The Art of Quality Investing launched yesterday

It will teach you the Quality Investing Philosophy from A to Z

Here's what you need to know:

It will teach you the Quality Investing Philosophy from A to Z

Here's what you need to know:

1️⃣ What is Quality Investing?

Quality investing is all about investing in the best companies in the world.

You try to buy wonderful companies at a fair price

Quality investing is all about investing in the best companies in the world.

You try to buy wonderful companies at a fair price

2️⃣ Three steps to invest in quality stocks

1. Buy wonderful companies

2. Led by outstanding managers

3. Trading at fair valuation levels

1. Buy wonderful companies

2. Led by outstanding managers

3. Trading at fair valuation levels

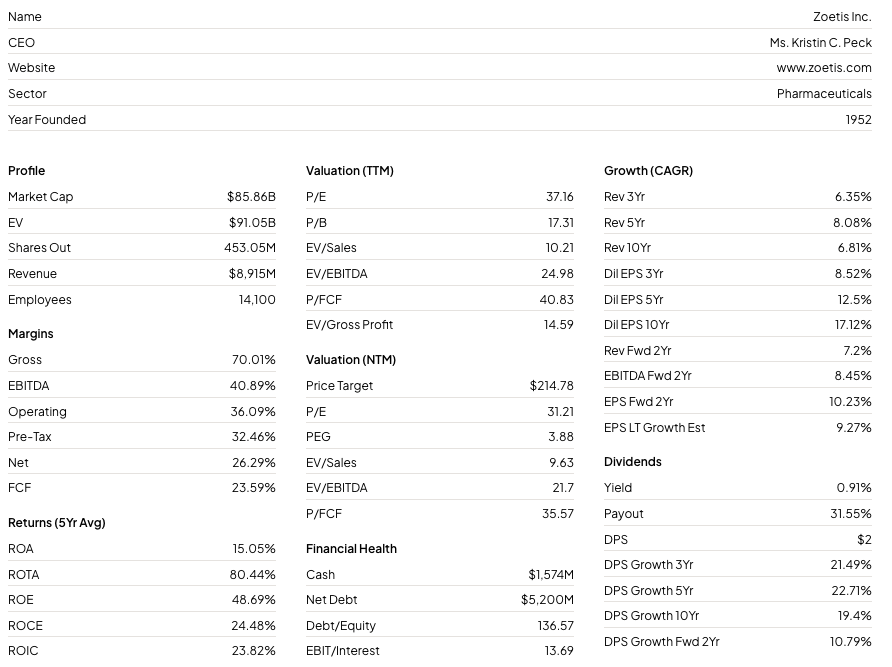

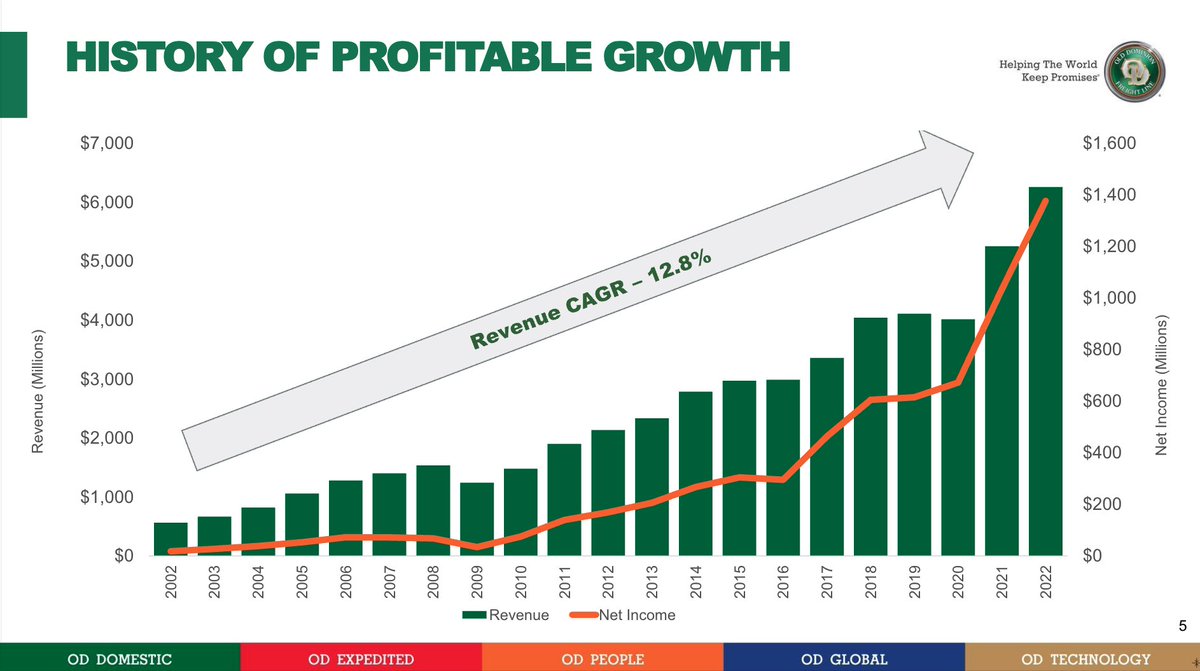

3️⃣ Six characteristics of quality

- Competitive advantage

- Skin in the game

- Low capital intensity

- Great capital allocation

- High profitability

- Secular trend

- Competitive advantage

- Skin in the game

- Low capital intensity

- Great capital allocation

- High profitability

- Secular trend

4️⃣ Quality Investing Vs Value Investing

- Value Investing: Fair companies at a wonderful price

- Quality Investing: Wonderful companies at a fair price

- Value Investing: Fair companies at a wonderful price

- Quality Investing: Wonderful companies at a fair price

5️⃣ Quality Investing Vs Growth Investing

- Growth Investing: Focus on tomorrow's winners at an early stage

- Quality Investing: Focus on companies that have already won

- Growth Investing: Focus on tomorrow's winners at an early stage

- Quality Investing: Focus on companies that have already won

Grab your copy of the book here: geni.us/SlNoKQL

• • •

Missing some Tweet in this thread? You can try to

force a refresh