I'm the Volatility Guy - UVXY / VXX / VIX

Join VTS members from 70+ countries

YouTube: https://t.co/xW8aGbjwSb

3 subscribers

How to get URL link on X (Twitter) App

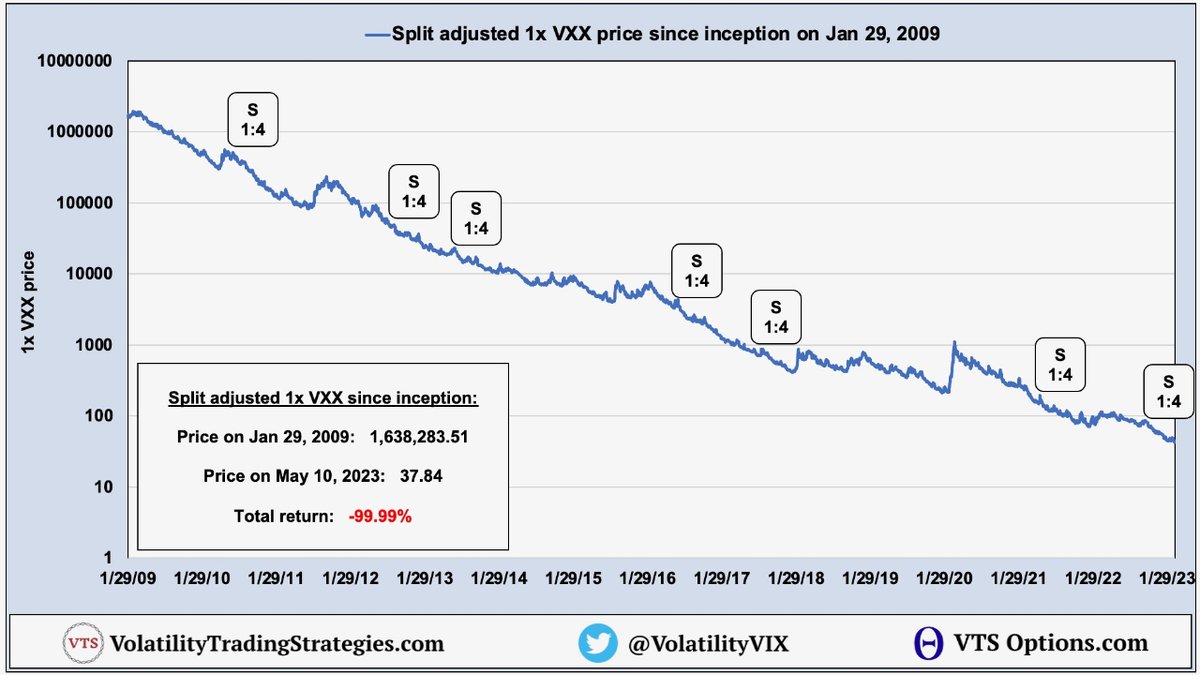

VXX is not a stock and doesn't derive it's price based on supply and demand

VXX is not a stock and doesn't derive it's price based on supply and demand

If you have 40 years, the numbers start to look worse

If you have 40 years, the numbers start to look worse

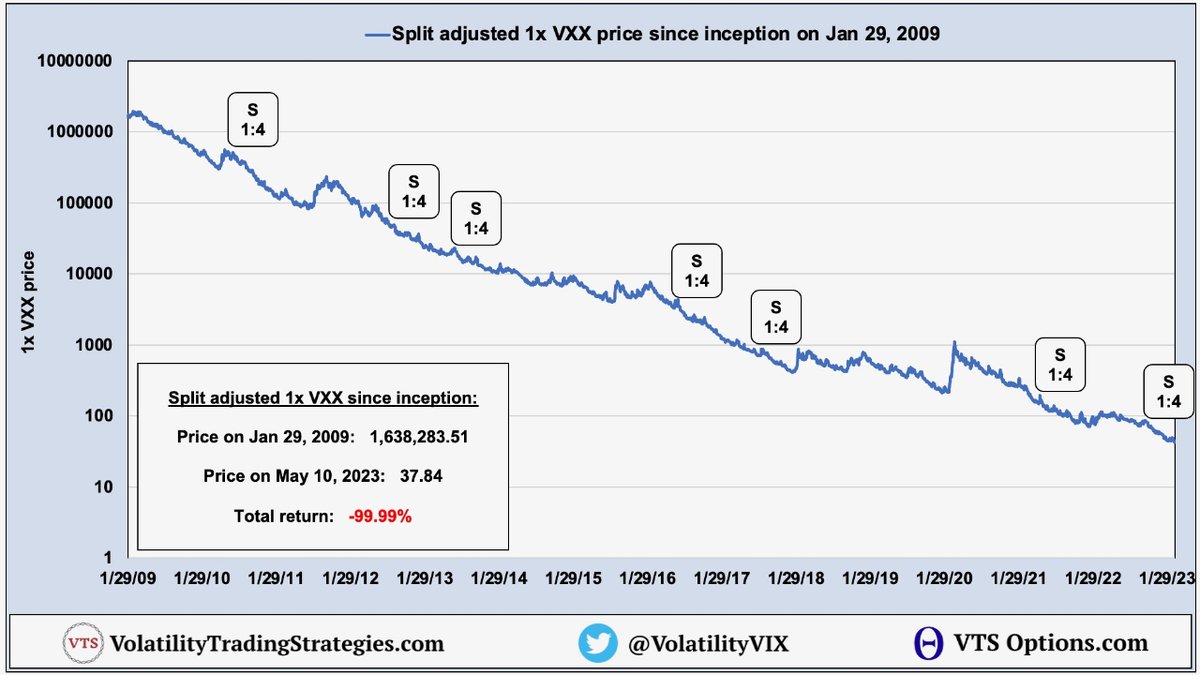

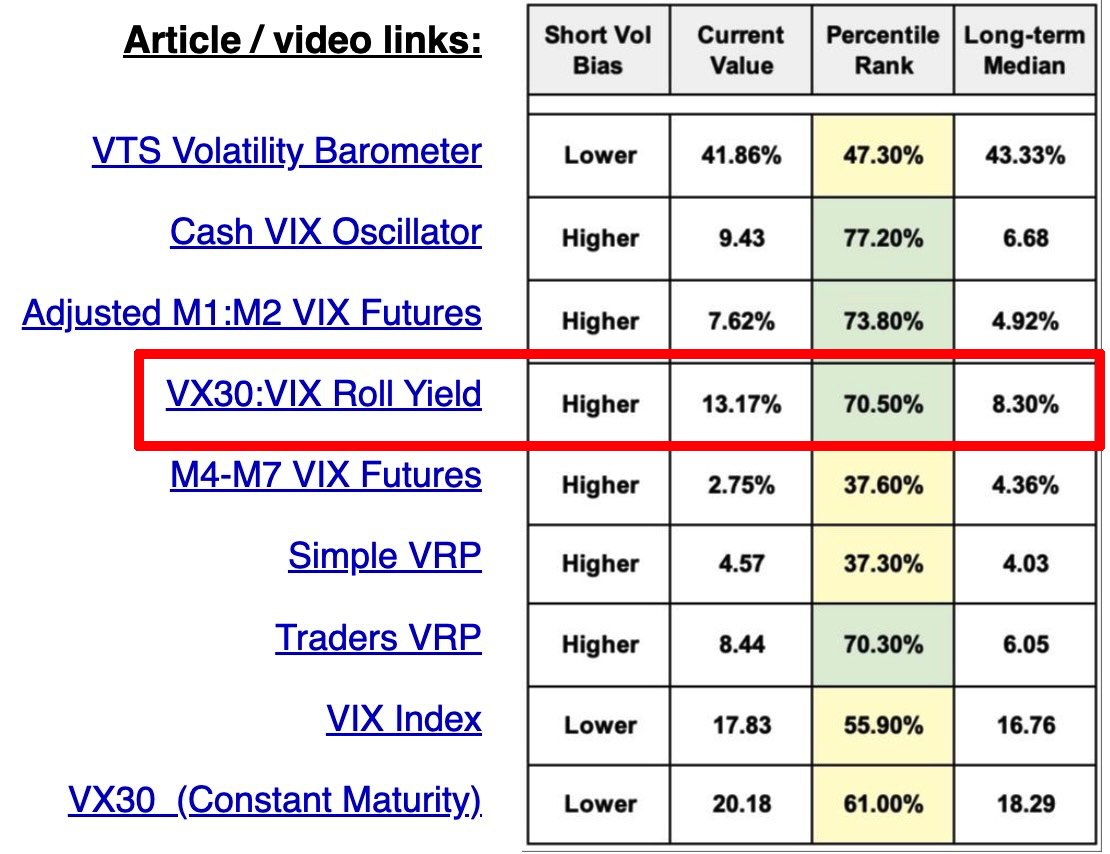

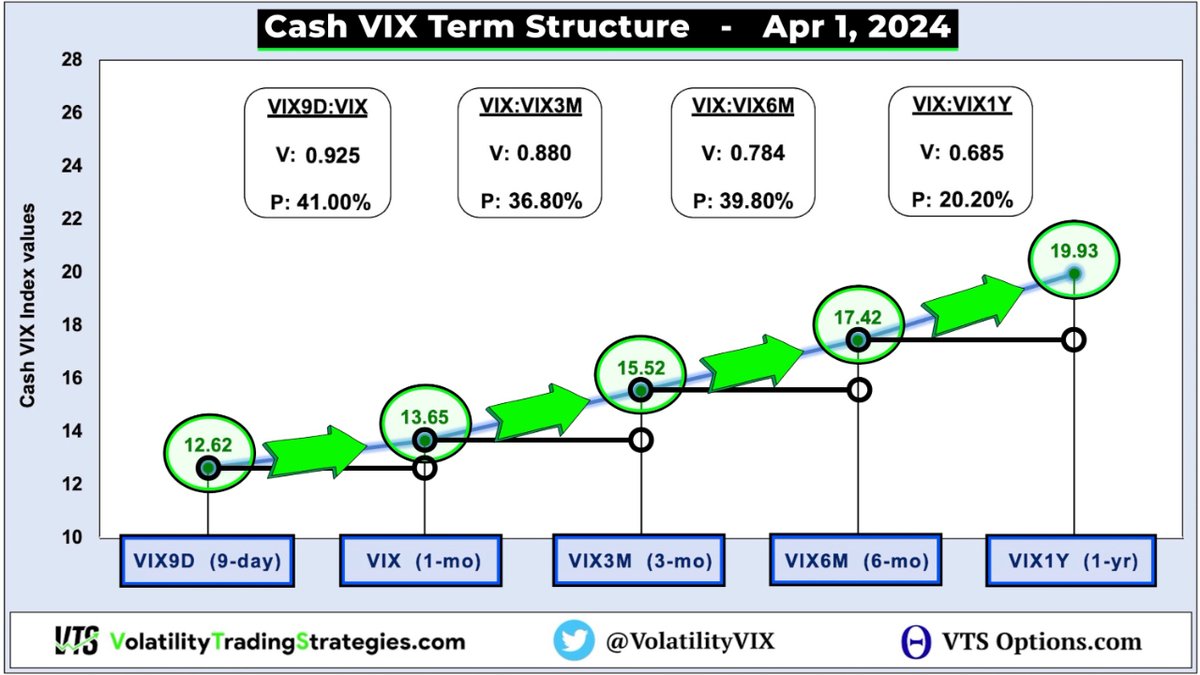

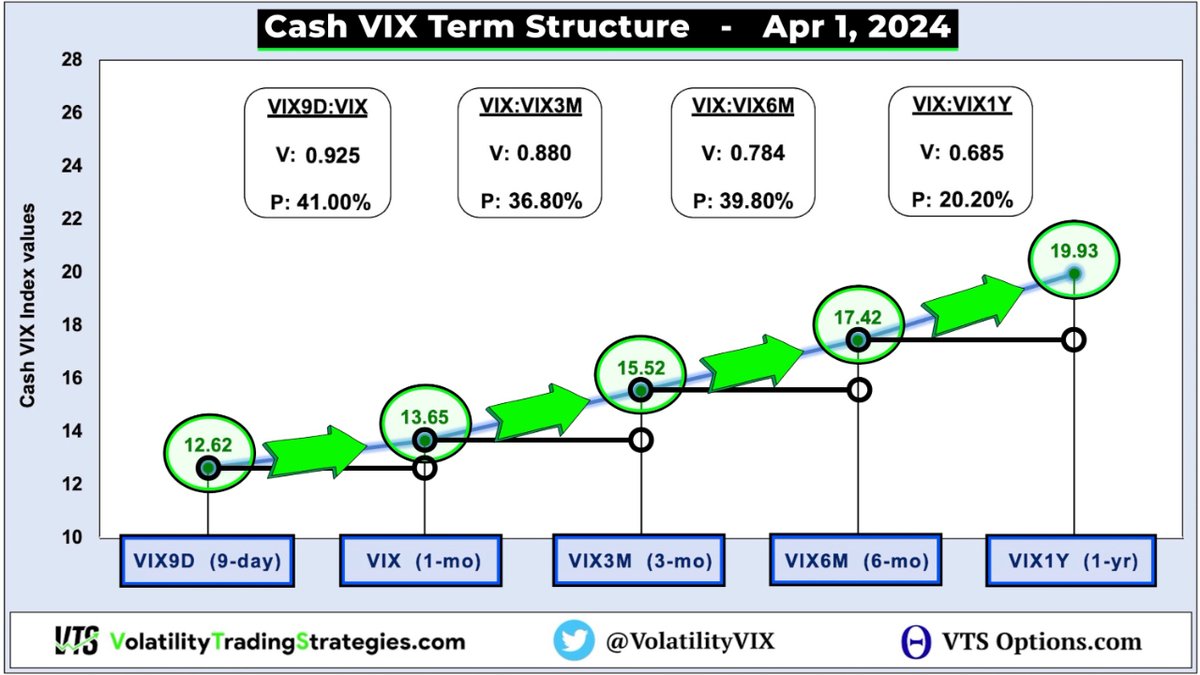

In a calm market with no fear, short term indicators should be lowest

In a calm market with no fear, short term indicators should be lowest

2) I've heard people talking about their layering systems where they divide their capital into pieces and only short naked UVXY Calls with the 1st level

2) I've heard people talking about their layering systems where they divide their capital into pieces and only short naked UVXY Calls with the 1st level

5-day VIX : S&P correlation

5-day VIX : S&P correlation

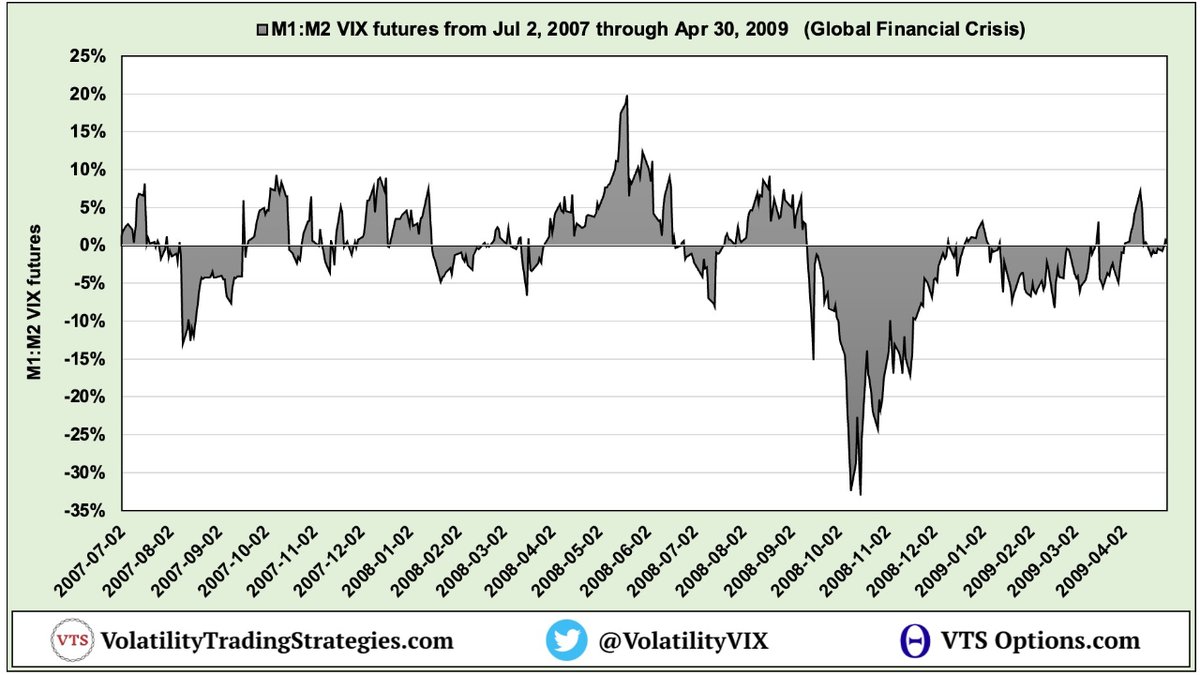

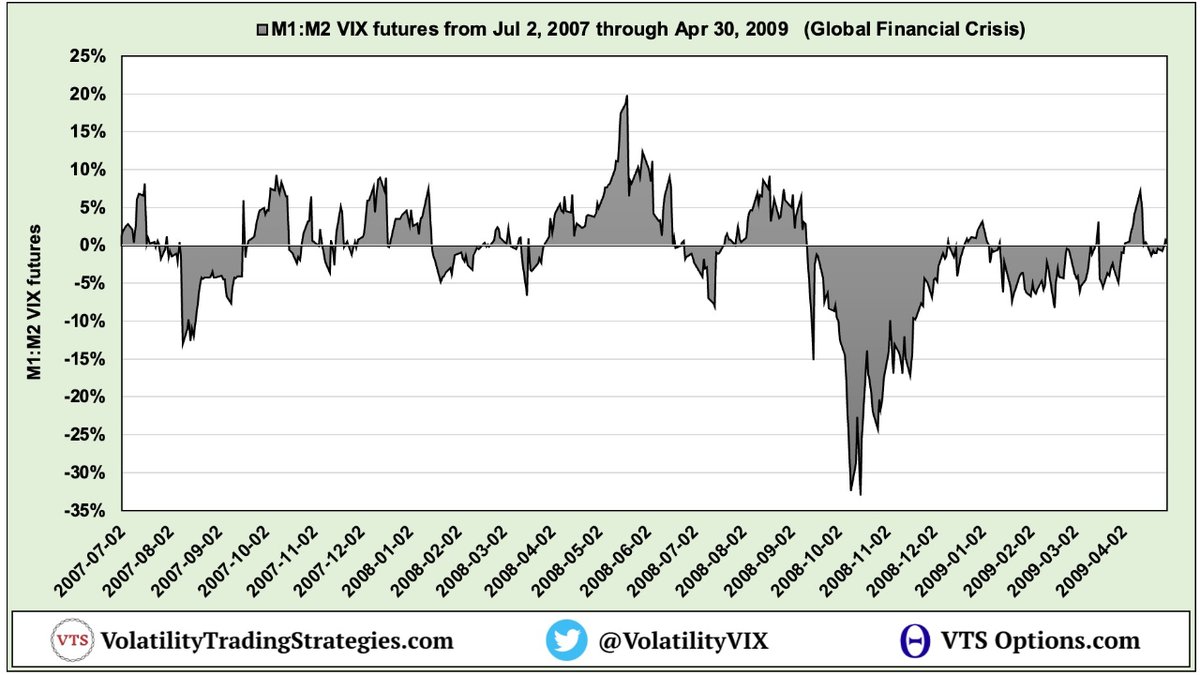

Long VXX when M1:M2 VIX futures backwardation < -2.5%

Long VXX when M1:M2 VIX futures backwardation < -2.5%

2011 European debt crisis:

2011 European debt crisis:

Historically, the difference between that final trade closing print and the official settlement value the next day can be double digit % change

Historically, the difference between that final trade closing print and the official settlement value the next day can be double digit % change

2) Volatility ETPs don't trade based on supply and demand

2) Volatility ETPs don't trade based on supply and demand

Rolling 3-year "Short VXX return"

Rolling 3-year "Short VXX return"

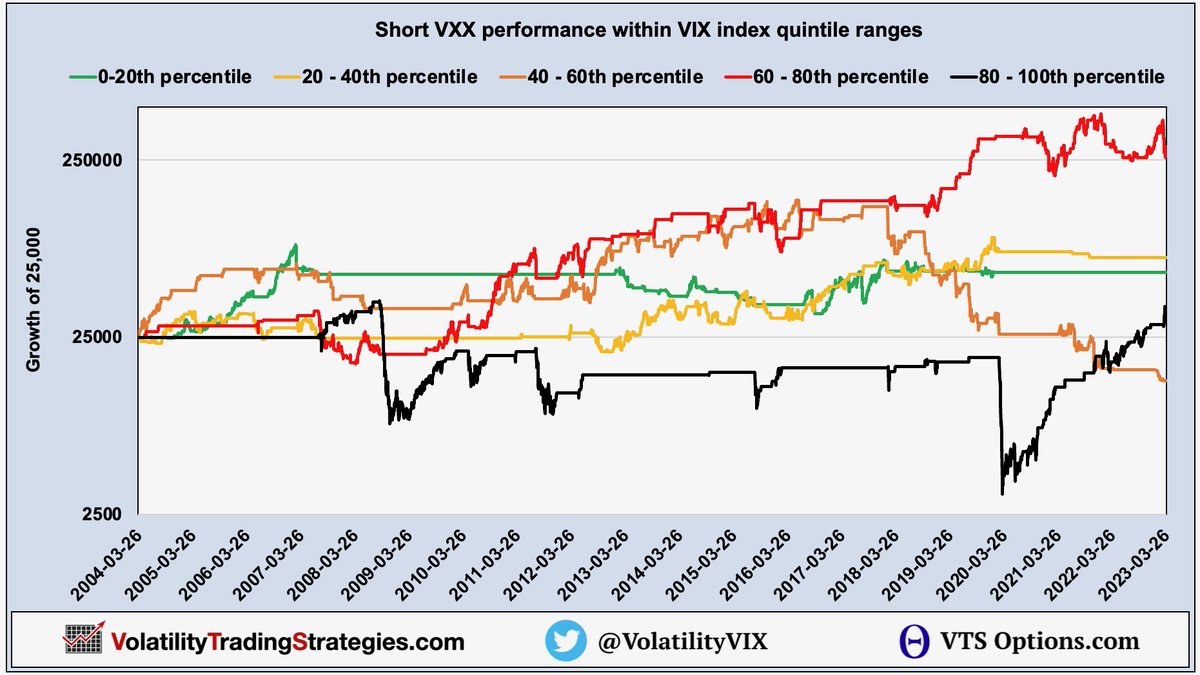

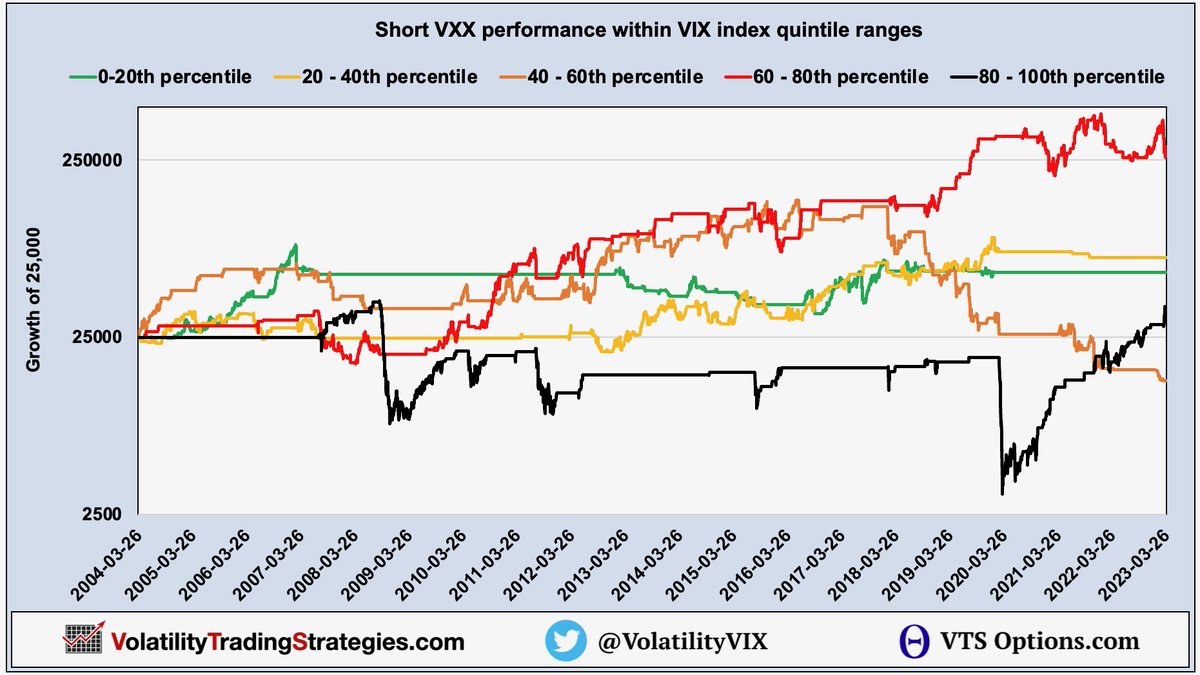

0 - 20% range:

0 - 20% range:

Before showing short VXX performance, we have to divide the VIX up into 5 equal ranges (quintiles)

Before showing short VXX performance, we have to divide the VIX up into 5 equal ranges (quintiles)

2) But MEAN can be deceiving because the outlier values can dramatically increase the average

2) But MEAN can be deceiving because the outlier values can dramatically increase the average

VXX is not a stock and doesn't derive it's price based on supply and demand

VXX is not a stock and doesn't derive it's price based on supply and demand

And that wasn't even the worst of it

And that wasn't even the worst of it

2) When a drawdown occurs, it's not a linear percentage move required to get back to the break even point

2) When a drawdown occurs, it's not a linear percentage move required to get back to the break even point

VXX is not a stock and doesn't derive it's price based on supply and demand

VXX is not a stock and doesn't derive it's price based on supply and demand

2) In the beginning there was $VXX

2) In the beginning there was $VXX

Technically speaking, you could make a case the VIX Index at 19.63 today is just average

Technically speaking, you could make a case the VIX Index at 19.63 today is just average

2) Contango is simply defined as the M2 VIX future trading higher than the M1 VIX future for the "Short Vol" traders out there:

2) Contango is simply defined as the M2 VIX future trading higher than the M1 VIX future for the "Short Vol" traders out there: