Why is the gold price rising?

some thoughts follow... 🧵

Let's start in year 1965 (just because it is the year I was born in), which is when DeGaulle started complaining about Americans & $. Of course it is typical for French to complain 😂, but De Gaulle followed up by sending war ships to NY harbor to retake the gold that French sent over to NYFed before Hitler invaded in WW2. Other European nations followed & soon Nixon found himself incapable to fulfilling the collateral required by Bretton-Woods 1944 while conducting Vietnam war and had to give up gold/$ connection in 1971.

1971 can be viewed in several ways, depending on whom you ask: (i) the year when $ seized to be real money, (ii) the year when US declared themselves as New Rome - the Currency Empire, or (iii) the year when FX system was born.

Of these FX system to this day is not well appreciated by most central bank managers, even though it is the clearest way by which nations get poorer or richer literally overnight. Fed has weaponized FX system against Europe, UK, Japan, China, Russia, Turkiye, among others over the past few years, influencing directly the welfare of societies.

some thoughts follow... 🧵

Let's start in year 1965 (just because it is the year I was born in), which is when DeGaulle started complaining about Americans & $. Of course it is typical for French to complain 😂, but De Gaulle followed up by sending war ships to NY harbor to retake the gold that French sent over to NYFed before Hitler invaded in WW2. Other European nations followed & soon Nixon found himself incapable to fulfilling the collateral required by Bretton-Woods 1944 while conducting Vietnam war and had to give up gold/$ connection in 1971.

1971 can be viewed in several ways, depending on whom you ask: (i) the year when $ seized to be real money, (ii) the year when US declared themselves as New Rome - the Currency Empire, or (iii) the year when FX system was born.

Of these FX system to this day is not well appreciated by most central bank managers, even though it is the clearest way by which nations get poorer or richer literally overnight. Fed has weaponized FX system against Europe, UK, Japan, China, Russia, Turkiye, among others over the past few years, influencing directly the welfare of societies.

Some may say "Fed is just a domestic organization for US, why would they do such a thing?".

Well, not everybody was this naive, even a century ago. Below is a vision of what the Fed could end up being from a book published in 1912, the year before Fed was established and WW1 started.

You decide whether the vision for Fed was attained or not? Isn't whether the Fed is hiking or easing every talking head on TV/X/utube dwells on 24/7? Powell's words and nuances are discussed for months & months... Not so little local organization, ha?

Well, not everybody was this naive, even a century ago. Below is a vision of what the Fed could end up being from a book published in 1912, the year before Fed was established and WW1 started.

You decide whether the vision for Fed was attained or not? Isn't whether the Fed is hiking or easing every talking head on TV/X/utube dwells on 24/7? Powell's words and nuances are discussed for months & months... Not so little local organization, ha?

Let's go back to 1971; there are two important steps here: (a) decision for demonetization of gold, (b) finding a way to keep $ valuable.

Volcker and Fed followed a very determined policy to demonetize gold; that is to say, gold is not to be money. In Q1-2023, gold price increased by 10%, or some 5% in the last week alone. Did you hear anything on Bloomberg channel or CNBC about gold? Anything on FT or WSJ? No! Gold is not to be mentioned! It is the forbidden asset. In fact, gold is not money anywhere in the world today, some 53 years of being abolished by the US.... Isn't that interesting?

mises.org/mises-wire/pau…

Volcker and Fed followed a very determined policy to demonetize gold; that is to say, gold is not to be money. In Q1-2023, gold price increased by 10%, or some 5% in the last week alone. Did you hear anything on Bloomberg channel or CNBC about gold? Anything on FT or WSJ? No! Gold is not to be mentioned! It is the forbidden asset. In fact, gold is not money anywhere in the world today, some 53 years of being abolished by the US.... Isn't that interesting?

mises.org/mises-wire/pau…

The next item is more interesting in that there is credible evidence that it was Kissinger who ordered Iran & Saudis to link their oil purchases with the new anchorless $ and then to quadruple oil prices!

Obviously, increasing oil price would make $ more valuable because of the following simple calculation: the total value of all gold in the world today is something like $10T, yet oil industrial production is $10T per year & still growing in a world with a population of 8B. Kissinger's plan of tying $ to the base commodity for industrial revolution was rather brilliant!

Obviously, increasing oil price would make $ more valuable because of the following simple calculation: the total value of all gold in the world today is something like $10T, yet oil industrial production is $10T per year & still growing in a world with a population of 8B. Kissinger's plan of tying $ to the base commodity for industrial revolution was rather brilliant!

Kissinger may have had some other ideas or missions...

It was well documented that global population was on the rise, which was of some concern due to limited resources. Increasing the price of oil would have prohibited the access to oil by poorer nations. The growth of population was not a consequence of better medicine, as most people think, but rather more food facilitated by the Haber-Bosch process to extract nitrogen from air. Haber was a German chemist who was developing chemical weapons for WW1 and happened to discover this chemical reaction that ended up being used in producing chemical fertilizers.

It is a coincidence that some many fertilizer factories were closed in Europe during covid and European farmers are under pressure in Canada, Holland and France today?

Read the report below to gain some insight about what BigWigs think:

nssm200.com/#primary

It was well documented that global population was on the rise, which was of some concern due to limited resources. Increasing the price of oil would have prohibited the access to oil by poorer nations. The growth of population was not a consequence of better medicine, as most people think, but rather more food facilitated by the Haber-Bosch process to extract nitrogen from air. Haber was a German chemist who was developing chemical weapons for WW1 and happened to discover this chemical reaction that ended up being used in producing chemical fertilizers.

It is a coincidence that some many fertilizer factories were closed in Europe during covid and European farmers are under pressure in Canada, Holland and France today?

Read the report below to gain some insight about what BigWigs think:

nssm200.com/#primary

If you do not believe that BigWigs see global population growth as an important issue, maybe this can convince you:

All this concern by BigWigs about global population rise is also apparent in the mysterious little organization called Club of Rome, funding a young MIT research group to conduct a study about Limits to Growth (LtG), which had proposed several scenarios based on a computer model (which was given to me as a HW problem when I was an engineering student in 1984; easy to code!).

The most disturbing scenario calculated by LtG is "overshoot & collapse" case where humans exceed the carrying capacity of Planet Earth and die out like bacteria in a petri dish 🥴

I confirm that when I modeled LtG and played around with a computer in 1984, I could not get anything but overshoot & collapse, sooner or later. "Equilibrium" never lasted very long.

All natural phenomena consist of cycles... except on finX, people believe in perpetual exponential growth 🥳

The most disturbing scenario calculated by LtG is "overshoot & collapse" case where humans exceed the carrying capacity of Planet Earth and die out like bacteria in a petri dish 🥴

I confirm that when I modeled LtG and played around with a computer in 1984, I could not get anything but overshoot & collapse, sooner or later. "Equilibrium" never lasted very long.

All natural phenomena consist of cycles... except on finX, people believe in perpetual exponential growth 🥳

However, all these projections by the Elites had to take a back seat to two rising forces, the battle with USSR & Japan in 1980s.

They were dealt in the same way which the Fed is attempting with deal with Russia and China today: explosion in debt & supporting direct war (Afganistan then, Ukraine today) and strong $ policy, which was extended to fight gold & oil induced inflation first & then weaponized to crush Japan. The same plan that the Fed is implementing to try to crush BRICS today (not much success so far).

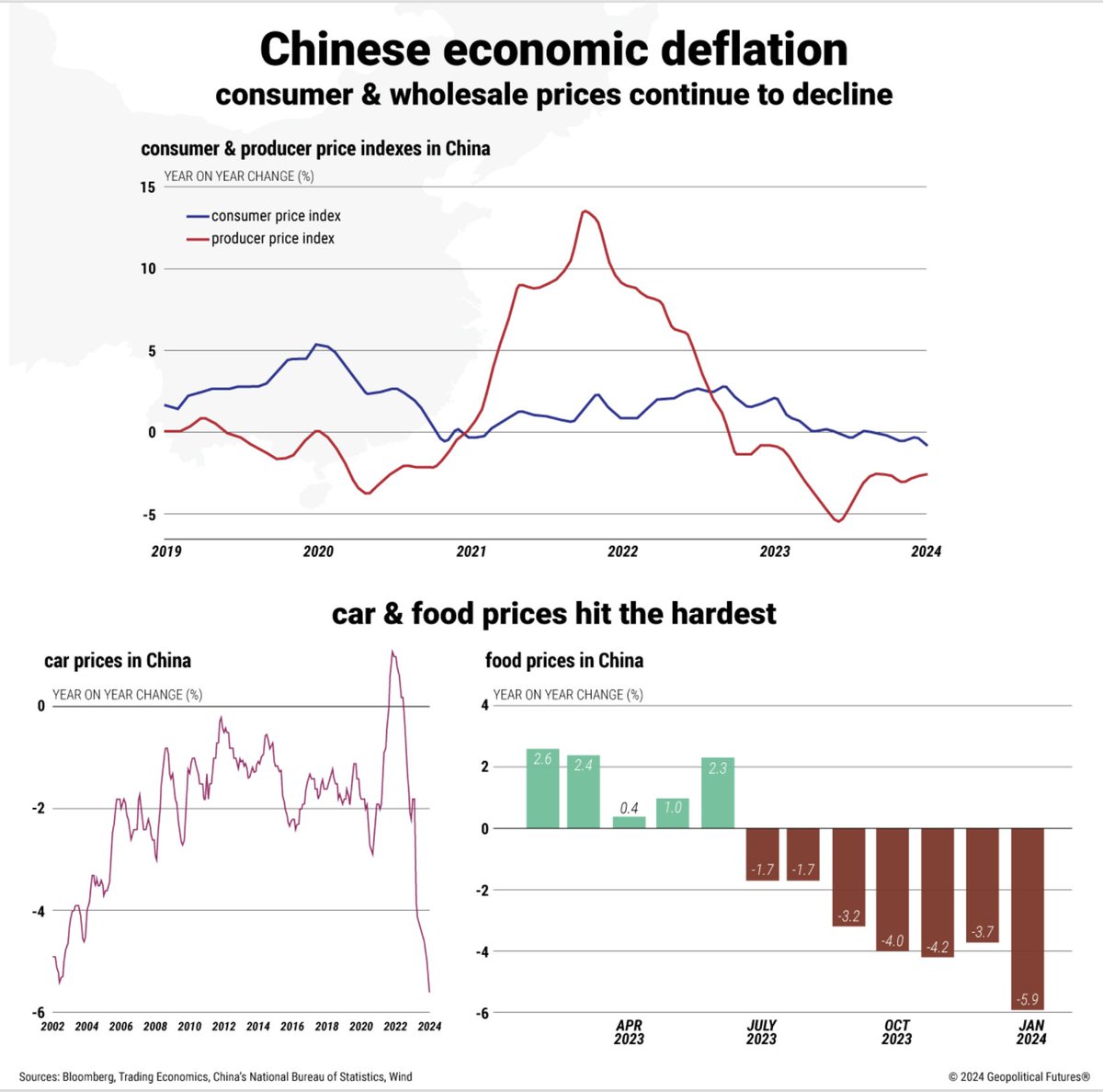

Isn't it interesting that both Japan in 1980s and China today are collapsing under the immense pressure of their RE bubbles?

To keep the story short, 1989 was a huge victory for the West in that Japan busted under RE debt & USSR also started dismantling with the fall of Berlin Wall.

Consequently, a singular empire - USA was left over. 🏆🥇

They were dealt in the same way which the Fed is attempting with deal with Russia and China today: explosion in debt & supporting direct war (Afganistan then, Ukraine today) and strong $ policy, which was extended to fight gold & oil induced inflation first & then weaponized to crush Japan. The same plan that the Fed is implementing to try to crush BRICS today (not much success so far).

Isn't it interesting that both Japan in 1980s and China today are collapsing under the immense pressure of their RE bubbles?

To keep the story short, 1989 was a huge victory for the West in that Japan busted under RE debt & USSR also started dismantling with the fall of Berlin Wall.

Consequently, a singular empire - USA was left over. 🏆🥇

What came next was absolutely vicious and counter-intuitive to me! 🤯

The freaking rich elites noticed that billions of inexpensive (as in by 50x) workers became available by the collapse of communism system for both Europe and USA & proceeded to dismantle factories and well-paying jobs & shipping everything overseas!

Folks like Ross Perot & James Goldsmith tried to explain the situation, but many presidents in a row passed laws in Congress to dismantle the industrial base of USA.

The result was happy CEOs, cashing out the inheritance from the hard work of generations of Americans. It was sold as "globalization", meaning cheap crap was produced in the most distant places on the planet, transported by ships & planes, drove a huge consumption mania in the West... for what exactly? 🤨🤔

Oh yeah! DEBT addiction exploded... which made banksters happy 🥰

youtube.com/results?search…

The freaking rich elites noticed that billions of inexpensive (as in by 50x) workers became available by the collapse of communism system for both Europe and USA & proceeded to dismantle factories and well-paying jobs & shipping everything overseas!

Folks like Ross Perot & James Goldsmith tried to explain the situation, but many presidents in a row passed laws in Congress to dismantle the industrial base of USA.

The result was happy CEOs, cashing out the inheritance from the hard work of generations of Americans. It was sold as "globalization", meaning cheap crap was produced in the most distant places on the planet, transported by ships & planes, drove a huge consumption mania in the West... for what exactly? 🤨🤔

Oh yeah! DEBT addiction exploded... which made banksters happy 🥰

youtube.com/results?search…

to be continued.

Two more important development were squeezed into the last few years of the last century (while everybody was focused on the love affairs of Bill Clinton and/or OJ trial): (i) 1933 Glass-Steagall act, which separated investment and commercial banking, was repealed in 1999. This paved the way for the growth of so-called derivatives sector, now thought to be in the range many many thousands of trillions of $ of completely unregulated leverage.

Risks of derivatives were pointed out but were bullied away by Summers, Rubin & Greenspan. Derivatives pose perhaps the biggest risk of a deflationary collapse in the event of another financial melt down.

pbs.org/wgbh/frontline…

Risks of derivatives were pointed out but were bullied away by Summers, Rubin & Greenspan. Derivatives pose perhaps the biggest risk of a deflationary collapse in the event of another financial melt down.

pbs.org/wgbh/frontline…

(b) The second major development was the route taken by the US military industrial complex in 1990s.

Dangers of a large military industrial complex was pointed out by the very general who won the WW2:

Dangers of a large military industrial complex was pointed out by the very general who won the WW2:

Yet, after several years of the end of Cold War, it was decided that it was not a good idea for US to rest in peace. Instead a neocon think tank called The Project for the American New Century pushed for NATO expansion for weapons sales to more European countries, as well as seeking permawars around the world.

This created a huge annual expense for the USgov of $1T/y while some claim that tens of trillions are missing in Pentagon accounting.

This created a huge annual expense for the USgov of $1T/y while some claim that tens of trillions are missing in Pentagon accounting.

Of course, by this time, several smart folks, like Warren Buffett, understood the slippery slope that US is pursuing and explained this in their own ways. But they were completely disregarded:

money.cnn.com/magazines/fort…

money.cnn.com/magazines/fort…

Going forward a few years, GFC hit. This great Oscar-winning documentary lay out some of the disturbing details:

One of the key issues emphasized by the producer of this great documentary is how so many elite economists were on the pay roll of Wall Street, falsifying economic outlook:

Here are some of my favorite scenes from this documentary.

Why do you want to believe Ivy-League economists right before massive recession hits (just like now, again)?

Why do you want to believe Ivy-League economists right before massive recession hits (just like now, again)?

In October 2008, we experienced another one of those stunning moments in that then Treasury Secretary Paulson, a former Goldman CEO who took the gov job to save hundreds of millions of $s in taxes, used the GFC opportunity to claim that "Wall Street is the US economy" and to save the banksters on the backs of the Main Street.

In a matter of few months, by April 2009, stock market recovered and gamblers were back to gambling while the Main Street took at least 10 years to "recover". These 10 years were denoted as "secular stagnation... but we do not know why?" by the very person who had released the hell of derivatives a decade earlier as Treasury Secretary (by then fired from Harvard president position & speaking as an economist). Others called it "silent depression".

The only visible reaction by the public was far from a revolution or even revolt... Occupy Wall Street peaked some 2 years after Leaman Collapse, but quickly erased by the police.

In a matter of few months, by April 2009, stock market recovered and gamblers were back to gambling while the Main Street took at least 10 years to "recover". These 10 years were denoted as "secular stagnation... but we do not know why?" by the very person who had released the hell of derivatives a decade earlier as Treasury Secretary (by then fired from Harvard president position & speaking as an economist). Others called it "silent depression".

The only visible reaction by the public was far from a revolution or even revolt... Occupy Wall Street peaked some 2 years after Leaman Collapse, but quickly erased by the police.

One of the brains behind Occupy Wall Street was David Greaber, who was a true economist, producing important books like BS jobs, which claimed that about 70% of all jobs in the 21st century were pointless & not critical for social needs. The same thesis was put forward by Keynes and Russell in 1930 as a future state of economies based on industrial revolution.

After being denied tenure at Yale, Greaber died in 2020 early during pandemic, before seeing the proof of his thesis: during the two years when entire global economy was either fully or partially shut down, we needed very few critical workers for all our needs: food was produced, all goods were delivered to our door step by Amazon. People "worked" remotely, a rapid change in business model, which is now at the core of impending collapse in Commercial Real Estate that had infested all large city down towns.

en.wikipedia.org/wiki/Bullshit_…

After being denied tenure at Yale, Greaber died in 2020 early during pandemic, before seeing the proof of his thesis: during the two years when entire global economy was either fully or partially shut down, we needed very few critical workers for all our needs: food was produced, all goods were delivered to our door step by Amazon. People "worked" remotely, a rapid change in business model, which is now at the core of impending collapse in Commercial Real Estate that had infested all large city down towns.

en.wikipedia.org/wiki/Bullshit_…

The banksters escaped the GFC w/o anybody going to jail, which was a major accomplishment given that post dot-com bubble mania, similar behavior by Enron has encountered substantial reaction from the law; long jail sentences for CFO & CEO, with president of Enron committing suicide.

Hence the invincible banksters must have concluded that they are smart and everybody else is poor & dumb! They then took the lending crazy to the next level during 2010s, as documented by this nice documentary "97% owned: The Money System":

Hence the invincible banksters must have concluded that they are smart and everybody else is poor & dumb! They then took the lending crazy to the next level during 2010s, as documented by this nice documentary "97% owned: The Money System":

Debt was extended not only to US domestically, but also EU banks did the same... globally!! EMs started a construction spree, because buildings are the most visible accomplishment for any administration, not thinking too hard whether buildings could pay for the debt down the line and how much value added they would provide to the economy. These are not factories or farms, but mostly RE and CRE. Amazing that this borrowing & spending mania followed in the foot steps of RE collapses in Japan in 1989 and US/EU in 2008... But people never really learn!

Here is a little calculation on debt numbers accumulated through 2010s: global debt reached $350T, typically on a 5 year loan. This meant that every year $70T of debt has to be refinanced. In comparison, gold market was still 10T in total, oil market 5-10T per year (depending on the highly variable oil price) and global GDP was 70-80T.

In other words, debt refinancing economy became equal production/consumption economy!

The implication of this fact is very interesting: money was gold, then oil (petrodollar) and now it was debt.

IMF conducted a study in 2017 to measure how much USD$ controlled world trade - the control was absolute!

imf.org/en/Publication…

Here is a little calculation on debt numbers accumulated through 2010s: global debt reached $350T, typically on a 5 year loan. This meant that every year $70T of debt has to be refinanced. In comparison, gold market was still 10T in total, oil market 5-10T per year (depending on the highly variable oil price) and global GDP was 70-80T.

In other words, debt refinancing economy became equal production/consumption economy!

The implication of this fact is very interesting: money was gold, then oil (petrodollar) and now it was debt.

IMF conducted a study in 2017 to measure how much USD$ controlled world trade - the control was absolute!

imf.org/en/Publication…

Now that $-Milkshake system was fully in place, global trade could be controlled from a computer in two buildings in DC and $ could be weaponized towards EMs.

This thought process & confidence it inspired in BigWigs, further advanced financialization of US foreign policy. Fragility of domestic production, and/or the welfare of both the global and domestic societies faded in comparison to the power these levers of money aroused in the hands of the few.

This thought process & confidence it inspired in BigWigs, further advanced financialization of US foreign policy. Fragility of domestic production, and/or the welfare of both the global and domestic societies faded in comparison to the power these levers of money aroused in the hands of the few.

Since the process from changing from real money (gold) to fake money (debt) was very slow, Americans were like a frog cooking happily & slowly, never quite appreciating the decline in standard of living that took place over 5 decades.

These are very nicely documented here:

wtfhappenedin1971.com

These are very nicely documented here:

wtfhappenedin1971.com

Fake money (debt) and globalization brought significant changes to the economy; prices of goods produced overseas (clothing, furniture, electronics, cars) declined, prices of substantial needs such as education, healthcare, childcare, food & housing skyrocketed.

Despite these obvious trends, consumer price inflation (CPI) was manipulated 50 years in a row to give the impression of falling - if there was constant disinflation, how come most people strained to afford housing, healthcare & education?

Let's make a little calculation:

Today in America, RE costs $1M. Including 30 year mortgage at 7%, taxes, insurance, maintainance, we are talking about $3.5M. Most student graduate with 50-200k debt on a solid interest. Over 30-40 years, this can easily become 0.5M. Thus, life long earning potential of ~$4M is needed to afford just college+home & nothing else. Very few can pay this off before reaching retirement.

Thus, the economic model prevailing today is debt slavery.

Despite these obvious trends, consumer price inflation (CPI) was manipulated 50 years in a row to give the impression of falling - if there was constant disinflation, how come most people strained to afford housing, healthcare & education?

Let's make a little calculation:

Today in America, RE costs $1M. Including 30 year mortgage at 7%, taxes, insurance, maintainance, we are talking about $3.5M. Most student graduate with 50-200k debt on a solid interest. Over 30-40 years, this can easily become 0.5M. Thus, life long earning potential of ~$4M is needed to afford just college+home & nothing else. Very few can pay this off before reaching retirement.

Thus, the economic model prevailing today is debt slavery.

Meanwhile, a very different economic strategy was followed in Europe post GFC:

First, Greece, who organized Summer Olympics in 2008, right before GFC hit, had overspent "just a little". Greeks claimed that they organized a great summer for the world and deserved some slack.

ECB banksters disagreed and went down on Greece like a bold eagle catching an unsuspecting rabbit. Today, Greece owes debt for the next 100+ years, a typical trick used by Worldbank and IMF banksters of enforcing unpayable amounts & stealing the futures of unborn generations of a nation.

First, Greece, who organized Summer Olympics in 2008, right before GFC hit, had overspent "just a little". Greeks claimed that they organized a great summer for the world and deserved some slack.

ECB banksters disagreed and went down on Greece like a bold eagle catching an unsuspecting rabbit. Today, Greece owes debt for the next 100+ years, a typical trick used by Worldbank and IMF banksters of enforcing unpayable amounts & stealing the futures of unborn generations of a nation.

As ECB banksters were busy piling on debt on Greece and criticizing PIGS for all the troubles of EU, suddenly came Brexit in 2016! EU lost UK, which was once the largest empire in modern history. UK was much smarter than other EU countries in that they had not given up their domestic currency in support for "Euro". Euro is managed by ECB, another opaque agency administered by shady characters behind a thick curtain, most possibly BIS - Bank of International Settlements, a spin off of old European money post WW2, located in Switzerland and untouchable legally, as outlined in the famous book "The Tower of Basel".

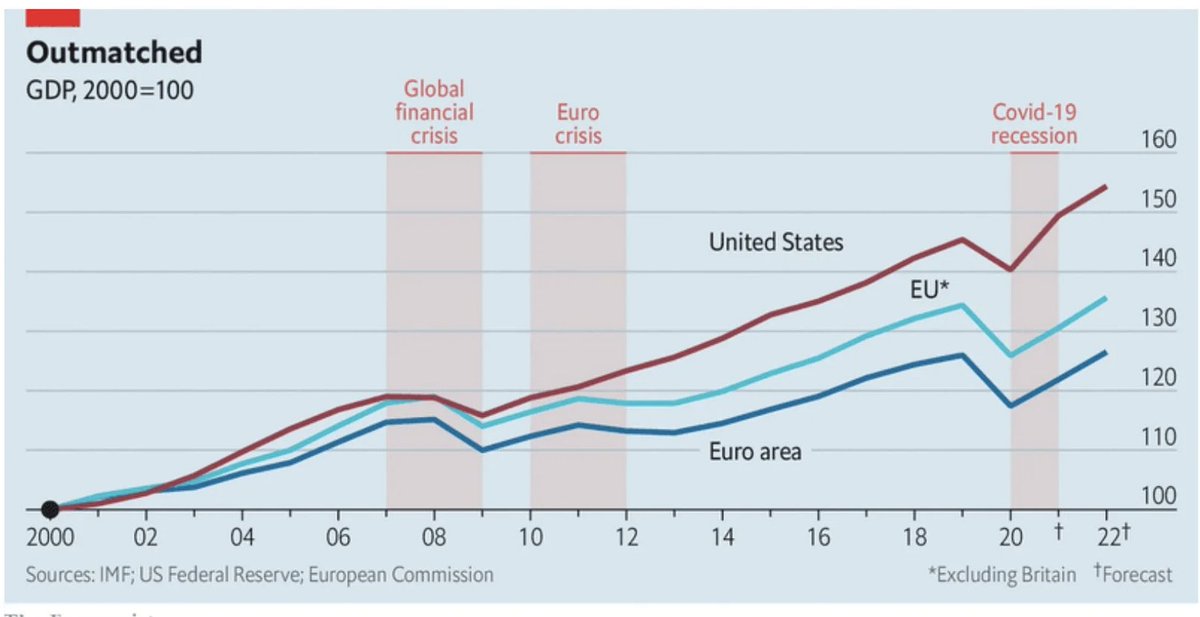

Due to this infighting & fracturing, EU lost a lot of momentum, as clearly shown by GDP growth since its foundation:

Due to this infighting & fracturing, EU lost a lot of momentum, as clearly shown by GDP growth since its foundation:

The complexity of future envisioned by European Elites surfaced during the depths of covid by this video released by (now) King Charles. When the entire globe was immersed in mortal danger & economies were totally shut down, the pandemic was painted as an "opportunity" (like WTF?).

The accompanying book was published simultaneously by Klaus Schwab as "The Great Reset" in June 2020.

The accompanying book was published simultaneously by Klaus Schwab as "The Great Reset" in June 2020.

Obviously, the EU elites had something cooking for a long time & revealed their plan during the pandemic.

For reasons that are not necessary to go in here, this plan did not fully fan out in the global sense, simply because Europeans did not control US or China or Russia or India or Middle East.

However, make no mistake; EU have not given up. Below is a very recent video of the Chairperson of European Parliament, the appointed Queen of Europe, outlining the plan for de-growth for Europe, on the basis of Limits to Growth work, which Club of Rome funded 50 years ago!

Today, Germany, normally traditional industrial engine and export economy of Europe, is being de-industrialized at neck-breaking pace. 🤯

For reasons that are not necessary to go in here, this plan did not fully fan out in the global sense, simply because Europeans did not control US or China or Russia or India or Middle East.

However, make no mistake; EU have not given up. Below is a very recent video of the Chairperson of European Parliament, the appointed Queen of Europe, outlining the plan for de-growth for Europe, on the basis of Limits to Growth work, which Club of Rome funded 50 years ago!

Today, Germany, normally traditional industrial engine and export economy of Europe, is being de-industrialized at neck-breaking pace. 🤯

Two questions immediately arise here:

1) How can they freaking do this?

2) What are the economic & monetary implications of -de-growth?

First question is rather straightforward; it is well known that the rich think & behave very differently than the rest of us. This is well explained here:

1) How can they freaking do this?

2) What are the economic & monetary implications of -de-growth?

First question is rather straightforward; it is well known that the rich think & behave very differently than the rest of us. This is well explained here:

The second question is far more interesting. The economic growth model is fairly new in global history; it is less than 100 years old. In fact, much of it happened post WW2. Before that, we had large empires: kings & queens. Massive income disparity, no opportunity for masses.

Economic growth meant that poor can become rich & that there is always more schtuff than needed.

Economic de-growth model means that poor will never become rich, only get poorer. The already rich will remain rich.

Most importantly, the debt-based monetary system we analyzed above can not be deployed any longer, since de-growth economy corresponds to negative interest rate policy (NIRP).

Economic growth meant that poor can become rich & that there is always more schtuff than needed.

Economic de-growth model means that poor will never become rich, only get poorer. The already rich will remain rich.

Most importantly, the debt-based monetary system we analyzed above can not be deployed any longer, since de-growth economy corresponds to negative interest rate policy (NIRP).

Under conditions of de-growth economies, what should be money?

Here is where we can start addressing the initial question of this 🧵.

For the rich, it is gold of course!! Look at the video below on how much effort goes into storing the gold of the rich generations and central banks!

How about for others who are already indebted up to their eye balls 👀 and think they are rich🤑 ?

CBDC which is already prepared for operational use by BIS. It will be a fiat currency but not based on credit given by criteria related to your age, education or job. We do not know what will be the criteria, but can only speculate, at this point...

See how far into the future rich elites think ahead?

Here is where we can start addressing the initial question of this 🧵.

For the rich, it is gold of course!! Look at the video below on how much effort goes into storing the gold of the rich generations and central banks!

How about for others who are already indebted up to their eye balls 👀 and think they are rich🤑 ?

CBDC which is already prepared for operational use by BIS. It will be a fiat currency but not based on credit given by criteria related to your age, education or job. We do not know what will be the criteria, but can only speculate, at this point...

See how far into the future rich elites think ahead?

Going Direct - Fed attempts 🚁 money:

As EU deals with all this, there is concern in DC about eye-popping levels of debt. Fed tasks Stan Fischer, former PhD advisor to Bernanke & Draghi (Fed & ECB chairs) at MIT, former Fed vice chair. Stan prepares a step-wise plan, published by Blackrock in a short document entitled "Dealing with the next downturn" and presents his idea in a conference in Fall 2019 (second half of the video below).

The idea to deal with debt is controlled sustained moderate inflation by helicopter money to be sent by US Congress to Americans during the next down turn.

Six months after the publication of this plan, covid hits and the plan is implemented to the letter by the Fed as well as Congress. This tells me how coordinated and future looking Fed is actually is.

High demand on restricted supply chains drives inflation immediately to 9%. Everybody is shocked with the inflation; even though given the circumstances of globally lock downs and fiscal injections, I wondered why it was not 100% ? Powell sticks to Stan Fischer going direct plan by dismissing every call about inflation using a new word he invented: "transitory".

As EU deals with all this, there is concern in DC about eye-popping levels of debt. Fed tasks Stan Fischer, former PhD advisor to Bernanke & Draghi (Fed & ECB chairs) at MIT, former Fed vice chair. Stan prepares a step-wise plan, published by Blackrock in a short document entitled "Dealing with the next downturn" and presents his idea in a conference in Fall 2019 (second half of the video below).

The idea to deal with debt is controlled sustained moderate inflation by helicopter money to be sent by US Congress to Americans during the next down turn.

Six months after the publication of this plan, covid hits and the plan is implemented to the letter by the Fed as well as Congress. This tells me how coordinated and future looking Fed is actually is.

High demand on restricted supply chains drives inflation immediately to 9%. Everybody is shocked with the inflation; even though given the circumstances of globally lock downs and fiscal injections, I wondered why it was not 100% ? Powell sticks to Stan Fischer going direct plan by dismissing every call about inflation using a new word he invented: "transitory".

Putin:

Both the EU/WEF Great Reset plan and Fed's Going Direct inflationary plan get disrupted in early 2022 by no other than Putin, who spent the entire pandemic period being "a little disconnected from things".

His move into Ukraine follows Biden's awkward withdrawal from Afghanistan, after 20 years of war. The resonance with USSR era withdrawal in 1989 and the fall of USSR in 1991 is very much apparent here.

We must backtrack some 15 years to understand where Putin was coming from...

Both the EU/WEF Great Reset plan and Fed's Going Direct inflationary plan get disrupted in early 2022 by no other than Putin, who spent the entire pandemic period being "a little disconnected from things".

His move into Ukraine follows Biden's awkward withdrawal from Afghanistan, after 20 years of war. The resonance with USSR era withdrawal in 1989 and the fall of USSR in 1991 is very much apparent here.

We must backtrack some 15 years to understand where Putin was coming from...

What happens when empires fall?

Putin has some sense of long-term history on empires that is sometimes lacking in US leaders. In particular, he knows what happens when empires fall. In WW1, the Austria-Hungarian Empire, the Ottoman Empire & the Russian Empire fell apart within a matters of 4 short years, after hundreds of centuries of order & the British Empire was badly hurt:

all 4 empires in 4 years!

The result is the birth of a bunch of small states that are trying to form some kind coalesence using anything that they can hold into: language, religion, some kind of joint identity... anything... but it is hard, like gluing a vase that fell on the floor and got shattered into tiny pieces. Nation states never existed before!

Obviously in 1991, USSR broke into 15 parts and most became part of the new EU instead of the new Russia. Putin knows that Russia is quite fragile given that after 1000 years of war, Russia still commands over land some 3x larger than any other country.

Putin remembers well what Catherine the Great said "I have no way to defend my borders except to expand them".

Putin has some sense of long-term history on empires that is sometimes lacking in US leaders. In particular, he knows what happens when empires fall. In WW1, the Austria-Hungarian Empire, the Ottoman Empire & the Russian Empire fell apart within a matters of 4 short years, after hundreds of centuries of order & the British Empire was badly hurt:

all 4 empires in 4 years!

The result is the birth of a bunch of small states that are trying to form some kind coalesence using anything that they can hold into: language, religion, some kind of joint identity... anything... but it is hard, like gluing a vase that fell on the floor and got shattered into tiny pieces. Nation states never existed before!

Obviously in 1991, USSR broke into 15 parts and most became part of the new EU instead of the new Russia. Putin knows that Russia is quite fragile given that after 1000 years of war, Russia still commands over land some 3x larger than any other country.

Putin remembers well what Catherine the Great said "I have no way to defend my borders except to expand them".

The Grand Chessboard:

Putin understood that geography is destiny and fragility of the US trying to pull strings from a continent far away, while Russia bridged Eurasia; Europe, Middle East and Asia, some 6 Billion people mostly from still developing regions in the world. Being the energy hub for 6 Billion people carried enormous capability for economic expansion. After spelling out his resentment to the US delegation in a 2007 conference in Munich (see below video), Putin spent the next 15 years by taking the following important geopolitical steps (among many others - this is not a political post):

1) Establishment of BRICS in 2009, right after GFC, as a core group that can duplicate some of the functions of USSR, while being far less ideological and more trade oriented group that nations that also include so-called Global South.

2) Entry of Russia into OPEC, a much valuable support as US production ramped up from 5 to 13 mbpd since GFC.

3) Influence over US military movements in the Middle East, by taking advantage of Obama's hesitance following the Syrian Red Line crisis. Initially mysterious, this chess move ended up reducing the number of US troops in the Middle East from hundreds of thousands at its peak 15 years ago to 15-30k today, scattered to many bases; no single base is currently capable of defending itself, despite 2 carrier fleets in the region.

4) Expansion of natural gas exports to EU and in particular to Germany, in a trade relation that dates back to early 1960s. It is well known that due it being an industrial production economy since its foundation, Germany always needed inexpensive fossil fuels, initially domestic coal but then also oil from Iraq through Ottoman Empire that was being built through Berlin-Basra train way in 1903 and also desire to get oil in the Caspian Sea region during WW2 through Operation Barbarossa.

Both WW1 and WW2 history is clear that oil is at the very center of these wars conducted in the industrial era.

Nordstream I and II pipelines were built to expand economic relations between Russia and Germany, but they were mysteriously destroyed in 2022.

At this stage, we remember the declassified words of the first secretary general of NATO (1952-1957) Lord Ismay, who said "NATO was created to keep Soviet Union out, the Americans in and the Germans down".

5) The final accomplishment of Putin has been to pinpoint the monetary system run by the US as a problem for the world after G7 countries froze Russia's financial assets totaling some $300+ Billion. This is an important item to point out for the conclusion section of this 🧵.

Putin understood that geography is destiny and fragility of the US trying to pull strings from a continent far away, while Russia bridged Eurasia; Europe, Middle East and Asia, some 6 Billion people mostly from still developing regions in the world. Being the energy hub for 6 Billion people carried enormous capability for economic expansion. After spelling out his resentment to the US delegation in a 2007 conference in Munich (see below video), Putin spent the next 15 years by taking the following important geopolitical steps (among many others - this is not a political post):

1) Establishment of BRICS in 2009, right after GFC, as a core group that can duplicate some of the functions of USSR, while being far less ideological and more trade oriented group that nations that also include so-called Global South.

2) Entry of Russia into OPEC, a much valuable support as US production ramped up from 5 to 13 mbpd since GFC.

3) Influence over US military movements in the Middle East, by taking advantage of Obama's hesitance following the Syrian Red Line crisis. Initially mysterious, this chess move ended up reducing the number of US troops in the Middle East from hundreds of thousands at its peak 15 years ago to 15-30k today, scattered to many bases; no single base is currently capable of defending itself, despite 2 carrier fleets in the region.

4) Expansion of natural gas exports to EU and in particular to Germany, in a trade relation that dates back to early 1960s. It is well known that due it being an industrial production economy since its foundation, Germany always needed inexpensive fossil fuels, initially domestic coal but then also oil from Iraq through Ottoman Empire that was being built through Berlin-Basra train way in 1903 and also desire to get oil in the Caspian Sea region during WW2 through Operation Barbarossa.

Both WW1 and WW2 history is clear that oil is at the very center of these wars conducted in the industrial era.

Nordstream I and II pipelines were built to expand economic relations between Russia and Germany, but they were mysteriously destroyed in 2022.

At this stage, we remember the declassified words of the first secretary general of NATO (1952-1957) Lord Ismay, who said "NATO was created to keep Soviet Union out, the Americans in and the Germans down".

5) The final accomplishment of Putin has been to pinpoint the monetary system run by the US as a problem for the world after G7 countries froze Russia's financial assets totaling some $300+ Billion. This is an important item to point out for the conclusion section of this 🧵.

1980s Redux - ColdWar/HotWar/CurrencyWar:

Fed & USgov responds to war in Europe with the automatism that won the 45-year old struggle post WW2: by launching Hot War on Russia, Cold War on China and Currency War on BRICS. It was a neck-breaking turn in early 2022, when after claiming transitory for almost 2 years, Fed started launching 75 bps rate increases and pushing all allies including EU/UK/Japan viciously under the bus, just when inflation was at peak globally. Almost all CBs around the world (with notable exceptions of Turkiye & Japan, the former then experienced 150% inflation for going against the Fed while the latter saw major currency depreciation, which they interpreted as the "end of 30-year deflation" 😵💫) had to follow Fed since & hike considerably on accumulated debt over the past 40 years! Remember debt is never paid, only refinanced.

We are currently in this cycle of rate hikes that are claimed to be against "inflation" but are kept in place for an extraordinarily long period. In comparison, there is only one other hiking cycle out of 18 in 111 years of Fed that was kept this long in face of slowing economy: the one that resulted with Great Depression in 1929.

The real reason behind this long hiking cycle is to pressure BRICS, in particular Russia and China, while Fed officials point to inflation every day as a distraction.

Statistics from former hiking cycles say that it takes on average 24 months after Fed starts hiking & 15 months after yield curve inversion for recession to start: we are in months 24 & 15, respectively, today.

Then the question becomes is there a global recession in sight? After all, most experts & economists on TV/X/utube/media agree that recession is no more & soft cotton landing will prevail 🥳

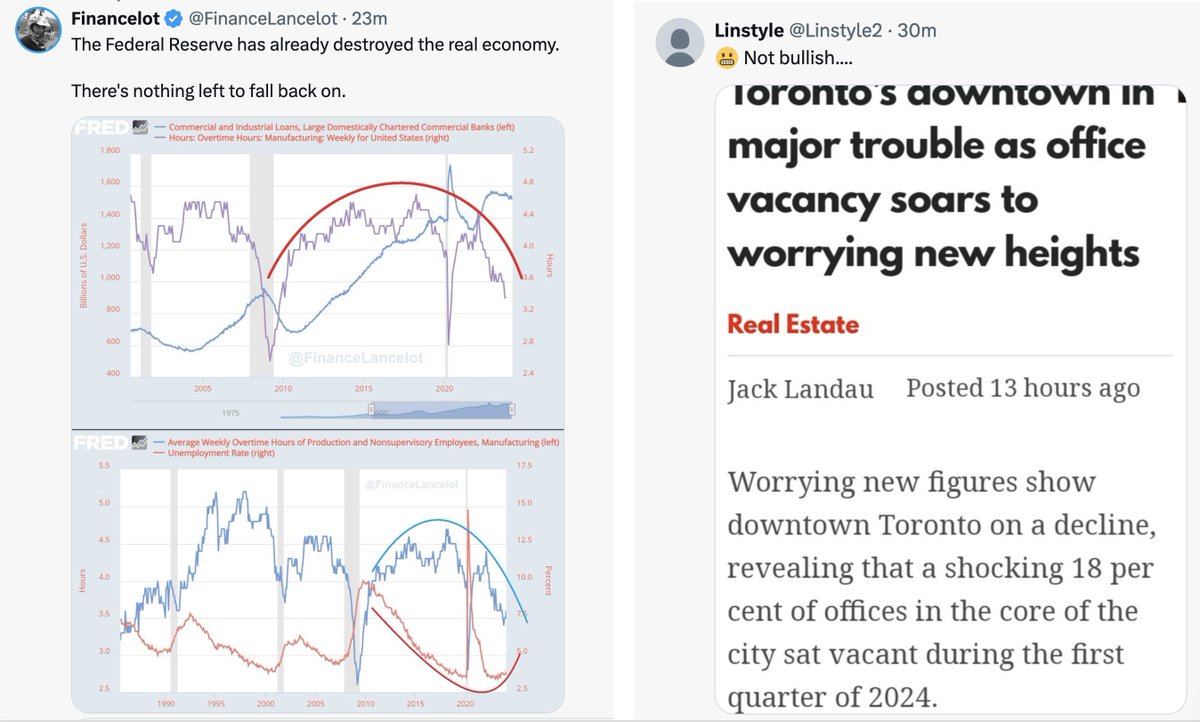

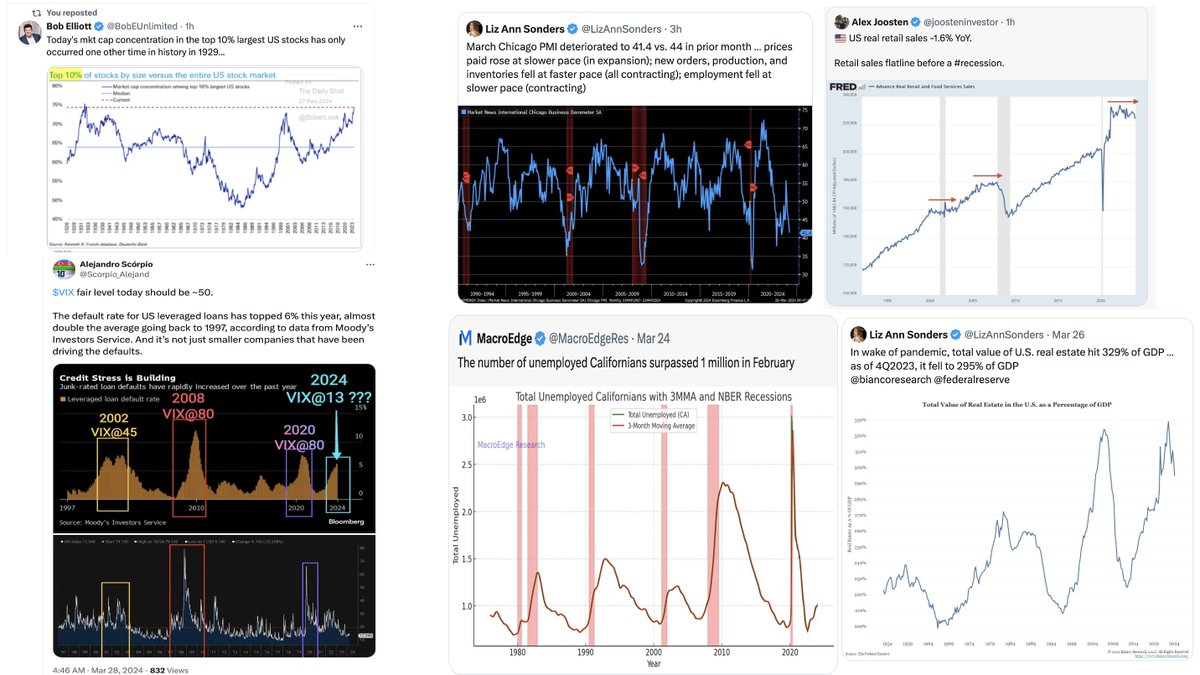

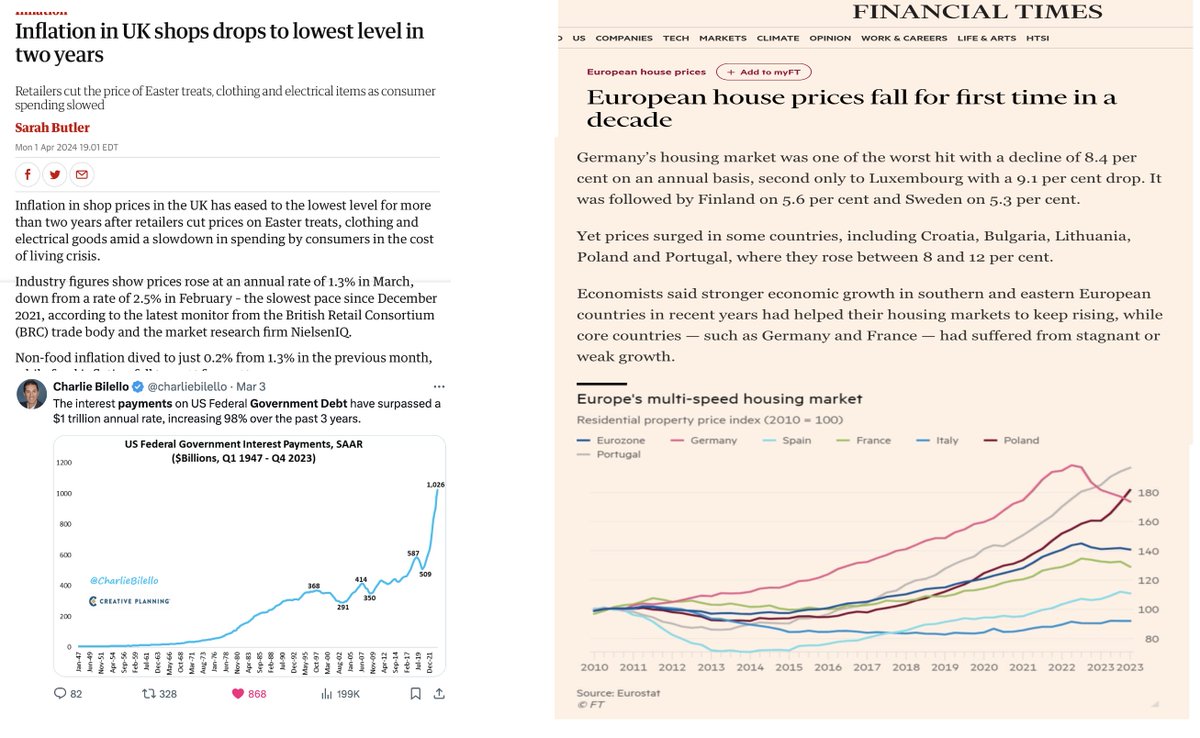

The following 25 graphs/post illustrate that global recession has very much started!!

(3 slides in this one & 3 slides in the next tweet)

Fed & USgov responds to war in Europe with the automatism that won the 45-year old struggle post WW2: by launching Hot War on Russia, Cold War on China and Currency War on BRICS. It was a neck-breaking turn in early 2022, when after claiming transitory for almost 2 years, Fed started launching 75 bps rate increases and pushing all allies including EU/UK/Japan viciously under the bus, just when inflation was at peak globally. Almost all CBs around the world (with notable exceptions of Turkiye & Japan, the former then experienced 150% inflation for going against the Fed while the latter saw major currency depreciation, which they interpreted as the "end of 30-year deflation" 😵💫) had to follow Fed since & hike considerably on accumulated debt over the past 40 years! Remember debt is never paid, only refinanced.

We are currently in this cycle of rate hikes that are claimed to be against "inflation" but are kept in place for an extraordinarily long period. In comparison, there is only one other hiking cycle out of 18 in 111 years of Fed that was kept this long in face of slowing economy: the one that resulted with Great Depression in 1929.

The real reason behind this long hiking cycle is to pressure BRICS, in particular Russia and China, while Fed officials point to inflation every day as a distraction.

Statistics from former hiking cycles say that it takes on average 24 months after Fed starts hiking & 15 months after yield curve inversion for recession to start: we are in months 24 & 15, respectively, today.

Then the question becomes is there a global recession in sight? After all, most experts & economists on TV/X/utube/media agree that recession is no more & soft cotton landing will prevail 🥳

The following 25 graphs/post illustrate that global recession has very much started!!

(3 slides in this one & 3 slides in the next tweet)

Turning Point 1 - The Energy Problem:

In addition to de-globalization & monetary system problems as outlined before, we are also facing several other issues that cannot be easily solved, even if people just get along.

The first of these is that oil is no longer abundant, while our civilization depends on it. This is very well explained below. It happened at least once before, which ended Bronze Age civilization within a single generation about 3300 years ago.

twitter.com/i/broadcasts/1…

In addition to de-globalization & monetary system problems as outlined before, we are also facing several other issues that cannot be easily solved, even if people just get along.

The first of these is that oil is no longer abundant, while our civilization depends on it. This is very well explained below. It happened at least once before, which ended Bronze Age civilization within a single generation about 3300 years ago.

twitter.com/i/broadcasts/1…

Turning Point 2 - The Aging Problem:

Humans are living longer than ever and societies are aging; never happened before in known history. China is aging 1 year on average every 2 years; median age of population of Japan is 49 today vs 21 in 1950. Fertility rates are dropping below level worldwide in advanced economies.

Economic needs of an older society is vastly different than a young society. Young buy houses, furniture, make babies, buy dipers, clothes, send their kids to schools, while the older folks spend at least 25% less and their main needs are in the area of healthcare sector. It is also less likely that an old society will engage in long wars.

Aging demographics correspond to totally different economics than over the past century, when global population increased by 5x.

Humans are living longer than ever and societies are aging; never happened before in known history. China is aging 1 year on average every 2 years; median age of population of Japan is 49 today vs 21 in 1950. Fertility rates are dropping below level worldwide in advanced economies.

Economic needs of an older society is vastly different than a young society. Young buy houses, furniture, make babies, buy dipers, clothes, send their kids to schools, while the older folks spend at least 25% less and their main needs are in the area of healthcare sector. It is also less likely that an old society will engage in long wars.

Aging demographics correspond to totally different economics than over the past century, when global population increased by 5x.

Turning Point 3 - Generational Change:

Seminal study of American socio-economic history by Strauss and Howe published in Generations & 4th Turning, along the same spirits of sci-fi novels by H.G. Wells (Time Machine), Isaac Asimov (Foundation) & Ayn Rand (Atlas Shrugged) focus on cultural differences among different generations affecting economics.

Although not spelled out in these books, my own interpretation is that generational cycles stem from the cycle shown in the graph attached below:

Hard times create strong people .... weak people create hard times...

This may resonate with some of you in that sense of weak leaders occupying top positions today (so-called woke culture).

In particular, 80 years after the Founding Fathers, there was Civil War, and 80 years later there was WW2. It has been about 80 years since WW2 (which is a scary thought). 80-year cycle corresponds to two generations.

What is less known is the impact of generational changes on financial markets, which exhibit a very deterministic Swiss-clock-like structure of 40-years of up-cycle and 40-years of down-cycle with sharp transitions, as seen by the plot I posted exactly four years ago on twitter.

According to these ideas, we have entered turbulent times with the onset of the pandemic and global turmoil will last for at least 40 years.

The connection of turmoil to gold is probably clear to everybody.

Seminal study of American socio-economic history by Strauss and Howe published in Generations & 4th Turning, along the same spirits of sci-fi novels by H.G. Wells (Time Machine), Isaac Asimov (Foundation) & Ayn Rand (Atlas Shrugged) focus on cultural differences among different generations affecting economics.

Although not spelled out in these books, my own interpretation is that generational cycles stem from the cycle shown in the graph attached below:

Hard times create strong people .... weak people create hard times...

This may resonate with some of you in that sense of weak leaders occupying top positions today (so-called woke culture).

In particular, 80 years after the Founding Fathers, there was Civil War, and 80 years later there was WW2. It has been about 80 years since WW2 (which is a scary thought). 80-year cycle corresponds to two generations.

What is less known is the impact of generational changes on financial markets, which exhibit a very deterministic Swiss-clock-like structure of 40-years of up-cycle and 40-years of down-cycle with sharp transitions, as seen by the plot I posted exactly four years ago on twitter.

According to these ideas, we have entered turbulent times with the onset of the pandemic and global turmoil will last for at least 40 years.

The connection of turmoil to gold is probably clear to everybody.

What is next?

My forecast, based on my reasoning posted in this thread, is Great Global Depression starting later in 2024 and lasting for decade(s).

It is true that deflation/depression periods are much rarer than inflationary episodes. This is because unlike inflation, deflation is not driven by money printing, but rather very fundamental reasons such as collapse of global business model, de-globalization, end of energy system, or in this case, also demographics/aging.

There are only four deflationary events since WW1 for the West:

1) US 1920: initially the gov stayed away but later responded by changing gold standard to gold "exchange" standard, in which certificates of gold were also accepted as well as physical gold, doubling the money supply. This fueled "roaring 20s". Global business model was not disrupted since the losing party, Germany did not own many colonies. Also, collapse of Ottoman Empire provided Middle East oil to the West. Overall, minor deflation.

2) US+Germany 1929-1938: initially starting with stock market collapse, this one evolved into total collapse of trade between US & Europe and therefore, by far the most important so far. Loss of global business model could not be offset by money printing, even after aborting gold system. Eventually war economy was adopted & ensuing destruction made another growth era possible. This historic experience showed us that once global business model collapses, no amount of money printing can restore the economy due to corporations going bust. As such, deflation is not a monetary phenomenon. It took 30 years for US stock market to recover.

3) 1989 Japan: Japanese econ collapsed after massive money printing to compete with the US, fueling RE bubble. By the time stock market crashed, US was moving their business to China. This event is extremely interesting because it happened at the exact moment of USSR collapse. Since USSR economy was a completely isolated, parallel system to the West, the main effect of the removal of this East-West barrier was to make available 4 BILLION inexpensive workers overseas for the US (and EU). For this reason, what happened in Japan, stayed in Japan. Japanese experience shows us again that it takes decades to get out of deflation (studied well by Richard Koo's balance sheet recession theory).

4) GFC: there was a short period of deflation following 2008. Despite being overrated by the finance sector, the ease by which the Fed could cure this glitch showed us that financial crises at the Wall Street do not pose a serious economic risk. Wall Street responded by robbing Main Street again (before & after, double theft) & forcing the Fed to pump up the stock market. Global business model remained unchanged, so this wasn't a real lasting deflation.

My forecast, based on my reasoning posted in this thread, is Great Global Depression starting later in 2024 and lasting for decade(s).

It is true that deflation/depression periods are much rarer than inflationary episodes. This is because unlike inflation, deflation is not driven by money printing, but rather very fundamental reasons such as collapse of global business model, de-globalization, end of energy system, or in this case, also demographics/aging.

There are only four deflationary events since WW1 for the West:

1) US 1920: initially the gov stayed away but later responded by changing gold standard to gold "exchange" standard, in which certificates of gold were also accepted as well as physical gold, doubling the money supply. This fueled "roaring 20s". Global business model was not disrupted since the losing party, Germany did not own many colonies. Also, collapse of Ottoman Empire provided Middle East oil to the West. Overall, minor deflation.

2) US+Germany 1929-1938: initially starting with stock market collapse, this one evolved into total collapse of trade between US & Europe and therefore, by far the most important so far. Loss of global business model could not be offset by money printing, even after aborting gold system. Eventually war economy was adopted & ensuing destruction made another growth era possible. This historic experience showed us that once global business model collapses, no amount of money printing can restore the economy due to corporations going bust. As such, deflation is not a monetary phenomenon. It took 30 years for US stock market to recover.

3) 1989 Japan: Japanese econ collapsed after massive money printing to compete with the US, fueling RE bubble. By the time stock market crashed, US was moving their business to China. This event is extremely interesting because it happened at the exact moment of USSR collapse. Since USSR economy was a completely isolated, parallel system to the West, the main effect of the removal of this East-West barrier was to make available 4 BILLION inexpensive workers overseas for the US (and EU). For this reason, what happened in Japan, stayed in Japan. Japanese experience shows us again that it takes decades to get out of deflation (studied well by Richard Koo's balance sheet recession theory).

4) GFC: there was a short period of deflation following 2008. Despite being overrated by the finance sector, the ease by which the Fed could cure this glitch showed us that financial crises at the Wall Street do not pose a serious economic risk. Wall Street responded by robbing Main Street again (before & after, double theft) & forcing the Fed to pump up the stock market. Global business model remained unchanged, so this wasn't a real lasting deflation.

Oh No! Deflation is not possible! They will print $ 🥳

In that case, how come Japan has been struggling with deflation for 35 years? Didn't they print enough currency?

How come US could not get out of it after 5 years of MMT between 1933 and 1938? (Roosevelt's New Deal is well recognized, but nobody mentions the return of deflation in 1938!)

How come Germany could not get out of it after 5 years of MMT between 1933 and 1938? (They resorted to war economy.)

MMT = control of economy by the government via currency printing, ultimately paves the way for dictators who will grab the power concentrated in the government, as highlighted by true economist Hayek in his famous work "The Road to Serfdom".

The ultimate destination for all MMT is war economy.

Useful to watch the 2nd half of the video as well on how the rich can grab all hard assets in case of system collapse.

Revolutions happen, but they are far more rare than most people assume, as summarized in the fantastic historical study "The Great Leveler: Violence and the History of Inequality from the Stone Age to the 21st Century".

In that case, how come Japan has been struggling with deflation for 35 years? Didn't they print enough currency?

How come US could not get out of it after 5 years of MMT between 1933 and 1938? (Roosevelt's New Deal is well recognized, but nobody mentions the return of deflation in 1938!)

How come Germany could not get out of it after 5 years of MMT between 1933 and 1938? (They resorted to war economy.)

MMT = control of economy by the government via currency printing, ultimately paves the way for dictators who will grab the power concentrated in the government, as highlighted by true economist Hayek in his famous work "The Road to Serfdom".

The ultimate destination for all MMT is war economy.

Useful to watch the 2nd half of the video as well on how the rich can grab all hard assets in case of system collapse.

Revolutions happen, but they are far more rare than most people assume, as summarized in the fantastic historical study "The Great Leveler: Violence and the History of Inequality from the Stone Age to the 21st Century".

