Russian Oligarchs' Role in Drone Manufacturing and Sanction Evasion: Investigating sanctions evasion with exclusive documents and email correspondence.

🧵Thread exposing manipulation, cover-ups, and state aid to evade sanctions revealed through leaked documents and emails:

🧵Thread exposing manipulation, cover-ups, and state aid to evade sanctions revealed through leaked documents and emails:

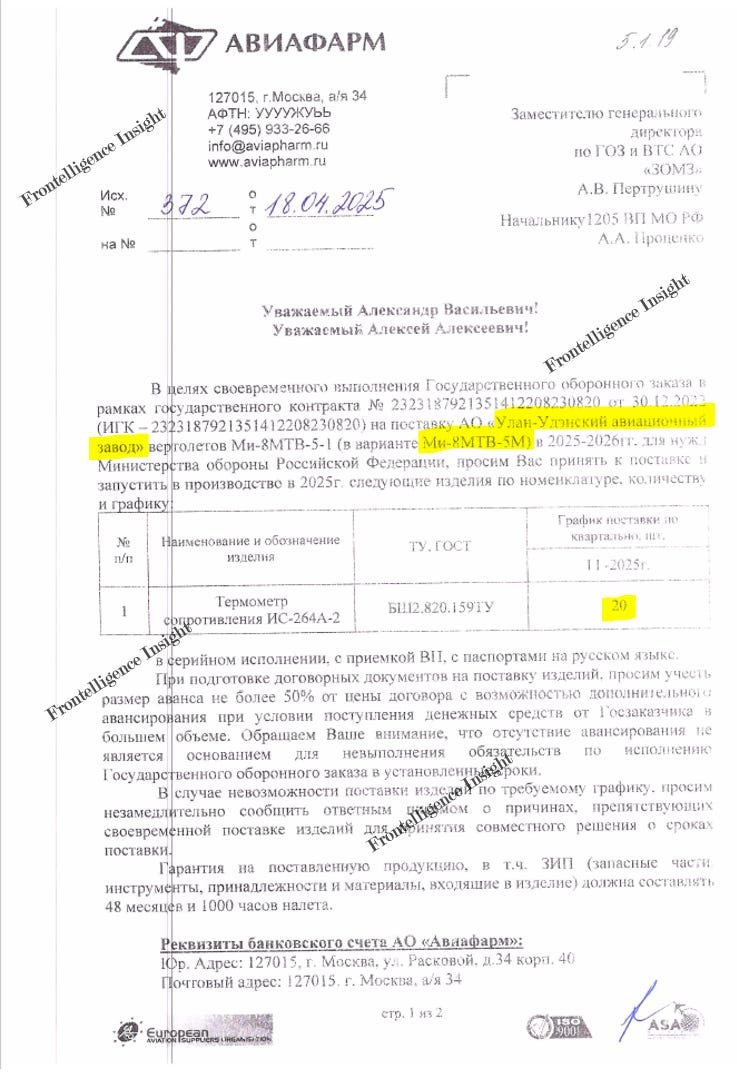

2/ Russian companies aiding military production may not be easily discernible. Consider RusAgro, which presents itself solely as a major agricultural player, owned by sanctioned oligarch Vadim Moshkovich. Another key figure is Maxim Basov - its CEO. Keep these names in mind

3/ In addition to their association with RusAgro, Maxim Basov and Vadim Moshkovich co-founded a company called AssistAgro in 2021. Both RusAgro and AssistAgro have been subject to sanctions from both the US and Ukraine.

