1) Why does $UVXY reverse split so damn often?

Well if it didn't the price would be completely un-tradable as it would effectively be 0

Yes, but why? 🤔

con't...

Well if it didn't the price would be completely un-tradable as it would effectively be 0

Yes, but why? 🤔

con't...

2) Volatility ETPs don't trade based on supply and demand

It's best to view them as basically a formula, they all have a set methodology and they track underlying indexes

UVXY tracks with 1.5x daily leverage the SPVIXSTR index

It's best to view them as basically a formula, they all have a set methodology and they track underlying indexes

UVXY tracks with 1.5x daily leverage the SPVIXSTR index

3) The SPVIXSTR index tracks the value of a constant rolling 1 month maturity VIX future (VX30)

Essentially, where the front two months of VIX futures go, UVXY goes 1.5x the opposite on a daily basis

Essentially, where the front two months of VIX futures go, UVXY goes 1.5x the opposite on a daily basis

4) In a stable market the front two month VIX futures (M1 & M2) will typically be trading above the VIX index and will gradually be shifting down towards the VIX index through the expiration cycles

5) How often you ask?

As we can see, the VX30:VIX roll yield (M1&M2 VIX futures prices vs the spot VIX index price) is positive on 82.83% of trading days

About 83% of the time the UVXY has a headwind and tends to bleed down

As we can see, the VX30:VIX roll yield (M1&M2 VIX futures prices vs the spot VIX index price) is positive on 82.83% of trading days

About 83% of the time the UVXY has a headwind and tends to bleed down

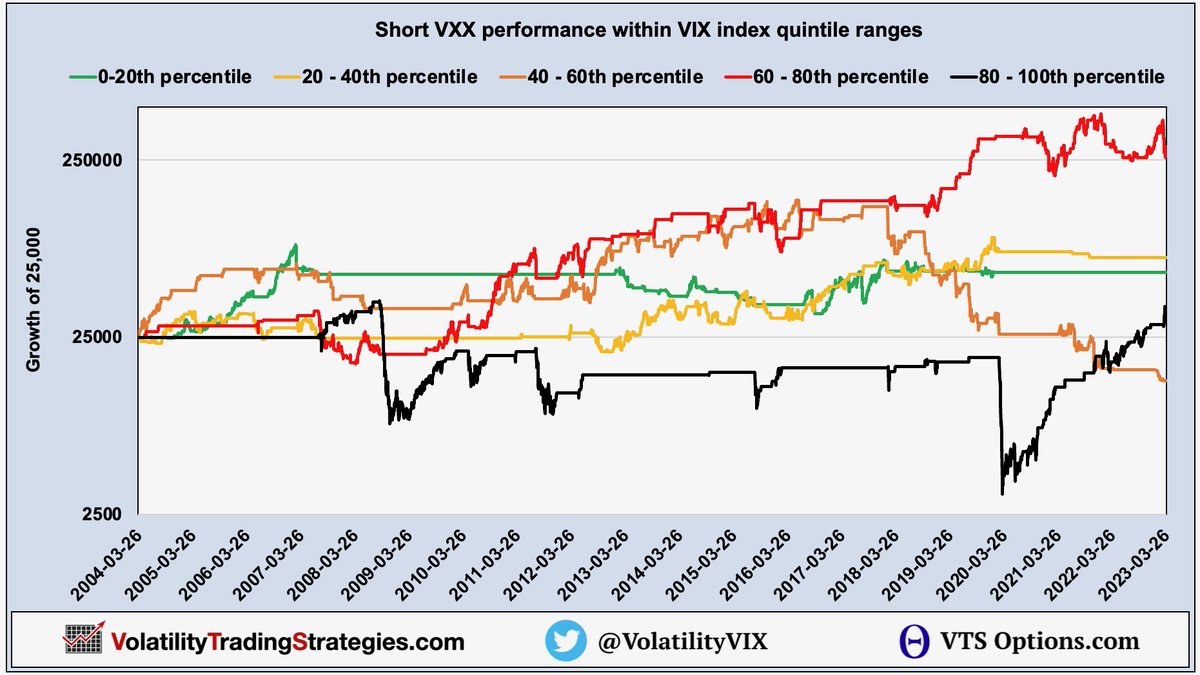

6) Obviously that leaves 17% where the opposite is true and UVXY has a tail wind

During major market crashes the UVXY can spike violently!

1000%, 1500% maybe more in the next crisis

Obviously don't short with your eyes closed, it's NOT free money

During major market crashes the UVXY can spike violently!

1000%, 1500% maybe more in the next crisis

Obviously don't short with your eyes closed, it's NOT free money

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh