views

I have thoughts

Not just because I run an undercollateralised lending protocol, but more widely on the notion of credit scoring on-chain

Strap in

Not just because I run an undercollateralised lending protocol, but more widely on the notion of credit scoring on-chain

Strap in

https://twitter.com/nope_its_lily/status/1769883252679184704

Put simply, I think that there isn't really any bulletproof mechanism for determining a crypto-native credit score

Credora is currently the only game in town, and it suffers from an information problem: it only works if a borrower actually attests to all of the assets they own

Credora is currently the only game in town, and it suffers from an information problem: it only works if a borrower actually attests to all of the assets they own

If I say 'I have $100 million' and only provide wallet addresses and API keys for off-chain accounts attesting to half, then any score I receive needs to be scaled to account for this

Note: this is why Alameda never got a Credora rating - they never showed their full hand

Note: this is why Alameda never got a Credora rating - they never showed their full hand

They receive and operate over data in an SGX enclave so they don't see your raw exposure (e.g. asset and location, which broadcasts trading signal if you're a firm) but that messaging doesn't really penetrate, so borrowers are wary about using them

But they'll use Hidden Road(?)

But they'll use Hidden Road(?)

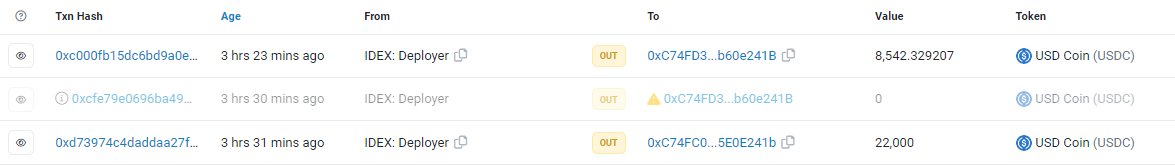

So imagine you're a founder of a DEX for stablecoins, and you decide not to tell your credit score provider about your position on Aave LTV'd within an inch of its life

But you still say 'I have all of this collateral available and liquid'

What are they meant to do with that?

But you still say 'I have all of this collateral available and liquid'

What are they meant to do with that?

More generally, a Credora credit score is issued, then updated once a month - that isn't fast enough to account for the maglev speed markets we operate in

So I look at a 'BBB+' and have no idea if last weeks Bitmex scam wick means that should be a D now

So I look at a 'BBB+' and have no idea if last weeks Bitmex scam wick means that should be a D now

Disclaimer: I do actually like Credora to the extent that it's trying to perform an impossible task, and we'll be integrating what reports they have available for a borrower into Wildcat dashboards for lenders to view

It's still information for risk assessment purposes

It's still information for risk assessment purposes

We're also moving towards finally being able to use ZK for this kind of thing

Accountable is a new startup working on this - allowing parties to prove statements about their positions without ever moving their data off-prem

'Here's a proof I've only ever had a max X% drawdown'

Accountable is a new startup working on this - allowing parties to prove statements about their positions without ever moving their data off-prem

'Here's a proof I've only ever had a max X% drawdown'

There's more reason there to show all your cards, because no one else sees them

You can compute/demand proofs in real time ('prove to me you have 50 million liquid right now')

But this isn't a credit score, rather pure information: what set of queries 'makes' a BBB+ rating?

You can compute/demand proofs in real time ('prove to me you have 50 million liquid right now')

But this isn't a credit score, rather pure information: what set of queries 'makes' a BBB+ rating?

I think Accountable is going to be an *extremely* important part of how we go about risk analytics in the next cycle

It's not a credit score provider as such, but it doesn't purport to be, and could be used to augment (or supplant) Credora ratings

We'll support them too

It's not a credit score provider as such, but it doesn't purport to be, and could be used to augment (or supplant) Credora ratings

We'll support them too

One of the reasons I believe we need Wildcat for on-chain credit is a bit of cart-before-horse thinking: reputation bootstrapping

Onboarding debt on borrower terms and honouring redemptions for all to witness is *very* good signal

Problem: 1001 days in the life of a turkey

Onboarding debt on borrower terms and honouring redemptions for all to witness is *very* good signal

Problem: 1001 days in the life of a turkey

Three years ago I stood outside the EthCC venue and told someone who wanted to create Moody's on-chain that it wouldn't work without auditors attesting to full and honest accountings of holdings

Most auditors won't touch a MM, much less a DAO

And so we spin our wheels

Most auditors won't touch a MM, much less a DAO

And so we spin our wheels

Measuring crypto risk fascinates me - there are so many strange vectors novel to our pit that would put a credit analyst in a coma

We'll get there eventually, but I don't know how it 'looks' - it CANNOT just be through CeDeFi prime brokerage though

We *need* open systems

We'll get there eventually, but I don't know how it 'looks' - it CANNOT just be through CeDeFi prime brokerage though

We *need* open systems

Anyway, that's that for now, I should be out talking to funds

12k remains the target

12k remains the target

• • •

Missing some Tweet in this thread? You can try to

force a refresh