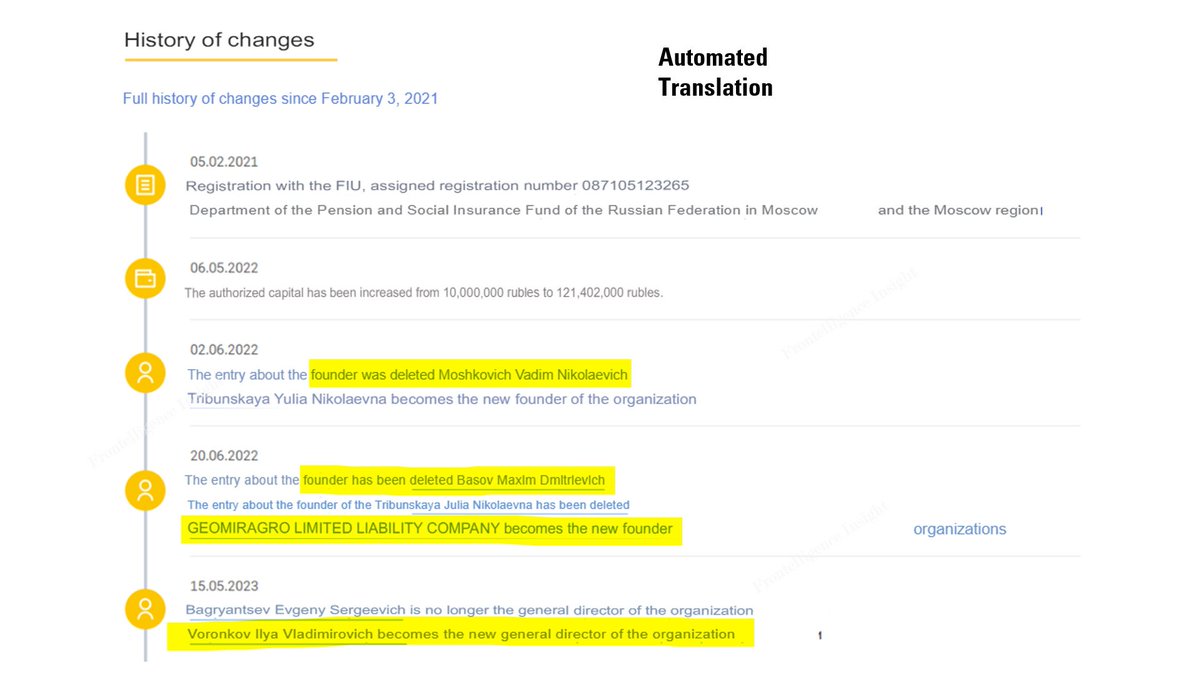

4/ When the invasion of Ukraine by Russia began and sanctions were imposed on oligarchs, some of them made attempts to alter the nominal ownership of companies.

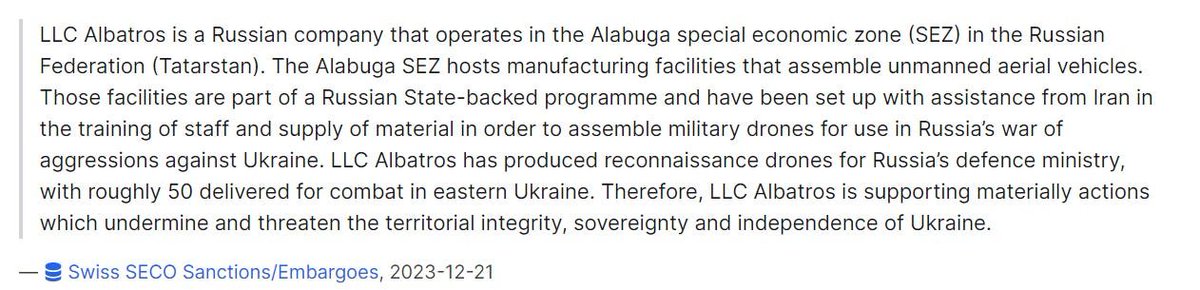

5/ Public registries indicate that AssistAgro owners Maxim Basov and Vadim Moshkovich were replaced by new owners, including Ilya Voronkov, linked to Albatros. Albatros LLC is sanctioned by several countries for producing reconnaissance drones for Russia, as per Swiss SECO.

6/The drones produced by Albatros were delivered and utilized in Eastern Ukraine against Ukrainian forces during combat operations. Furthermore, this assertion can be independently confirmed through video evidence, which has been published by Russian sources themselves.

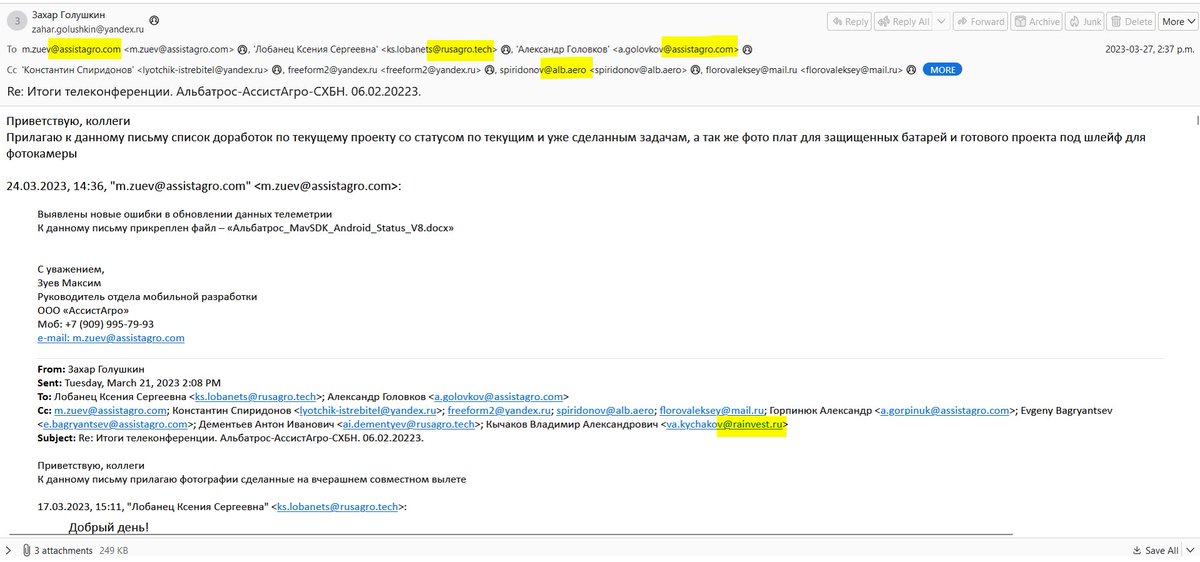

7/ The ties between these individuals and companies go beyond ownership changes. Through accessing hundreds of emails, we've uncovered correspondence among members deliberating on drone-related issues. Discussions involve representatives from RusAgro, AssistAgro, and Albatros.

8/ The discussion revolves around testing and issues related to UAVs, accompanied by photos, which further substantiates that these companies are not only linked by common founders but also by collaboration in drone production.

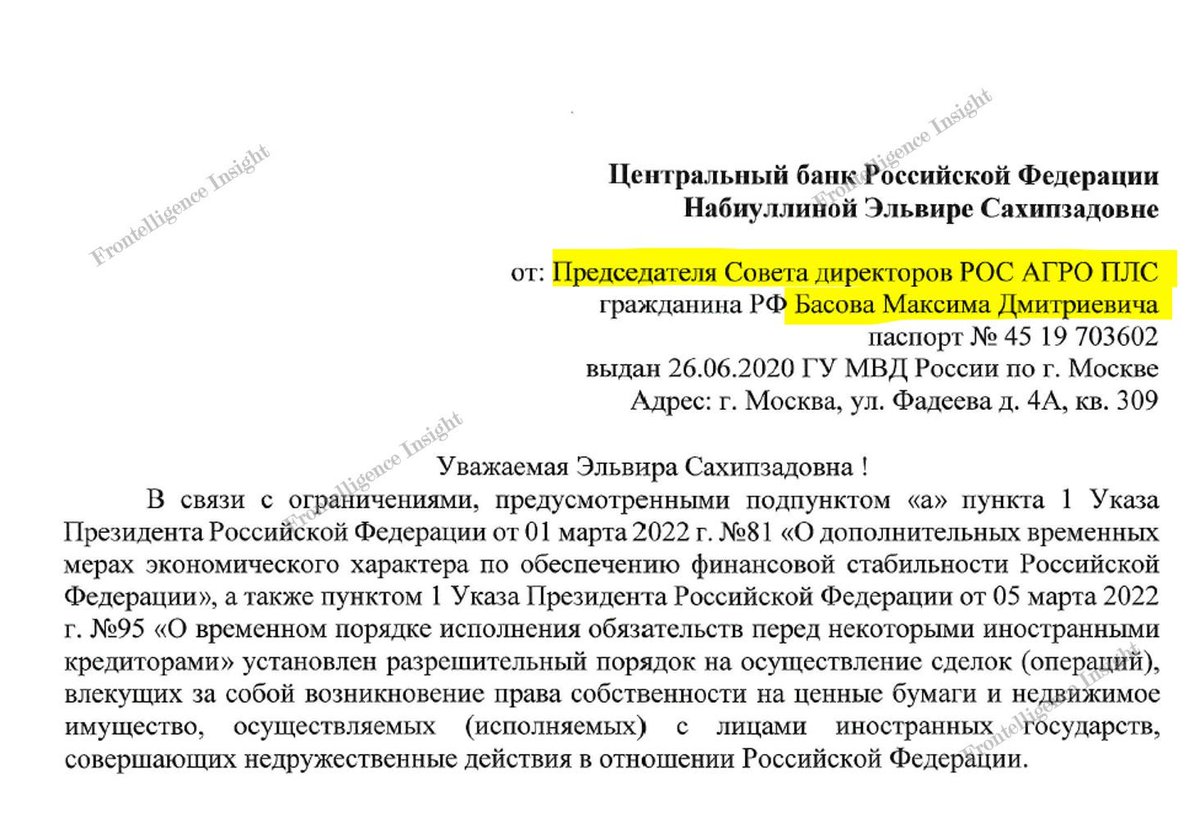

9/ With that information in mind, let's revisit Maxim Basov. On 09.06.2022, Maxim Basov contacted Elvira Nabiullina, the Head of the Central Bank of Russia, asking for the transfer of financial assets from his Cyprus-based company to his own name to evade sanctions.

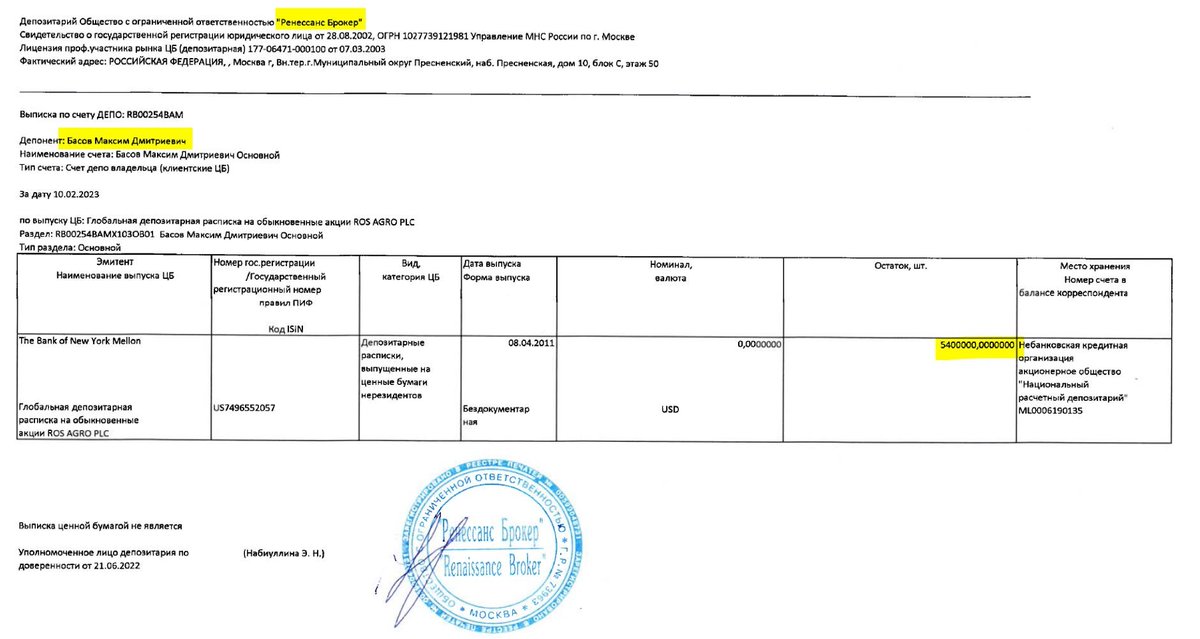

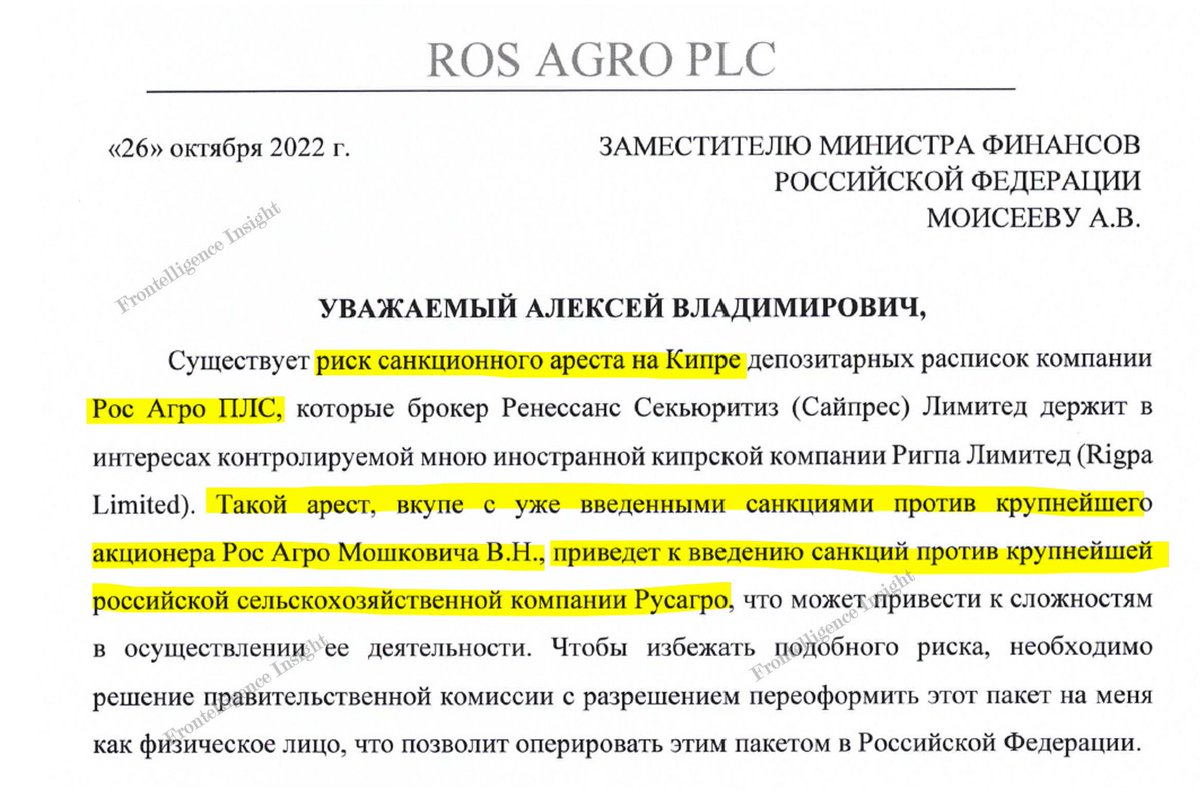

10/ The proposed scheme: The Cyprus company RIGPA LIMITED, owned by Maxim Basov, transfers 54M Rus AGRO depositary receipts, held at brokerage Renaissance Securities, to Basov himself, enabling their use in Russia and avoiding the risk of asset seizure in Cyprus.

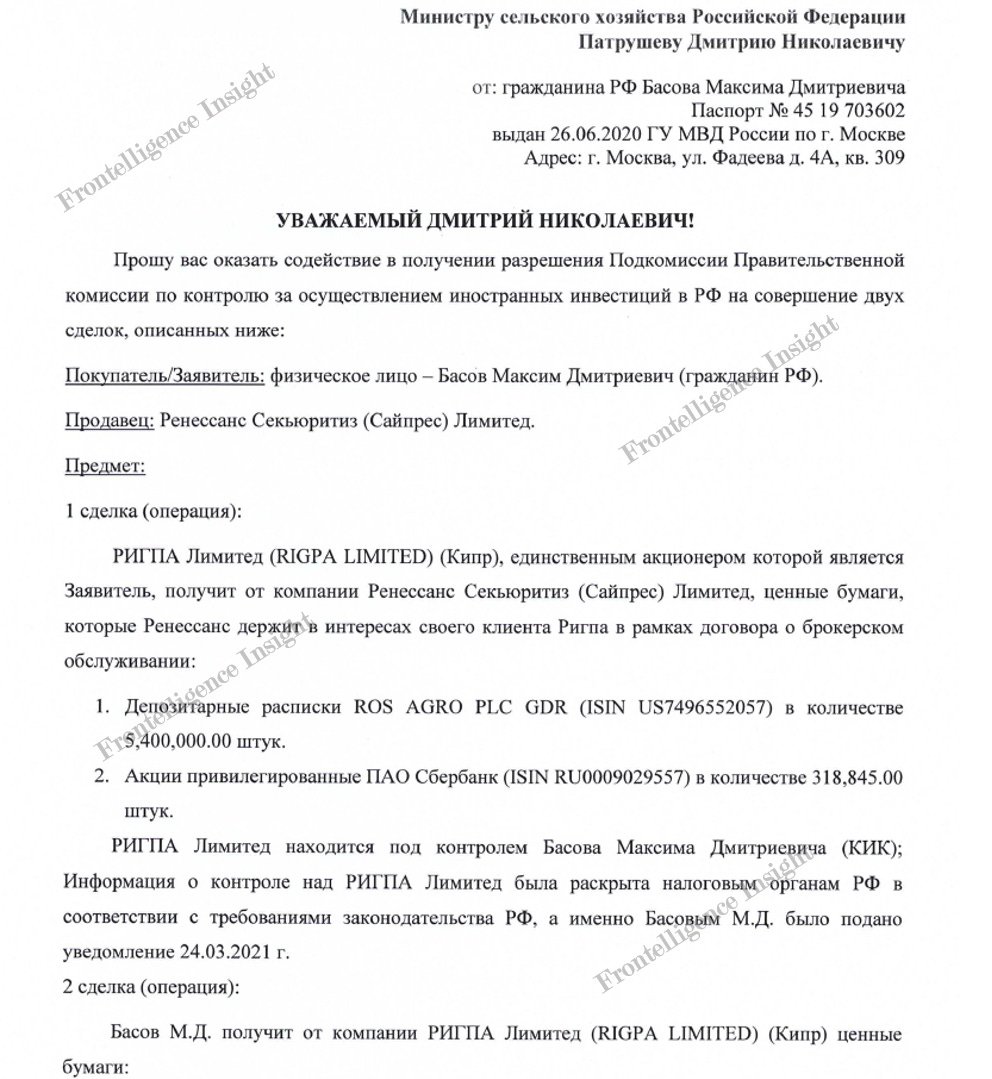

11/ On the 22nd of August, he receives a rejection letter from the Central Bank, explaining why his requested actions are not applicable to his specific case.

12/ On October 26, 2022, Basov sent another request, reaching out to Minister of Agriculture Dmitry Patrushev. The name may sound familiar, as he is the son of Nikolai Patrushev, former FSB director and head of the Russian Security Council - one of Putin's staunchest allies.

13/ The balance document issued by Renaissance Broker on February 10, 2023, indicates that the Rus Agro (Ros Agro PLC) depositary receipts are registered under his name - Maxim Basov. This suggests that he successfully transferred them from RIGPA Limited to himself

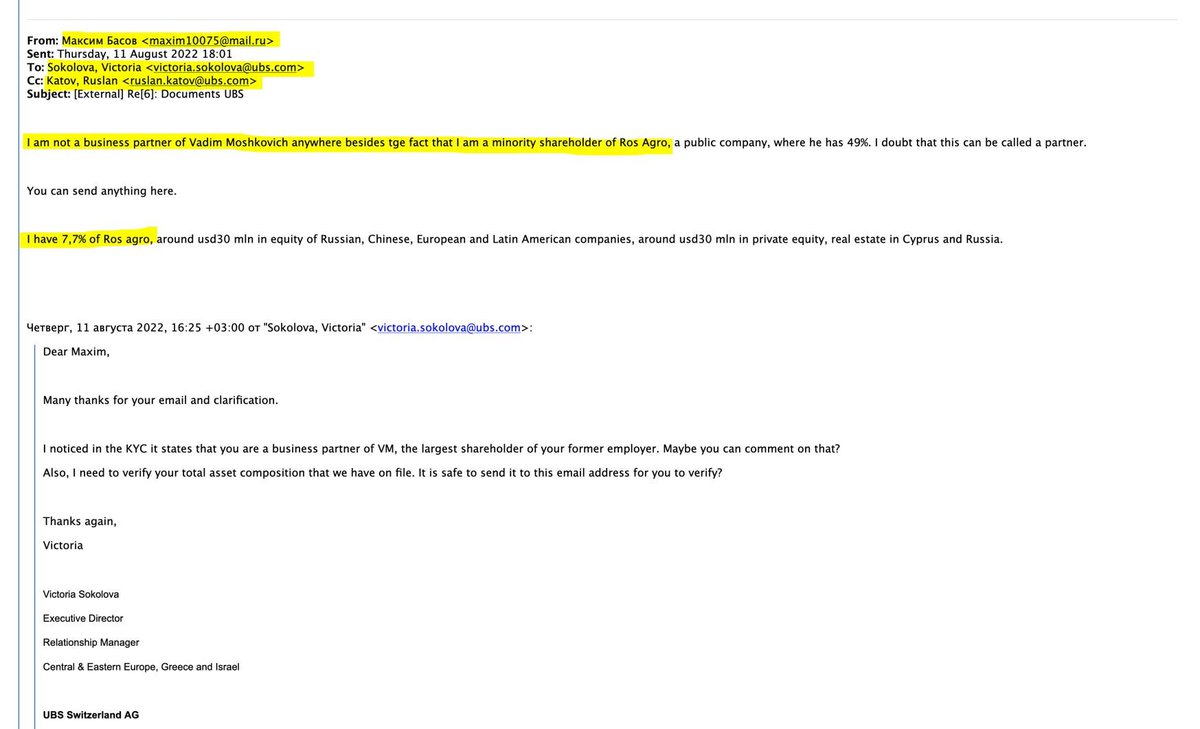

14/ In August 2022, Basov worked with UBS Bank (Switzerland) - specifically with Victoria Sokolova and Ruslan Katov. Victoria sought Basov's input on a KYC statement regarding his connection to sanctioned Vadim Moshkovich. Basov claimed that he was not his business partner

15/It's a clear fabrication, given that Basov served as CEO at RusAgro under Moshkovich until 2021 and co-founded another company, AssistAgro, with him. Furthermore, in a May 2022 letter to Nabiullina, Basov identified himself as the Chairman of the Board of Directors of RusAgro

16/ In another request addressed to the Deputy Minister of Finances, Alexey Moiseev, written in October of 2022, Basov asks to help with his efforts to mitigate the risk of sanctions being imposed on depositary receipts of Rus Agro, and he also links this to oligarch Moshkovich

17/ We also noted that Basov was corresponding with an employee of Russian origin to address this issue at UBS Bank. Upon conducting an additional check, we discovered interesting information. According to the Delta Executive Search post, Victoria Sokolova, to quote:

18/ ...has over 20 years of experience in Corporate and Investment Banking... as a top ranked Equity Research analyst in London and more recently as part of the oligarch coverage team at Sberbank CIB

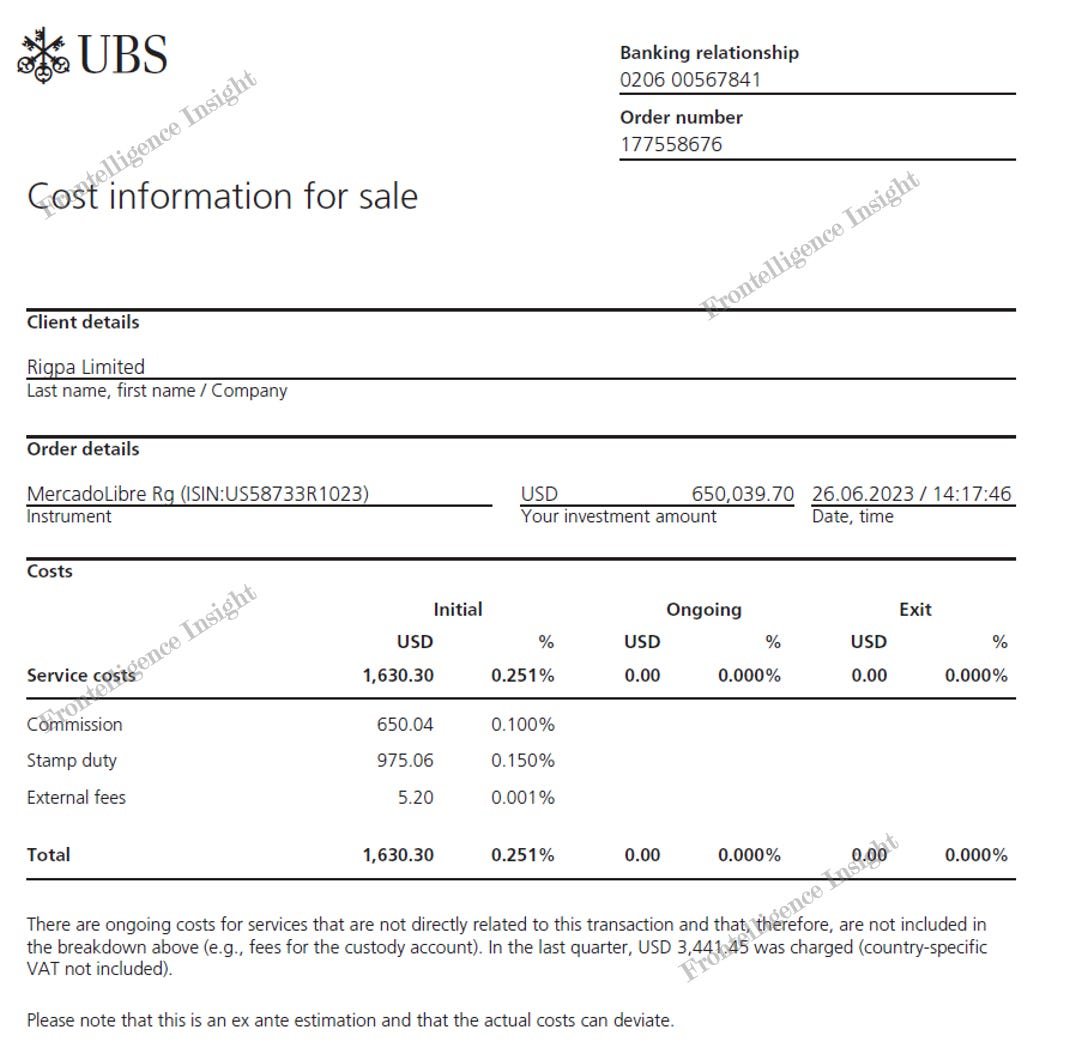

19/ Based on UBS sale documents issued to Rigpa Limited - Maxim’s offshore company registered in Cyprus, it's evident he continued operating via UBS in 2023. This suggests he likely passed the KYC process, despite affiliations and direct involvement with sanctioned entities.

20/ Documentary evidence unequivocally shows the involvement of Maxim Basov, Vadim Moshkovich, and Ilya Voronkov enterprise in drone manufacturing activities, concealed under the guise of existing agricultural enterprises. Not only have they taken proactive steps to evade potential asset seizures through associations, but it appears that Maxim Basov also lied during the KYC process, while UBS may have failed to conduct thorough due diligence. Their efforts to distance themselves from drone production by manipulating formal ownership and transferring assets amidst sanction risks suggest a clear awareness of their involvement in illicit activities, prompting preemptive measures to evade potential repercussions.

Through email correspondence, it has become evident that companies like RusAgro and AssistAgro are directly involved in the production of drones aiding the invasion of Ukraine. Consequently, despite their efforts to conceal their involvement in such activities, there should be a stronger stance from the international community against these companies and their affiliated entities.

Through email correspondence, it has become evident that companies like RusAgro and AssistAgro are directly involved in the production of drones aiding the invasion of Ukraine. Consequently, despite their efforts to conceal their involvement in such activities, there should be a stronger stance from the international community against these companies and their affiliated entities.

21/ If you have found this thread valuable, please consider liking and sharing the thread's first message. Additionally, we kindly ask for your support, as we do not have any funding outside of your donations and subscriptions:

buymeacoffee.com/frontelligence

buymeacoffee.com/frontelligence

• • •

Missing some Tweet in this thread? You can try to

force a refresh