American Rare Earths ($ARR.ASX) has captured recent headlines, and if one believes what they say, this company is destined to be USA’s golden ticket to rare earth independence

Sounds fantastic right?

Well it is, except for the fact that this company is just your next scam preying on uninformed investors and politicians in the often misunderstood rare earth space

This thread will tell you exactly why this project is not going to materialize, and why the people behind it do everything to cover up it’s absurdity

Sounds fantastic right?

Well it is, except for the fact that this company is just your next scam preying on uninformed investors and politicians in the often misunderstood rare earth space

This thread will tell you exactly why this project is not going to materialize, and why the people behind it do everything to cover up it’s absurdity

Looking at the recent share price performance, one might assume that rare earths has indeed made a wild discovery, and is bound to be the rare earth treasure trove the USA was searching for all this time

However, when we dive into the details, we see that this company is just your typical junior covering up an uneconomical project with a neat looking powerpoint deck, and a shitty scoping study

Let me state it clearly: There is approximately 0 chance this will be a commercially and technically viable source of separated rare earth oxides for the USA

Let’s take a look

However, when we dive into the details, we see that this company is just your typical junior covering up an uneconomical project with a neat looking powerpoint deck, and a shitty scoping study

Let me state it clearly: There is approximately 0 chance this will be a commercially and technically viable source of separated rare earth oxides for the USA

Let’s take a look

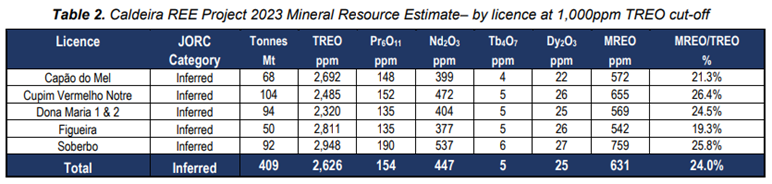

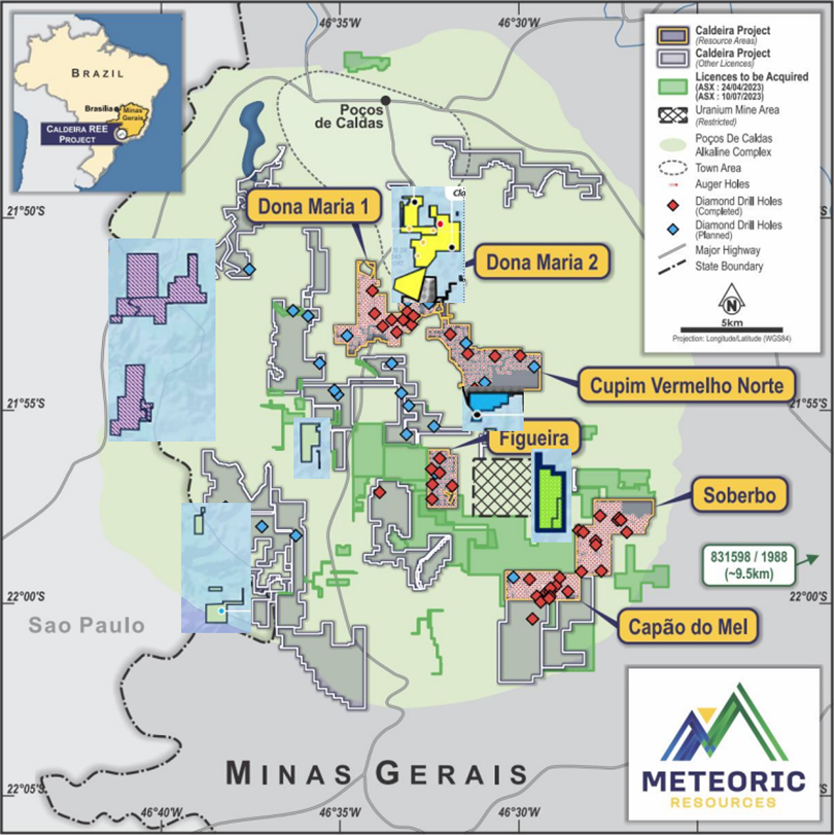

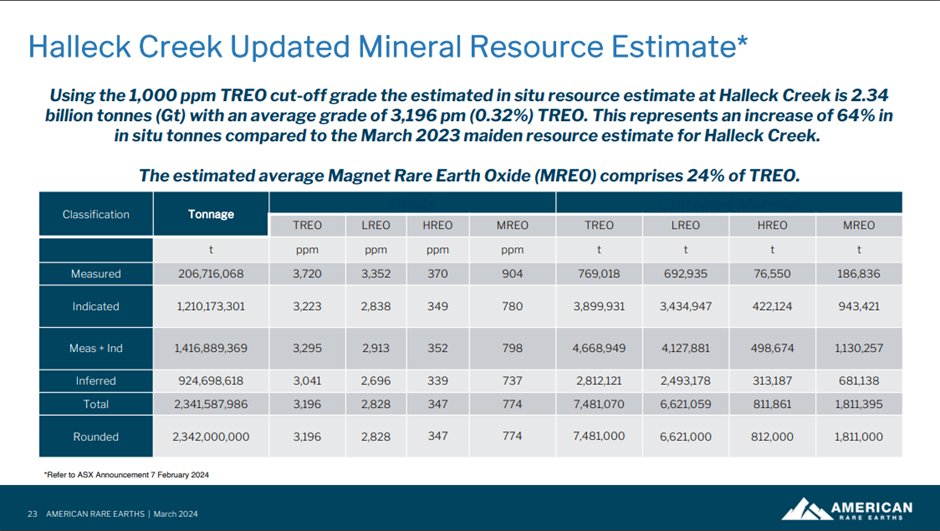

So American Rare Earth has a resource of approx. 2.4 billion tonnes at 3196ppm TREO (i.e. 0.3% TREO)

What’s interesting to note, and what is not directly mentioned here, is that the REEs in this resource are hosted in allanite which is a rare earth mineral that is thus far non-proven commercially speaking

(For now I’m setting aside the absurdly low grade, which would be typical for an ionic clay project, and not a hard rock mine where one must blast and crush the rock in order to liberate the target mineral)

What’s interesting to note, and what is not directly mentioned here, is that the REEs in this resource are hosted in allanite which is a rare earth mineral that is thus far non-proven commercially speaking

(For now I’m setting aside the absurdly low grade, which would be typical for an ionic clay project, and not a hard rock mine where one must blast and crush the rock in order to liberate the target mineral)

Why allanite is a problem is because the only proven commercial rare earth hard rock minerals (and thus with an existing flowsheet) are monazite/xenotime, bastnaesite and in small quantity loparite.

Sure, it is likely that REO extraction from allanite will be technically possible, but will it be anywhere close to commercial as well?

Sure, it is likely that REO extraction from allanite will be technically possible, but will it be anywhere close to commercial as well?

Let’s look at their plan

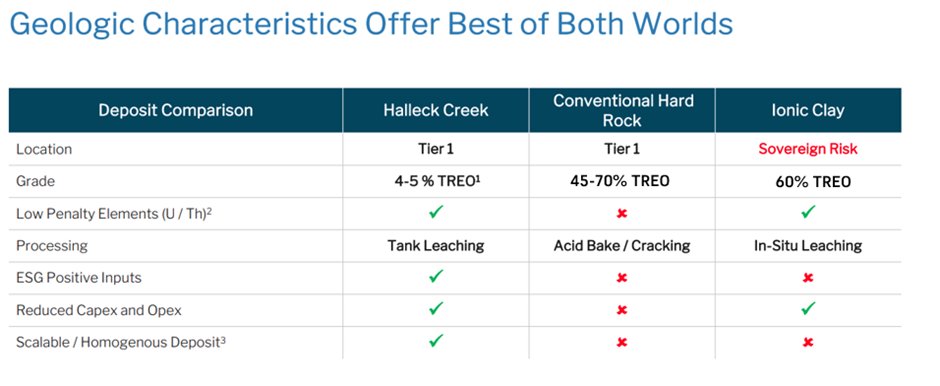

First indication that this project is utter shit, and that management is also well aware of that, is this slide in the investor presentation

Based on this slide one would assume that the project looks quite promising, with a grade of 4-5% TREO vs ~6% TREO grade in other hard rock projects

First indication that this project is utter shit, and that management is also well aware of that, is this slide in the investor presentation

Based on this slide one would assume that the project looks quite promising, with a grade of 4-5% TREO vs ~6% TREO grade in other hard rock projects

However, it’s only after reading the little footnotes that one finds out this 4-5% TREO figure is after the ore is upgraded through Dense Media Separation (DMS) and wet high intensity magnet separation (WHIMS) to a REO concentrate (!!)

What they do here is blatant junior shitco behaviour by portraying their concentrate grade against ore grades of other sources of rare earths. A fair comparison based on concentrate grade would’ve looked like this:

What they do here is blatant junior shitco behaviour by portraying their concentrate grade against ore grades of other sources of rare earths. A fair comparison based on concentrate grade would’ve looked like this:

I can see why they would leave this out of the corporate presentation (which remember, is essentially a sales deck convincing you to invest)

Producing a concentrate of a mere 5% TREO, while other concentrates target 50%+ does not make your project look good

Producing a concentrate of a mere 5% TREO, while other concentrates target 50%+ does not make your project look good

Just to see how idiotic producing a concentrate like this is, let’s make a net smelter revenue (NSR) estimate for this concentrate – that is, what a offtaker would pay for this material

American Rare Earth states they can produce a 4-5% TREO concentrate through DMS and WHIMS. Let’s take 4,5% for the sake of an example here.

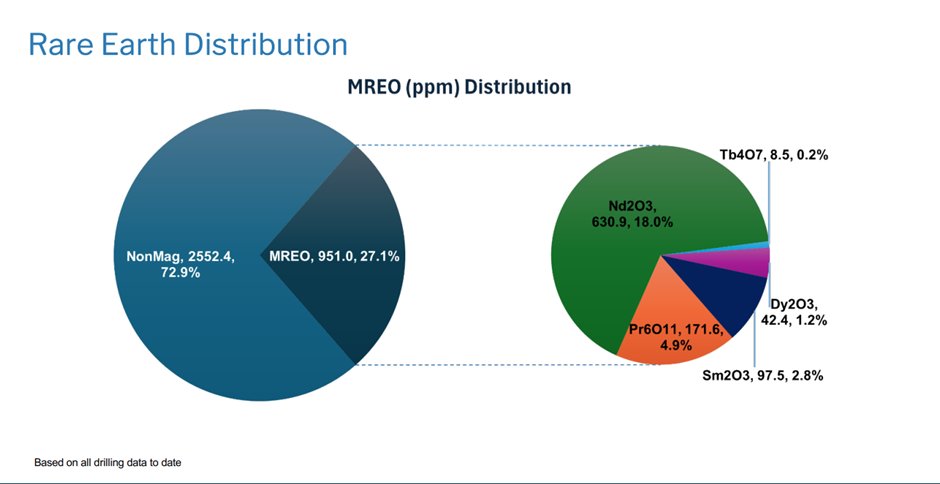

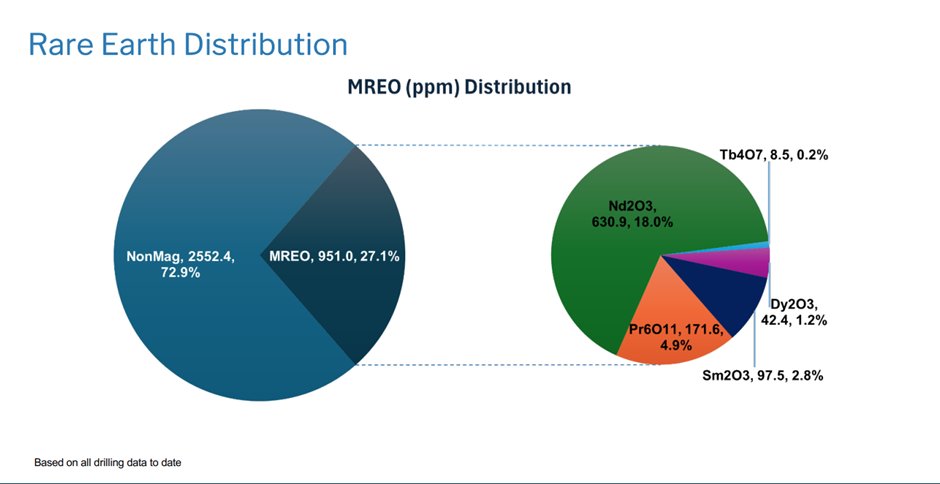

Based on the REO distribution in their allanite we can make an estimate of the potential price paid for this concentrate. I assume a 33% payability in for the concentrate (which is similar to basnaesite & monazite concentrates traded worldwide)

Based on the REO distribution in their allanite we can make an estimate of the potential price paid for this concentrate. I assume a 33% payability in for the concentrate (which is similar to basnaesite & monazite concentrates traded worldwide)

Remember that this is just for the sake to see what potential economics ‘could’ be, since this is not yet an established commercial rare earth mineral and has no recognized flowsheet yet, so neither a payability figure.

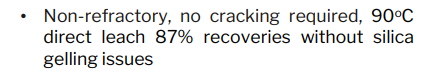

A counterargument could be made, that if allanite is in fact tank leachable at 90 degrees celcius blablabla the payability figure should be higher (since less costs would be incurred getting to separate oxides)

However, that would be easily countered by the fact that if one leaches 6% REO concentrate (so 94% gangue material) your acid usage will skyrocket as it reacts with all kinds of stuff nobody likes to see, also bringing along additional separation costs down the line

A counterargument could be made, that if allanite is in fact tank leachable at 90 degrees celcius blablabla the payability figure should be higher (since less costs would be incurred getting to separate oxides)

However, that would be easily countered by the fact that if one leaches 6% REO concentrate (so 94% gangue material) your acid usage will skyrocket as it reacts with all kinds of stuff nobody likes to see, also bringing along additional separation costs down the line

Okay so for the NSR revenue, let’s calculate

NdPr payability = 4,5% * (18% + 4,9%) * 33% * USD$60,000/t = USD$204/t

Dy payability = 4,5% * 1,2% * 33% * USD$275,000/t = USD$49/t

Tb payability = 4,5% * 0,2% * 33% * USD$875,000/t = USD$26/t

Total = USD$279/t

NdPr payability = 4,5% * (18% + 4,9%) * 33% * USD$60,000/t = USD$204/t

Dy payability = 4,5% * 1,2% * 33% * USD$275,000/t = USD$49/t

Tb payability = 4,5% * 0,2% * 33% * USD$875,000/t = USD$26/t

Total = USD$279/t

So for a 5% TREO allanite concentrate the mine owner can expect to be paid USD$279/t.

What do they have to do to achieve producing a concentrate?

Well, they have to

a) Blast the rock

b) Dig the rock and crush it

c) Run it through a DMS plant

d) Run it through a WHIMS

What do they have to do to achieve producing a concentrate?

Well, they have to

a) Blast the rock

b) Dig the rock and crush it

c) Run it through a DMS plant

d) Run it through a WHIMS

This part of the flowsheet seems actually quite similar to your average spodumene producer

(It’s always tricky to make cross sector comparisons, but for the lack of a better alternative, we can do a little order of magnitude estimate)

Many spodumene producers have a similar flowsheet to American Rare Earths, producing a concentrate via blasting, digging and DMS

If we assume the operating costs (AISC) of spodumene concentrate producers, which sit around USD400-700/t, we see how utterly uneconomical such an operation by American Rare Earth would be...

USD279/t in revenue with USD400/t+ in costs

(It’s always tricky to make cross sector comparisons, but for the lack of a better alternative, we can do a little order of magnitude estimate)

Many spodumene producers have a similar flowsheet to American Rare Earths, producing a concentrate via blasting, digging and DMS

If we assume the operating costs (AISC) of spodumene concentrate producers, which sit around USD400-700/t, we see how utterly uneconomical such an operation by American Rare Earth would be...

USD279/t in revenue with USD400/t+ in costs

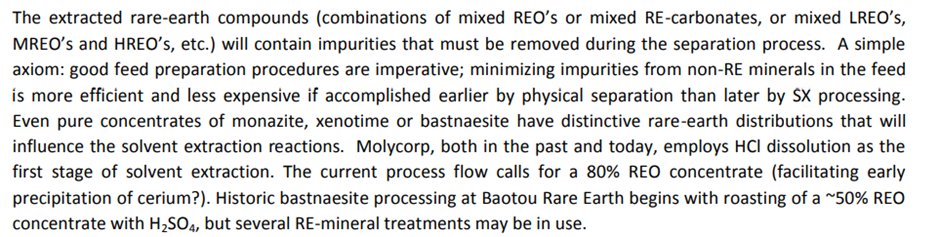

Moreover, were they to somehow produce this concentrate at a break even price, there is another problem to be dealt with

Nobody wants it

Allanite is non-proven commercially, and the low grade concentrate $ARR plans to produce, complicates things further

That is because low concentrate grade means a lot of impurities will be sent further downstream (unless further beneficiated). This means unnecessary complexification and reagent use once the concentrate is digested through leaching and enters the SX circuit.

Nobody wants it

Allanite is non-proven commercially, and the low grade concentrate $ARR plans to produce, complicates things further

That is because low concentrate grade means a lot of impurities will be sent further downstream (unless further beneficiated). This means unnecessary complexification and reagent use once the concentrate is digested through leaching and enters the SX circuit.

There is therefore no reason why any Chinese party would accept this concentrate over the readily available monazite concentrate or rare earth carbonate on the market.

One would be very desperate were they to take upon the technical and economical risk of accepting an allanite concentrate

One would be very desperate were they to take upon the technical and economical risk of accepting an allanite concentrate

To summarize thus far:

This mine will produce:

a) a low grade concentrate (i.e. not pure)

b) at negative NSR margin

c) that nobody wants to buy

This mine will produce:

a) a low grade concentrate (i.e. not pure)

b) at negative NSR margin

c) that nobody wants to buy

Now, $ARR has realized point C as well, and therefore plans to separate and produce the rare earth oxides themselves

I can make a whole separate thread about the problems with that as well, but will just keep it simple:

1. Allanite is a non-proven commercial REE mineral

2. The concentrate is super low grade, this will cause reagent costs to skyrocket and the solvent extraction (SX) circuit to break down

Voila

I can make a whole separate thread about the problems with that as well, but will just keep it simple:

1. Allanite is a non-proven commercial REE mineral

2. The concentrate is super low grade, this will cause reagent costs to skyrocket and the solvent extraction (SX) circuit to break down

Voila

Now, I do not expect this thread to gain much traction, as it is filled with mining and refining details

The problem is, it's exactly these technical details what ultimately make or break a project

The $ARR c-suite knows very well most people don't understand the details, and prey with their sales pitch on the unassuming retail investor and average politician

The problem is, it's exactly these technical details what ultimately make or break a project

The $ARR c-suite knows very well most people don't understand the details, and prey with their sales pitch on the unassuming retail investor and average politician

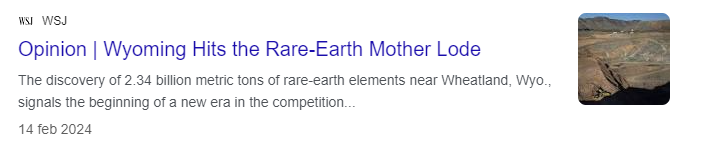

Headlines like this in the WSJ exacerbate the problem further

The problem is that marketing like this has real world implications, with (government) funding allocated to shit projects that produce nothing tangible except filling c-suite pockets

We need to fix this.

The problem is that marketing like this has real world implications, with (government) funding allocated to shit projects that produce nothing tangible except filling c-suite pockets

We need to fix this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh