🚨🚨 Today I'm publishing part 2 of my thesis.

Get comfy. This is prob a 15 minute read. It's called-

Financial Nihilism: The Zeitgeist of Young America

Get comfy. This is prob a 15 minute read. It's called-

Financial Nihilism: The Zeitgeist of Young America

So, apparently last month’s main section “A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything”…was quite a doozy. I’ve been writing these for a long time so I think I have a decent sense of when I write something above or below the average of all the monthlies I’ve written previously.

And I knew the one last month was a good one when I wrote it. But even I underestimated how much “A Lack of Pretense…” was going to strike a chord with folks. Because when I turned the main section into a tweet thread, it went properly viral – 2k+ bookmarks, 500k+ views. Big numbers for content that meaty.

And I knew the one last month was a good one when I wrote it. But even I underestimated how much “A Lack of Pretense…” was going to strike a chord with folks. Because when I turned the main section into a tweet thread, it went properly viral – 2k+ bookmarks, 500k+ views. Big numbers for content that meaty.

https://x.com/Travis_Kling/status/1753455596462878815?s=20

But it wasn’t just the raw numbers of the response, it was the qualitative characteristics of the response. The thesis REALLY resonated with people. I received many dozens of responses through numerous avenues (Twitter comments, reposts, DMs, Telegrams, text, email, podcasts). By my estimate:

· 80% of the response was strong agreement (with varying levels of begrudgingness);

· 10% was “you don’t know what you’re talking about”; and

10% was some form of pushback/disagreement (with varying levels of thoughtfulness).

· 80% of the response was strong agreement (with varying levels of begrudgingness);

· 10% was “you don’t know what you’re talking about”; and

10% was some form of pushback/disagreement (with varying levels of thoughtfulness).

I did two podcasts in the weeks that followed unpacking the thesis further - you can listen/watch below.

https://x.com/APompliano/status/1756106880298934626?s=20

https://x.com/MikeIppolito_/status/1755313858447614169?s=20

Probably the topic within the thesis that garnered the most discussion was the concept of “financial nihilism” – the idea that cost of living is strangling most Americans; that upward mobility opportunity is out of reach for increasingly more people; that the American Dream is mostly a thing of the past; and that median home prices divided by median income is at a completely untenable level.

You can click this link and spend 10 mins scrolling through the mentions of “financial nihilism” on Twitter over the last few weeks. It would be 10 minutes well spent.

x.com/search?q=%22fi…

You can click this link and spend 10 mins scrolling through the mentions of “financial nihilism” on Twitter over the last few weeks. It would be 10 minutes well spent.

x.com/search?q=%22fi…

Given how much discussion this concept sparked and how deeply it resonated with folks, this month we will unpack Financial Nihilism in more detail. To begin, it is not my term. Credit belongs to @kofinas, the host of the Hidden Forces podcast. He first introduced the concept at least 2 ½ years ago. Financial Nihilism goes hand in hand with Populism - a political approach that strives to appeal to ordinary people who feel that their concerns are disregarded by established elite groups. Populism is a topic I’ve discussed numerous times here in the past, perhaps most pointedly in my February 2021 monthly (link below) about Gamestop. The underlying drivers of Financial Nihilism and Populism are the same – this system is not working for me, so I want to try something very different (e.g., buy SHIB or vote for Trump).

kanaandkatana.com/blog/february-…

kanaandkatana.com/blog/february-…

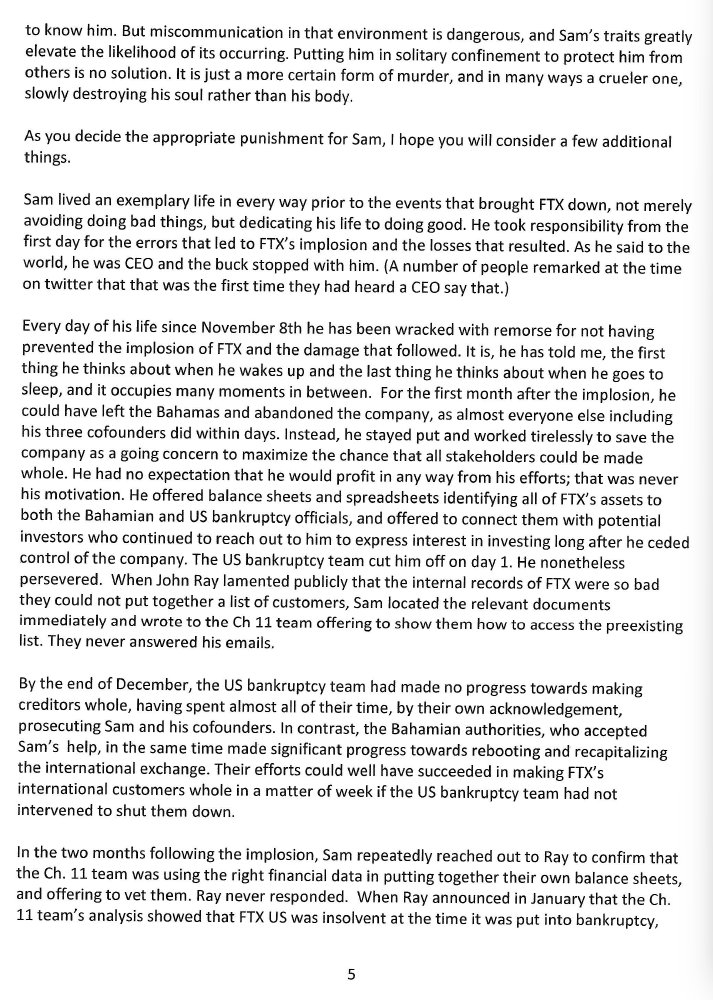

How would you go about characterizing the drivers of Financial Nihilism? As previously mentioned, the chart of median home prices to median household income is the single most emblematic symbol of Financial Nihilism in my opinion.

Shown below with a couple annotations –

Shown below with a couple annotations –

You can see Boomers (and GenX) bought all the houses at about 4.5x annual income. Then subprime lending fueled the housing bubble and the bubble collapsed. Not long thereafter, Millennials entered the workforce and got to the point where they could start buying houses at ~5.5x annual income. Then Covid happened, the Fed printed $6 trillion, and now houses are 7.5x annual income, much higher than even the peak of the housing bubble. Simply out of reach for many millions of Americans under 40. The numbers just don’t add up.

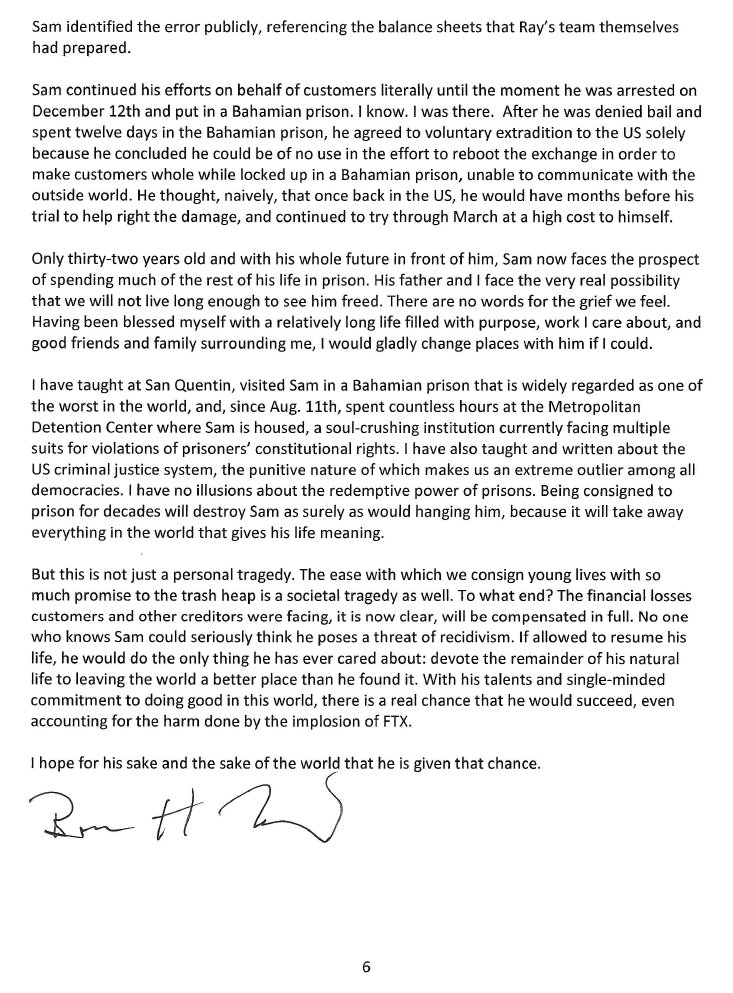

We can drill down into this real estate situation further. Shown below is the share of total real estate value by generation in the US-

From 1989 to 2023, the total value of US real estate held by households went from $7tn to $45tn, nearly a 7x increase. In 2020, when the youngest Millennial turned 25, Millennials held 13% of total real estate value. In 2005, when the youngest GenX turned 25, their share of housing wealth was 17%. And in 1989, when the youngest Boomer turned 25, they already had 33% of total real estate value. Kind of a raw deal for the current generation of young folks, right?

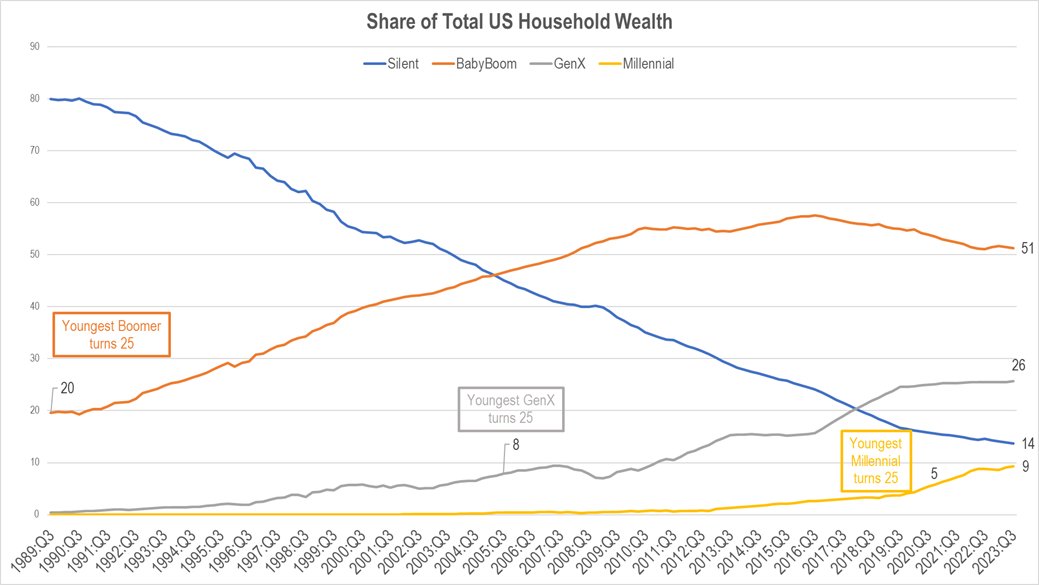

Let’s keep going though. Here’s the distribution of household wealth by generation. Similar type of chart as above, but looking at total net worth vs just real estate –

From 1989 to 2023, total US household wealth increased from $20tn to $143tn, a 7x increase.

Drilling down into these numbers, the rise of Financial Nihilism among young people is hardly surprising. In 2020, the youngest Millennial turned 25, and Millennials had a paltry 5% of total household wealth. Compare that to GenX – in 2005 the youngest Gen X’er turned 25, and their generation had already amassed 8% of all household wealth. Then compare that further to Baby Boomers – in 1989 the youngest Boomer turned 25 and by that point the Boomer generation had gathered 20% of total household wealth. Maybe they got that from making coffee at home and skipping the guac at Chipotle!

Drilling down into these numbers, the rise of Financial Nihilism among young people is hardly surprising. In 2020, the youngest Millennial turned 25, and Millennials had a paltry 5% of total household wealth. Compare that to GenX – in 2005 the youngest Gen X’er turned 25, and their generation had already amassed 8% of all household wealth. Then compare that further to Baby Boomers – in 1989 the youngest Boomer turned 25 and by that point the Boomer generation had gathered 20% of total household wealth. Maybe they got that from making coffee at home and skipping the guac at Chipotle!

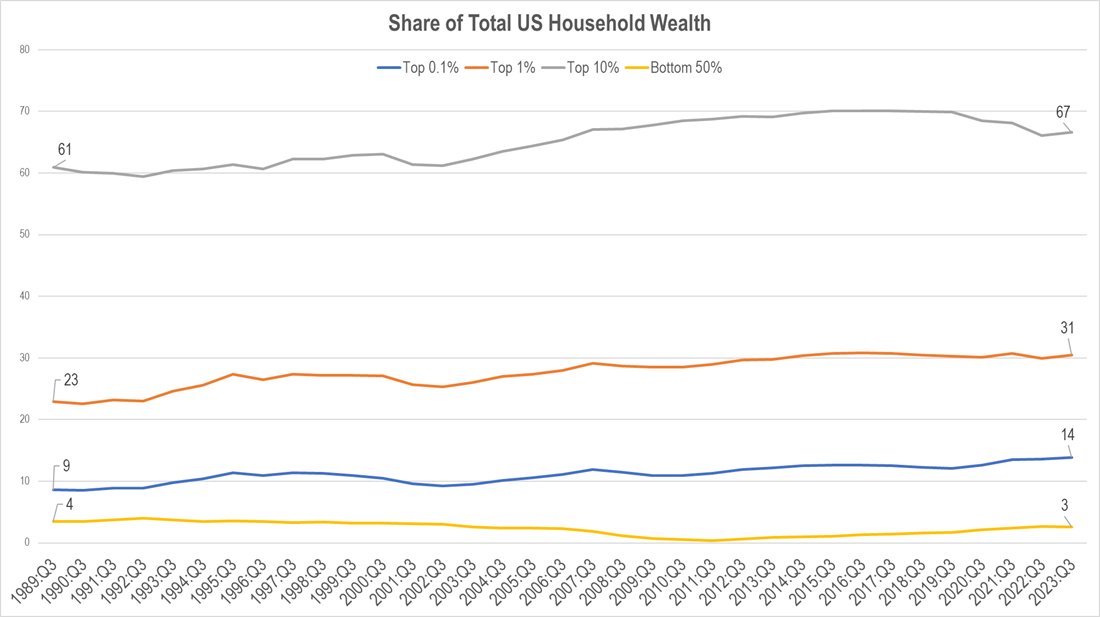

Looking at these statistics from wealth percentile instead of generation is equally as discouraging-

Again, total wealth over this time increased 7x from $20tn to $143tn. The top 10%, top 1% and top 0.1% all saw big increases in their relative share over this timeframe, while the bottom 50% actually lost a little ground. Literally watching the rich get richer while the American Dream of upward mobility slips out of reach for the majority. Tough.

Looking at the same analysis for real estate value yields a slightly different looking chart but with the same results –

The whole pie grows $38tn over this time, and the rich get richer while the Bottom 50% actually lose ground.

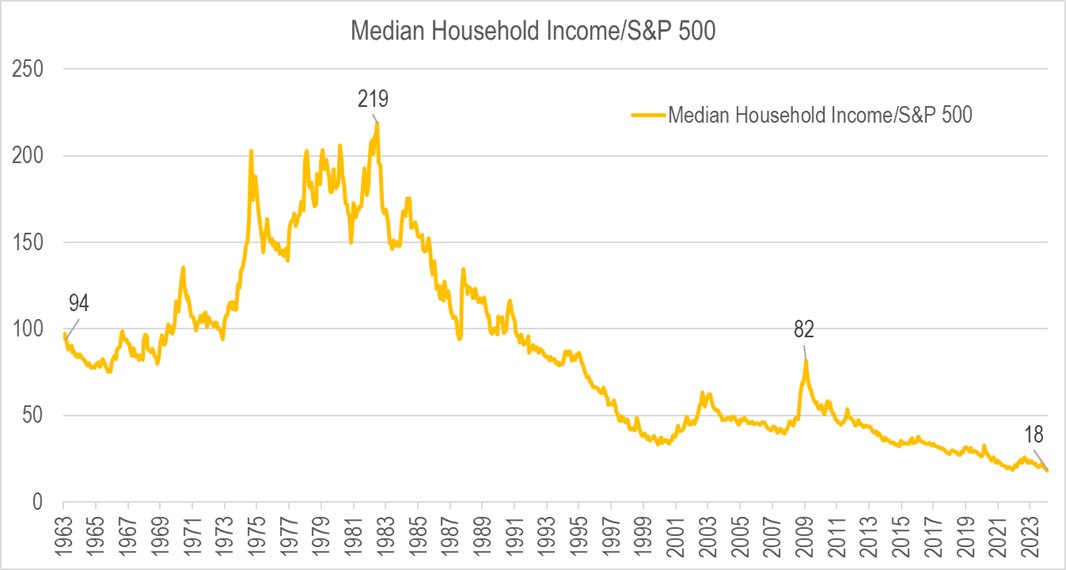

I’ll give you one last chart to prove my point before we move on. Below is the ratio of Median Household Income to the S&P 500. Think of it as, “how many shares of the SPX can I buy with a year’s worth of median income?”

I’ll give you one last chart to prove my point before we move on. Below is the ratio of Median Household Income to the S&P 500. Think of it as, “how many shares of the SPX can I buy with a year’s worth of median income?”

Again, it paints a tough picture. Back in the early 60’s you could get 94 shares of the SPX with the median household income. That peaked in the crash of 1982 at 219 shares and then structurally collapsed. The stock market is getting less and less affordable for the average American.

That’s the setup. The Boomers have all the money. The rich have been getting richer while the poor are getting poorer. The American Dream of upward mobility has been slipping out of reach for increasingly more people. Why do you think Oliver Anthony exploded out of nowhere into such popularity? That is Financial Nihilism. So if you’re like the large majority of Americans and you’re on the wrong end of this, what do you do about it?

You take bigger risks. You feel driven to take bigger risks to try and leapfrog from your current financial position (mostly paycheck to paycheck; buying a home feels nearly impossible; saddled with student loans; salary increases not keeping up expense increases) to something more tenable. More comfortable. More baller.

You take bigger risks. You feel driven to take bigger risks to try and leapfrog from your current financial position (mostly paycheck to paycheck; buying a home feels nearly impossible; saddled with student loans; salary increases not keeping up expense increases) to something more tenable. More comfortable. More baller.

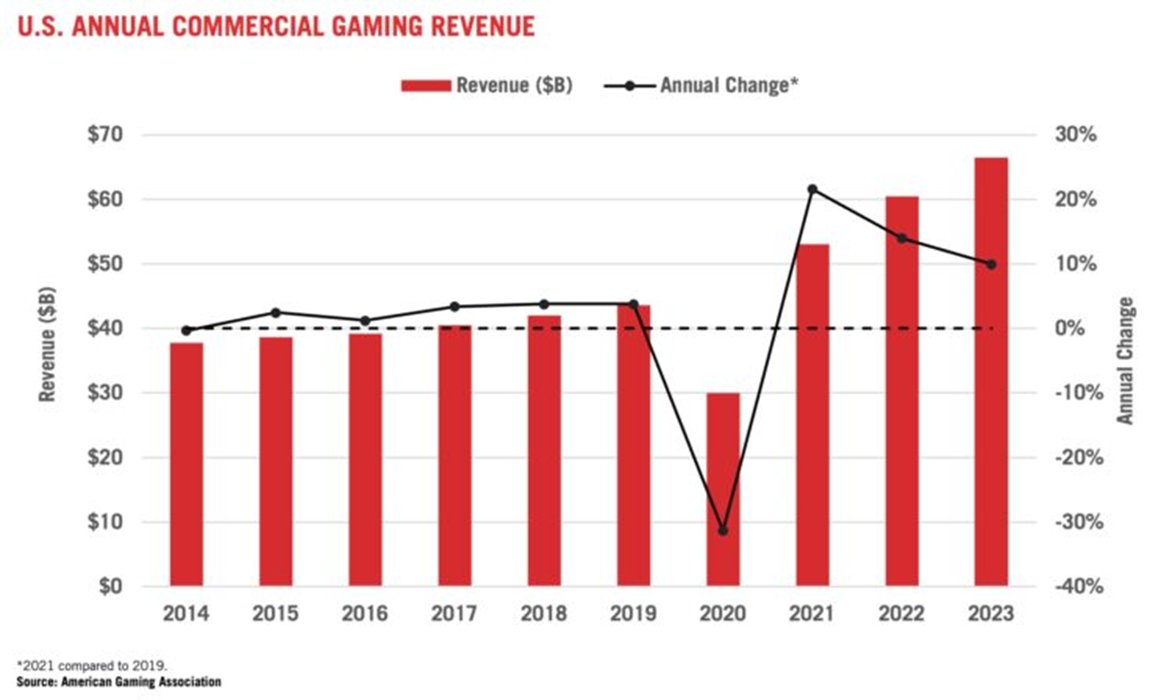

So you gamble. You. F**king. Gamble. You look anywhere, for anything, that can give you a 5:1, 10:1, 50:1 type of payout. Naturally, you look to literal gambling, which is growing at a breakneck pace-

Within gambling broadly, you look to sports gambling which is now available on your phone while you’re sitting on the couch. Incredible growth rate –

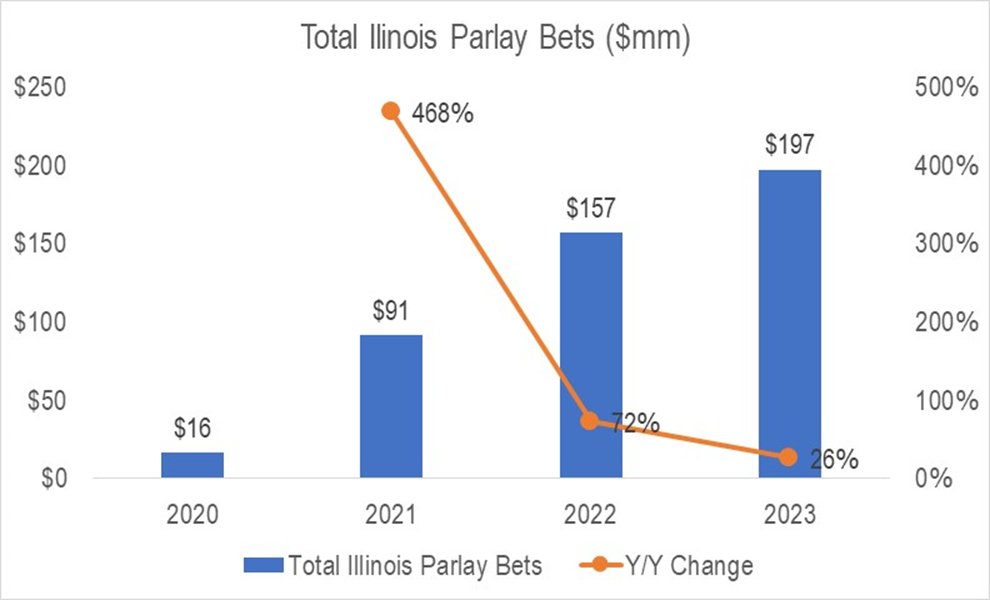

Going even further towards Financial Nihilism, you could look at the rise in the popularity of parlay bets, which include winning multiples of your original bet if you correctly win all bets made in a multi-bet series.

