Quite staggeringly confused debates about fiscal rules and the @OBR_UK "boxing the Chancellor in" over the last few days. A few clarifications as the Budget looms 🧵

Confusion 1: Lots of people saying today's fiscal rules being too tight is the problem. Just not true - these are the loosest rules ever. The Chancellor says they require debt to be falling but they really don't. Just that it’s FORECAST to fall in five years time.

Confusion 2: Conspiracy theorists claim the @OBR_UK has “boxed the Chancellor in”. This is just nonsense. Chancellors set their own fiscal rules and can change them whenever they like - as we've seen repeatedly over the past 15 years

Confusion 3: I've seen some people claim the @OBR_UK is too pessimistic. Those people have clearly not looked at 1) the OBR's current forecasts which are for FAR faster growth than the @bankofengland expects 2) their forecasting record (repeatedly too optimistic on growth)

We should focus on the real problems facing us fiscally, some of which do explain the challenge the Chancellor is having announcing the tax cuts he/the Prime Minister would like

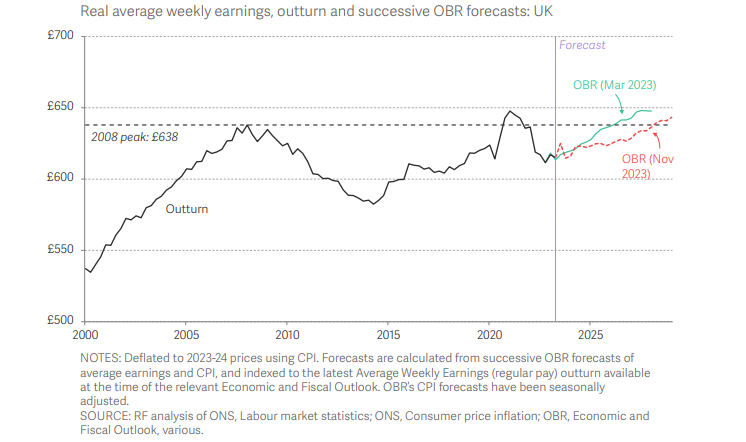

Real problem 1: the economic and fiscal substance has got more challenging. Debt interest costs are up and growth is weak. That means less scope to run a loose fiscal policy and still see debt falling.

Real problem 2: the OBR’s forecasts are having too big an effect on Govt's economic/political strategy. But that is because the Chancellor left no headroom (£13bn is a rounding error in the public finances) back in the Autumn. Previous Chancellors have left far more wriggle room

Real problem 3: the fiscal rule problem isn’t that they are too tight, it’s that they provide a huge incentive for the Treasury to cut investment spending by treating it identically to day-to-day spending – building a train line and burning money in the street are identical…

Why is it so important to understand what the real problems are? Because these problems aren't going away - both main parties support the same fiscal rules and face the same economic/fiscal context

• • •

Missing some Tweet in this thread? You can try to

force a refresh