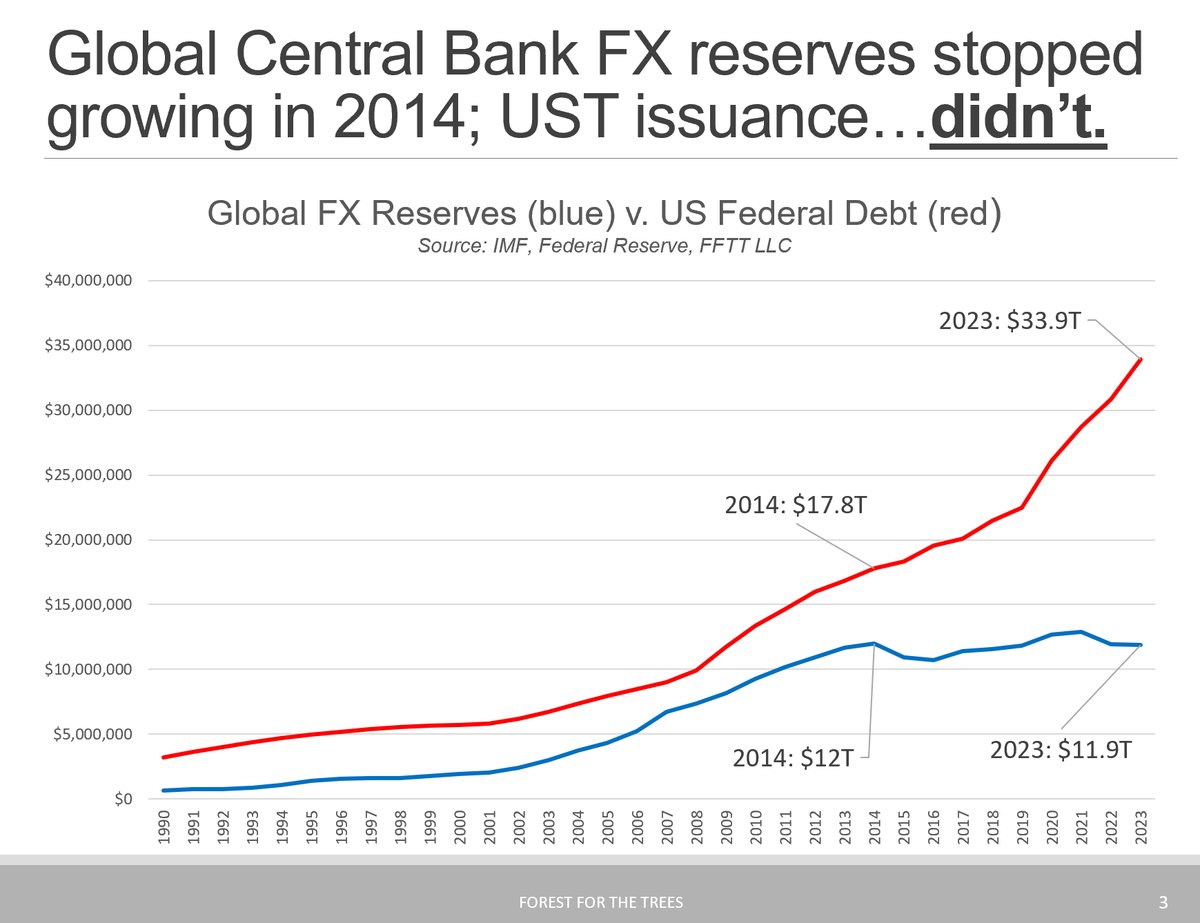

When I see this chart, I see that Hitler movie meme in my head, with Hitler saying "As long as Central Banks keep growing UST holdings, the US fiscal situation will be fine", followed by his general nervously saying, "Uh, sir...global CB's stopped growing UST holdings in 2014."

• • •

Missing some Tweet in this thread? You can try to

force a refresh