The biggest winners of this cycle will be apps that vertically integrate and build on-chain biz models

As web3 infra becomes increasingly commoditized, distribution is THE thing that matters

1/ Here is how consumer apps are quietly eating infrastructure

As web3 infra becomes increasingly commoditized, distribution is THE thing that matters

1/ Here is how consumer apps are quietly eating infrastructure

2/ Apps will finally have their day by commoditizing the crypto infra stack and vertically integrating

Attention, Distribution, Brand

These are what matters in this industry and the leading apps have it in spades

Attention, Distribution, Brand

These are what matters in this industry and the leading apps have it in spades

3/ If you have proprietary brand and distribution why are you going to let ETH, OP, SOL make money off your success?

You're going to vertically integrate and start rolling more of your own infra

The simplest way to do this is to roll your own L1 or L2 and so teams start here

You're going to vertically integrate and start rolling more of your own infra

The simplest way to do this is to roll your own L1 or L2 and so teams start here

4/ This generally fits into the appchain thesis but market leaders will take it even further

They don't just want their own L1/L2, they also want everyone else to deploy there

They don't just want their own L1/L2, they also want everyone else to deploy there

5/ There have been existential questions about whether anything in consumer crypto will ever make any money and I think the answer is increasingly clear

Consumer apps will make money by becoming 'infrastructure'

Consumer apps will make money by becoming 'infrastructure'

6/ Why now?

(A) Tech stack has gotten good enough that its easy to roll own blockchain

(B) Top crypto apps real hitting scale

(C) Disillusionment with endless infra cycle

(A) Tech stack has gotten good enough that its easy to roll own blockchain

(B) Top crypto apps real hitting scale

(C) Disillusionment with endless infra cycle

7/ It's getting easier and easier to roll your own L1/L2

LP's always ask the question of where has the $1B+ invested into blockchain infra gone and we are now seeing the answer

The answer is that it's making it WAY simpler to launch blockchains

LP's always ask the question of where has the $1B+ invested into blockchain infra gone and we are now seeing the answer

The answer is that it's making it WAY simpler to launch blockchains

8/ @Blast_L2 is the poster child

The team built a top 3 NFT marketplace and has executed insanely well

They needed to deploy an L2 to support new products like NFT perpetual products

They told OP and ARB to GTFO and rolled their own L2

The team built a top 3 NFT marketplace and has executed insanely well

They needed to deploy an L2 to support new products like NFT perpetual products

They told OP and ARB to GTFO and rolled their own L2

9/ Blast's largest innovations are not technical

They integrated Lido and Maker for yield (financial innovation)

They successfully leveraged Blur's stellar brand (marketing innovation)

These are different innovation vectors than last cycle's L2's like OP and ARB

They integrated Lido and Maker for yield (financial innovation)

They successfully leveraged Blur's stellar brand (marketing innovation)

These are different innovation vectors than last cycle's L2's like OP and ARB

10/ Same thing with @MantaNetwork

-Smart financial innovation in introducing yield to bridging

-Great marketing

But a lot of it is 3rd party tech (OP stack + Caldera)

Tech is not the primary innovation here

-Smart financial innovation in introducing yield to bridging

-Great marketing

But a lot of it is 3rd party tech (OP stack + Caldera)

Tech is not the primary innovation here

11/ Users clearly love it!

Blast + Manta are 4th and 7th biggest L2's

They are ahead or on par with more technically innovative products like zkSync and Starknet

Blast + Manta are 4th and 7th biggest L2's

They are ahead or on par with more technically innovative products like zkSync and Starknet

12/ If you take a bunch of third party infra and layer on a smart proprietary incentive scheme, is that infrastructure?

I think yes because its a blockchain and 3rd party apps can deploy there

But these things are slowly redefining what infrastructure is

I think yes because its a blockchain and 3rd party apps can deploy there

But these things are slowly redefining what infrastructure is

13/ We will see more of this as leading crypto apps hit scale - they will roll their own infrastructure and generate larger outcomes than a lot of the underlying software stack

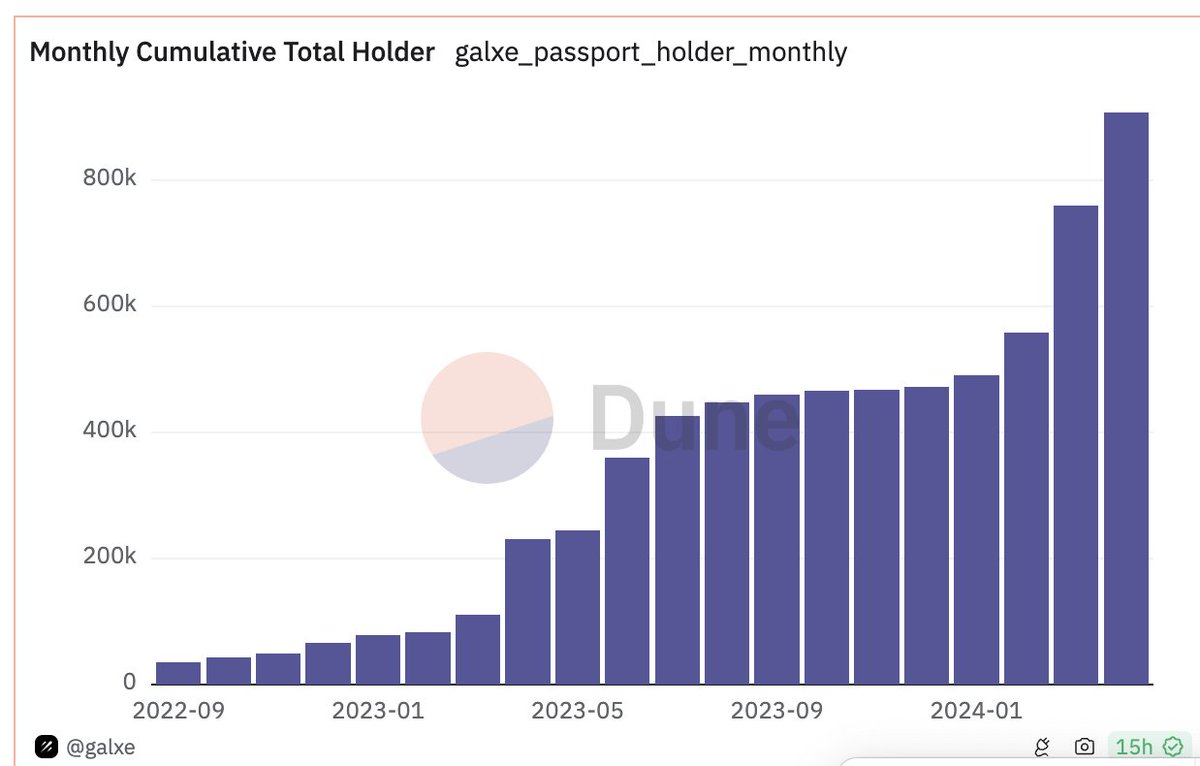

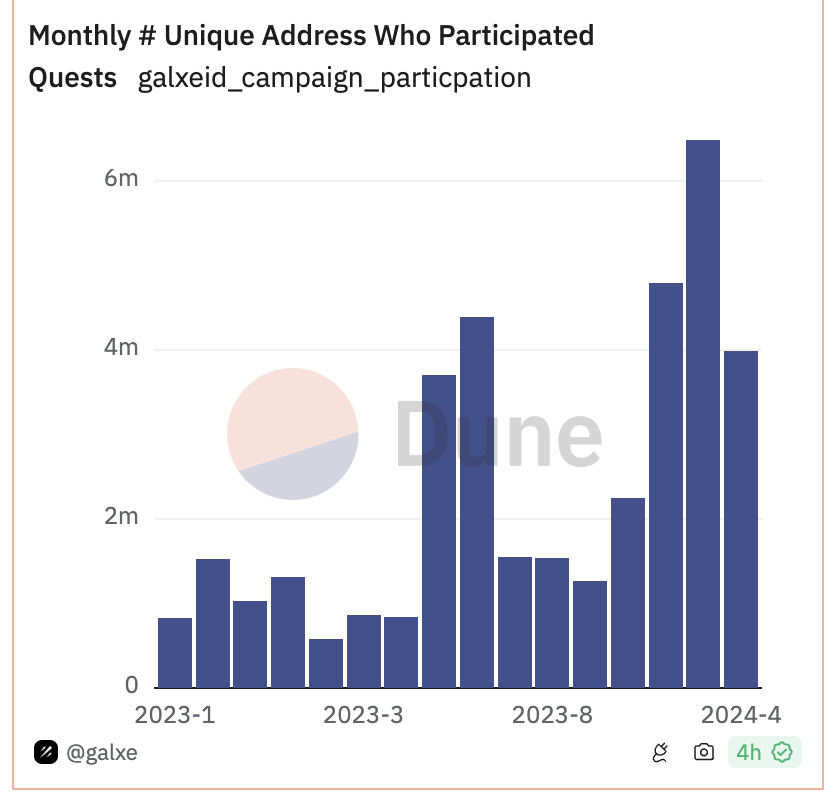

14/ Let's look at @Galxe (lattice portco) - they have built the top identity protocol in the industry and 3-5M wallets per month complete their quests

If they rolled their own L2, they would *day one* be top 10 users wise

If they rolled their own L2, they would *day one* be top 10 users wise

15/ Over 800K users have *paid* to KYC on Galxe and mint a passport

OP has something like 30-40k DAU's

Galxe is in tentpole position to vertically integrate and if their userbase keeps growing, other consumer facing apps will want to build on that

OP has something like 30-40k DAU's

Galxe is in tentpole position to vertically integrate and if their userbase keeps growing, other consumer facing apps will want to build on that

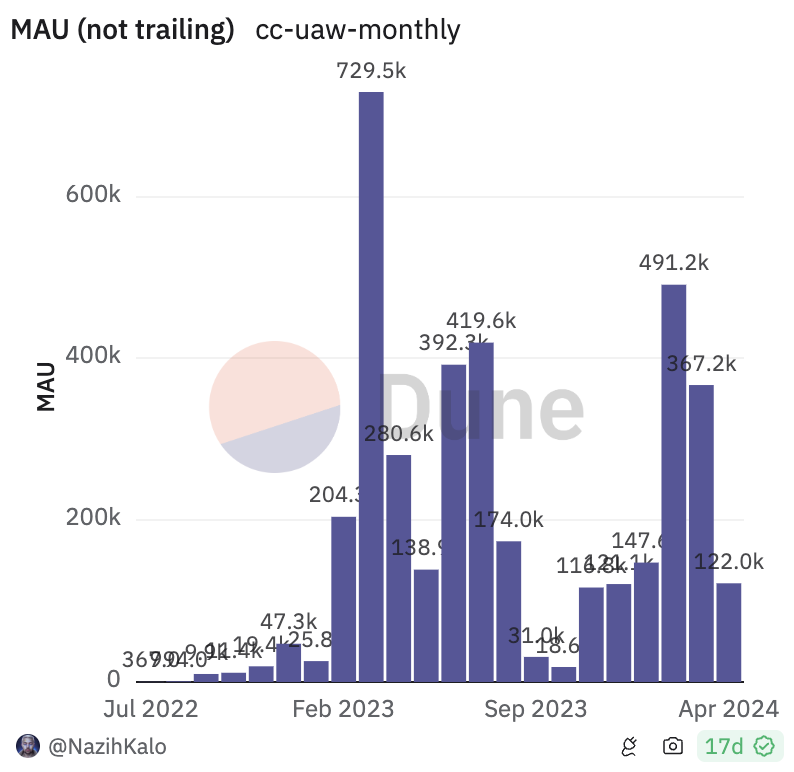

16/ Let's look at @cyberconnecthq (lattice portco)

They are consistently seeing 100K's MAU's across their social products

This is more than most generalized L2's!

They are consistently seeing 100K's MAU's across their social products

This is more than most generalized L2's!

17/ And now they're rolling their own social focused L2 with a native AA wallet + no seed phrases

Purpose built L2 for social apps and you can tap into their large userbase on day one

Will be a no brainer for more social apps to deploy here

Purpose built L2 for social apps and you can tap into their large userbase on day one

Will be a no brainer for more social apps to deploy here

https://x.com/CyberConnectHQ/status/1766117131513708664

18/ Layer3 (lattice portco) is aggregating consumer attention at mass scale across chains

They are already bigger than some of the established L2's

Why wouldn't they vertically integrate?

They are already bigger than some of the established L2's

Why wouldn't they vertically integrate?

https://x.com/layer3xyz/status/1781673323111628930

19/ Devs will deploy where the users are

Users will follow flagship apps

Users will follow flagship apps

https://x.com/layer3xyz/status/1774450524055904340

20/ Zora is an OG at this and launched its own L2 last summer

It seems to be doing well although I no longer live in brooklyn and am a bit out of the nft crowd so I am not that familiar

It seems to be doing well although I no longer live in brooklyn and am a bit out of the nft crowd so I am not that familiar

21/ Apps eating infrastructure is happening at the exact time that retail is increasingly disillusioned with the endless infra cycle

There are limited bids for the 100's of random infra tokens

There are limited bids for the 100's of random infra tokens

https://x.com/reganbozman/status/1780688748755484885

22/ This is leading to broader questions about market structure and whether the whole crypto vc market is broken

I think people are just bored of the 5th DA solution

I think people are just bored of the 5th DA solution

https://twitter.com/wassielawyer/status/1782544534389358616?s=46

23/ This brings us to the battle between pro and anti meme coin investors

The pro meme coin crowd will point out that many meme coin critics have funded a bunch of infra no one uses

They aren't wrong!

The pro meme coin crowd will point out that many meme coin critics have funded a bunch of infra no one uses

They aren't wrong!

https://x.com/jessewldn/status/1783225310726504865

24/ Funding useless infra because liquid comps trade well is the OG form of Western crypto financial nihilism

And now the meme coin investors have figured out the racket and are running it much more efficiently

And now the meme coin investors have figured out the racket and are running it much more efficiently

https://x.com/reganbozman/status/1767619566346408364

25/ This markets seems to be much more selective and favors stories that are easy to tell

What's a better meme?

We're a better L2 bc we use zkEVM and 10x faster DA blah blah

OR

We are the leading social app with 250K MAU's and we are building the L2 for social

What's a better meme?

We're a better L2 bc we use zkEVM and 10x faster DA blah blah

OR

We are the leading social app with 250K MAU's and we are building the L2 for social

26/ If you're building something novel in consumer crypto, reach out

We've been day one backers of a handful of the teams mentioned above and would love to roll the dice a few more times

We've been day one backers of a handful of the teams mentioned above and would love to roll the dice a few more times

• • •

Missing some Tweet in this thread? You can try to

force a refresh