The state of Illinois was the only source I could find that had parlay-specific data going back multiple years. But that insane growth shown in the chart above is indicative of the growth in popularity of parlays broadly. And as a reminder, these are bets where the “house odds” are better than regular bets, even while the potential payoff is much higher. When the numbers don’t add up, might as well swing for the fences even when you’re more likely to strike out.

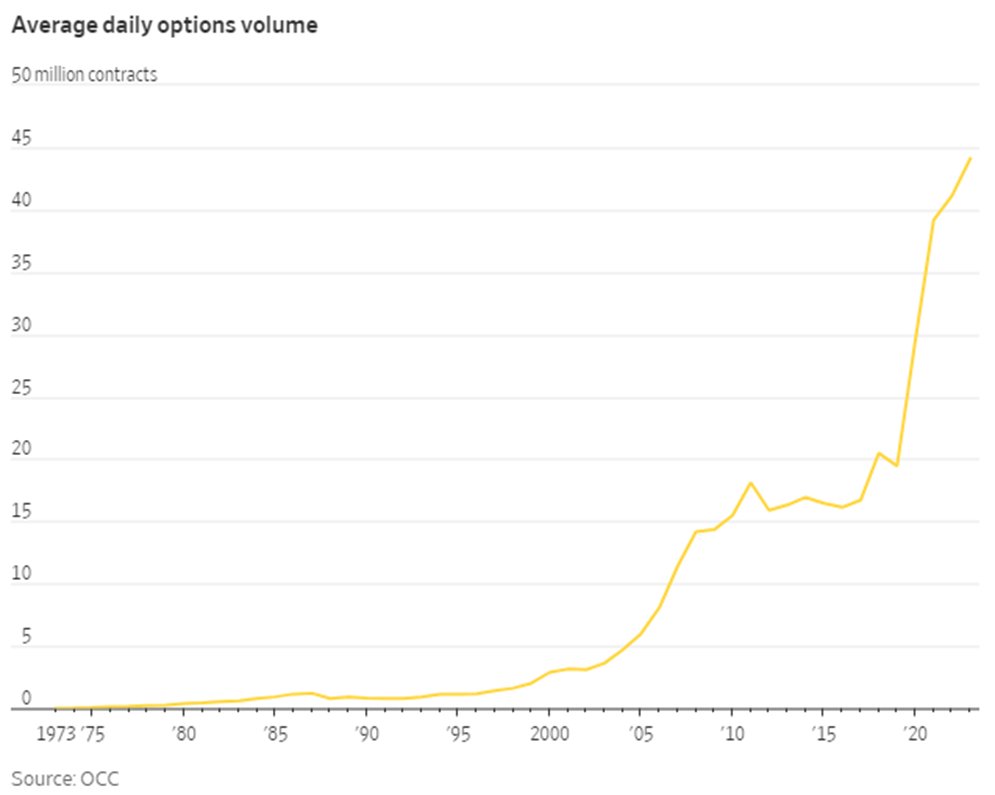

You know what parlays are kinda like? 0DTE options- options that expire the same day they are bought. Like parlays, 0DTE options offer higher probabilities of loss while offering potentially multiples of upside. Oh yeah, and either way the outcome occurs the same DAY you place the bet…err umm, same day you “make the investment”.

You know what 0DTE options popularity has been doing lately?

You know what 0DTE options popularity has been doing lately?

0DTE popularity has doubled since Covid. That’s a growth rate that looks familiar, right? Between 2016 and 2023, 0DTE trading increased from 5% of total SPX options volume to 43%.

The evidence for the rise of Financial Nihilism is all around us. Think about the cultural movement that was WallStreetBets, DeepF**kingValue, Gamestop, AMC, Bed, Bath & Beyond, Blockbuster. They cranked out a Seth Rogen movie in like EIGHTEEN MONTHS. That’s how top of mind Financial Nihilism is.

The evidence for the rise of Financial Nihilism is all around us. Think about the cultural movement that was WallStreetBets, DeepF**kingValue, Gamestop, AMC, Bed, Bath & Beyond, Blockbuster. They cranked out a Seth Rogen movie in like EIGHTEEN MONTHS. That’s how top of mind Financial Nihilism is.

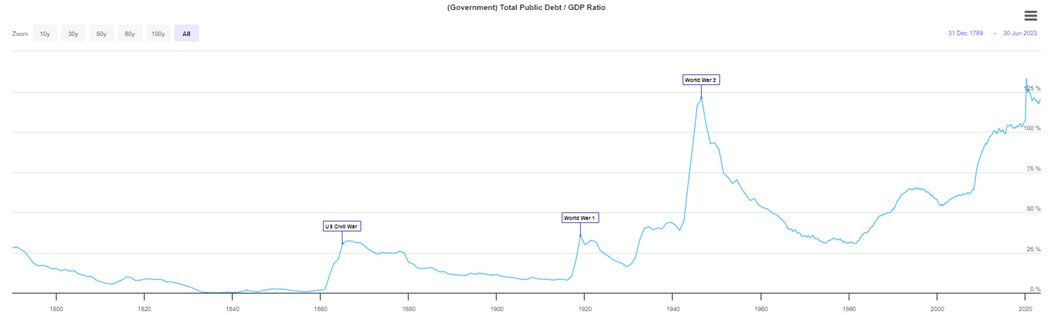

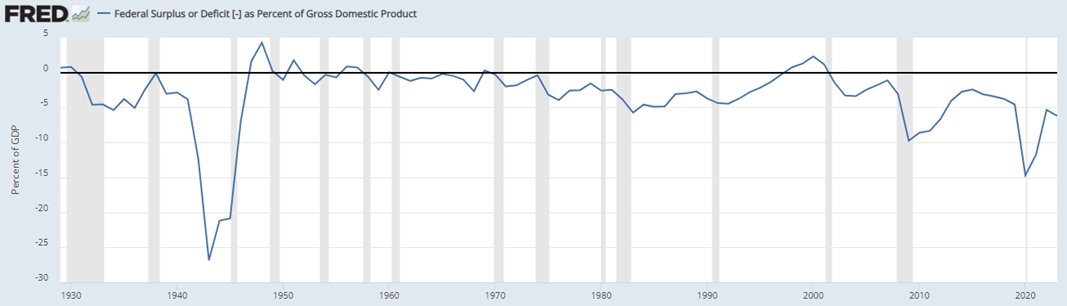

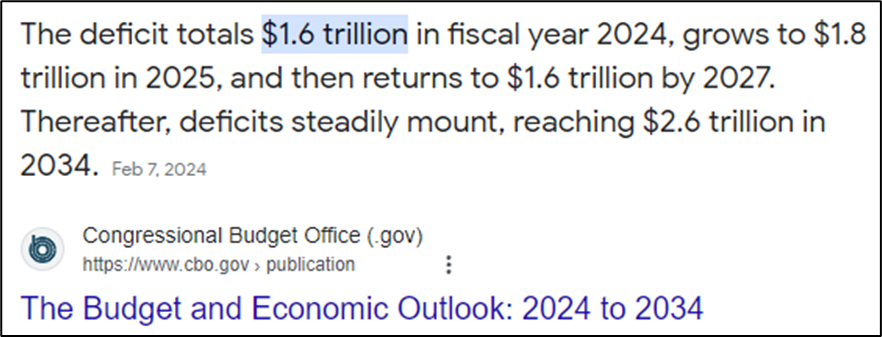

One more thing to add, and then I’ll bring this all back to crypto. Those individuals choosing to act out Financial Nihilism are doing so in direct response to, and in imitation of, the monetary and fiscal policies of the Fed and the US government. Those monetary and fiscal policies have been a major driver of wealth inequality both through generations and wealth percentiles. The US government has been egregiously irresponsible. Makes a poker player look like Dave Ramsey.

I think the thread got disconnected. Last few tweets are here-

https://x.com/Travis_Kling/status/1764697358229451032?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh