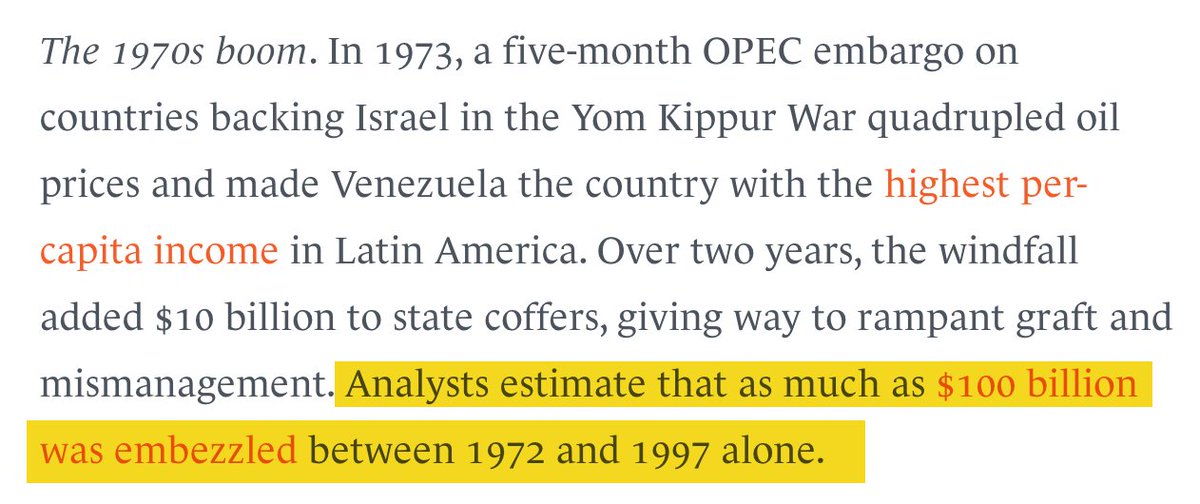

It was around this time that OPEC was formed, the gold standard broke, and in response to the Arab-Israeli war and a peak in US conventional, OPEC started limiting exports.

It was around this time that OPEC was formed, the gold standard broke, and in response to the Arab-Israeli war and a peak in US conventional, OPEC started limiting exports.

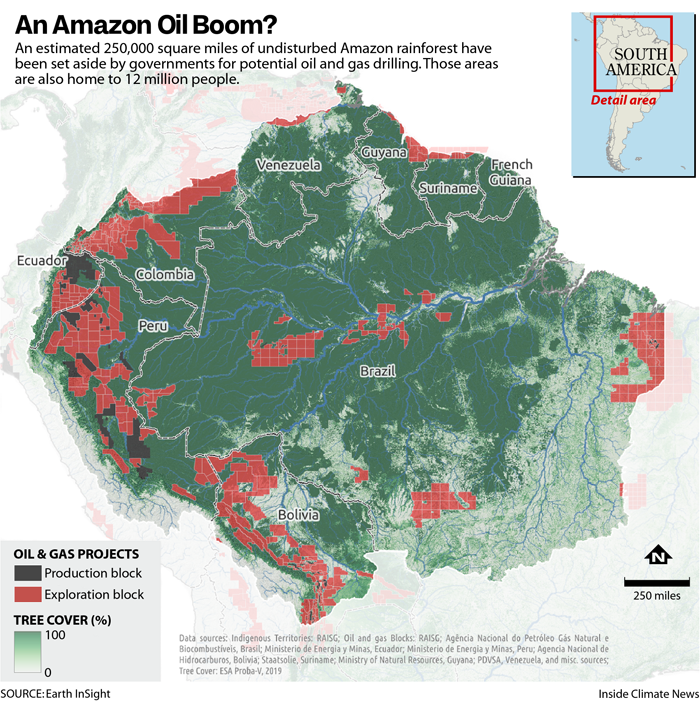

Now let's compare to South America.

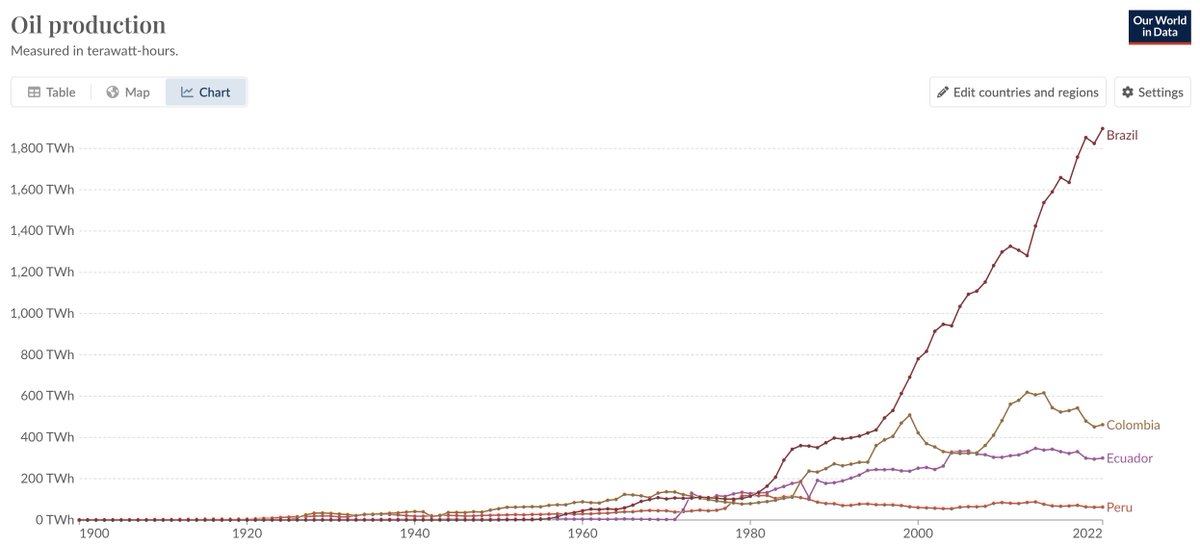

South America's oil industry began nearly 100 years after that of the United States.

Even Venezuela - which still holds some of the largest known reserves - didn't start producing large amounts of crude until the 1950s.

South America's oil industry began nearly 100 years after that of the United States.

Even Venezuela - which still holds some of the largest known reserves - didn't start producing large amounts of crude until the 1950s.