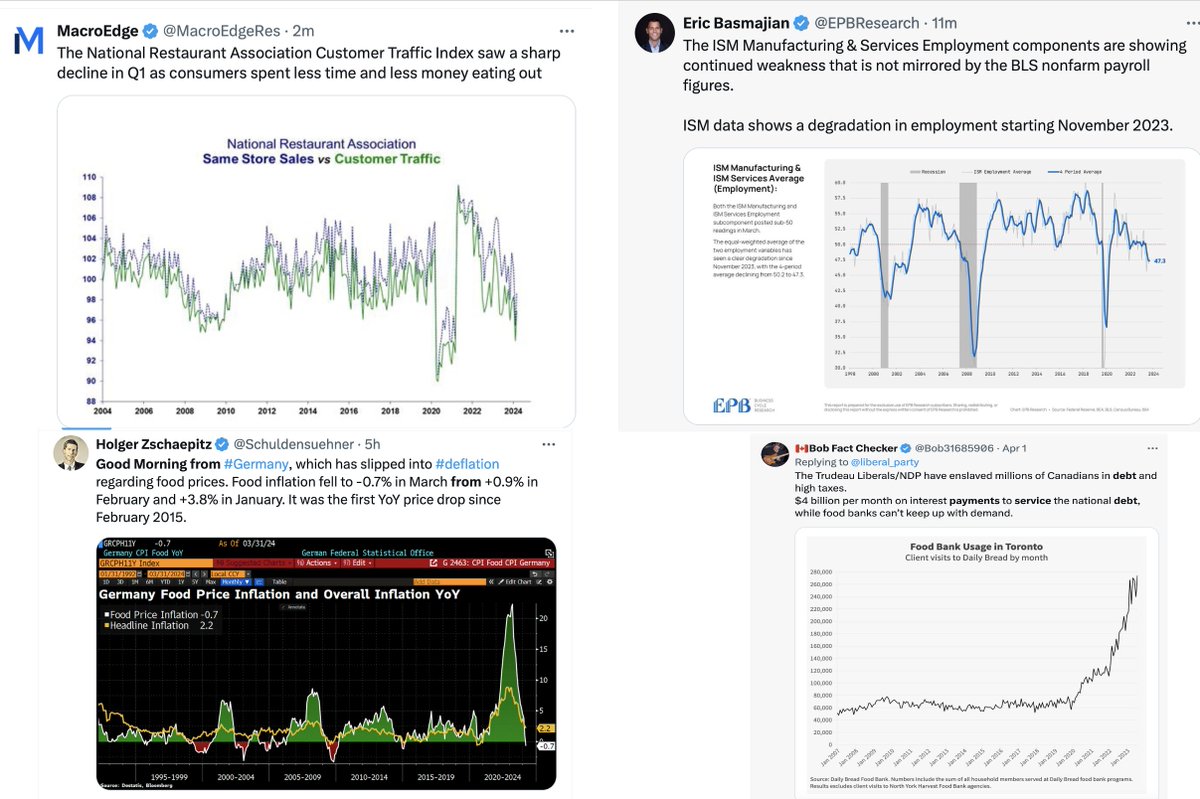

Why Gold? - 1) It is that time again:

After 40 tweets to explain where I am coming from, I have finally arrived at the reasons for why gold price could be rising.

First reason is what @CRutherglen, in my view the best gold price analyst on X, posted on the basis of monetary and business cycles. The associated beautiful plots are attached below.

After 40 tweets to explain where I am coming from, I have finally arrived at the reasons for why gold price could be rising.

First reason is what @CRutherglen, in my view the best gold price analyst on X, posted on the basis of monetary and business cycles. The associated beautiful plots are attached below.

Why Gold? - 2) Abuse of $, Allies & Trade:

It is pretty clear from the 40 tweets above that US foreign policy in the 21st century amounted to extensive military campaigns in oil-rich regions of the world, as well as strained relations with traditional allies in Europe & Asia.

Nonstop bombing lasting decades scares people; they do not want to live in constant fear. Given the capabilities of US military, most nations cannot protect themselves; they do not have the resources and/or interest. Most people do not like to see other nations getting bombed day & night with a mantra of "shock & awe". This leaves a scar in the mind of most peaceful, normal people. US only accounts for 4% of world population. Why is all this bombing of everybody? What happened to peace? (I assume that this is what many others are thinking as well.)

Extensive printing of $ to the tune of sometimes 1 trillion $ per day (during covid). US Treasury bond issuance campaigns nowadays can easily exceed $50B per auction, which used to be annual amount. USgov is deficit spending $2-3T/year or more more than half the tax revenues (why pay taxes then?). $ is often weaponized; we are living through a longest stretch of $ being used as a weapon by the Fed against the rest of the world! Why are tens of millions from EMs immigrating to US & EU? Because their economies are wrecked by hot war, cold war & currency war.

Trade relations are extremely strained because most production is abroad while $ printing is controlled centrally by the US. This is not real trade; it is buying goods by typing numbers on a computer. People do not understand this. It is clearly unfair & unequal.

Overall, US is not in a good place in the eyes of the world population and hence, USD$ is now under severe threat.

I would like to add that almost none of the US citizens have anything to do with all this; most people want to have & pursue a normal life. These actions are carried out by few sickos in power, often by not even bothering to reveal to anybody what the long-term agenda is. In addition, investigative journalism is dead! Don't expect any Watergate-level reporting & reaction soon.

Foreign policy & monetary policy are never discussed in presidential elections, even though they have entirely tainted the reputation of the US.

It is pretty clear from the 40 tweets above that US foreign policy in the 21st century amounted to extensive military campaigns in oil-rich regions of the world, as well as strained relations with traditional allies in Europe & Asia.

Nonstop bombing lasting decades scares people; they do not want to live in constant fear. Given the capabilities of US military, most nations cannot protect themselves; they do not have the resources and/or interest. Most people do not like to see other nations getting bombed day & night with a mantra of "shock & awe". This leaves a scar in the mind of most peaceful, normal people. US only accounts for 4% of world population. Why is all this bombing of everybody? What happened to peace? (I assume that this is what many others are thinking as well.)

Extensive printing of $ to the tune of sometimes 1 trillion $ per day (during covid). US Treasury bond issuance campaigns nowadays can easily exceed $50B per auction, which used to be annual amount. USgov is deficit spending $2-3T/year or more more than half the tax revenues (why pay taxes then?). $ is often weaponized; we are living through a longest stretch of $ being used as a weapon by the Fed against the rest of the world! Why are tens of millions from EMs immigrating to US & EU? Because their economies are wrecked by hot war, cold war & currency war.

Trade relations are extremely strained because most production is abroad while $ printing is controlled centrally by the US. This is not real trade; it is buying goods by typing numbers on a computer. People do not understand this. It is clearly unfair & unequal.

Overall, US is not in a good place in the eyes of the world population and hence, USD$ is now under severe threat.

I would like to add that almost none of the US citizens have anything to do with all this; most people want to have & pursue a normal life. These actions are carried out by few sickos in power, often by not even bothering to reveal to anybody what the long-term agenda is. In addition, investigative journalism is dead! Don't expect any Watergate-level reporting & reaction soon.

Foreign policy & monetary policy are never discussed in presidential elections, even though they have entirely tainted the reputation of the US.

Why Gold? 3) Why so fast now?

Something big is going on; I just do not know what? Some theories:

1) BIS is doing it: Europeans are not happy with the $ & US and they have resources to drive the price of gold fast. Just like what happened 50 years ago; see tweet #1 on this 🧵

2) China & India are doing it. In particular, an idea suggested by @DA_Sully is that Chinese are buying gold now that their RE sector is crashing.

3) TINA: gold is money for millennia, especially when fiat crashes again. (Sorry, crypto is new and not proven.)

4) WW3: very unpleasant, but it is a possibility... two major wars in Europe & Middle East that can easily expand. Many people, especially the rich could be worried. See above for the great lengths the rich will go to store their gold under the Alps.

Something big is going on; I just do not know what? Some theories:

1) BIS is doing it: Europeans are not happy with the $ & US and they have resources to drive the price of gold fast. Just like what happened 50 years ago; see tweet #1 on this 🧵

2) China & India are doing it. In particular, an idea suggested by @DA_Sully is that Chinese are buying gold now that their RE sector is crashing.

3) TINA: gold is money for millennia, especially when fiat crashes again. (Sorry, crypto is new and not proven.)

4) WW3: very unpleasant, but it is a possibility... two major wars in Europe & Middle East that can easily expand. Many people, especially the rich could be worried. See above for the great lengths the rich will go to store their gold under the Alps.

@Threadroll

@threadreaderapp

unroll

@threadreaderapp

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh