For convenience, here's all the info on the Mar jobs report in a single thread - sorry to be the bearer of bad news, especially regarding American citizens losing so much ground in this economy...

The headline numbers once again look good w/ over 300k payrolls added and the employment number from the household survey rising even faster, but what kinds of jobs are being created? Turns out they're all part-time:

And this isn't new - it's a continuation of a long trend: full-time employment is lower today than Feb '23 w/ all of the net job creation since then being part-time work:

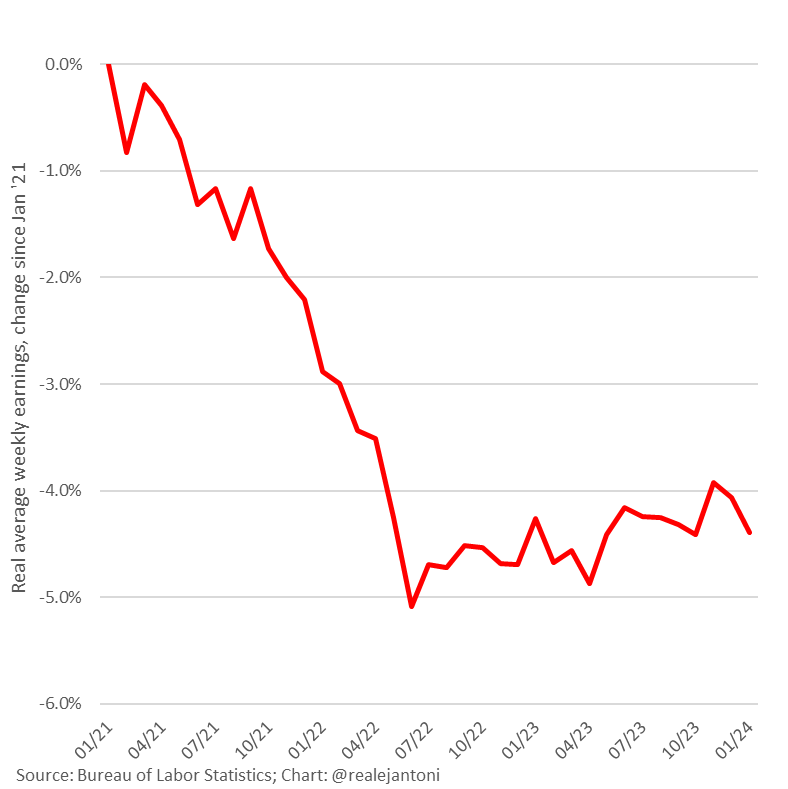

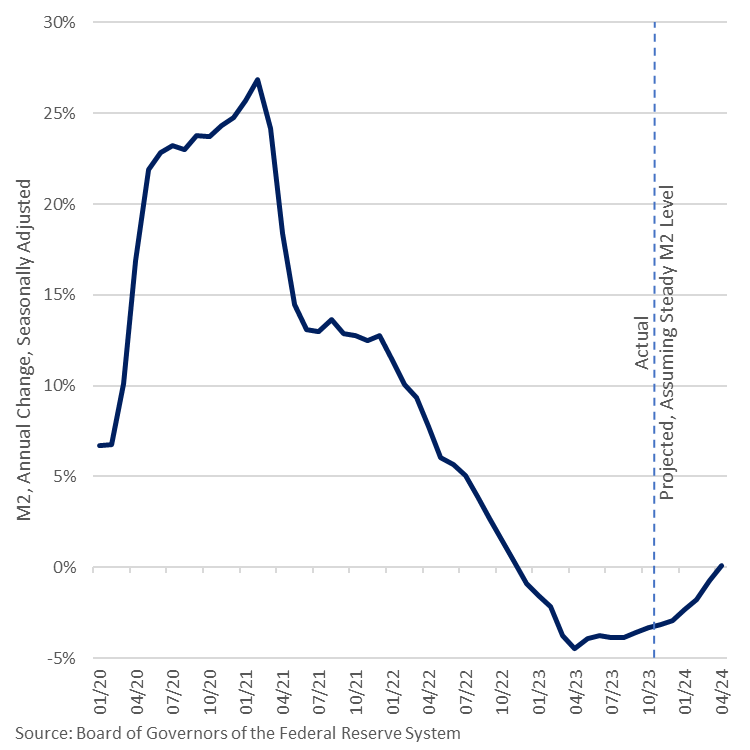

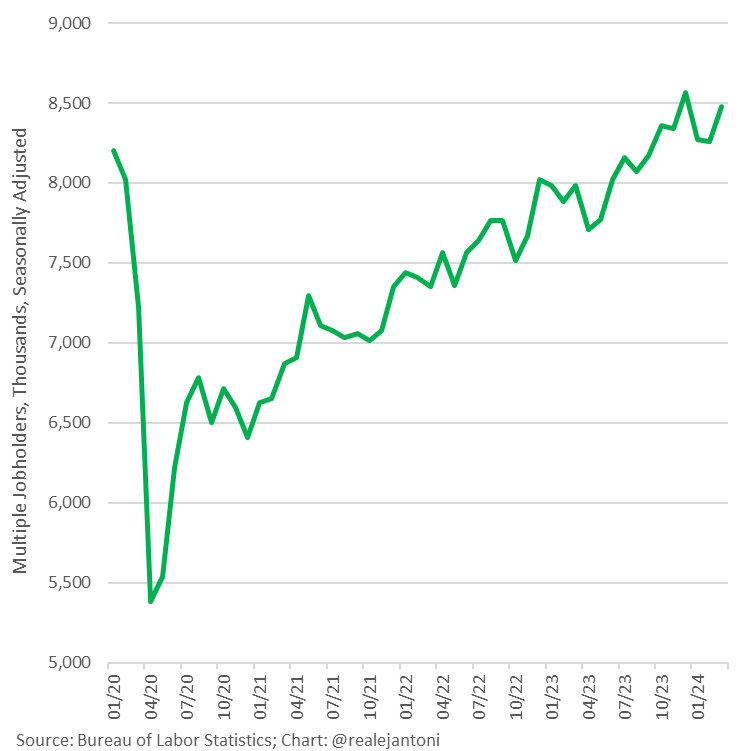

Why the surge in part-time employment? Many Americans have been laid off and replaced 1 full-time job w/ 2 or 3 part-time ones; people are also picking up additional jobs to make ends meet in a cost-of-living crisis; this has caused an unprecedented divergence between the household and establishment surveys, since the latter double counts individuals w/ multiple jobs while the former survey shows a net loss of jobs since Aug '23:

Number of people w/ multiple jobs jumped again in Mar but remember that this figure only increases when someone gets a 2nd job; if you're already working 2 gigs and pick up a 3rd, you're not counted again - at least not here; but you ARE counted again in the nonfarm payrolls...

W/ the shift to so much part-time work, average hours worked per week has trended down for over almost 3 years and is below the pre-pandemic average; your hourly wage raise doesn't do much good when it's combined w/ a cut in your hours:

Another disturbing datum point: too many jobs are in gov't; the economy isn't adding enough private-sector jobs to support number of workers gov't is hiring; Mar's ratio was about 3:1, nowhere near sustainable, especially since those private-sector jobs were all part-time, generating less tax revenue than average full-time job:

Let's break down the annual change in private sector for a closer look: we find the fastest growing sector was health care, which is dominated by gov't; most of the hiring over the last year came directly or indirectly from gov't - even the construction jobs were mostly financed w/ gov't guaranteed loans on projects that aren't profitable (which is why the private sector wasn't undertaking those projects)...

We'd rather see good-paying blue-collar manufacturing jobs taking the lead, but that sector has been anemic: employment is up a mere 0.1% since Jan '23, having added zero jobs in Mar '24:

And while it's good to see the labor force participation rate climb, we're still way below the pre-pandemic rate, and that's hiding the true level of unemployment by excluding millions of workers from the calculation:

The Bureau of Labor Statistics even has a category of people called "not in labor force" and it's about 5 million above the pre-pandemic level, and waaay above the pre-pandemic trend which had begun trending down in about Set '18:

So, if you account for the millions of people who are clearly missing from the labor market today (and therefore are not employed), you can calculate that the unemployment rate isn't 3.8% but btwn 6.5% and 7.7% depending on which dataset and methodology you prefer to use:

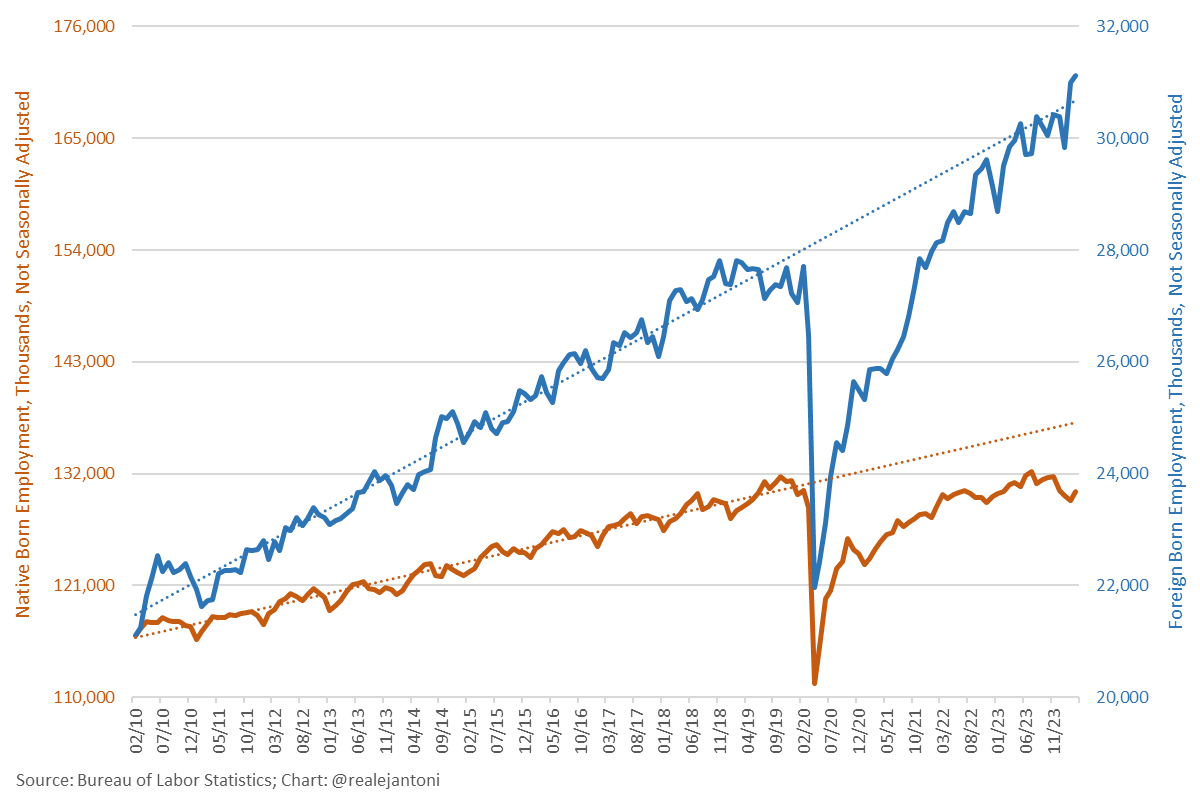

But who is getting these jobs? It's not native-born Americans, but foreigner workers - the former lost 651k jobs over the last 12 months, while employment of foreigners rose by 1.3 million:

And again, this is the continuation of a trend where Americans have been completely left behind in this economy; foreign-born employment is not only several million above its pre-pandemic level but is even above its pre-pandemic trend, while native-born Americans have made no progress in 4 years - in fact, they've gone backwards; a quick note on the different axes here: this chart was constructed so that the different values on the left and right axes are proportional; that means if both groups had the same rate of increase, the lines would have the same slope; also important is that these are not seasonally adjusted datasets so month-over-month changes are as apples-to-oranges comparison in most cases, while year-over-year changes do not have that issue; you can still create a seasonal adjustment yourself, it's just not provided by BLS; lastly, some have tried to blame the decline of native-born employment on Americans retiring, but that would only be enough of a change to slow the rate of growth, not turn it into decline:

• • •

Missing some Tweet in this thread? You can try to

force a refresh