How to get URL link on X (Twitter) App

JPM believes that the UpVar in the SPX complex is too cheap historically and that you should buy those swaps. More specifically the 3-5 year ones.

JPM believes that the UpVar in the SPX complex is too cheap historically and that you should buy those swaps. More specifically the 3-5 year ones.

2/ Before we dive into how selling $SPX penny puts and Optionsellers is connected, it’s important to begin with the story of Cordier’s fund and career.

2/ Before we dive into how selling $SPX penny puts and Optionsellers is connected, it’s important to begin with the story of Cordier’s fund and career.

Happy Monday, I hope everyone has a fantastic week!

Happy Monday, I hope everyone has a fantastic week!

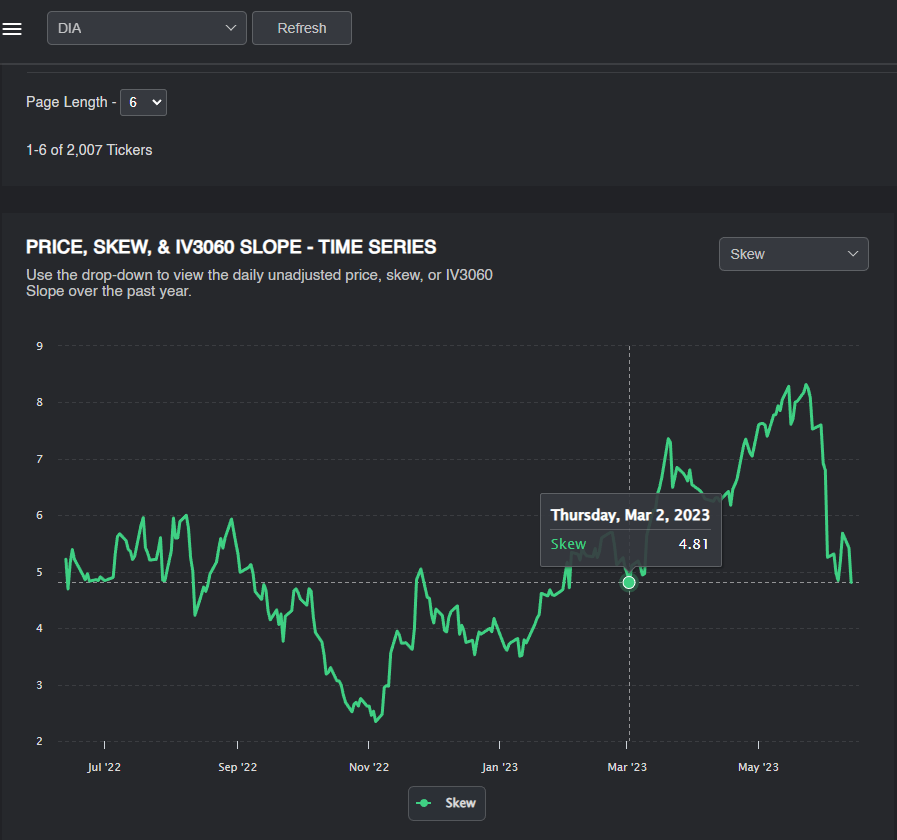

2/ Today saw the entire vol surface be re-priced higher, aka Fixed strike vol up about half a point. This is in part due to the recently large $VIX trades I have covered and some large put spreads opened. Skew and IV have reached 3 month highs, dating back to November.

2/ Today saw the entire vol surface be re-priced higher, aka Fixed strike vol up about half a point. This is in part due to the recently large $VIX trades I have covered and some large put spreads opened. Skew and IV have reached 3 month highs, dating back to November.

https://twitter.com/deitaone/status/17458744203111714332/ To clear up some misconceptions about this trade, there is zero immediate impact unless vol actually starts to get going here. This can be a large portfolio hedge as $VVIX and the $VIX sit near all time lows while the cost to hedge is nearly the “cheapest” on record.

https://twitter.com/VolSignals/status/17445363800745046852/ When I started out in vol trading “sell a cab, drive a cab” was one of the first lessons I was taught. This simply means if you sell the "dogshit" options then expect "dogshit" results. For example, if you buy 1 month $TSLA 1000c for 0.01, IT'S PRICED 0.01 FOR A REASON.

2/ Let’s kick things off by looking at our current vol profile. As you can see, IV has crashed lower since the recent peak on 10/27. 30d IV has moved down about 7%. This is similar to the same decline in IV after the SVB crisis in March. Even 180d IV is down substantially.

2/ Let’s kick things off by looking at our current vol profile. As you can see, IV has crashed lower since the recent peak on 10/27. 30d IV has moved down about 7%. This is similar to the same decline in IV after the SVB crisis in March. Even 180d IV is down substantially.

2/ This is a PnL chart of the $SPY 10/20 420p. The purple boxes highlight the June selloff, August, and now September. Do you notice any similarities? Sure there's a buck to be made overnight but the suppression is quite clear for $25 lower in 2 weeks.

2/ This is a PnL chart of the $SPY 10/20 420p. The purple boxes highlight the June selloff, August, and now September. Do you notice any similarities? Sure there's a buck to be made overnight but the suppression is quite clear for $25 lower in 2 weeks.

https://twitter.com/jaredhstocks/status/16789308274456862742/ I have gotten countless messages and mentions asking if "this is it," "what's next?" Remember PAYtience! I started writing that thread the day after June OPEX ended. Nothing has changed, we are still on track per expectations.

https://twitter.com/jaredhstocks/status/1678938683360129024?s=20

https://twitter.com/jaredhstocks/status/16766787227438325762/ $SPY Today, skew has gone vertical and back to June 1st levels. We now have about a 4% Vol risk premium between IV and RV. Clearly some fear is in the air which is also evident in the +13% increase in 1 month $VIX futures.

https://twitter.com/jaredhstocks/status/16686691680891944972/ I have already highlighted the lowest $COR90D reading since October 2008 in my recent post.

https://twitter.com/jaredhstocks/status/1661151929463078912

2/ $COR3M Currently, this is the most uncorrelated market since Volmageddon. Levels this low occur during market tops, not bottoms.

2/ $COR3M Currently, this is the most uncorrelated market since Volmageddon. Levels this low occur during market tops, not bottoms.

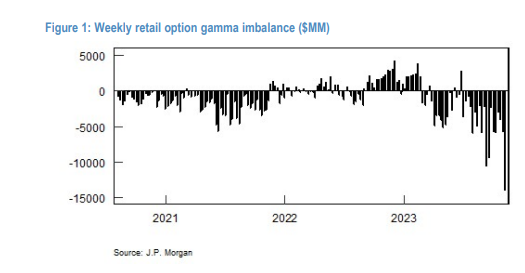

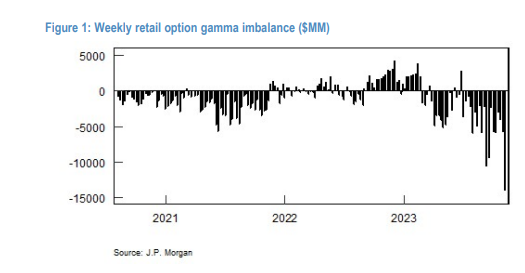

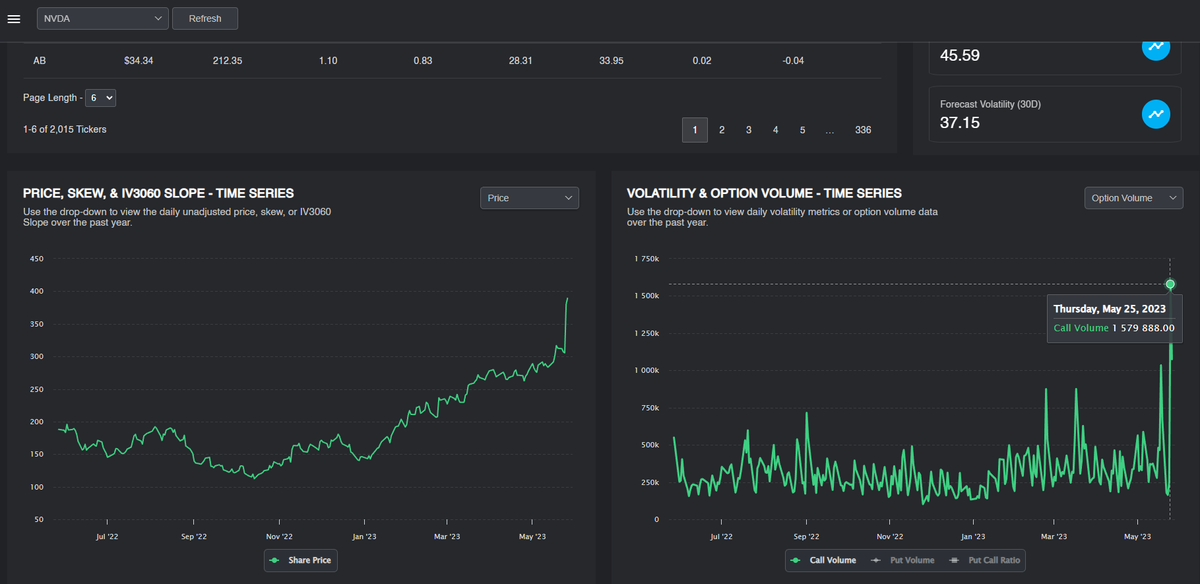

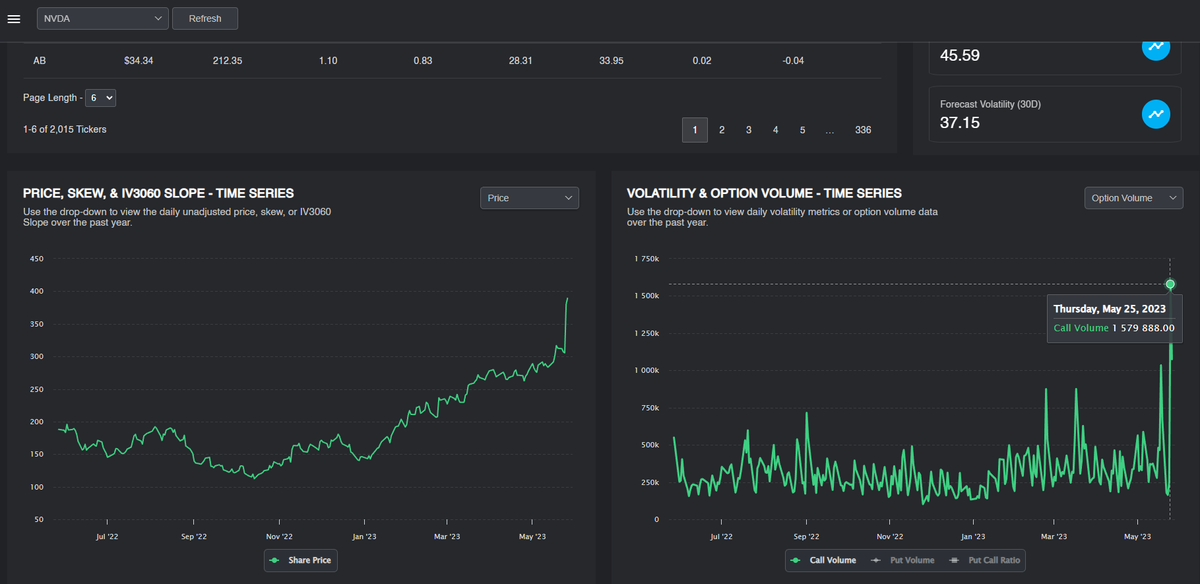

2/ In case you are new or need a refresher, here is a split-adjusted chart of $GME at it's peak. A near 10,000% increase with 370 Million shares traded. $NVDA reached it's all time high on 5/25, the day after the earnings report.

2/ In case you are new or need a refresher, here is a split-adjusted chart of $GME at it's peak. A near 10,000% increase with 370 Million shares traded. $NVDA reached it's all time high on 5/25, the day after the earnings report.

2/ The vol cone illustrates IV across different expirations, currently and historically. Options are still not even past the first quartile mark or near the median IV. This signals that there is no fear in the short term.

2/ The vol cone illustrates IV across different expirations, currently and historically. Options are still not even past the first quartile mark or near the median IV. This signals that there is no fear in the short term.

Since the start of last week, you can see from the two charts below that options have moved back towards contango, and IV/RV just get crushed. The VRP gap is being closed.

Since the start of last week, you can see from the two charts below that options have moved back towards contango, and IV/RV just get crushed. The VRP gap is being closed.

Before adding new information, it's important to understand what happened last week as it paints the full picture of my analysis. I will review some options flow, volatility insights, FOMC, earnings, economic data, and a few other data points to expand upon my previous thread.

Before adding new information, it's important to understand what happened last week as it paints the full picture of my analysis. I will review some options flow, volatility insights, FOMC, earnings, economic data, and a few other data points to expand upon my previous thread.