I went from losing money day trading to making $1,000’s a day.

What helped me become profitable is understanding 𝗺𝗮𝗿𝗸𝗲𝘁 𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲 𝗽𝗿𝗶𝗰𝗲 𝗮𝗰𝘁𝗶𝗼𝗻 and 𝗹𝗶𝗾𝘂𝗶𝗱𝗶𝘁𝘆 to enter and exit trades

Here is how to find and read them 👇

$SPY $SPX $QQQ $NVDA

What helped me become profitable is understanding 𝗺𝗮𝗿𝗸𝗲𝘁 𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲 𝗽𝗿𝗶𝗰𝗲 𝗮𝗰𝘁𝗶𝗼𝗻 and 𝗹𝗶𝗾𝘂𝗶𝗱𝗶𝘁𝘆 to enter and exit trades

Here is how to find and read them 👇

$SPY $SPX $QQQ $NVDA

1. 𝗠𝗔𝗥𝗞𝗘𝗧 𝗦𝗧𝗥𝗨𝗖𝗧𝗨𝗥𝗘𝗦

First we need to understand and identify the three market structures

1. Up trend

2. Down trend

3. Consolidation/Range/Sideways

First we need to understand and identify the three market structures

1. Up trend

2. Down trend

3. Consolidation/Range/Sideways

2. 𝗜𝗗𝗘𝗡𝗧𝗜𝗙𝗬𝗜𝗡𝗚 𝗧𝗥𝗘𝗡𝗗𝗦

Uptrends - Are identified by Higher highs and higher lows

Downtrends - Are identified by Lower high and Lower lows

Sideways - Is identified by the lows and highs almost if not equal forming a box

Uptrends - Are identified by Higher highs and higher lows

Downtrends - Are identified by Lower high and Lower lows

Sideways - Is identified by the lows and highs almost if not equal forming a box

3. 𝗧𝗜𝗠𝗘 𝗙𝗥𝗔𝗠𝗘𝗦 𝗧𝗢 𝗨𝗦𝗘

MACRO TRENDS

- DAILY WEEKLY MONTHLY

MICRO TRENDS

- 4HR 1HR 30Min 15Min 5Min

Micro trends will help you identify a intraday trend for good entries and exits

Macro trends will help you identify the overall trend to keep you in the trade

MACRO TRENDS

- DAILY WEEKLY MONTHLY

MICRO TRENDS

- 4HR 1HR 30Min 15Min 5Min

Micro trends will help you identify a intraday trend for good entries and exits

Macro trends will help you identify the overall trend to keep you in the trade

𝗧𝗜𝗠𝗘𝗙𝗥𝗔𝗠𝗘𝗦 𝗖𝗢𝗡𝗧.

Don’t get stuck on the smaller timeframes like the 5 min

One thing that has helped me find liquidity, not panic sell and swing trades is looking at the higher timeframes

Always zoom out and look at the bigger picture and macro trends

Don’t get stuck on the smaller timeframes like the 5 min

One thing that has helped me find liquidity, not panic sell and swing trades is looking at the higher timeframes

Always zoom out and look at the bigger picture and macro trends

4. 𝗕𝗢𝗦 𝗩𝗦 𝗖𝗛𝗢𝗖𝗛

Now that we have identified how to find trends let’s look at how to trade them

We have two concepts to know

BOS - Break of Structure

CHOCH - Change of Character

Now that we have identified how to find trends let’s look at how to trade them

We have two concepts to know

BOS - Break of Structure

CHOCH - Change of Character

5. 𝗥𝗘𝗔𝗟 𝗟𝗜𝗙𝗘 𝗘𝗫𝗔𝗠𝗣𝗟𝗘

Here is an example of the BOS and CHOCH pattern. After a series of bearish trend (LL LH), the price breaks the lower low into a Higher high. This signifies a BOS into a CHOCH which should give a trend reversal.

Here is an example of the BOS and CHOCH pattern. After a series of bearish trend (LL LH), the price breaks the lower low into a Higher high. This signifies a BOS into a CHOCH which should give a trend reversal.

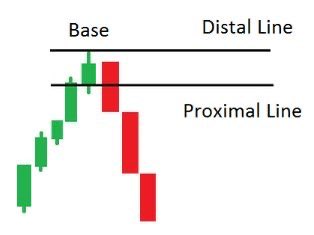

6. 𝗛𝗢𝗪 𝗧𝗢 𝗙𝗜𝗡𝗗 𝗟𝗜𝗤𝗨𝗜𝗗𝗜𝗧𝗬 𝗧𝗢 𝗧𝗔𝗞𝗘 𝗧𝗥𝗔𝗗𝗘

Enter a trade: When a Choch pattern forms, mark a supply/demand zone based on the recent trend. Wait for the price to retrace to the zone and then enter trade in the direction of the trend reversal.

Add the stop loss level: Put the stop loss a few points below the demand zone. If it breaks below it would invalidate the trade since it creates a Lower low

Take profit: Exit the trade when a counter-trend choch pattern forms on the chart again.

Enter a trade: When a Choch pattern forms, mark a supply/demand zone based on the recent trend. Wait for the price to retrace to the zone and then enter trade in the direction of the trend reversal.

Add the stop loss level: Put the stop loss a few points below the demand zone. If it breaks below it would invalidate the trade since it creates a Lower low

Take profit: Exit the trade when a counter-trend choch pattern forms on the chart again.

7. 𝗪𝗛𝗔𝗧 𝗪𝗘 𝗟𝗘𝗔𝗥𝗡𝗘𝗗

- Find trends

- Understand Price action and Market Structure

- Find liquidity to take trades

- Timeframes to use

- BOS vs CHOCH

- Find trends

- Understand Price action and Market Structure

- Find liquidity to take trades

- Timeframes to use

- BOS vs CHOCH

All that I ask is that you RT and LIKE for others to learn 📚

Follow @realjgbanks for more tips $SPY

Follow @realjgbanks for more tips $SPY

• • •

Missing some Tweet in this thread? You can try to

force a refresh