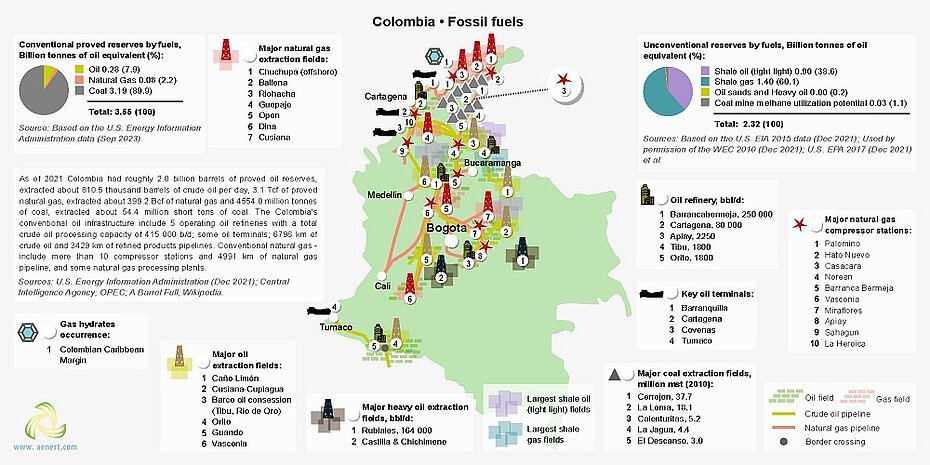

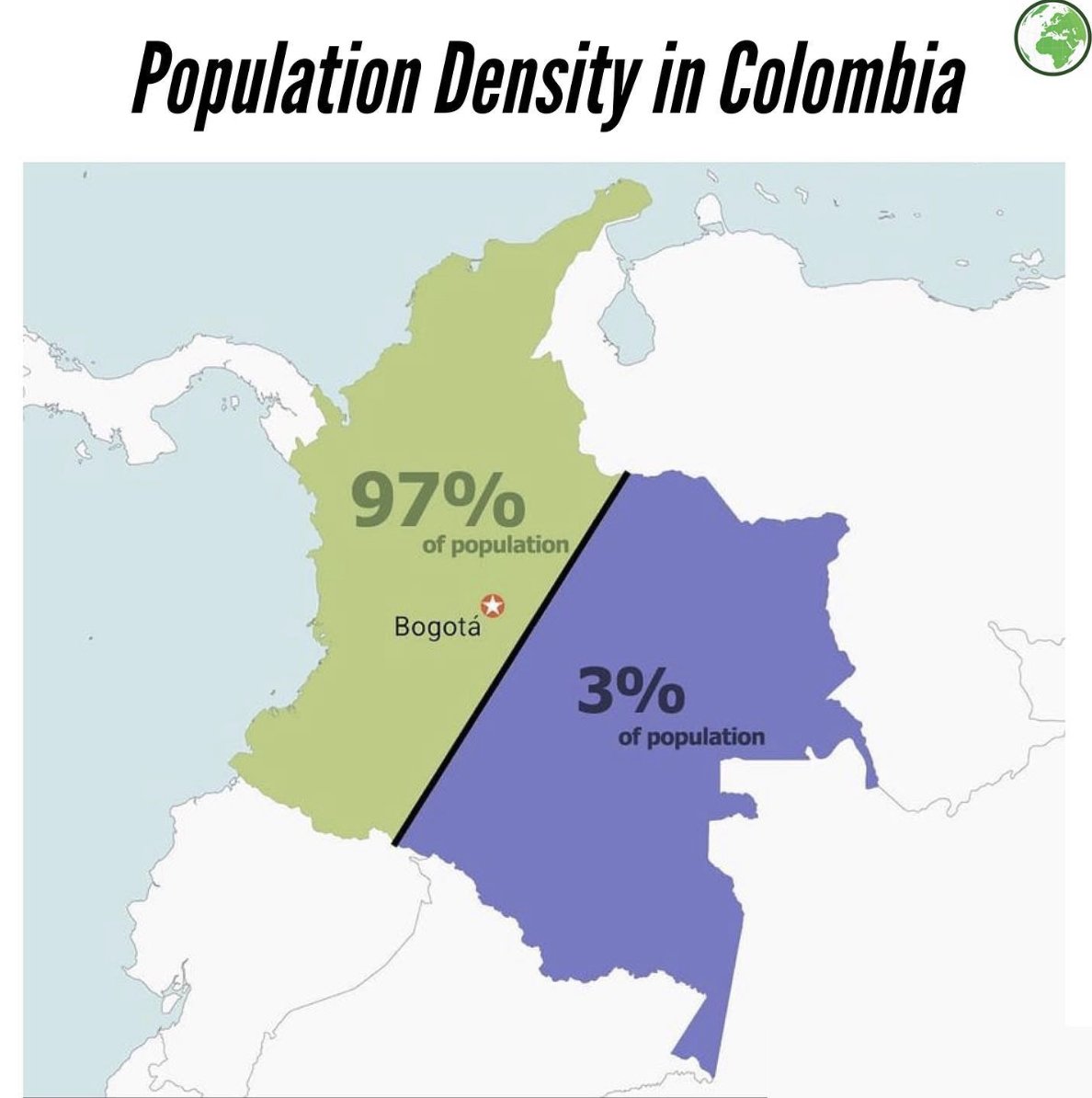

Compare to Colombia for example. Nearly all of the exploration and production has occurred in the populated areas west of the Andes.

But the vast area to the east has barely even been explored.

But the vast area to the east has barely even been explored.

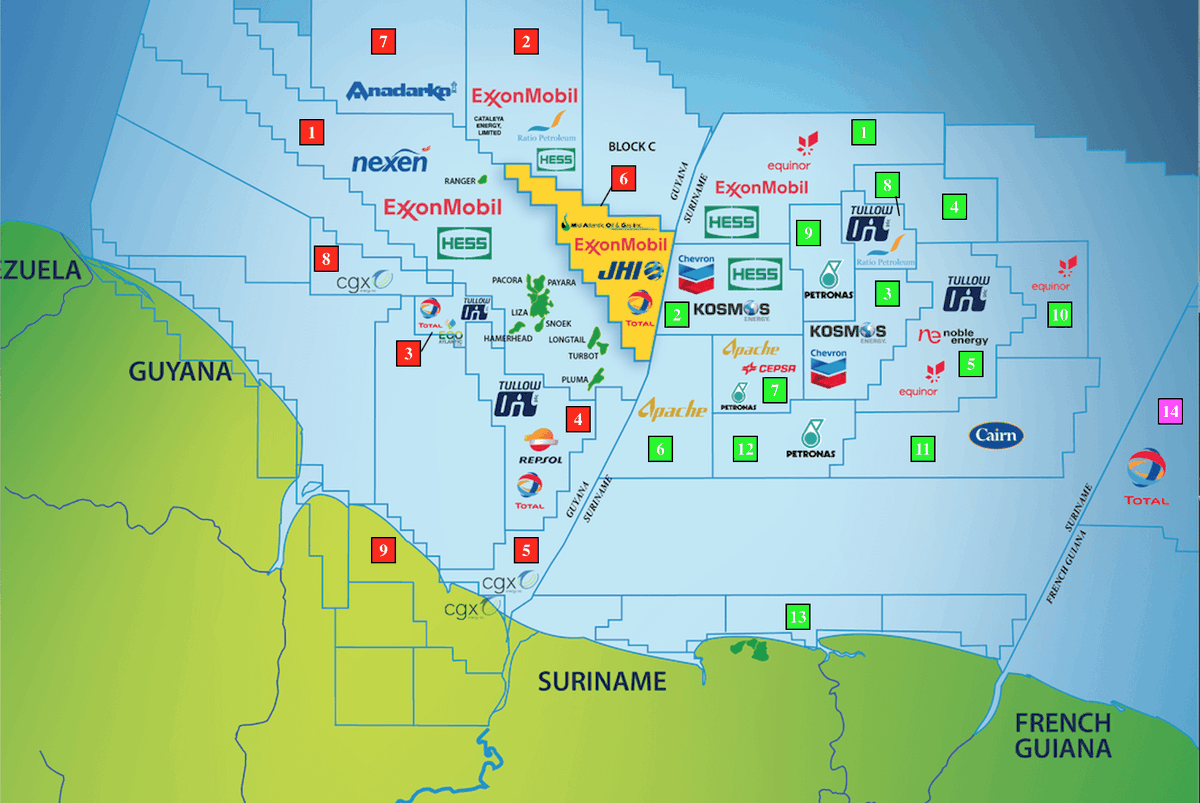

In Guyana, vast oil fields have only recently been discovered, and only more recently started producing.

What keeps South America from becoming more highly developed is stability and FDI, NOT a lack of conventional resources.

In Brazil, the military founded Petrobras has maintained growing production for decades.

What keeps South America from becoming more highly developed is stability and FDI, NOT a lack of conventional resources.

In Brazil, the military founded Petrobras has maintained growing production for decades.

My thesis is simple, South America's conventional reserves have only relatively recently begun exploitation.

The tight reserves, from which nearly all US oil growth since the 1980s has some from, are practically untapped.

I think we political stability and exploration, Latin American oil will deliver economic prosperity to the region for decades to come.

The tight reserves, from which nearly all US oil growth since the 1980s has some from, are practically untapped.

I think we political stability and exploration, Latin American oil will deliver economic prosperity to the region for decades to come.

What has kept Latin America's oil industry from growing has been politics and grift.

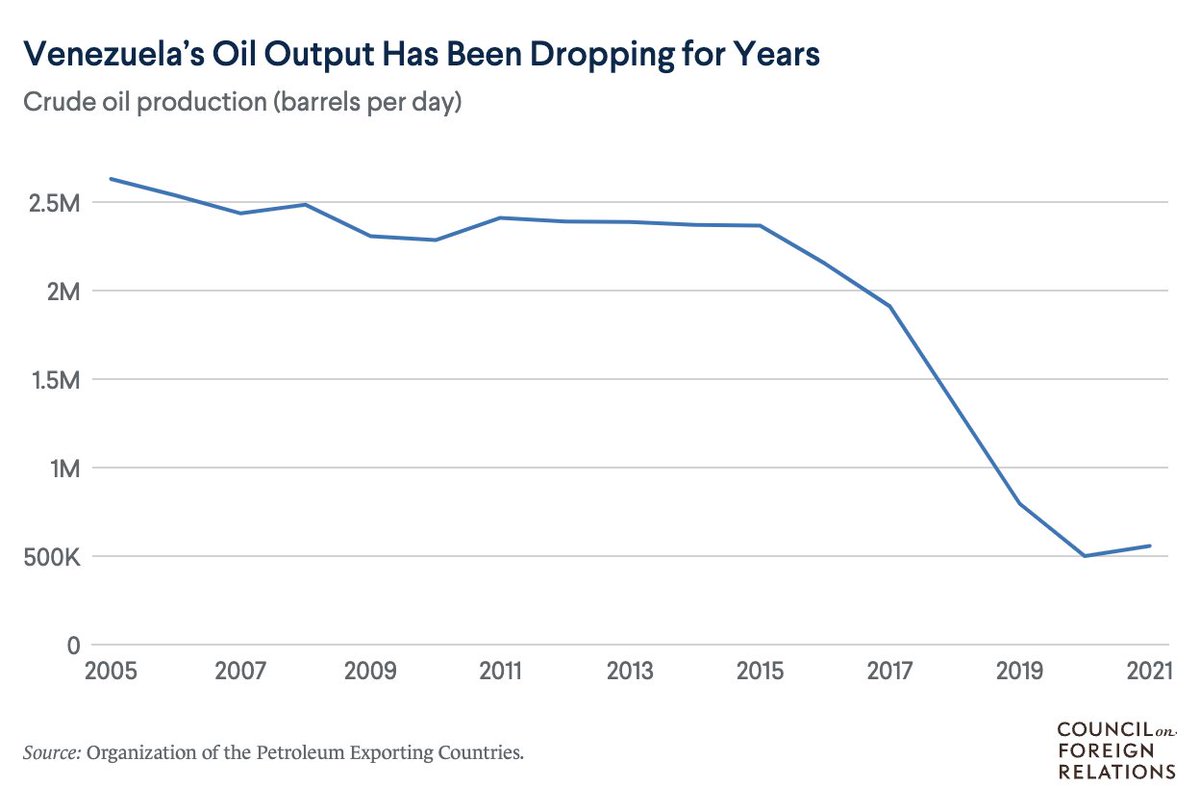

It wasn't a lack of conventional reserves that led to the downfall of Venezuela - it was a lack of investment.

I expect any LatAm country under a free market will see oil production grow.

It wasn't a lack of conventional reserves that led to the downfall of Venezuela - it was a lack of investment.

I expect any LatAm country under a free market will see oil production grow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh