1/ Yesterday was a prime example of why crypto Twitter (and often crypto media) should not be trusted when it comes to crypto policy. Let's debunk claims that the EU is banning anonymous crypto transactions or self-custodial wallets.

Here is what’s actually in the EU Anti Money Laundering Regulation (AMLR) and what in means for crypto in the EU 🧵

Here is what’s actually in the EU Anti Money Laundering Regulation (AMLR) and what in means for crypto in the EU 🧵

2/ First things first: The AMLR is not a crypto regulation.

It’s a broad AML/CFT framework that applies to institutions, so called “obliged entities” (OEs). All financial institutions, including CASPs (crypto-asset service providers), are OEs. But also non-financial institutions like football clubs or gambling services that might be prone to AML/CFT risk will be treated as OEs under the AMLR.

It’s a broad AML/CFT framework that applies to institutions, so called “obliged entities” (OEs). All financial institutions, including CASPs (crypto-asset service providers), are OEs. But also non-financial institutions like football clubs or gambling services that might be prone to AML/CFT risk will be treated as OEs under the AMLR.

3/ As such, the AMLR applies only to OEs/service providers and explicitly excludes obligations for providers of hardware and software or providers of self-custody wallets that don’t have access/control over the crypto-assets (e.g. Metamask, ledger).

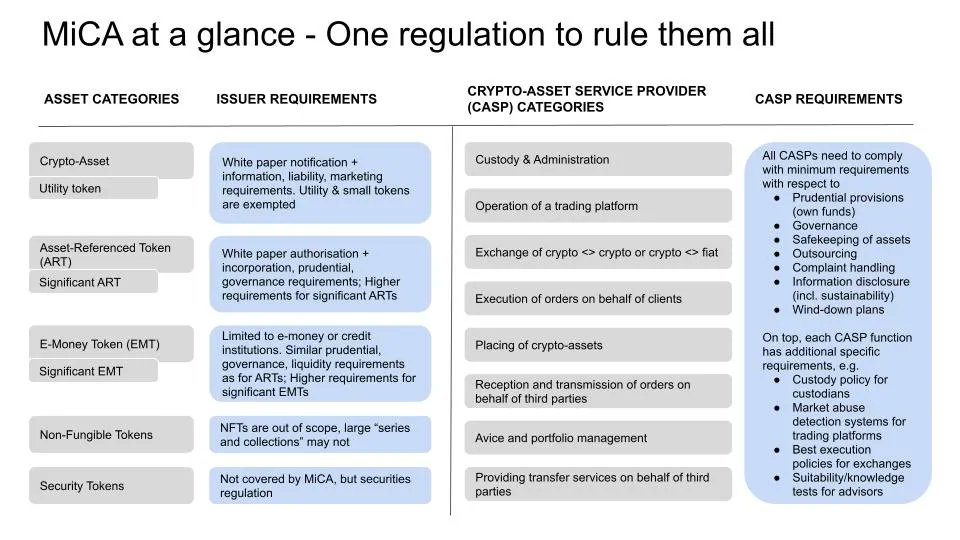

4/ The AMLR will apply to all CASPs (exchanges, brokers etc.) that are regulated under MiCA. These CASPs will need to follow standard KYC/AML procedures like customer due diligence (CDD) etc.

This is nothing new, as all crypto exchanges & custodial wallet providers in the EU are already subject to these obligations under the current AMLD5.

This is nothing new, as all crypto exchanges & custodial wallet providers in the EU are already subject to these obligations under the current AMLD5.

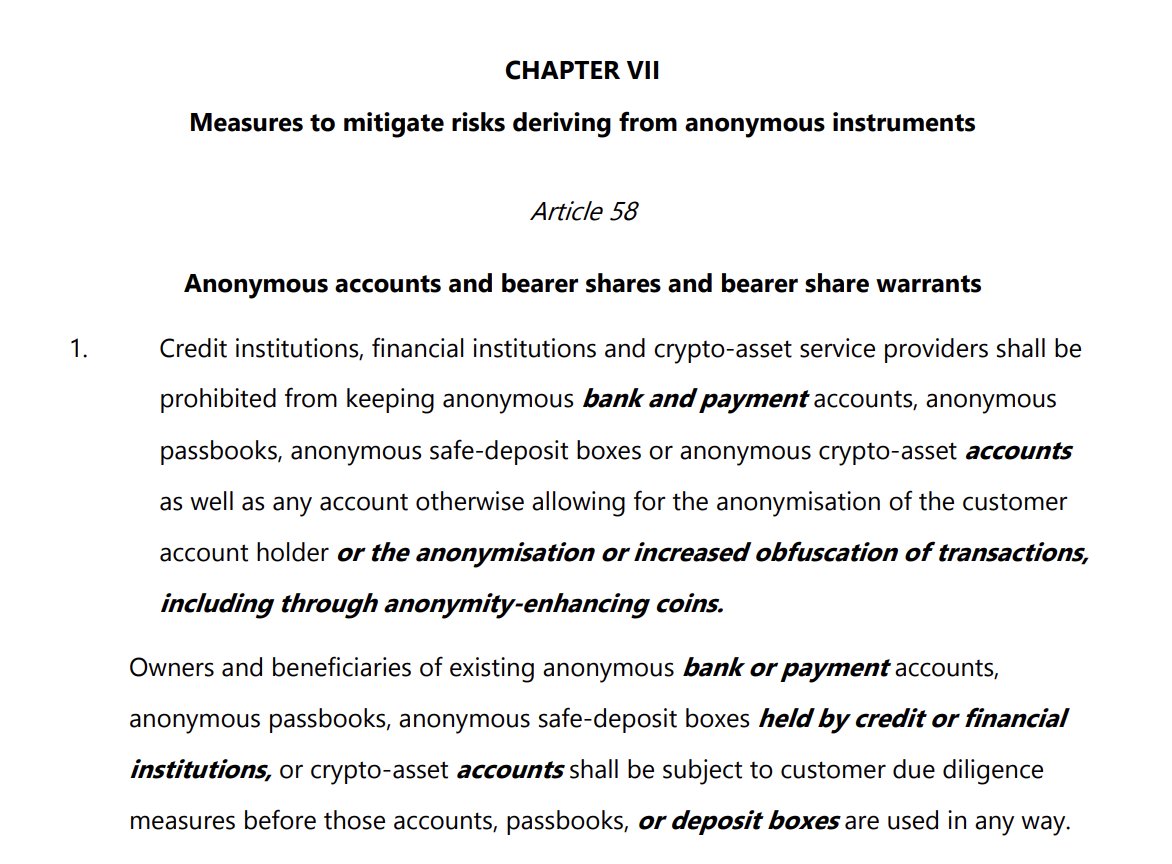

5/ The AMLR (Art. 58) now explicitly prohibits CASPs to provide anonymous accounts, meaning a custodial crypto business cannot provide services for anonymous users. This is already prohibited under existing AML rules anyway, so nothing new.

Also, CASPs will not be allowed to provide accounts for privacy coins. This is already existing business practice across the world (see delistings across all major exchanges - not only in the EU).

And btw: MiCA already prohibits the listing of crypto-assets with built-in anonymisation function.

Also, CASPs will not be allowed to provide accounts for privacy coins. This is already existing business practice across the world (see delistings across all major exchanges - not only in the EU).

And btw: MiCA already prohibits the listing of crypto-assets with built-in anonymisation function.

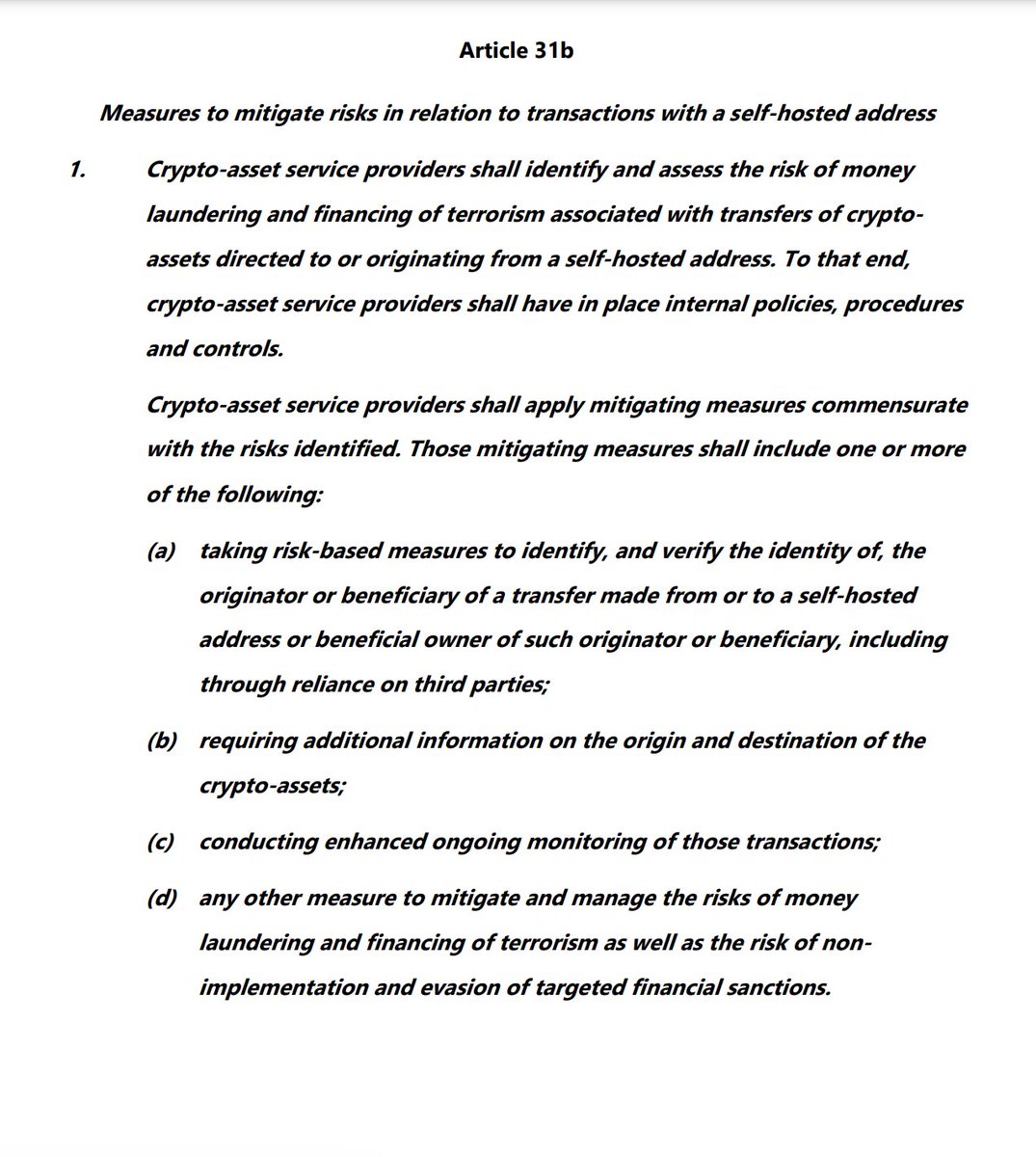

6/ With respect to transfers between CASPs and self-custody wallets (AMLR Art. 31b), AMLR requires “risk-mitigating” measures, including for example the use of blockchain analytics, or the collection of additional data about the origin/destination of those crypto-assets.

This is in line with the Transfer of Funds Regulation (TFR), the EU implementation of the FATF travel rule, that will require CASPs to at least collect data for transfers to/from self-custody wallets (e.g. name of the originator/beneficiary).

This is in line with the Transfer of Funds Regulation (TFR), the EU implementation of the FATF travel rule, that will require CASPs to at least collect data for transfers to/from self-custody wallets (e.g. name of the originator/beneficiary).

7/ As such, this is nothing new either. Previous versions of the proposed AMLR proposed a way stricter approach that would have meant a KYC on the self-custody originator/beneficiary, but also thanks to industry efforts a risk-based approach with various options was finally agreed on.

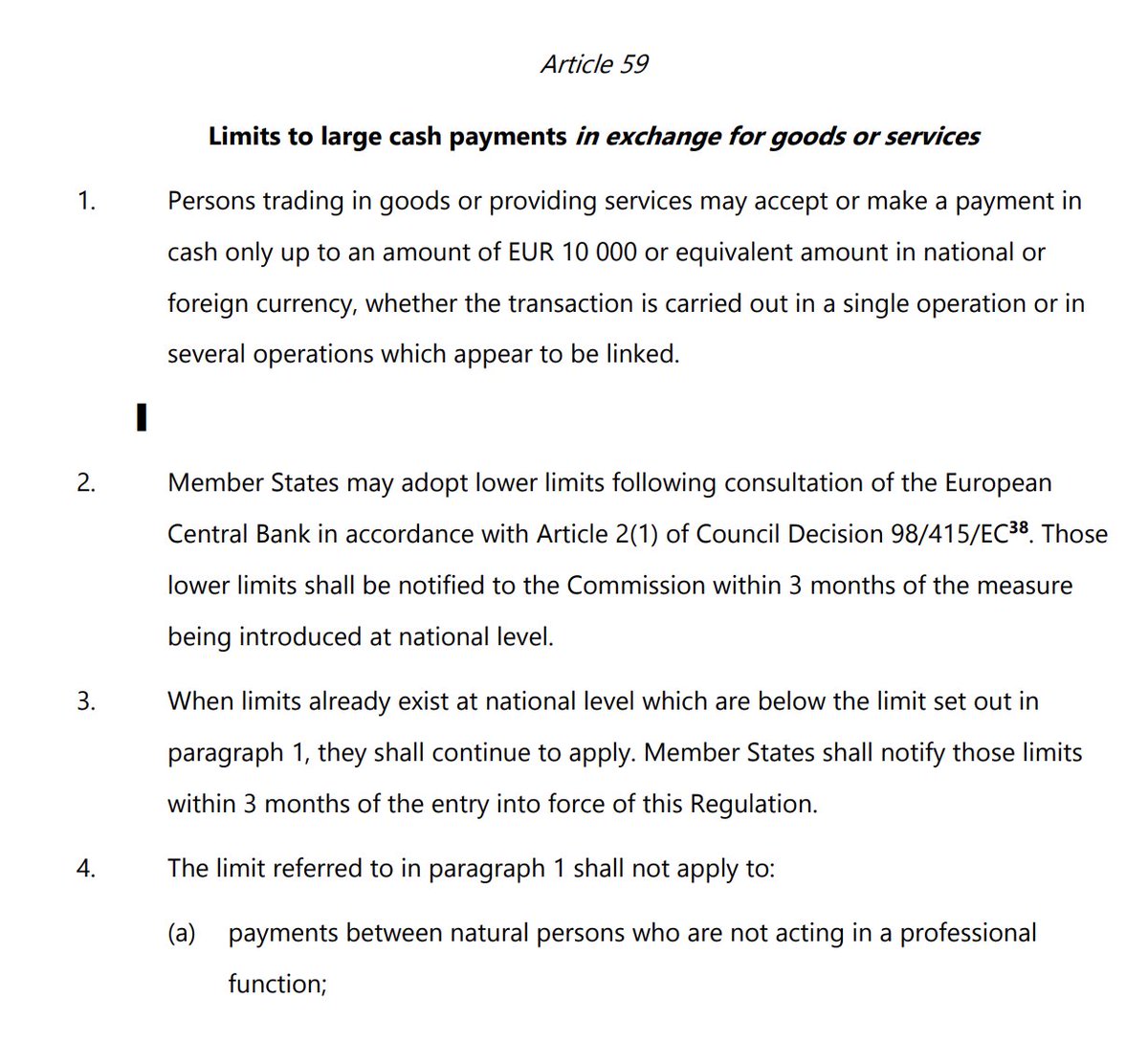

8/ With respect merchant payments (AMLR Art. 59), cash payments were limited to a maximum of 10k € unfortunately. EU member states can even adopt lower limits if they want to.

This is bad news.

This is bad news.

9/ The good news:

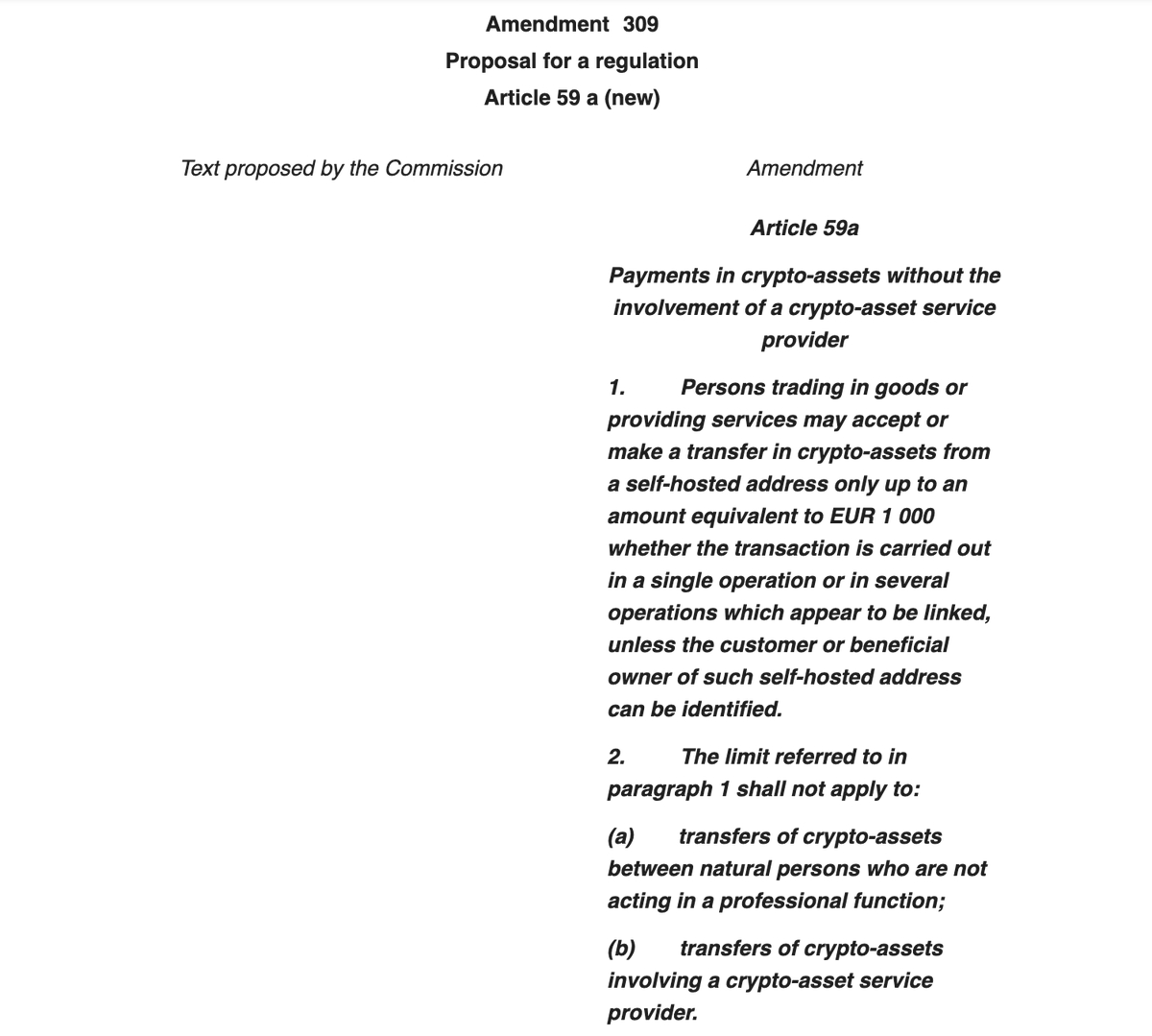

Previously the Parliament also proposed an amendment to limit merchant payments from a self-custody wallet (without CASPs involved) to 1k € (see screenshot below). This has been removed from the final, agreed on version.

Previously the Parliament also proposed an amendment to limit merchant payments from a self-custody wallet (without CASPs involved) to 1k € (see screenshot below). This has been removed from the final, agreed on version.

10/ Therefore, you will be able to use your self-custody wallets for buying goods/services in the EU without any restrictions.

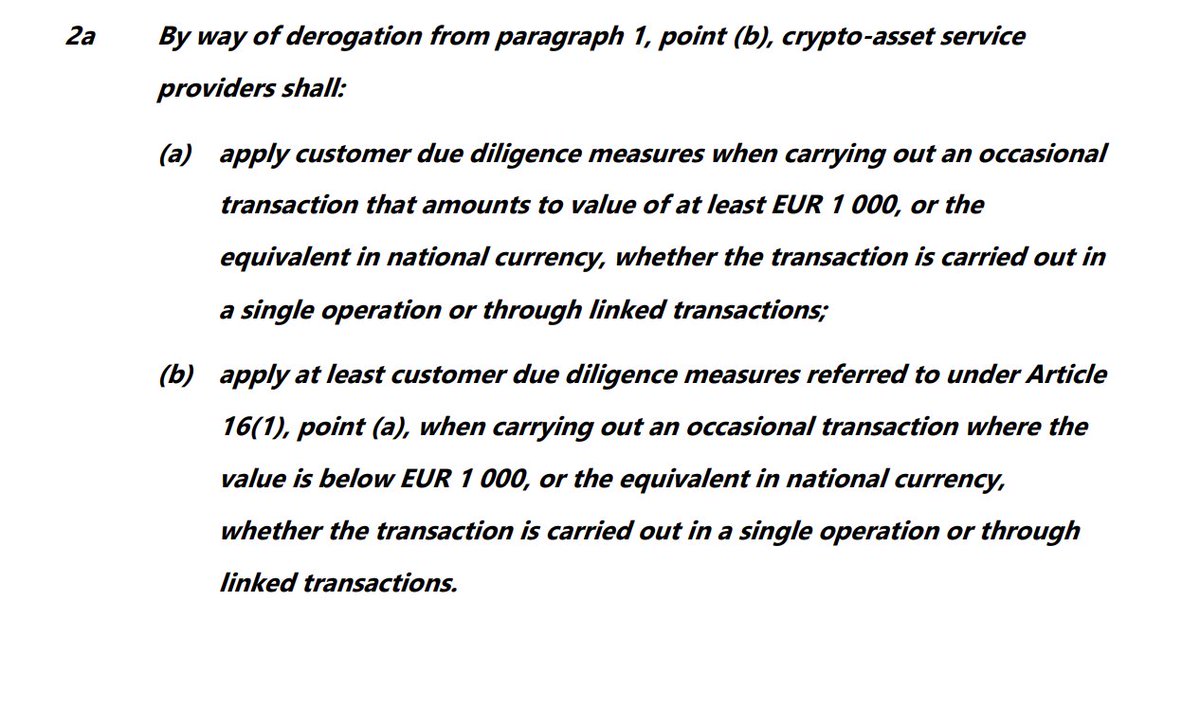

11/ If you want to use a CASP though for buying goods & services with crypto, even outside of a regular business relationship (so-called occasional transaction), this CASP will need to perform customer due diligence on you - meaning verify your identity + potential additional KYC/AML measures if the transaction is above 1k € (AMLR Art. 15).

12/ Those are the most important crypto-related AMLR sections and as you can see, the impact on self-custody wallets and CASPs is very limited, almost zero.

13/ I am certainly not a fan of the AMLR. For example, I don't agree with lowering the thresholds for cash payments or further restricting the e-money exemption for low value, low risk payments.

But the FUD that was spread yesterday by some of the biggest CT accounts was just plain wrong, and frankly I'm pretty frustrated with the state of the crypto media for picking up on this news and not being able to do the work to properly inform people.

But the FUD that was spread yesterday by some of the biggest CT accounts was just plain wrong, and frankly I'm pretty frustrated with the state of the crypto media for picking up on this news and not being able to do the work to properly inform people.

14/ The AMLR is not an ban of

-self-custody payments

-self-custody wallets

-P2P transfers

It mostly reiterates AML/CFT rules for CASPs and other OEs, but for the most part, these rules were already mandatory and common business practice anyway (from AMLD5, MiCA, TFR).

-self-custody payments

-self-custody wallets

-P2P transfers

It mostly reiterates AML/CFT rules for CASPs and other OEs, but for the most part, these rules were already mandatory and common business practice anyway (from AMLD5, MiCA, TFR).

15/ In fact, if you look at what the EU Parliament suggested in its first AMLR report months ago, this final version a great outcome for the industry.

The EU Parliament initially proposed to

-limit self-custody merchant payments to 1k€

-add DAOs, DeFi arrangements, potentially developers to the AMLR’s scope

-add NFT platforms to the AMLR’s scope

The EU Parliament initially proposed to

-limit self-custody merchant payments to 1k€

-add DAOs, DeFi arrangements, potentially developers to the AMLR’s scope

-add NFT platforms to the AMLR’s scope

16/ Thanks to the education and advocacy efforts of many industry groups and representatives, all of this was luckily prevented.

The impact from the AMLR on crypto in the EU will therefore be extremely limited.

The impact from the AMLR on crypto in the EU will therefore be extremely limited.

17/ All of this is obviously not legal advice.

Here is the final compromise text if you want to check for yourself.

europarl.europa.eu/meetdocs/2014_…

Here is the final compromise text if you want to check for yourself.

europarl.europa.eu/meetdocs/2014_…

18/ The text was agreed on by the ECON committee in the EU Parliament in March, and it only needs to pass final - purely formal - approval in the EU Parliament’s plenary (probably end of April) and in the Council of the EU. It will enter into application 3 years after its publication (~Summer 2027).

19/ Hopefully this will help debunk most of yesterday’s headlines & FUD.

I’d appreciate if you could help me correct the false rumors & bad takes by sharing the first tweet below.

I’ll continue to do my best to share updates on all things Crypto & EU.

I’d appreciate if you could help me correct the false rumors & bad takes by sharing the first tweet below.

I’ll continue to do my best to share updates on all things Crypto & EU.

https://x.com/paddi_hansen/status/1771929859704389954?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh