You can't make this up:

New evidence suggests the Bank of Japan INTERVENED on Monday when the Japanese Yen crashed.

At 9:30 PM ET on Sunday night, the Japanese Yen weakened to 160 against the US Dollar for the first time since 1990.

Then, exactly 2.5 hours after the headlines came out, the ratio just crashed from 160.20 to 156.50.

Today, the BOJ said its current account will fall 7.56 TRILLION YEN, or $48.2 billion USD, more than TRIPLE previous expectations.

Did the BOJ just artificially prop up their currency minutes after it collapsed?

Something didn't add up.

(1/5)

New evidence suggests the Bank of Japan INTERVENED on Monday when the Japanese Yen crashed.

At 9:30 PM ET on Sunday night, the Japanese Yen weakened to 160 against the US Dollar for the first time since 1990.

Then, exactly 2.5 hours after the headlines came out, the ratio just crashed from 160.20 to 156.50.

Today, the BOJ said its current account will fall 7.56 TRILLION YEN, or $48.2 billion USD, more than TRIPLE previous expectations.

Did the BOJ just artificially prop up their currency minutes after it collapsed?

Something didn't add up.

(1/5)

That's when we posted the below asking if "someone just intervened?"

It simply didn't make sense that the currency crashed just minutes after hitting the 160 threshold.

The latest data suggests that the Bank of Japan (BOJ) intervened on Monday.

(2/5)

It simply didn't make sense that the currency crashed just minutes after hitting the 160 threshold.

The latest data suggests that the Bank of Japan (BOJ) intervened on Monday.

(2/5)

The BOJ reported Tuesday that its current account will fall 7.56 TRILLION YEN, or $48.2 billion USD.

This is "due to fiscal factors including government bond issuance and tax payments on Wednesday."

That’s more than TRIPLE the estimated drop of 2.1 trillion yen.

(3/5)

This is "due to fiscal factors including government bond issuance and tax payments on Wednesday."

That’s more than TRIPLE the estimated drop of 2.1 trillion yen.

(3/5)

This means that the BOJ likely intervened with $5.5 TRILLION Yen for the first time since 2022.

It also means that Japanese authorities are increasingly worried about currency devaluation.

Future intervention will likely hold less credibility as confidence degrades.

(4/5)

It also means that Japanese authorities are increasingly worried about currency devaluation.

Future intervention will likely hold less credibility as confidence degrades.

(4/5)

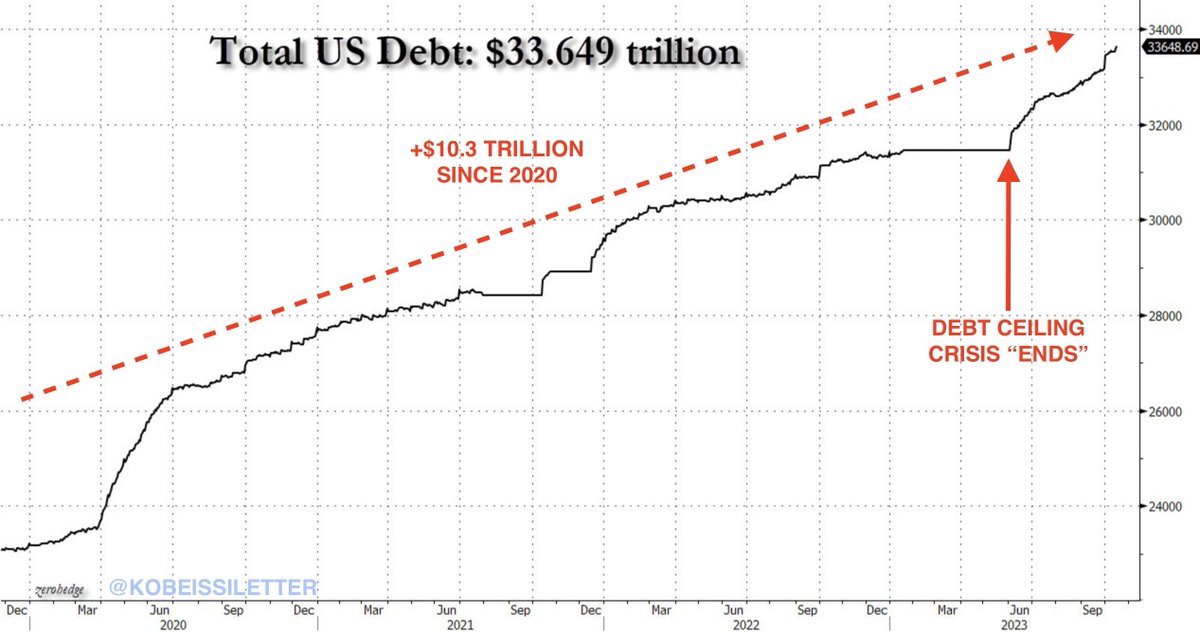

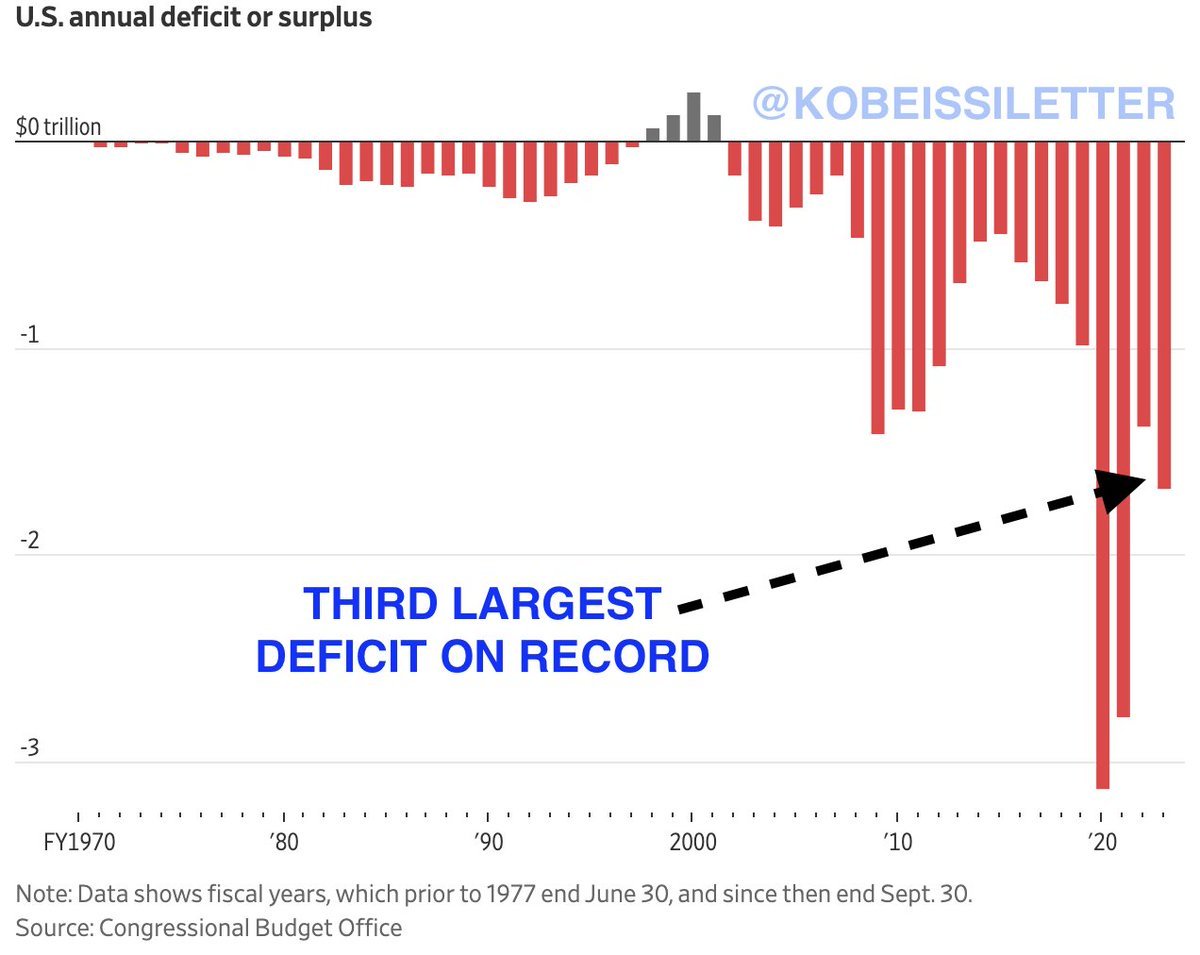

Japan now has a 263% Debt-to-GDP ratio.

As the BOJ is struggling to raise rates, the Yen continues to weaken against the Dollar.

A preview of what will happen if the US doesn't reduce deficit spending.

Follow us @KobeissiLetter for real time analysis as this develops.

(5/5)

As the BOJ is struggling to raise rates, the Yen continues to weaken against the Dollar.

A preview of what will happen if the US doesn't reduce deficit spending.

Follow us @KobeissiLetter for real time analysis as this develops.

(5/5)

• • •

Missing some Tweet in this thread? You can try to

force a refresh