1/ Selling “penny puts” in the $SPX complex has become commonplace in today’s markets, it’s essentially now a socially acceptable practice amongst portfolio managers. This is the story of James Cordier from Optionsellers, a fund that blew up and the infamous $150M margin call.

2/ Before we dive into how selling $SPX penny puts and Optionsellers is connected, it’s important to begin with the story of Cordier’s fund and career.

James began his career at Heinold Commodities in Milwaukee as a broker in 1984. After establishing a good reputation in the industry, he took his expertise and founded Liberty Trading Group in 1999. The futures/options brokerage would use options to bet on the prices of wheat, natural gas, and corn. From there, the group would eventually morph into what we know as the infamous Optionsellers fund. The fund managed about 300 high net worth clients who ranged from the owner of the Tampa Bay Lighting to elderly folks in their 90s.

In 2005, James wrote the book, “The Complete Guide to Option Selling: How Selling Options Can Lead to Stellar Returns in Bull and Bear Markets.” The book went on to be published by McGraw Hill in 2015. He also was a regular guest analyst on CNBC, Bloomberg Television, Fox Business News, and had publications on major news outlets like the Wall Street Journal. It’s safe to say that people trusted James with their money and his fund quickly grew in AUM.

James began his career at Heinold Commodities in Milwaukee as a broker in 1984. After establishing a good reputation in the industry, he took his expertise and founded Liberty Trading Group in 1999. The futures/options brokerage would use options to bet on the prices of wheat, natural gas, and corn. From there, the group would eventually morph into what we know as the infamous Optionsellers fund. The fund managed about 300 high net worth clients who ranged from the owner of the Tampa Bay Lighting to elderly folks in their 90s.

In 2005, James wrote the book, “The Complete Guide to Option Selling: How Selling Options Can Lead to Stellar Returns in Bull and Bear Markets.” The book went on to be published by McGraw Hill in 2015. He also was a regular guest analyst on CNBC, Bloomberg Television, Fox Business News, and had publications on major news outlets like the Wall Street Journal. It’s safe to say that people trusted James with their money and his fund quickly grew in AUM.

3/ Optionsellers as the name implies, specialized in selling options, mainly deep out-of-the-money options. Assuming you already have basic knowledge of what an option is, why would James only sell DOTM (deep out of the money) calls and puts? Four words. Leverage to the tits!

In 2016, James did an interview with the site Borntosell where he said, “Commodity options this far out of the money don't move dramatically like at-the-money stock options. In addition, the leverage in commodities allows investors to get much bigger premiums with substantially smaller margins. For example, 50% to 100% out-of-the-money and expire in 6-9 months. We might get $700 for the call and the margin requirement is around $1000. A single contract of gold controls 100 ounces, so this is an option on about $100K of underlying value.” I’ll leave the payoff diagram to a DOTM call option below.

In 2016, James did an interview with the site Borntosell where he said, “Commodity options this far out of the money don't move dramatically like at-the-money stock options. In addition, the leverage in commodities allows investors to get much bigger premiums with substantially smaller margins. For example, 50% to 100% out-of-the-money and expire in 6-9 months. We might get $700 for the call and the margin requirement is around $1000. A single contract of gold controls 100 ounces, so this is an option on about $100K of underlying value.” I’ll leave the payoff diagram to a DOTM call option below.

4/ This exact philosophy of high leverage trades is what’s going to cause the ultimate blowup of his fund, but how did it happen?

In the fall of 2018, the BLS reported that Natural Gas storage supply hit a 16 year low. Fast forward to November 14th, 2018 and warnings of a cold front spiked natural gas futures by 18% to a 4 year high on that day, as shown in the chart below. The optionsellers fund was short calls in very large quantities. This ultimately led to a snowball effect of those short calls needing to be covered, or in other words, his broker decided the position had more unrealized loss than what was in the account balance, leading to a margin call. When James didn’t post collateral for the margin call, his broker liquidated his positions, leading to a $150 Million realized loss. Not only did everybody lose 100% of their investment, they were also hit with margin debt calls equal to about a third of their investment.

Unfortunately, a Twitter user (who I won't out) had $400,000 invested with James, and between November 8th- November 15th, that $400K amounted to over a $1,000,000 loss. The user made a spreadsheet with the exact positions which I’ll leave a link to in the sources. Most of the short calls 5-10x in value within a single trading day!

You can see from the picture below that the short call positions never really went or actually expired in-the-money despite the Nat Gas spike. This technically means that James Cordier was correct in his prediction, but how did he manage to blow up his fund to the tune of $150M in losses?

In the fall of 2018, the BLS reported that Natural Gas storage supply hit a 16 year low. Fast forward to November 14th, 2018 and warnings of a cold front spiked natural gas futures by 18% to a 4 year high on that day, as shown in the chart below. The optionsellers fund was short calls in very large quantities. This ultimately led to a snowball effect of those short calls needing to be covered, or in other words, his broker decided the position had more unrealized loss than what was in the account balance, leading to a margin call. When James didn’t post collateral for the margin call, his broker liquidated his positions, leading to a $150 Million realized loss. Not only did everybody lose 100% of their investment, they were also hit with margin debt calls equal to about a third of their investment.

Unfortunately, a Twitter user (who I won't out) had $400,000 invested with James, and between November 8th- November 15th, that $400K amounted to over a $1,000,000 loss. The user made a spreadsheet with the exact positions which I’ll leave a link to in the sources. Most of the short calls 5-10x in value within a single trading day!

You can see from the picture below that the short call positions never really went or actually expired in-the-money despite the Nat Gas spike. This technically means that James Cordier was correct in his prediction, but how did he manage to blow up his fund to the tune of $150M in losses?

5/ Allow me to introduce you to the option greeks through the lens of a short call holder.

Delta: When you're short a call you hold negative delta which means that for every 1 point change in the spot price higher, the option price would lose that amount.

Gamma: In simple terms, this is how fast or the rate of change of an options delta when the spot price moves. A higher gamma means that the Delta can change drastically even for small moves in the underlying.

Vega: This measures how sensitive the option price is to changes in implied volatility. Put simply, for every 1% change in IV, the option price would lose money as when you’re short an option you have negative Vega. If Implied Volatility rises, you lose money.

There are third order Greeks like Zomma/Speed (DgammaDvol) and Ultima (DVommaDvol) at play but for simplicity sake, I’ll refrain from adding them.

Delta: When you're short a call you hold negative delta which means that for every 1 point change in the spot price higher, the option price would lose that amount.

Gamma: In simple terms, this is how fast or the rate of change of an options delta when the spot price moves. A higher gamma means that the Delta can change drastically even for small moves in the underlying.

Vega: This measures how sensitive the option price is to changes in implied volatility. Put simply, for every 1% change in IV, the option price would lose money as when you’re short an option you have negative Vega. If Implied Volatility rises, you lose money.

There are third order Greeks like Zomma/Speed (DgammaDvol) and Ultima (DVommaDvol) at play but for simplicity sake, I’ll refrain from adding them.

6/ Now that you understand the option greeks at play, let’s look at the short call position the Twitter user was actually in day by day.

The chart below is the option PnL of one Feb 2019 5.25c:

On November 5th, 2018, James sold to open the 5.25c for 0.05 a piece for a net credit of $500 and Nat Gas trading at 3.43.

Fast forward to Nov 8th, 2018, and the 5.25c was still trading at 0.05 a piece. This is the calm before the storm… Business as usual.

On Friday, Nov 9th, Nat Gas futures shot up 6%, moving the contract to 0.08 a piece and resulting in a paper loss of -$300 (Futures Multiplier).

Monday, Nov 12th, Nat Gas closed another 3% higher, moving the contract to 0.10 a piece and resulting in a paper loss of -$500.

Come Tuesday, Nov 13th, Nat Gas went 10% higher to 4.00, moving the contract to 0.22 a piece and resulting in a paper loss of -$1700 per contract. James had the opportunity to post a few $million in margin collateral on this day in order to keep the positions open. Had he done so, you probably wouldn’t be reading this.

Wednesday, Nov 14th… Otherwise known as the day of implosion. If you remember from earlier, this is when mainstream media warned of the cold front. Nat Gas futures went berzerk, closing 18% higher on the day to 4.75. The 5.25c moved to 0.65 a piece. At this point, James's broker issued a margin call. When it was not met, the broker market sold his position like a fire sale, resulting in a REALIZED loss of -$7000 per call contract.

Had you been on the other side, you would have 14x your money! Talk about leveraging to the tits in options. You might start to see where this is leading to in SPX.

The chart below is the option PnL of one Feb 2019 5.25c:

On November 5th, 2018, James sold to open the 5.25c for 0.05 a piece for a net credit of $500 and Nat Gas trading at 3.43.

Fast forward to Nov 8th, 2018, and the 5.25c was still trading at 0.05 a piece. This is the calm before the storm… Business as usual.

On Friday, Nov 9th, Nat Gas futures shot up 6%, moving the contract to 0.08 a piece and resulting in a paper loss of -$300 (Futures Multiplier).

Monday, Nov 12th, Nat Gas closed another 3% higher, moving the contract to 0.10 a piece and resulting in a paper loss of -$500.

Come Tuesday, Nov 13th, Nat Gas went 10% higher to 4.00, moving the contract to 0.22 a piece and resulting in a paper loss of -$1700 per contract. James had the opportunity to post a few $million in margin collateral on this day in order to keep the positions open. Had he done so, you probably wouldn’t be reading this.

Wednesday, Nov 14th… Otherwise known as the day of implosion. If you remember from earlier, this is when mainstream media warned of the cold front. Nat Gas futures went berzerk, closing 18% higher on the day to 4.75. The 5.25c moved to 0.65 a piece. At this point, James's broker issued a margin call. When it was not met, the broker market sold his position like a fire sale, resulting in a REALIZED loss of -$7000 per call contract.

Had you been on the other side, you would have 14x your money! Talk about leveraging to the tits in options. You might start to see where this is leading to in SPX.

7/ In the equity derivative world, puts are more expensive than calls because of what’s known as skew. The risk is always that stocks will crash but the most likely move is higher, so option prices reflect this. You might have heard the saying “Up like an escalator, down like an elevator.” While this is true in equities, the opposite is seen in commodity derivatives. For example, look at the chart below which shows Nat Gas futures dating back to 2001. The major spikes you see are “crashes upward.” So, call prices reflect this reality.

The calls that James sold have a positive spot/vol correlation which means that as the spot price rises, so does the volatility of the underlying. You can think of this as the option Greek Vega. Remember from tweet 5/ that if you’re short Vega and volatility rises, you lose value. It’s important to drill home this concept because it’s the real reason why his short call position blew up despite the calls never expiring in the money.

As the spot price of Nat Gas went on an 18% tear, the implied volatility went higher on the calls, therefore the delta increased, which priced in a higher likelihood of those short calls expiring in the money. Likelihood is the keyword there. If your broker sees that you're short all these calls and they "could" finish in the money and your account can’t support the exercise cost, that’s when they issue the margin collateral requirement.

All of this is to better explain that the option Greeks is the reason why his position got absolutely pummeled like a steamroller.

The calls that James sold have a positive spot/vol correlation which means that as the spot price rises, so does the volatility of the underlying. You can think of this as the option Greek Vega. Remember from tweet 5/ that if you’re short Vega and volatility rises, you lose value. It’s important to drill home this concept because it’s the real reason why his short call position blew up despite the calls never expiring in the money.

As the spot price of Nat Gas went on an 18% tear, the implied volatility went higher on the calls, therefore the delta increased, which priced in a higher likelihood of those short calls expiring in the money. Likelihood is the keyword there. If your broker sees that you're short all these calls and they "could" finish in the money and your account can’t support the exercise cost, that’s when they issue the margin collateral requirement.

All of this is to better explain that the option Greeks is the reason why his position got absolutely pummeled like a steamroller.

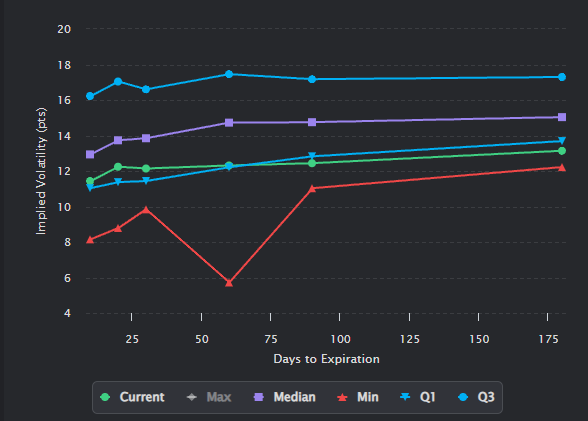

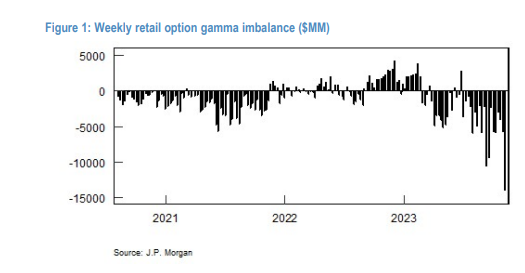

8/ So how does the Optionseller story relate to $SPX “penny puts”? Well, as of late, we have seen a dramatic uptick in funds selling DOTM puts for 0.05 a piece like this example below. Why might they do this? Low correlations in a low volatility envrionement. The maximum profit is actually quite limited for the amount of risk they are taking on (Sharpe Ratio). Someone who is at the forefront of understanding this toxic flow is @Ksidiii. He notes that tail selling is “making a comeback today in larger size than the last 10 years,” and desks are “jumping over one another” to sell these penny options.

2024 has no limit of geopolitical risks in the marketplace. Likewise, the record breaking interest in systematic vol selling programs imbeddes further market risk if the trade were to be unwound and I’m not talking about call overwriting strategies. I’m referring to the elevated interest in selling the most toxic and convex parts of the distribution. While it’s to be foreseen what the catalyst will be, If a systematically shocking news event hits the tape over the weekend when participants can’t manage their trade, I fear what happened to James will happen to those selling these penny puts.

James had over 30 years of veteran experience as a professional money manager selling options. It might seem like all professionals adhere to strict risk management practices, but it’s just truthfully not always the case. Silicon Valley Bank failed to hedge duration risk, Bear Stearns failed to see the risks in sub-prime mortgages, the SEC for crying out loud failed to simply look at options volume in Bernie Madoff’s scheme, the list goes on and on. The point remains that if you sell a cab, you will drive a cab.

2024 has no limit of geopolitical risks in the marketplace. Likewise, the record breaking interest in systematic vol selling programs imbeddes further market risk if the trade were to be unwound and I’m not talking about call overwriting strategies. I’m referring to the elevated interest in selling the most toxic and convex parts of the distribution. While it’s to be foreseen what the catalyst will be, If a systematically shocking news event hits the tape over the weekend when participants can’t manage their trade, I fear what happened to James will happen to those selling these penny puts.

James had over 30 years of veteran experience as a professional money manager selling options. It might seem like all professionals adhere to strict risk management practices, but it’s just truthfully not always the case. Silicon Valley Bank failed to hedge duration risk, Bear Stearns failed to see the risks in sub-prime mortgages, the SEC for crying out loud failed to simply look at options volume in Bernie Madoff’s scheme, the list goes on and on. The point remains that if you sell a cab, you will drive a cab.

9/END

In the aftermath of the Optionseller’s blowup, James famously made this apology video ().

Mr. Cordier now runs a commodity investment advisory site and has a YouTube channel which I’ll leave a link to both in the sources. This would be like if Bill Hwang started giving risk management advice on TikTok. Bill lost $20 Billion in two days...

The moral of the story is don’t sell penny puts if you don’t want to be the next Optionsellrs fund, and certainly don’t do it without proper risk management in place.

If you don’t mind sending out an email regarding “catastrophic losses,” well then, have at it!

In the aftermath of the Optionseller’s blowup, James famously made this apology video ().

Mr. Cordier now runs a commodity investment advisory site and has a YouTube channel which I’ll leave a link to both in the sources. This would be like if Bill Hwang started giving risk management advice on TikTok. Bill lost $20 Billion in two days...

The moral of the story is don’t sell penny puts if you don’t want to be the next Optionsellrs fund, and certainly don’t do it without proper risk management in place.

If you don’t mind sending out an email regarding “catastrophic losses,” well then, have at it!

Sources:

.

borntosell.com/covered-call-b…

prnewswire.com/news-releases/…

amazon.com/Complete-Guide…

institutionalinvestor.com/article/2bsx4k…

linkedin.com/in/james-cordi…

tampabay.com/news/business/…

bls.gov/blog/2019/what…

weather.gov/phi/EventRevie…

cnbc.com/2018/11/14/nat…

earlyretirementnow.com/2018/12/18/the…

docs.google.com/spreadsheets/d…

cordiercommodityreport.com

youtube.com/@RealJamesCord…

.

borntosell.com/covered-call-b…

prnewswire.com/news-releases/…

amazon.com/Complete-Guide…

institutionalinvestor.com/article/2bsx4k…

linkedin.com/in/james-cordi…

tampabay.com/news/business/…

bls.gov/blog/2019/what…

weather.gov/phi/EventRevie…

cnbc.com/2018/11/14/nat…

earlyretirementnow.com/2018/12/18/the…

docs.google.com/spreadsheets/d…

cordiercommodityreport.com

youtube.com/@RealJamesCord…

• • •

Missing some Tweet in this thread? You can try to

force a refresh