views

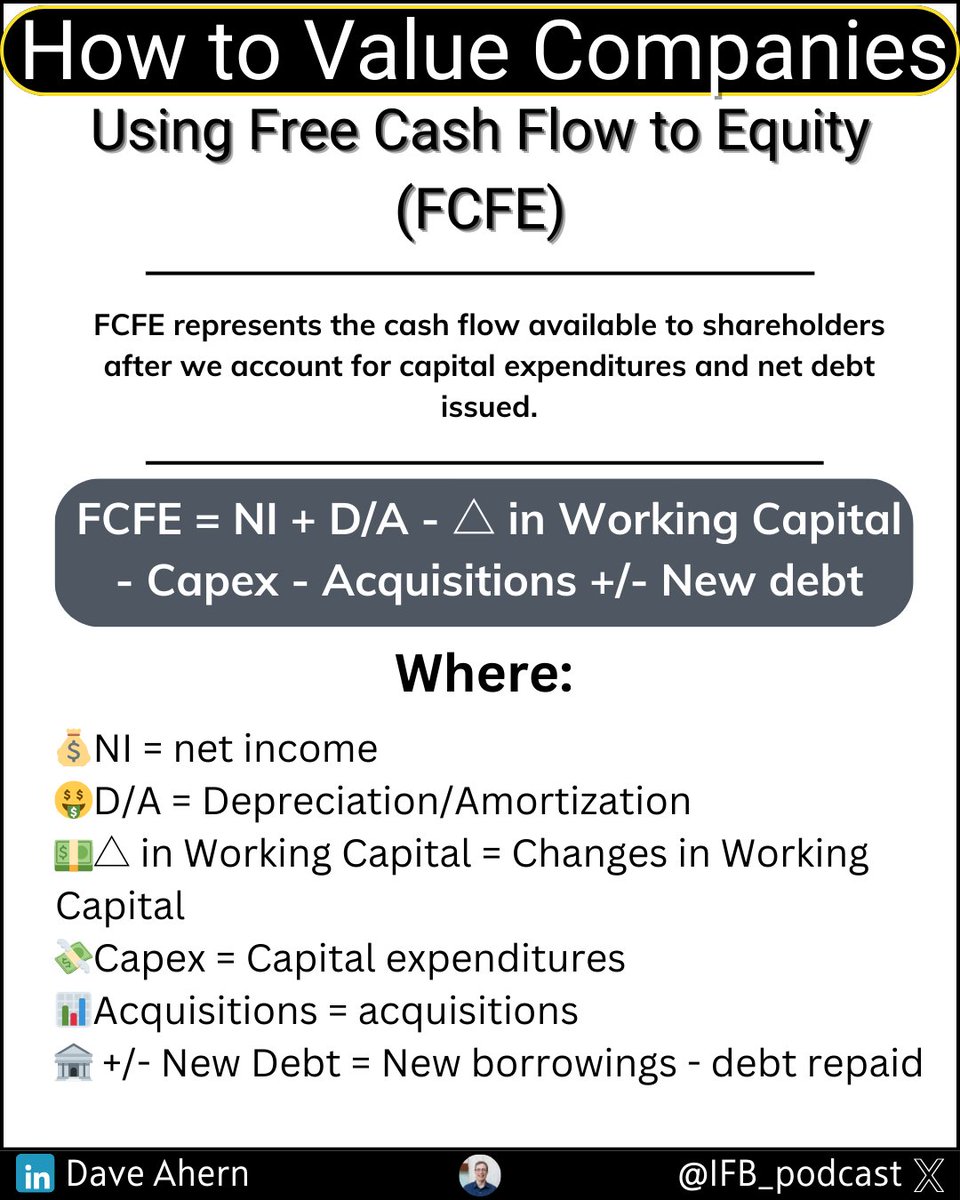

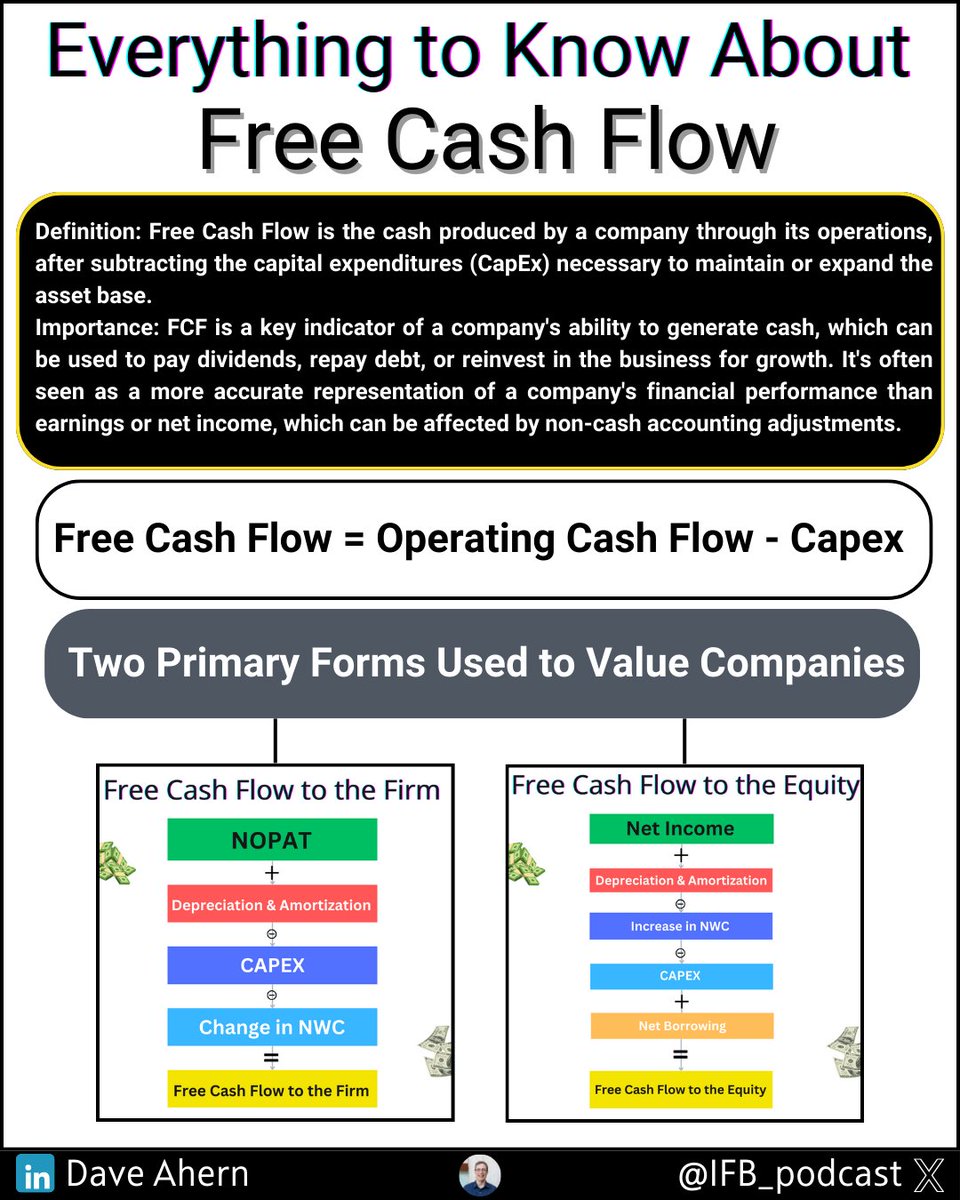

Want to learn how to value companies?

Using Free Cash Flow to the Firm is one of the best ways.

Below we'll find out how to calculate FCFF.

Using Free Cash Flow to the Firm is one of the best ways.

Below we'll find out how to calculate FCFF.

FCFF represents the base of most calculations using a DCF to value a company.

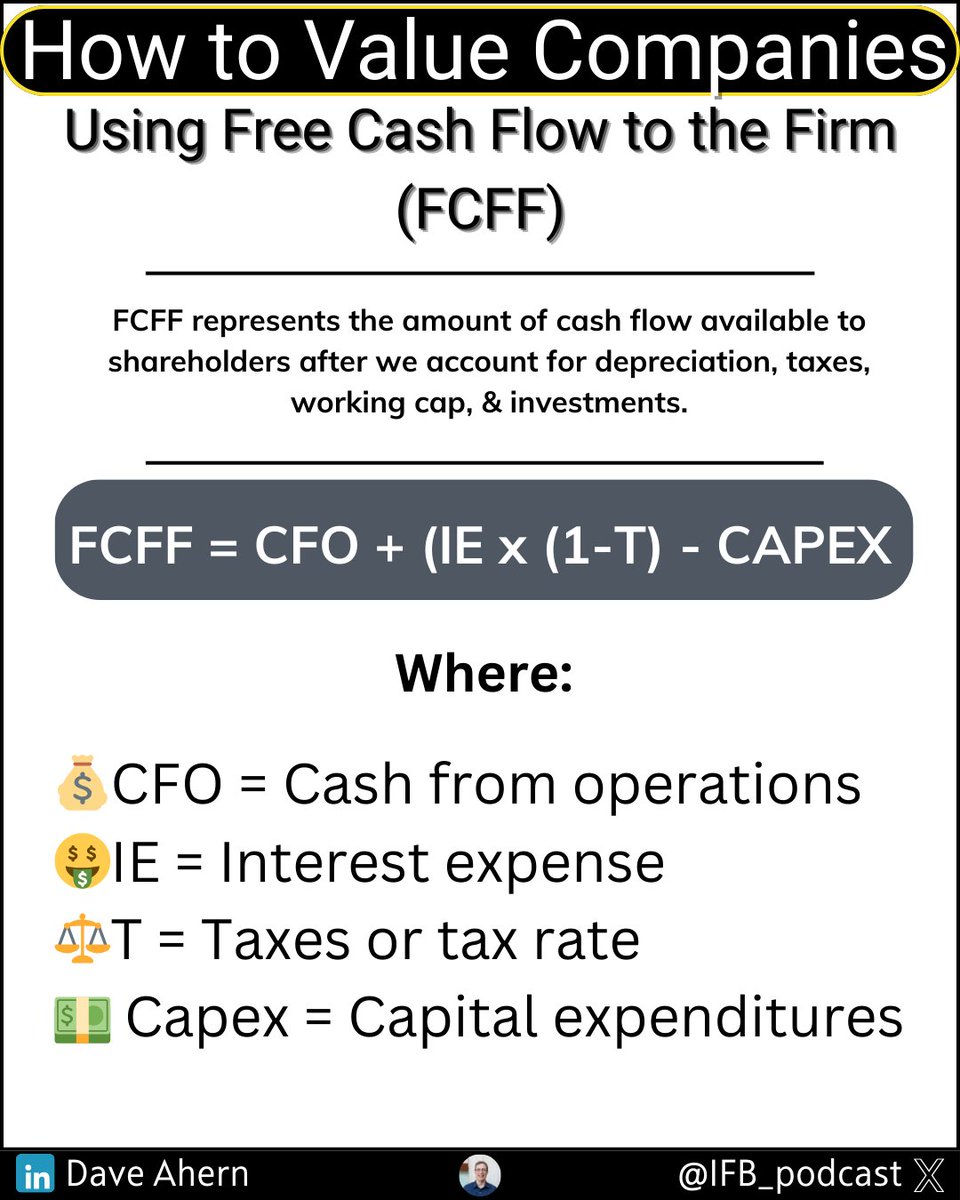

FCFF represents the amount of cash flow available to shareholders after we account for depreciation, taxes, working cap, & investments.

FCFF represents the amount of cash flow available to shareholders after we account for depreciation, taxes, working cap, & investments.

Many would argue, including myself, FCFF remains the most important metric representing the fair value of Google, for example.

Generally, a postive FCFF indicates the biz has enough cash to cover its operations plus investments, with money left over to allocate elsewhere, i.e. dividends, buybacks

A negative FCFF, indicates the company has not generated enough cash to cover its expenses + investments.

The easiest way to think of FCFF. It encompasses all investors in the biz (bond & shareholders) and takes into account all expenses and costs to run the biz.

The easiest way to think of FCFF. It encompasses all investors in the biz (bond & shareholders) and takes into account all expenses and costs to run the biz.

FCFF covers all the monies in (revs) and out (expenses, investments).

We have multiple ways we can calculate FCFF, but one of the easiest to start with is:

FCFF = CFO + (IE x (1-T) - CAPEX

We have multiple ways we can calculate FCFF, but one of the easiest to start with is:

FCFF = CFO + (IE x (1-T) - CAPEX

Where:

💰CFO = Cash from operations

🤑IE = interest expense

⚖️T = Taxes or tax rate

💵 Capex = Capital expenditures

Using this formula allows us to incorporate depreciation & amortization, net working capital in cash from operations.

💰CFO = Cash from operations

🤑IE = interest expense

⚖️T = Taxes or tax rate

💵 Capex = Capital expenditures

Using this formula allows us to incorporate depreciation & amortization, net working capital in cash from operations.

The interest expenses encompass the impact of any debt, taxes, well taxes, and capex, considering investments.

Is it perfect, nope, but its a start.

Let's put this to use with $GOOG, with the below inputs:

→CFO - $65,125

→IE - $357

→T - 18.95%

→Capex - $22,281

Is it perfect, nope, but its a start.

Let's put this to use with $GOOG, with the below inputs:

→CFO - $65,125

→IE - $357

→T - 18.95%

→Capex - $22,281

FCFF = 65,125 + (357 x (1-18.95%) - 22,281 = $43,133

Simple, huh?

Now we have the foundation to start a DCF, if we wanted.

You may be asking, what's the difference between cash flow and FCFF?

Simple, huh?

Now we have the foundation to start a DCF, if we wanted.

You may be asking, what's the difference between cash flow and FCFF?

Cash flows measure the cash in and out of the biz, or the liquidity of the biz. While FCFF measures the cash leftover after accounting for operating expenses and reinvestments.

The above FCFF calculations can act as a starting point to make adjustments.

The above FCFF calculations can act as a starting point to make adjustments.

For example, I like to use NOPAT and sales to capital ratios to measure expenses and reinvestments, but each to their own, more on this in the future.

Hope this helps!

Hope this helps!

• • •

Missing some Tweet in this thread? You can try to

force a refresh