Breaking down the stock market for beginners, using everyday language | Available everywhere | Sign up for Value Spotlight to continue your learning ⬇️

9 subscribers

How to get URL link on X (Twitter) App

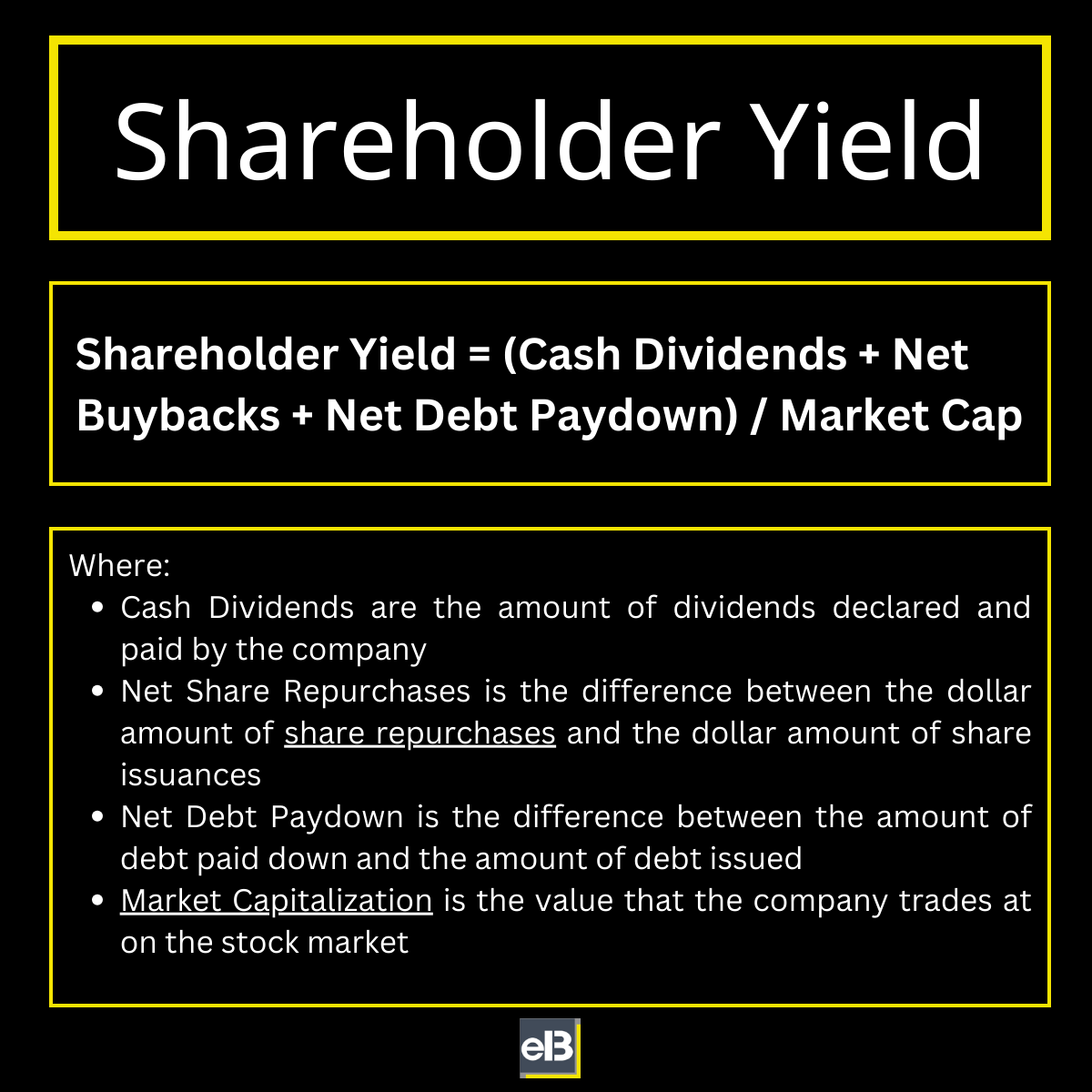

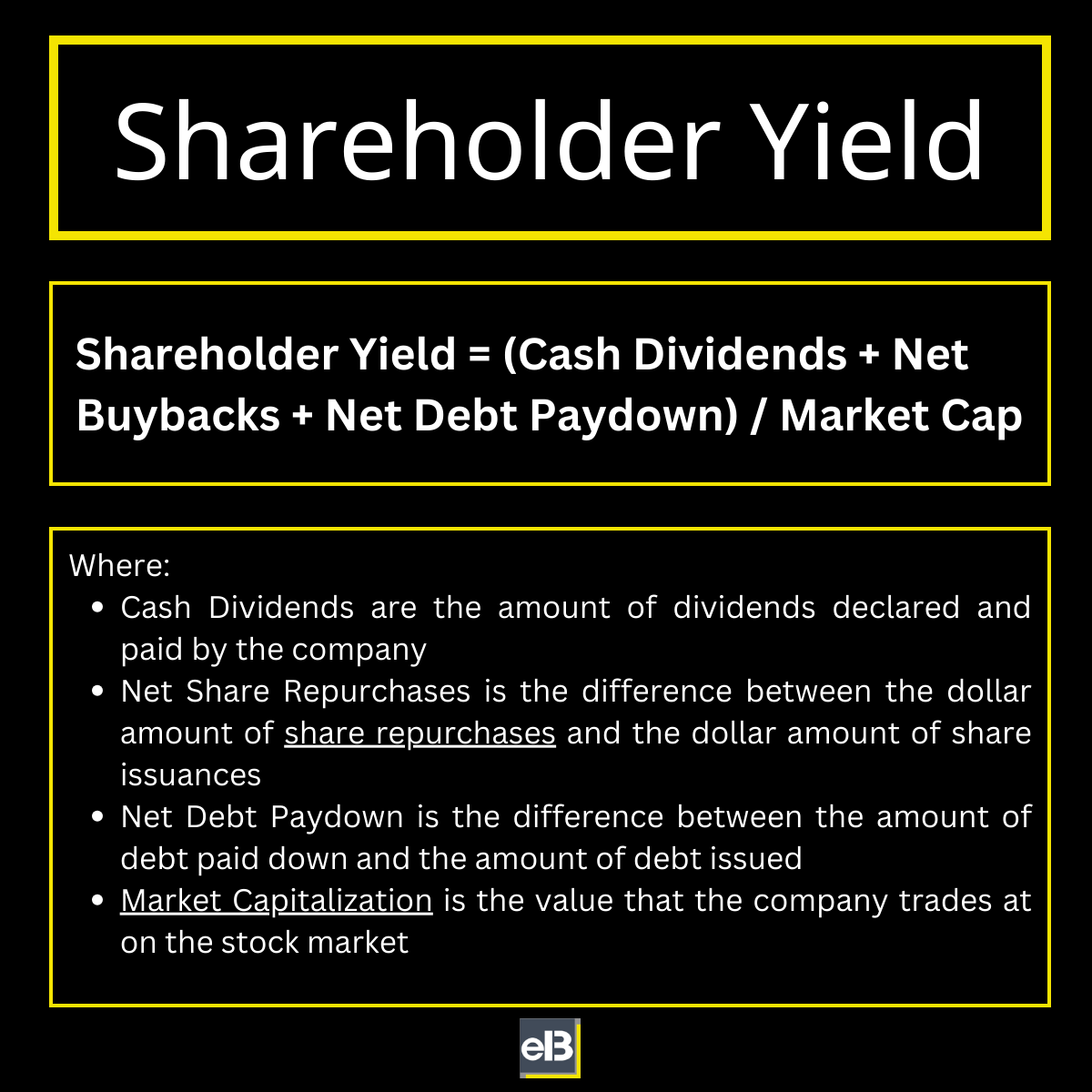

Shareholder yield is a financial metric measuring the amount of capital returned to shareholders through various means, including dividends, share buybacks, and debt reduction.

Shareholder yield is a financial metric measuring the amount of capital returned to shareholders through various means, including dividends, share buybacks, and debt reduction.

1️⃣Price to Free Cash Flow

1️⃣Price to Free Cash Flow

1️⃣Research industries you love.

1️⃣Research industries you love.

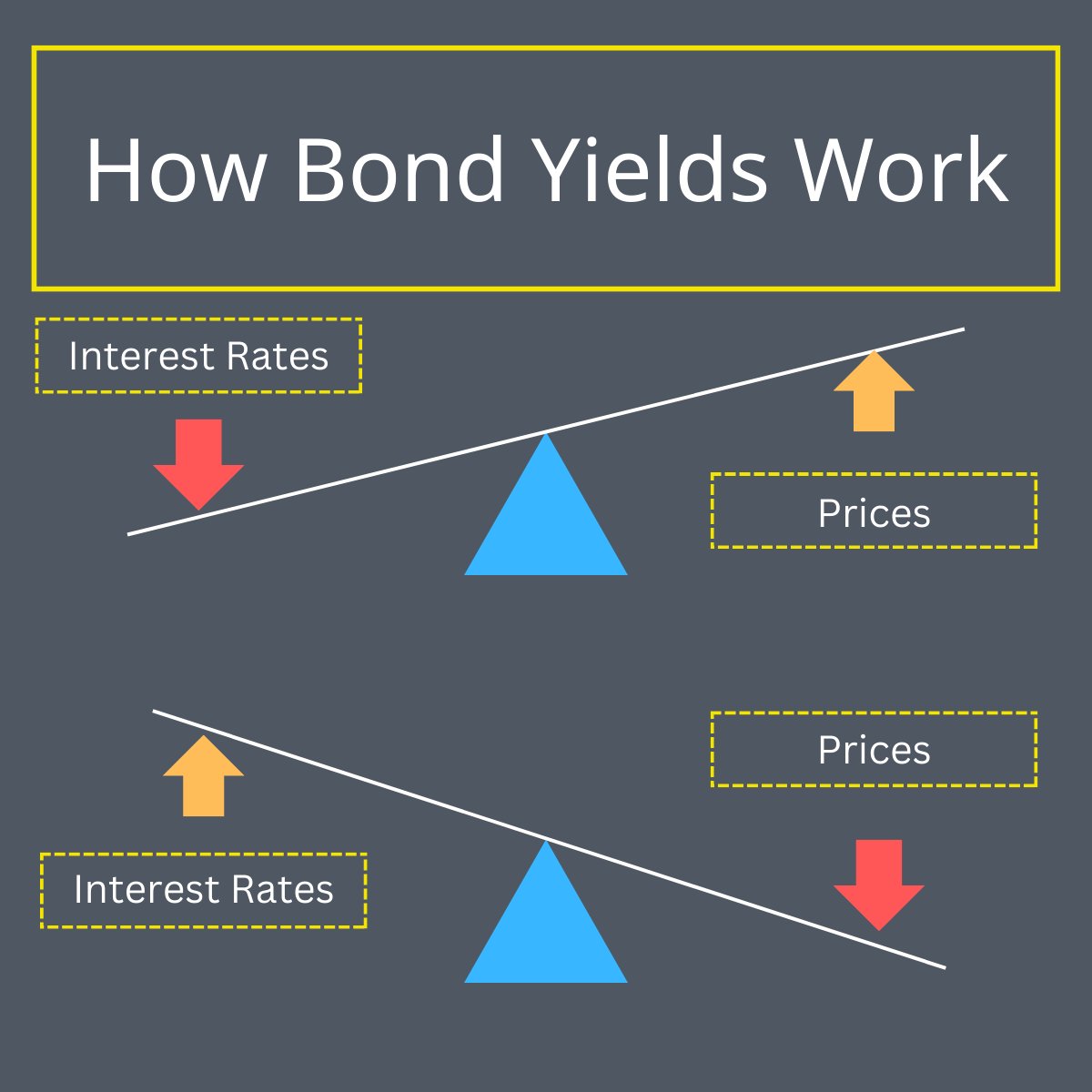

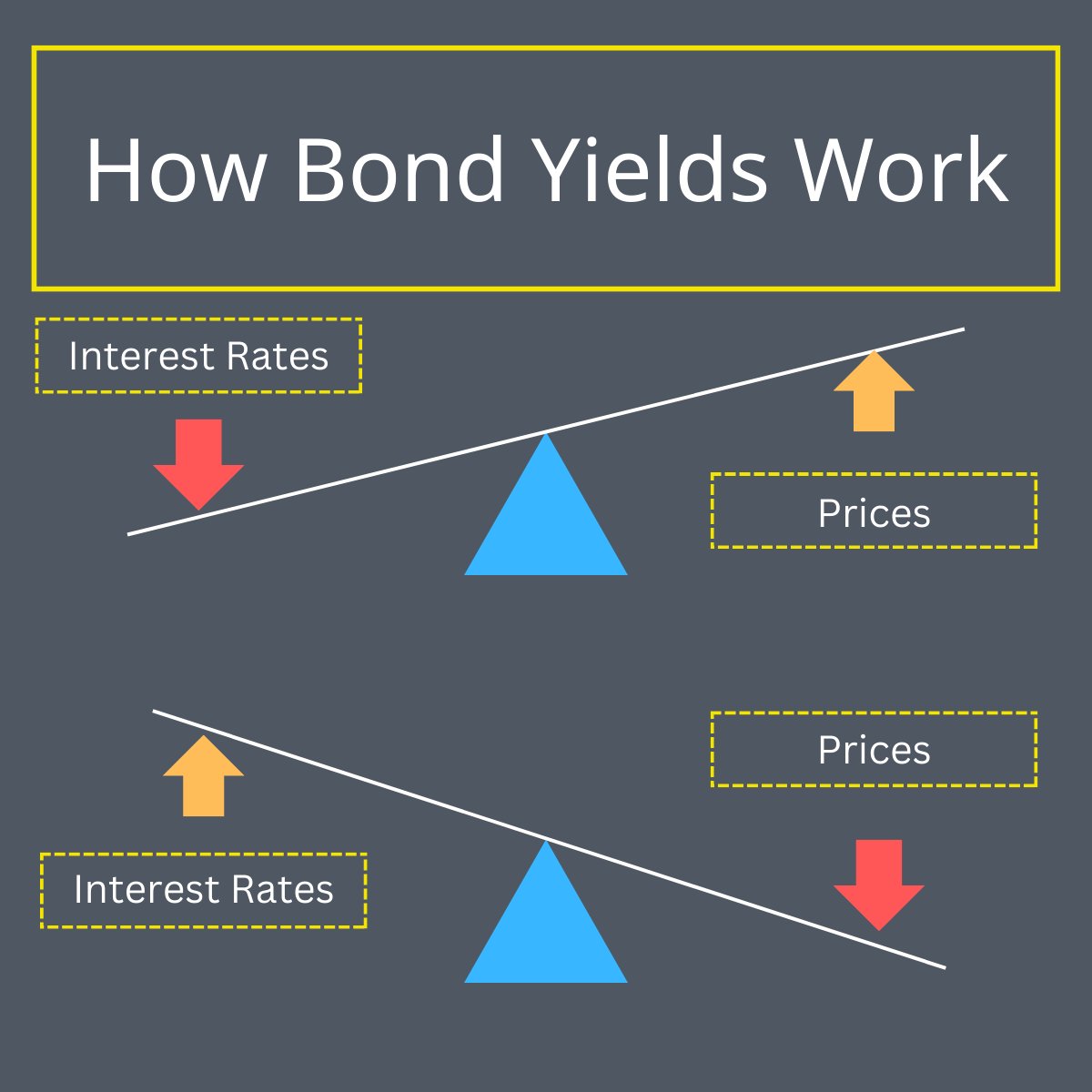

A bond yield measures the return an investor can expect from a bond.

A bond yield measures the return an investor can expect from a bond.

The P/FCF ratio is a valuation measure that helps investors assess the relationship between a company's market share price and free cash flow.

The P/FCF ratio is a valuation measure that helps investors assess the relationship between a company's market share price and free cash flow.

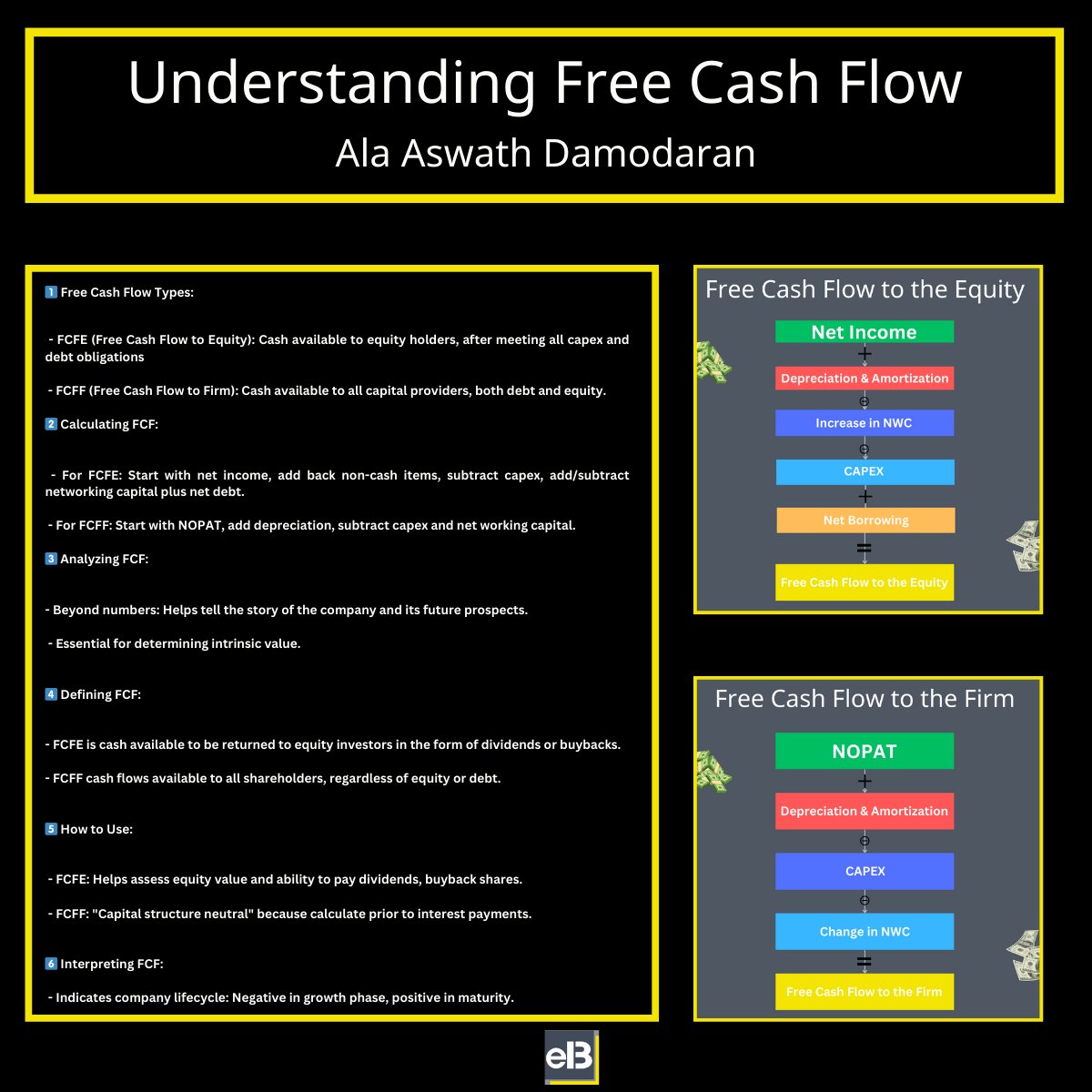

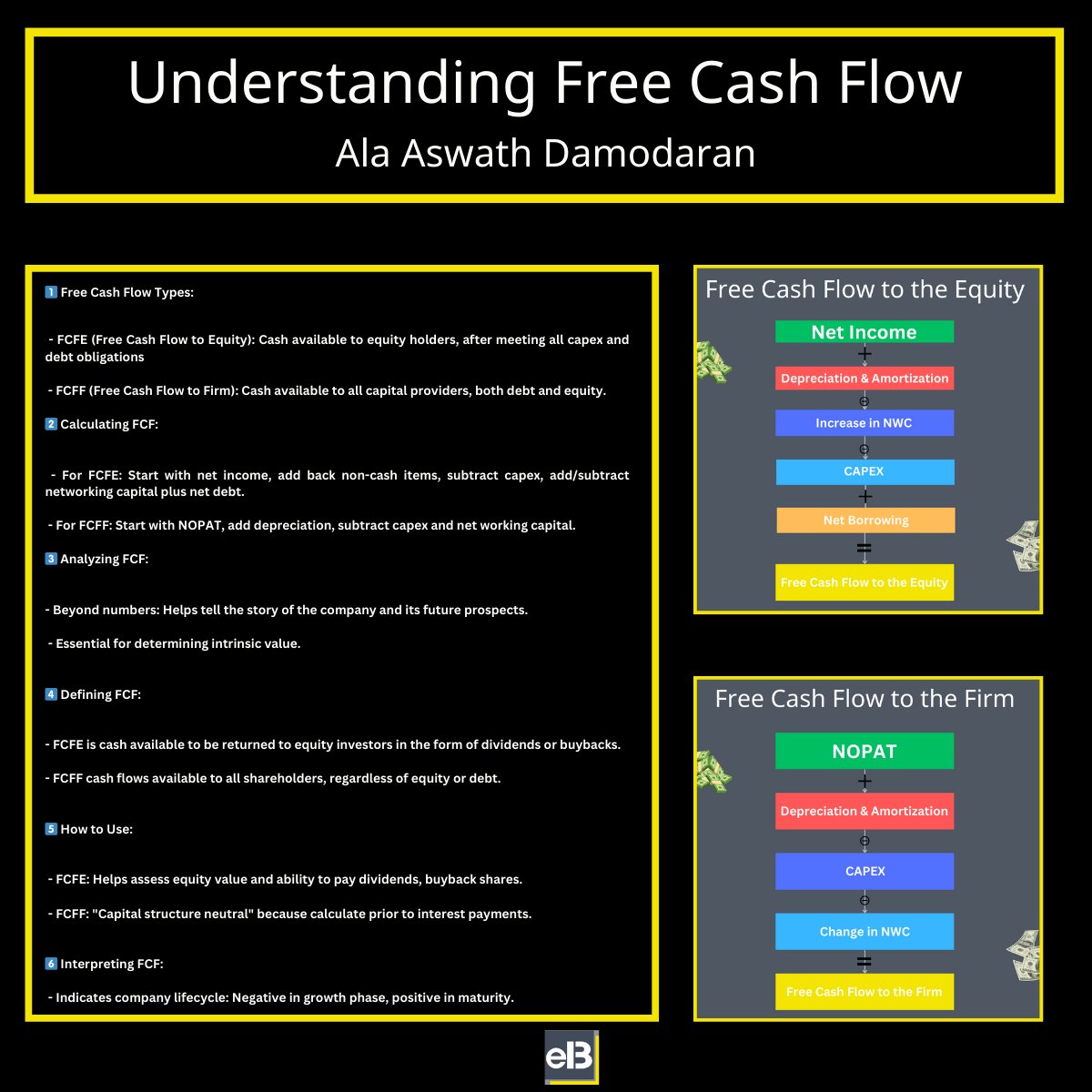

2/9 FCFF represents the amount of cash flow available to shareholders after we account for depreciation, taxes, working cap, & investments.

2/9 FCFF represents the amount of cash flow available to shareholders after we account for depreciation, taxes, working cap, & investments.

In the world of businesses, a "moat" is something that a company has or does that makes it really hard for other companies to compete with them or take away their customers.

In the world of businesses, a "moat" is something that a company has or does that makes it really hard for other companies to compete with them or take away their customers.

2. Gross Profits - Revenue less COGS (cost of goods sold)

2. Gross Profits - Revenue less COGS (cost of goods sold)

Buffett famously defines maintenance capex in his 1986 Letter as:

Buffett famously defines maintenance capex in his 1986 Letter as:

2/7 The quick ratio helps investors measure its ability to pay its current liabilities without needing to cash out its inventory or use additional debt.

2/7 The quick ratio helps investors measure its ability to pay its current liabilities without needing to cash out its inventory or use additional debt.https://twitter.com/1416134632815333378/status/1629149274532626432

A bond yield measures the return an investor can expect from a bond.

A bond yield measures the return an investor can expect from a bond.

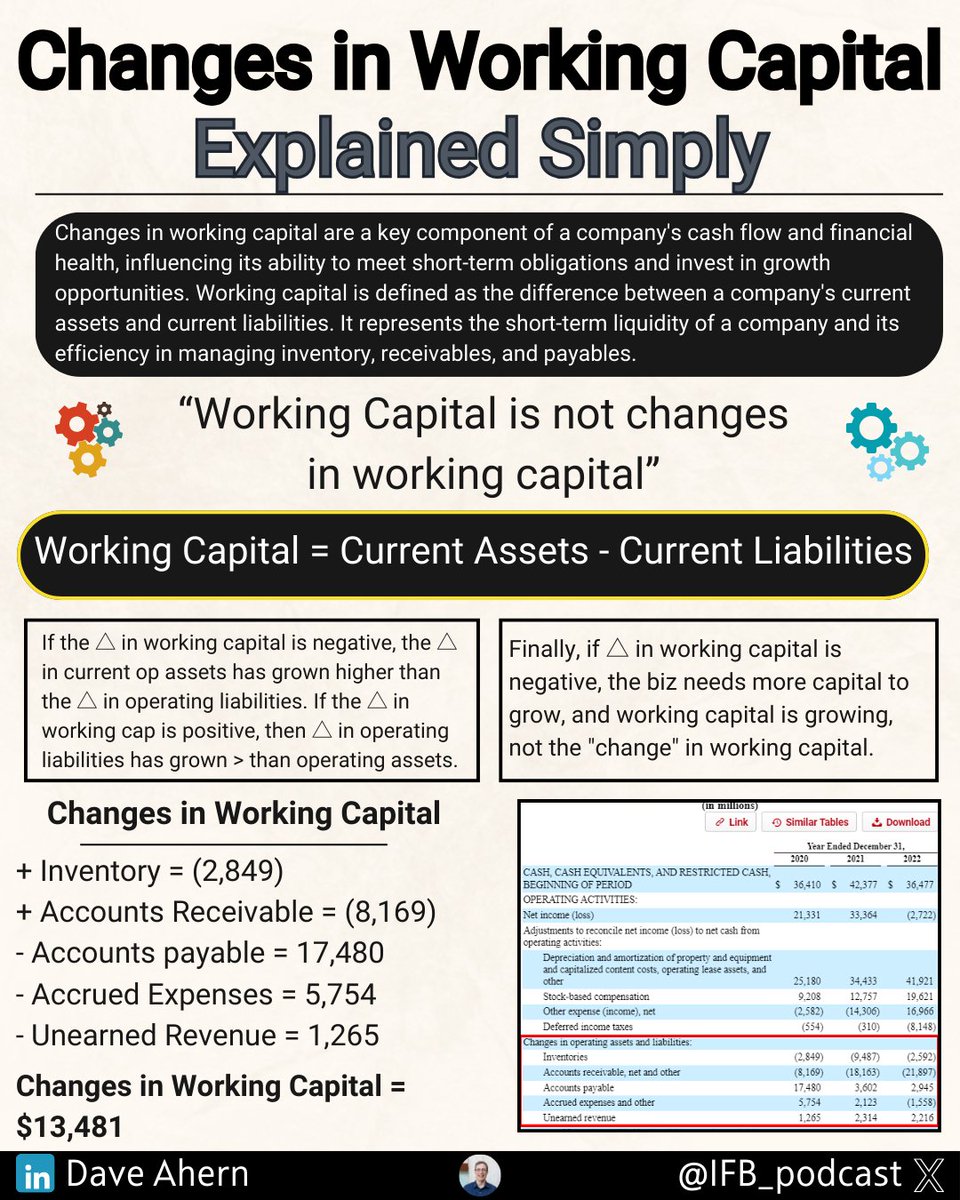

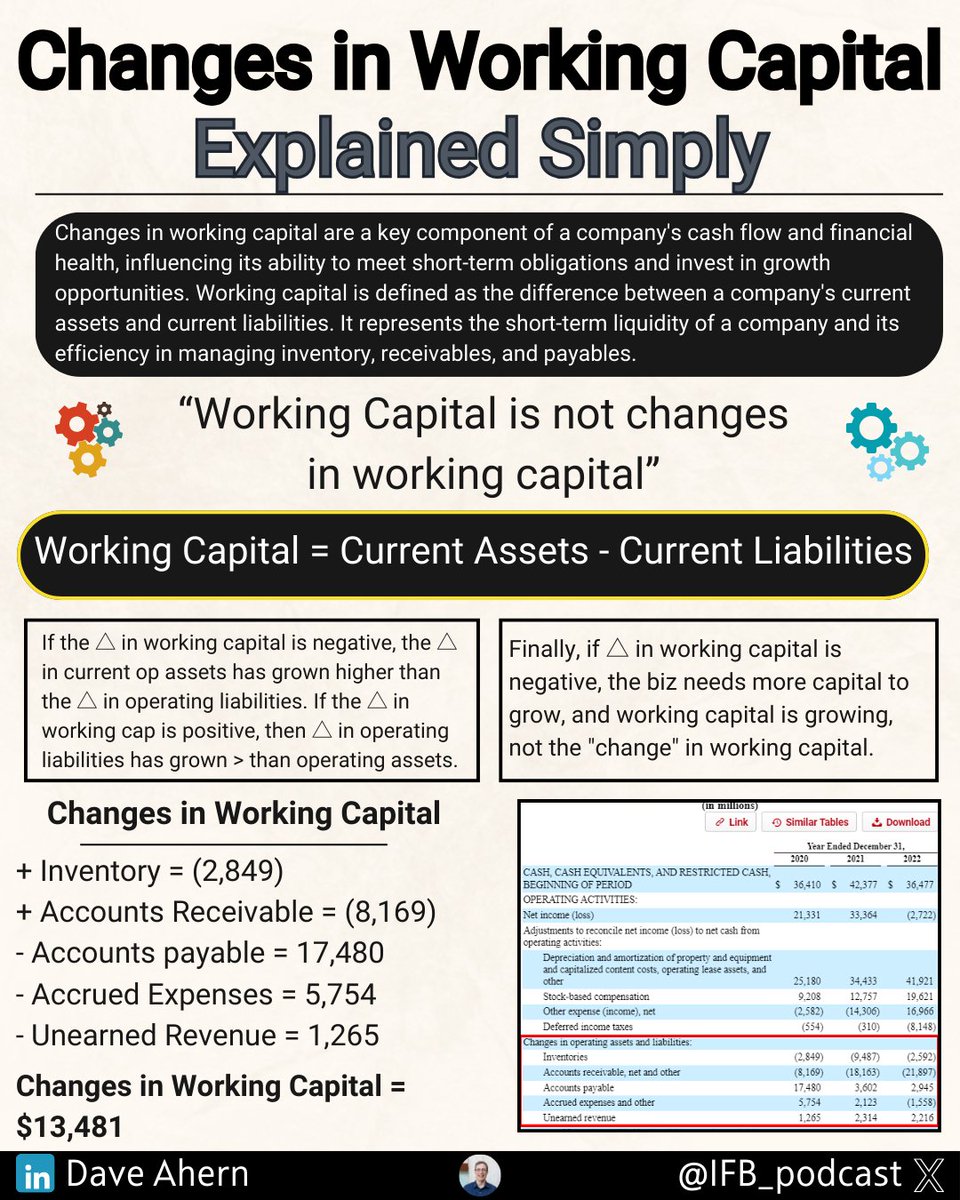

2/7 There are a few ways to calculate NWC, let's look a three:

2/7 There are a few ways to calculate NWC, let's look a three:

2/7 Step 1: Read the biz description. If I don't understand, I throw it in the too hard pile and move on to the next company.

2/7 Step 1: Read the biz description. If I don't understand, I throw it in the too hard pile and move on to the next company.

This short thread will outline some important ideas.

This short thread will outline some important ideas.

2/11 FCFE represents the cash flow available to shareholders after we account for capital expenditures and net debt issued.

2/11 FCFE represents the cash flow available to shareholders after we account for capital expenditures and net debt issued.

2/9 FCFF represents the amount of cash flow available to shareholders after we account for depreciation, taxes, working cap, & investments.

2/9 FCFF represents the amount of cash flow available to shareholders after we account for depreciation, taxes, working cap, & investments.

Return on Capital Employed (ROCE) is a financial ratio that measures a company's profitability and efficiency in generating returns from the capital it employs.

Return on Capital Employed (ROCE) is a financial ratio that measures a company's profitability and efficiency in generating returns from the capital it employs.

So, what are changes in working capital, and what does it mean?

So, what are changes in working capital, and what does it mean?