Every year, Warren Buffett writes a letter to shareholders

I read them all over the past 40 years

Here are 11 key learnings:

I read them all over the past 40 years

Here are 11 key learnings:

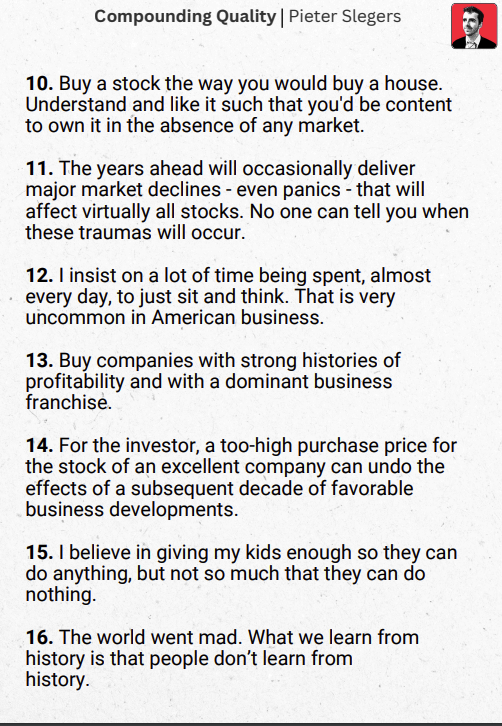

1. Executives should only eat what they kill

How many execs of stocks you own do this?

“At Berkshire... we use an incentive-compensation system that rewards key managers for meeting targets in their own bailiwicks,” Buffett wrote in his 1985 letter.

How many execs of stocks you own do this?

“At Berkshire... we use an incentive-compensation system that rewards key managers for meeting targets in their own bailiwicks,” Buffett wrote in his 1985 letter.

“We believe good unit performance should be rewarded whether Berkshire stock rises, falls, or stays even. Similarly, we think average performance should earn no special rewards even if our stock should soar.”

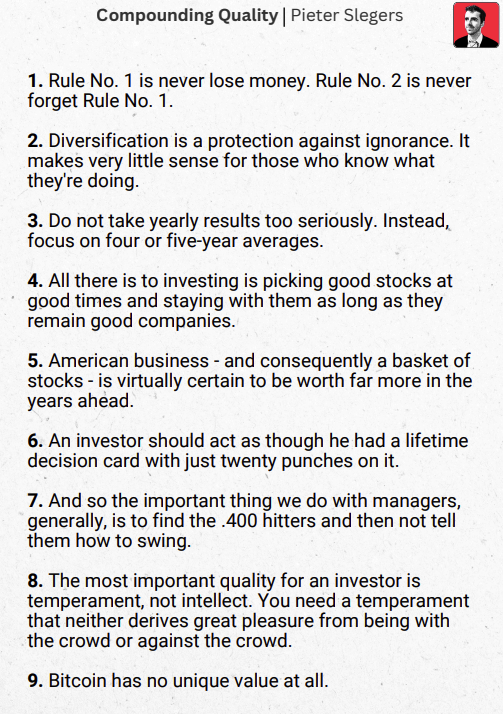

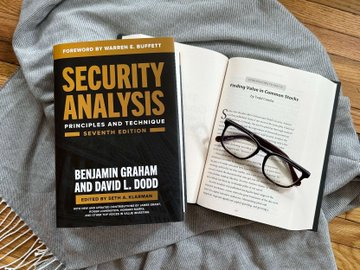

2. Buy stock as an owner, not a speculator

“Whenever Charlie and I buy common stocks for Berkshire’s insurance companies... we approach the transaction as if we were buying into a private business,” he wrote in his 1987 letter.

“Whenever Charlie and I buy common stocks for Berkshire’s insurance companies... we approach the transaction as if we were buying into a private business,” he wrote in his 1987 letter.

“We look at the economic prospects of the business, the people in charge of running it, and the price we must pay. We do not have in mind any time or price for sale.”

Ignore short-term movements in stock prices

Emotional Problems: Mr. Market

“Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his...

Emotional Problems: Mr. Market

“Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his...

Sad to say, the poor fellow has incurable emotional problems,”

Buffett wrote in his 1987 letter.

Buffett wrote in his 1987 letter.

Be fearful when others are greedy, and greedy when others are fearful

“Though markets are generally rational, they occasionally do crazy things...

“Though markets are generally rational, they occasionally do crazy things...

... Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon.”

Don’t invest in businesses that are too complex to fully understand

Keep It Simple

Keep It Simple

“Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten, and twenty years from now.”

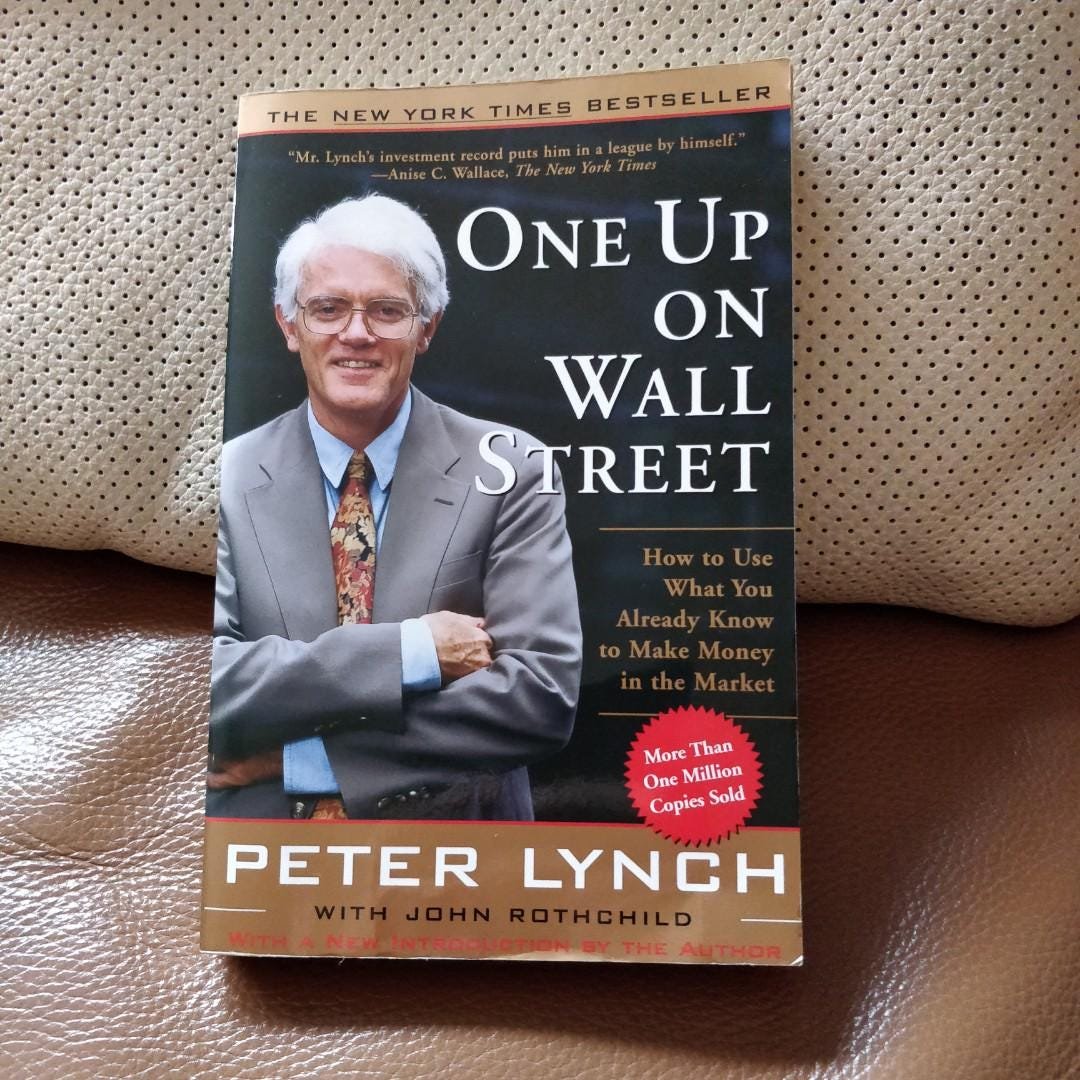

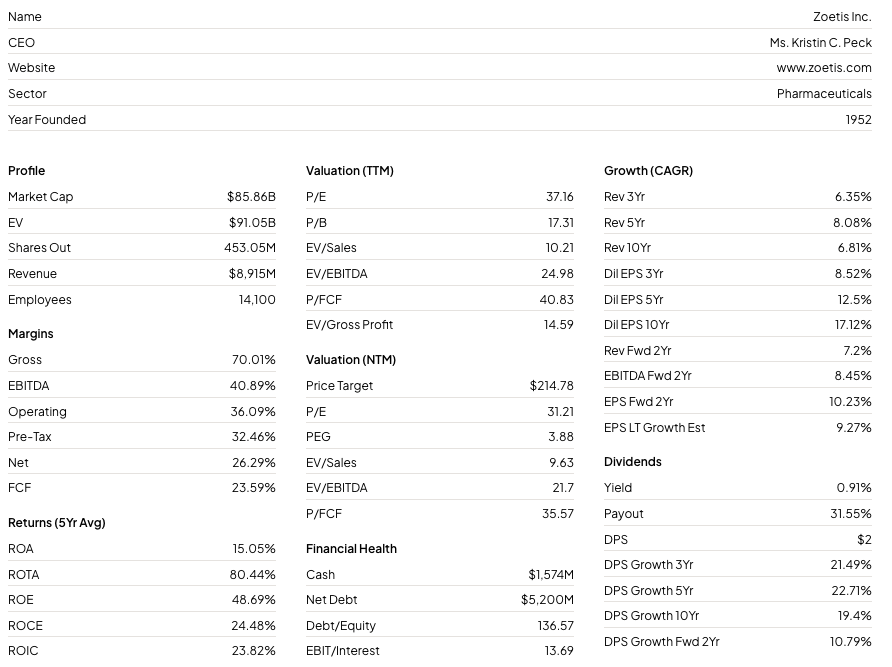

Invest in unsexy companies that build products people need

“As investors, however, our reaction to a fermenting industry is much like our attitude toward space exploration. We applaud the endeavor but prefer to skip the ride.”

“As investors, however, our reaction to a fermenting industry is much like our attitude toward space exploration. We applaud the endeavor but prefer to skip the ride.”

Never invest because you think a company is a bargain

“At Berkshire, we much prefer owning a non-controlling but substantial portion of a wonderful company to owning 100% of a so-so business...

“At Berkshire, we much prefer owning a non-controlling but substantial portion of a wonderful company to owning 100% of a so-so business...

... It’s better to have a partial interest in the Hope Diamond than to own all of a rhinestone,” he wrote in 2014.

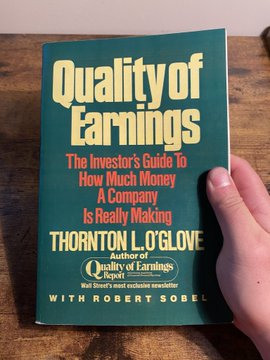

Don’t invest only because you expect a company to grow

FUZZY THINKING

“We view that as fuzzy thinking (in which, it must be confessed, I myself engaged some years ago)...

FUZZY THINKING

“We view that as fuzzy thinking (in which, it must be confessed, I myself engaged some years ago)...

... Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive,”

Never use your own stock to make acquisitions

“I would rather prep for a colonoscopy than issue Berkshire shares”

“I would rather prep for a colonoscopy than issue Berkshire shares”

Embrace the virtue of sloth

“When carried out capably, an investment strategy of that type will often result in its practitioner owning a few securities that will come to represent a very large portion of his portfolio...

“When carried out capably, an investment strategy of that type will often result in its practitioner owning a few securities that will come to represent a very large portion of his portfolio...

... To suggest that this investor should sell off portions of his most successful investments simply because they have come to dominate his portfolio is akin to suggesting the Bulls trade Michael Jordan because he has become so important to the team,” he adds.

Hire people who have no need to work

THEY DO IT FOR ♥

“We possess a cadre of truly skilled managers who have an unusual commitment to their own operations and to Berkshire. Many of our CEOs are independently wealthy and work only because they love what they do...

THEY DO IT FOR ♥

“We possess a cadre of truly skilled managers who have an unusual commitment to their own operations and to Berkshire. Many of our CEOs are independently wealthy and work only because they love what they do...

... Because no one can offer them a job they would enjoy more, they can’t be lured away.”

That's it for today.

If you liked this, you'll love the summary I made from reading all public writings of Warren Buffett.

Grab it here: compounding-quality.ck.page/5e50348f43

If you liked this, you'll love the summary I made from reading all public writings of Warren Buffett.

Grab it here: compounding-quality.ck.page/5e50348f43

• • •

Missing some Tweet in this thread? You can try to

force a refresh