2. Peter Lynch :

All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don't work out.

All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don't work out.

3. Joel Greenblatt:

Buy good companies (high ROC) that are cheap (high earnings yield) .

Greenblatt's Magic Formula returned 33% per year to shareholders.

Buy good companies (high ROC) that are cheap (high earnings yield) .

Greenblatt's Magic Formula returned 33% per year to shareholders.

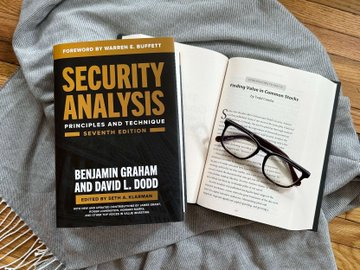

5. Benjamin Graham

Don't overpay.

The intelligent investor is a realist who sells to optimists and buys from pessimists.

Don't overpay.

The intelligent investor is a realist who sells to optimists and buys from pessimists.

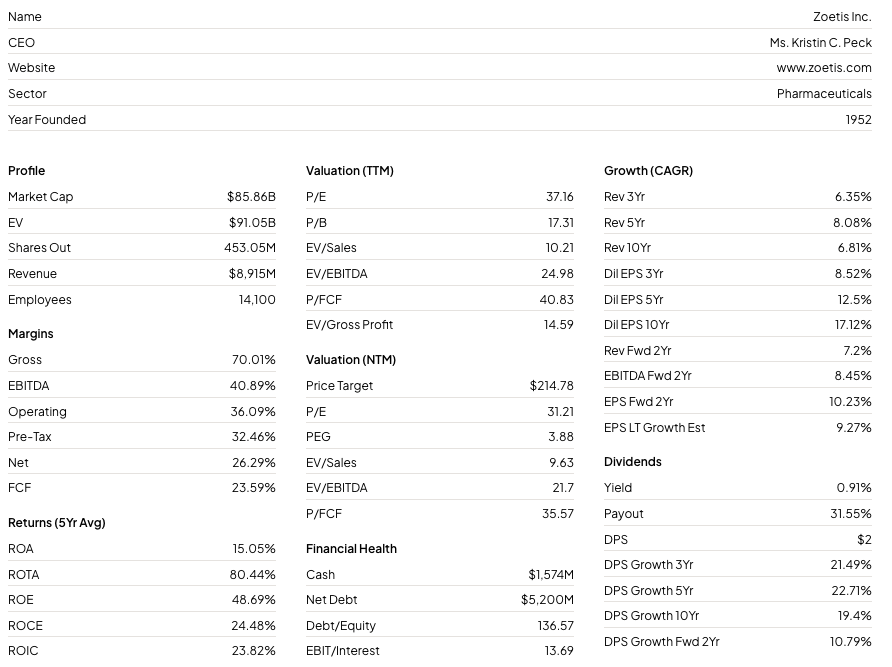

6. François Rochon

Focus on companies with high margins and high returns on capital.

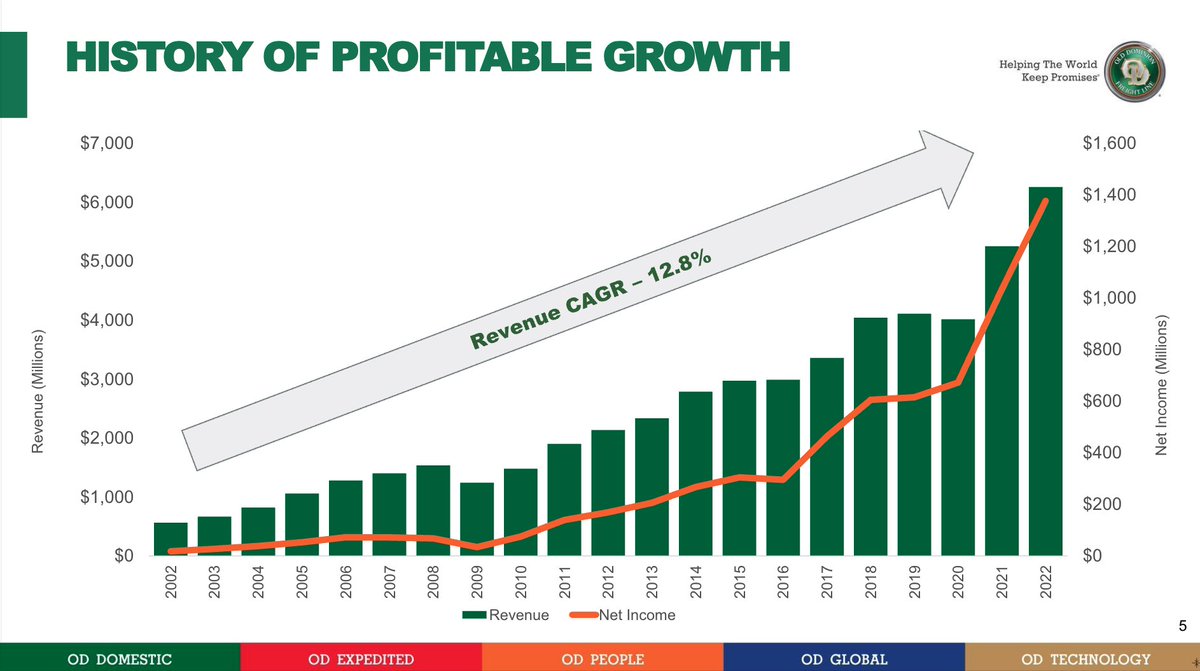

Time in the market beats timing the market.

Focus on companies with high margins and high returns on capital.

Time in the market beats timing the market.

7. Warren Buffett:

1. Buy good companies

2. Don't lose money

3. Always think for yourself

4. Don't overpay

5. Be patient

1. Buy good companies

2. Don't lose money

3. Always think for yourself

4. Don't overpay

5. Be patient

That's it for today.

Do you want to learn more? Grab my free investing e-book here: compounding-quality.ck.page/43ee564f9e

Do you want to learn more? Grab my free investing e-book here: compounding-quality.ck.page/43ee564f9e

• • •

Missing some Tweet in this thread? You can try to

force a refresh