Host - @thingshiddenio. Founder - @ikigai_fund. God exists.

10 subscribers

How to get URL link on X (Twitter) App

A major driver of this price action is likely the upcoming March 1 FTX estate unlock, to the tune of 11.2mm units of SOL. That's a big number. The buyers of the locked FTX SOL are sitting on big UPNL, even after this price correction. They want to hedge that and then realize it.

A major driver of this price action is likely the upcoming March 1 FTX estate unlock, to the tune of 11.2mm units of SOL. That's a big number. The buyers of the locked FTX SOL are sitting on big UPNL, even after this price correction. They want to hedge that and then realize it.

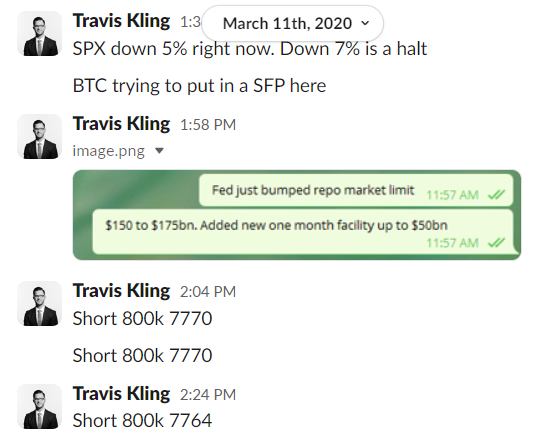

Most will remember, early March 2020 was when the world (and financial markets) were coming to the realization about how serious Covid was going to be.

Most will remember, early March 2020 was when the world (and financial markets) were coming to the realization about how serious Covid was going to be.

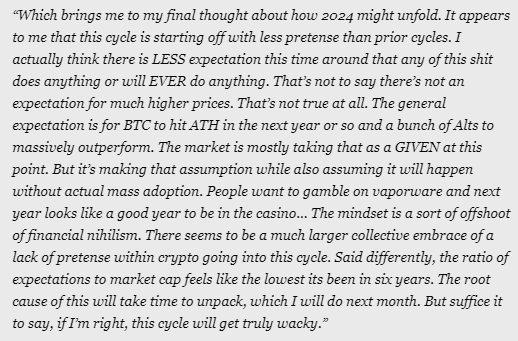

So, apparently last month’s main section “A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything”…was quite a doozy. I’ve been writing these for a long time so I think I have a decent sense of when I write something above or below the average of all the monthlies I’ve written previously.

So, apparently last month’s main section “A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything”…was quite a doozy. I’ve been writing these for a long time so I think I have a decent sense of when I write something above or below the average of all the monthlies I’ve written previously.https://x.com/Travis_Kling/status/1753455596462878815?s=20

On Dec 9th, 2022 I wrote this tweet thread. It was the first time I spoke out about the risks at Binance.

On Dec 9th, 2022 I wrote this tweet thread. It was the first time I spoke out about the risks at Binance.https://twitter.com/Travis_Kling/status/1601277098412617735?s=20

#Bitcoin hasn’t acted as a store of value. Its acted like an unprofitable SAAS stock. This doesn’t appear set to change any time soon. BTC will likely move about like an unprofitable SAAS stock in the future. It’s basically the inverse of the DXY, which proves big boy’s point.

#Bitcoin hasn’t acted as a store of value. Its acted like an unprofitable SAAS stock. This doesn’t appear set to change any time soon. BTC will likely move about like an unprofitable SAAS stock in the future. It’s basically the inverse of the DXY, which proves big boy’s point.

https://twitter.com/nic__carter/status/1622973966360133634In the wake of the damage done in crypto over the last year, its natural and necessary to try and use that damage as a catalyst for change for the better. This is the nature of the world. You make mistakes, you learn lessons, you make changes based on what you learn, you improve.