Can't get enough?

Here is my free course with 50 examples of Quality Stocks: compounding-quality.ck.page/afee7ce56b

Here is my free course with 50 examples of Quality Stocks: compounding-quality.ck.page/afee7ce56b

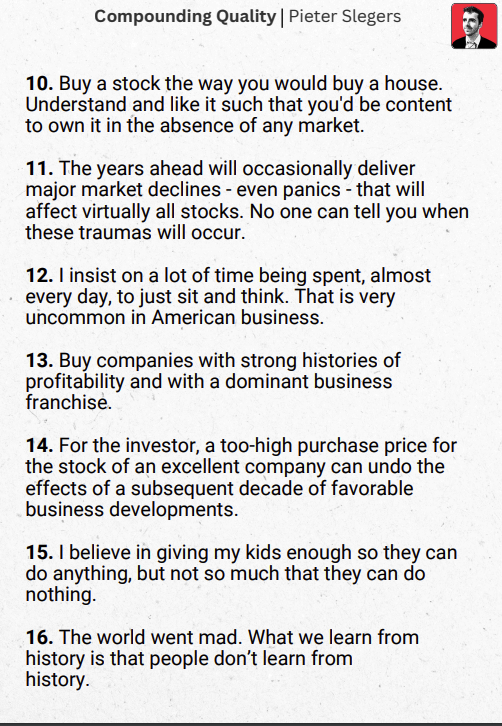

BONUS The Art of Quality Investing

A book that outlines the entire investment philosophy of Compounding Quality

It's available on Amazon

A book that outlines the entire investment philosophy of Compounding Quality

It's available on Amazon

• • •

Missing some Tweet in this thread? You can try to

force a refresh