Founder & President, Forest for the Trees (FFTT). Author of "The Mr. X Interviews, Volumes I & II.” I never solicit via DM's. RT not endorsements.

50 subscribers

How to get URL link on X (Twitter) App

2/ And I'm not talking about the 2-3% official CPI rate that even former US Treasury Secretary Larry Summers noted in early 2024 is total bullsh*t:

2/ And I'm not talking about the 2-3% official CPI rate that even former US Treasury Secretary Larry Summers noted in early 2024 is total bullsh*t:

2/ If we want to cut Entitlements + Defense to reduce the deficit/GDP, only to end up with higher deficit/GDP by the end of 2025 as stocks fall hard & rates spike on strong USD (see Wed's post-Fed market action), then we should do what Milei did in Argentina before devaluing USD

2/ If we want to cut Entitlements + Defense to reduce the deficit/GDP, only to end up with higher deficit/GDP by the end of 2025 as stocks fall hard & rates spike on strong USD (see Wed's post-Fed market action), then we should do what Milei did in Argentina before devaluing USD

2/ Complicating this is that US debt/GDP is so high that the US & global system has empirically shown it goes into a debt spiral at ~5% on 10y USTs...

2/ Complicating this is that US debt/GDP is so high that the US & global system has empirically shown it goes into a debt spiral at ~5% on 10y USTs...

2/ SPX Index alone (not Total Return) is even worse - up 392% in USD terms since January 1999, but down 49% in gold terms.

2/ SPX Index alone (not Total Return) is even worse - up 392% in USD terms since January 1999, but down 49% in gold terms.

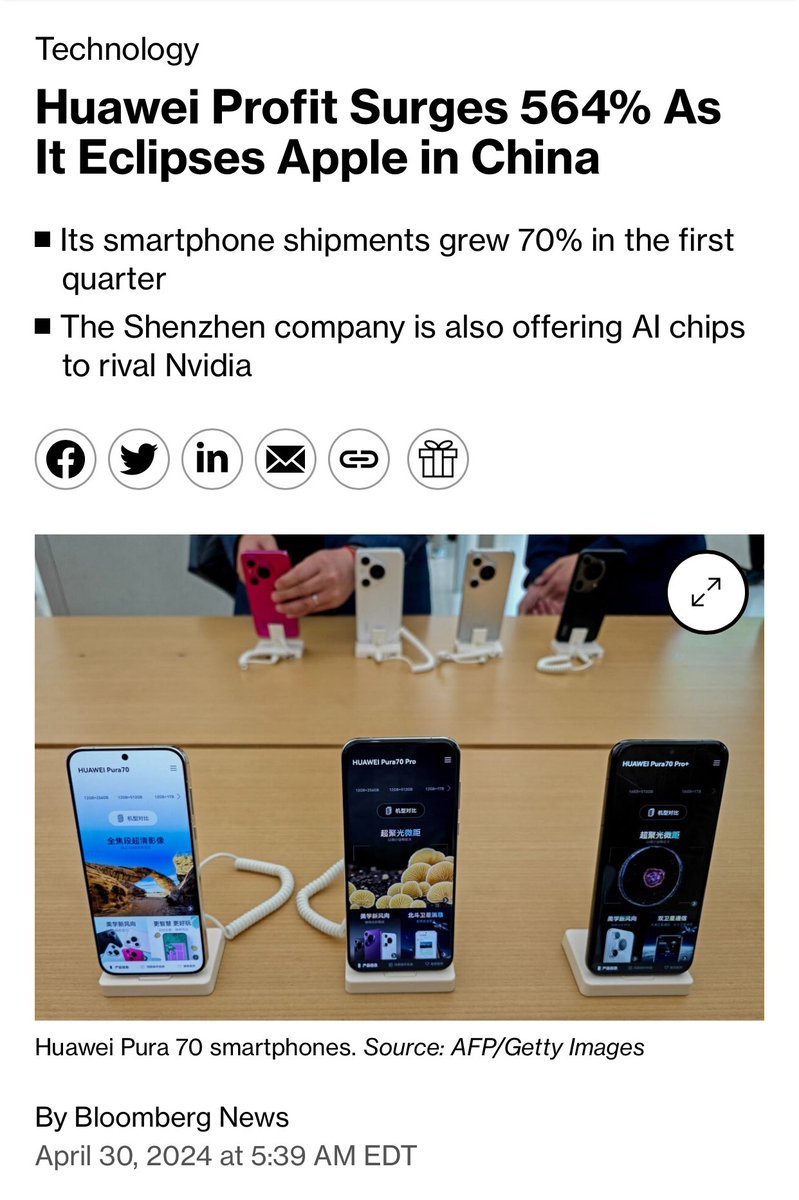

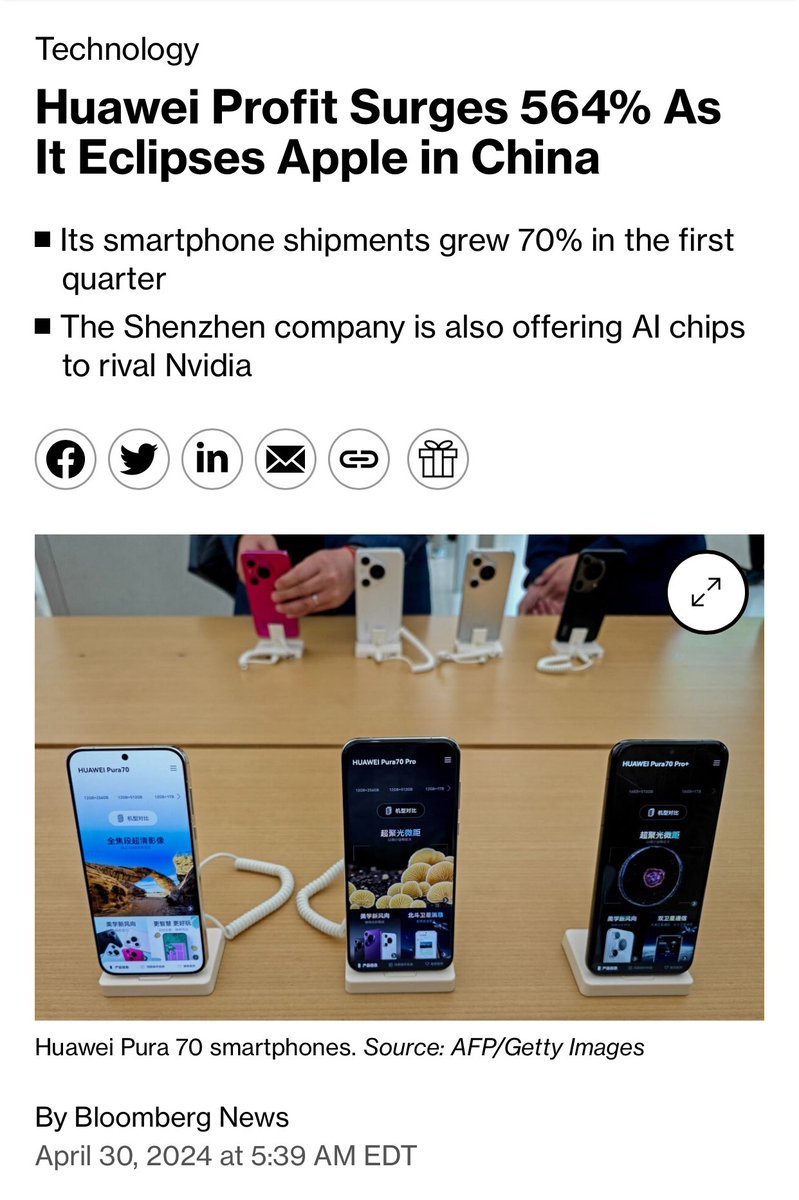

2/ Former INTC CEO Andy Grove warned about this 14 years ago in @EdwardGLuce's excellent book, "Time to Start Thinking: America in the Age of Descent."

2/ Former INTC CEO Andy Grove warned about this 14 years ago in @EdwardGLuce's excellent book, "Time to Start Thinking: America in the Age of Descent."

2/ Here's LT USTs v. SPX, since global Central Banks stopped growing holdings of USTs on net in 3q14:

2/ Here's LT USTs v. SPX, since global Central Banks stopped growing holdings of USTs on net in 3q14:

2/ Bakken? Below 2019 production levels:

2/ Bakken? Below 2019 production levels:

2/ The next few quotes are from @EdwardGLuce's excellent & prescient 2012 book, "Time to Start Thinking: America in the Age of Descent"

2/ The next few quotes are from @EdwardGLuce's excellent & prescient 2012 book, "Time to Start Thinking: America in the Age of Descent"

https://twitter.com/EpsilonTheory/status/17675310986558587312/ To stop inflation at this point, the Fed would need to cut rates to 0% & balance the Federal budget, which would trigger a 7% of GDP decline.

2/ US policymakers could have cross-checked their analysis that it was all "automation" by watching inbound container volumes at US ports, but chose to ignore the inconvenient message (to "free trade" dogma) contained in record inbound container volumes.

2/ US policymakers could have cross-checked their analysis that it was all "automation" by watching inbound container volumes at US ports, but chose to ignore the inconvenient message (to "free trade" dogma) contained in record inbound container volumes.

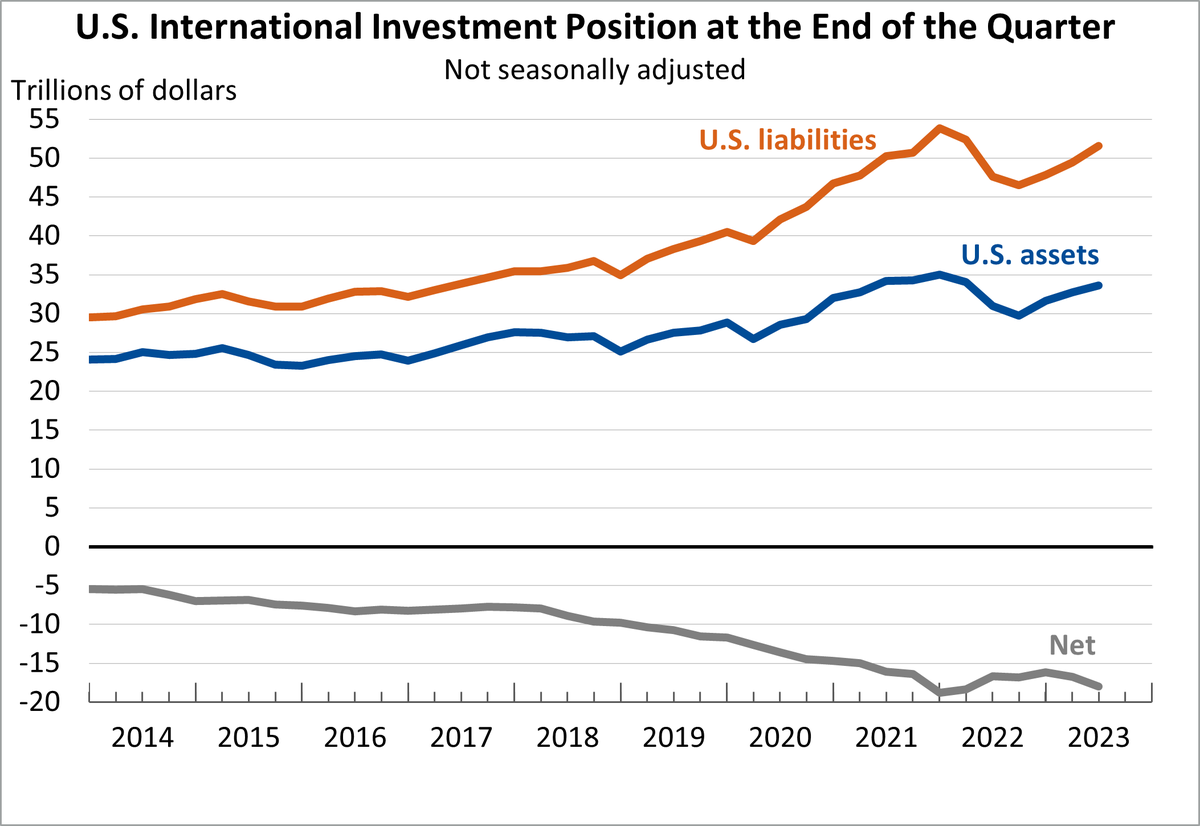

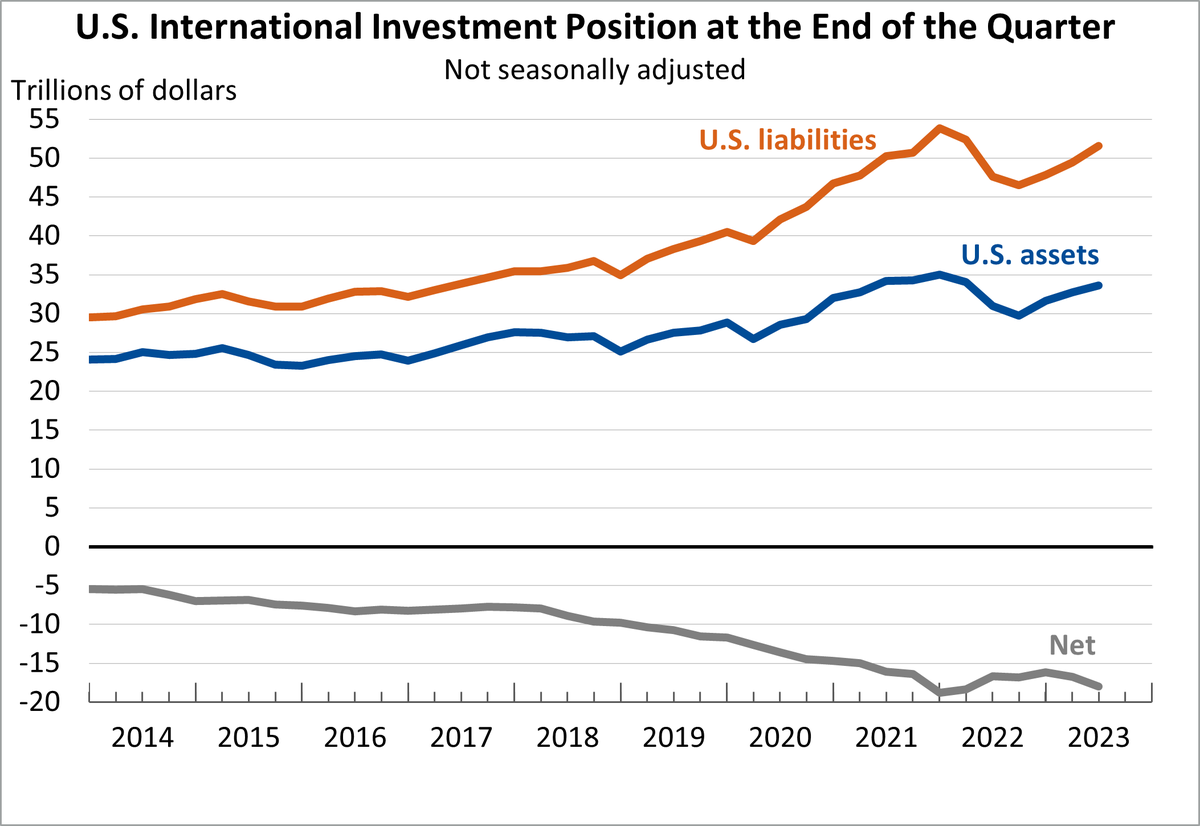

2/ This is what the "Let's weaponize a stronger USD!" advocates continue to miss.

2/ This is what the "Let's weaponize a stronger USD!" advocates continue to miss.https://twitter.com/DeItaone/status/17114029286725063562/ The cure to "USD Dutch Disease" is simple, but not politically easy:

2/ For this divergence to close, Fed needed only to stand aside & let unsecured depositors at SVB, etc. lose 100% of their unsecured deposits, & then continue to stand aside thru the ensuing bank run, equity mkt sell-off, & severe global recession that likely would've followed.

2/ For this divergence to close, Fed needed only to stand aside & let unsecured depositors at SVB, etc. lose 100% of their unsecured deposits, & then continue to stand aside thru the ensuing bank run, equity mkt sell-off, & severe global recession that likely would've followed.

https://twitter.com/michaelxpettis/status/1646571061461520385

2/ Many arguing that "de-dollarization isn't happening" employ a strawman argument like:

2/ Many arguing that "de-dollarization isn't happening" employ a strawman argument like: