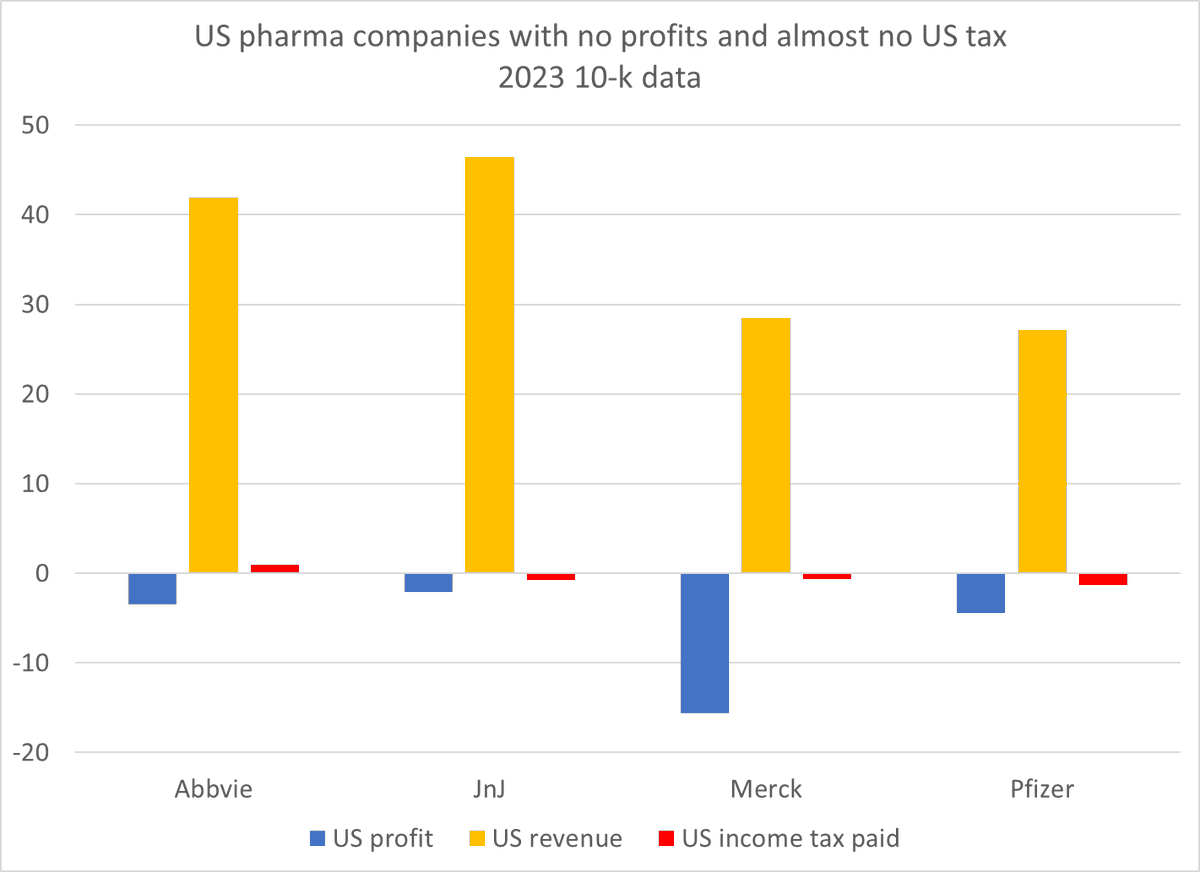

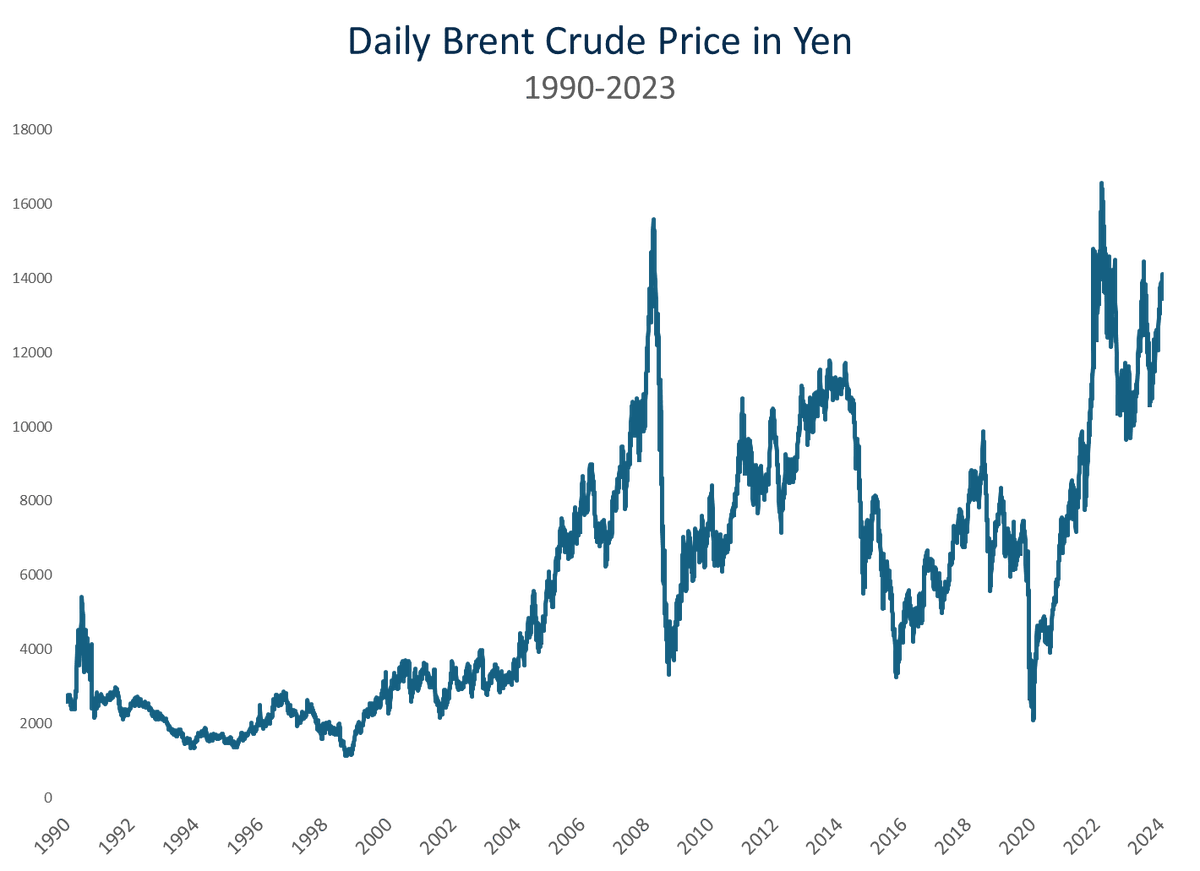

Why doesn't Japan just let the yen float (even further) down? One answer shouldn't be a surprise to any American who has observed just how much Americans care about the price of oil --

1/

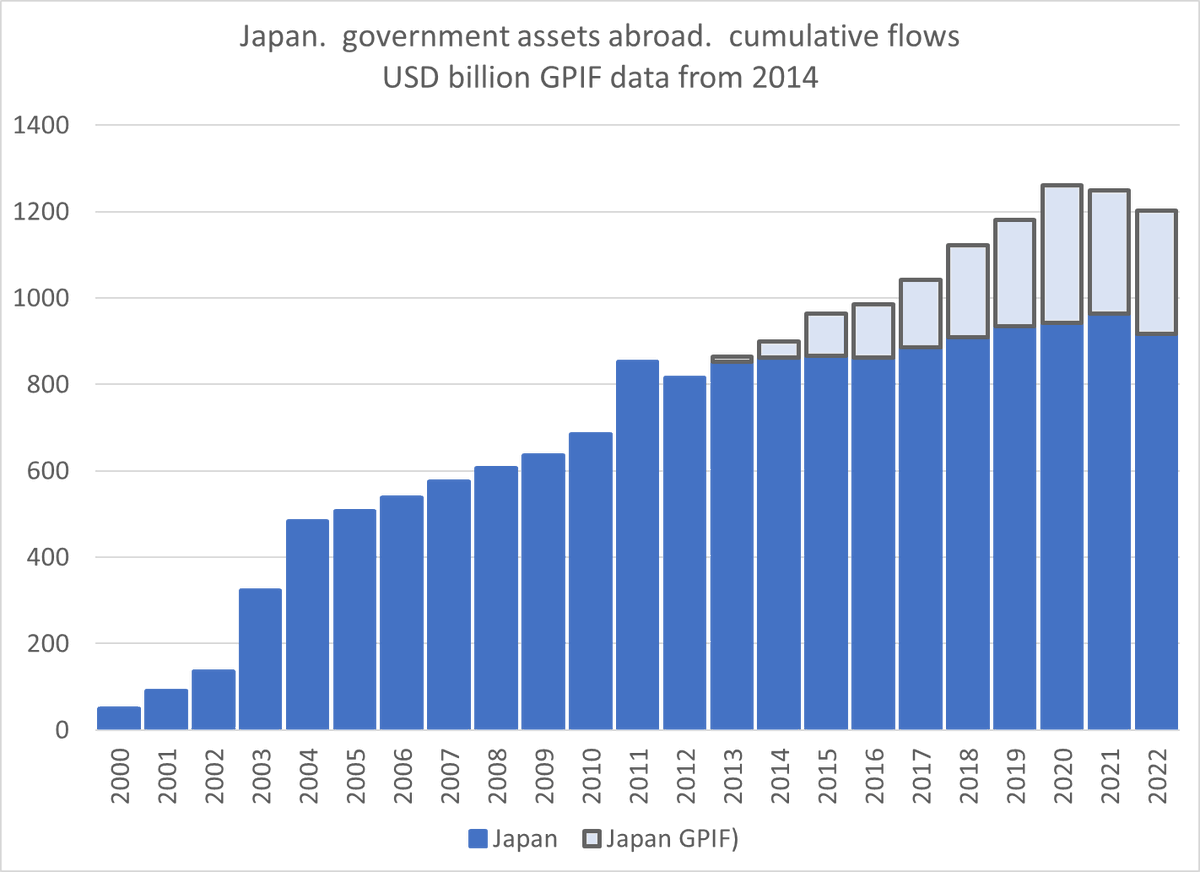

(chart thanks to @Mike_Weilandt)

1/

(chart thanks to @Mike_Weilandt)

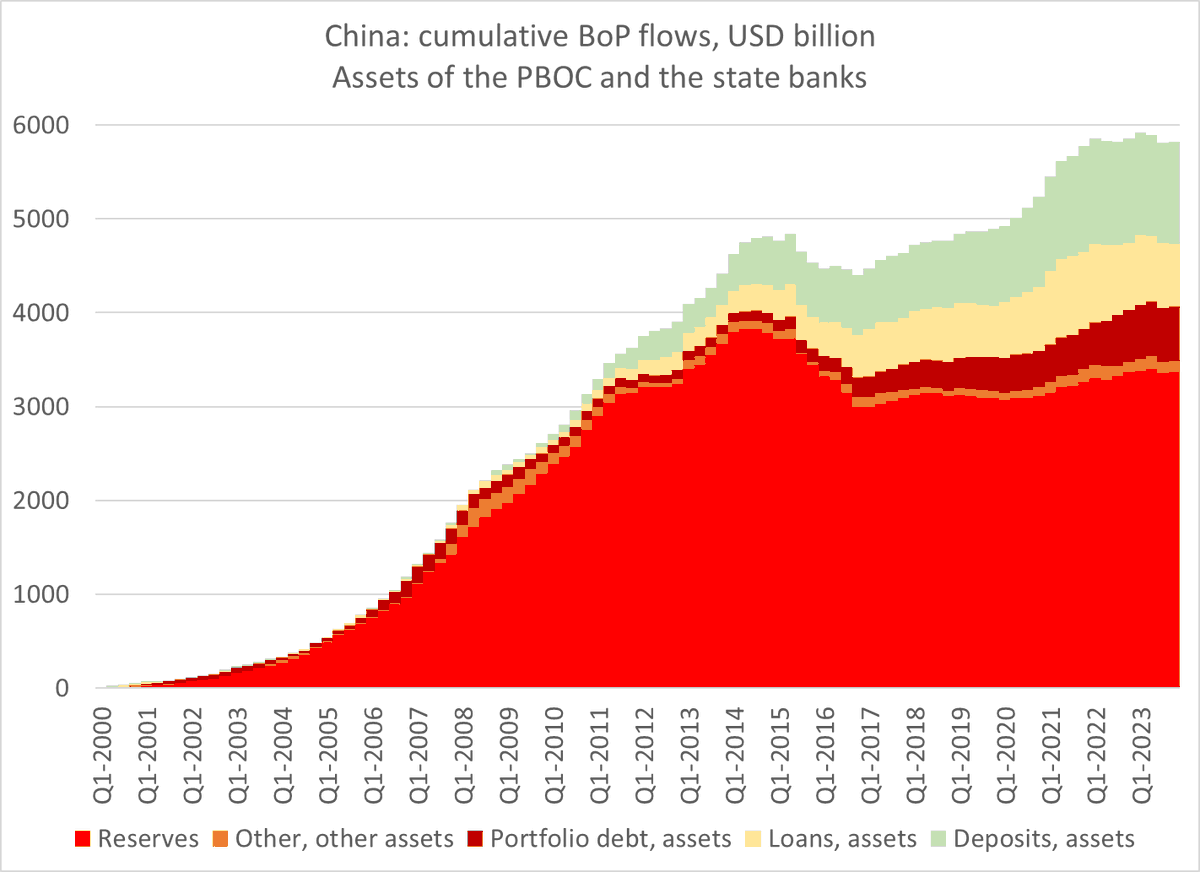

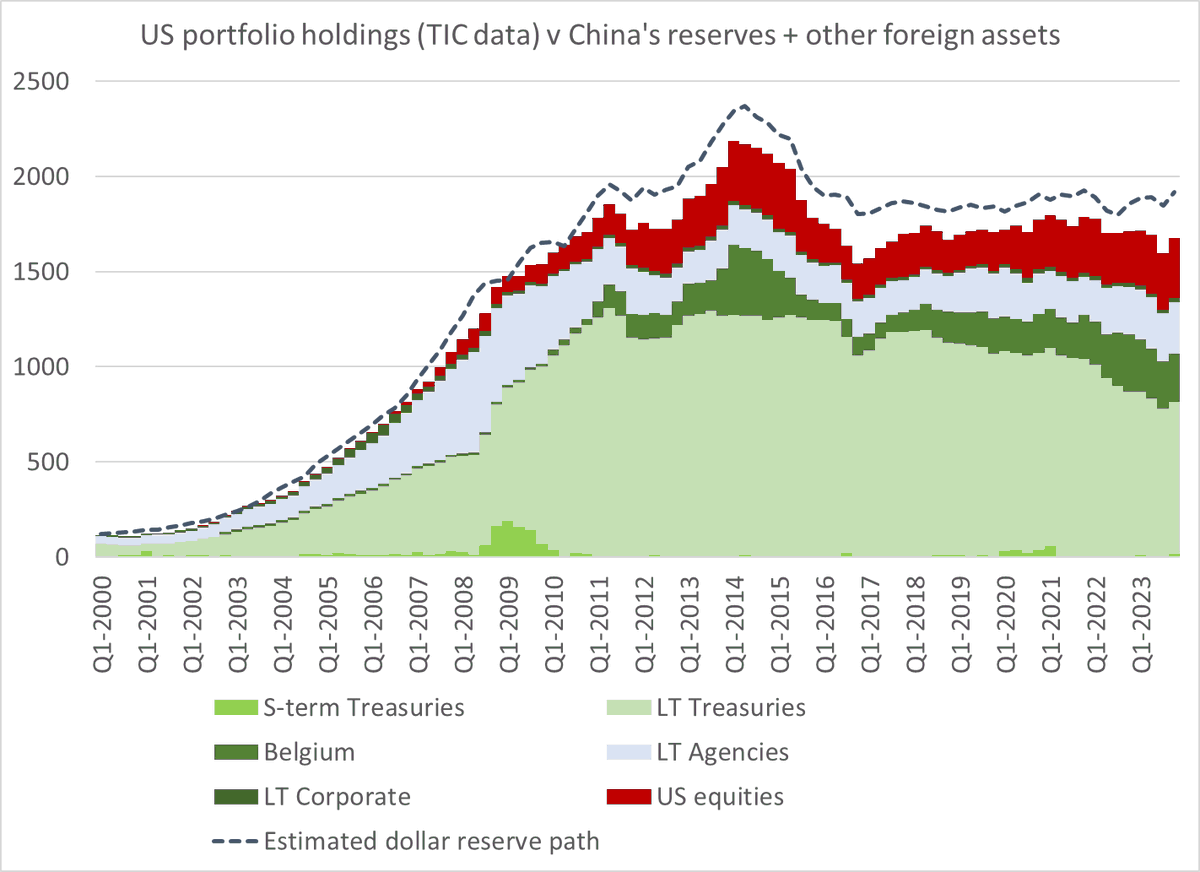

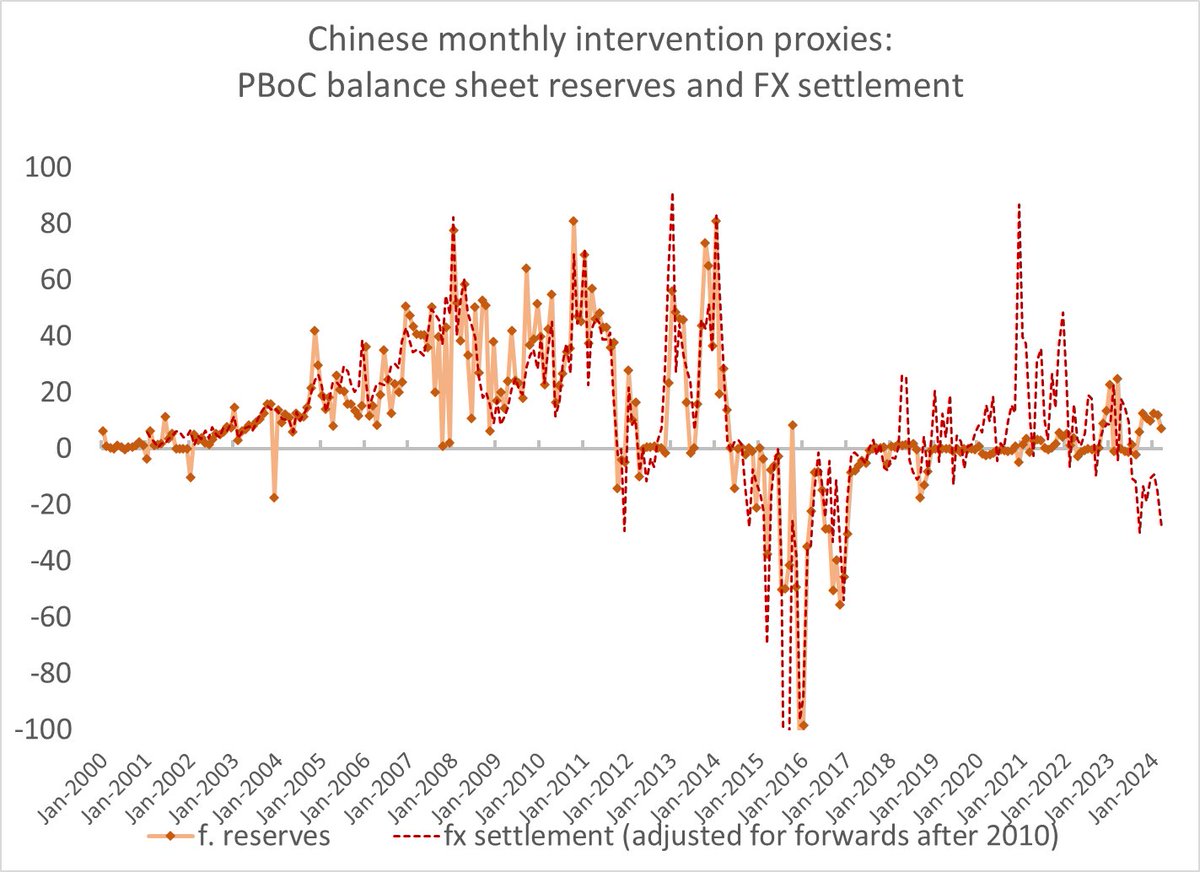

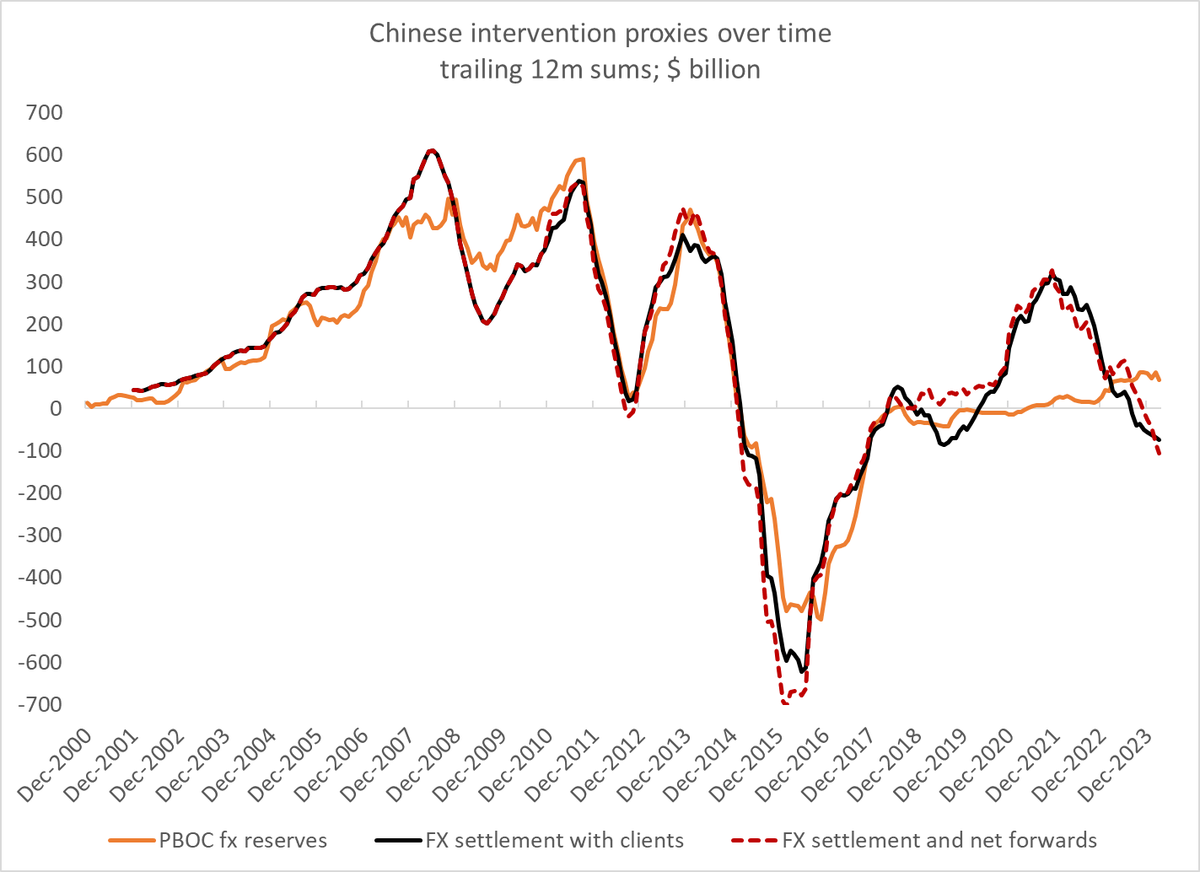

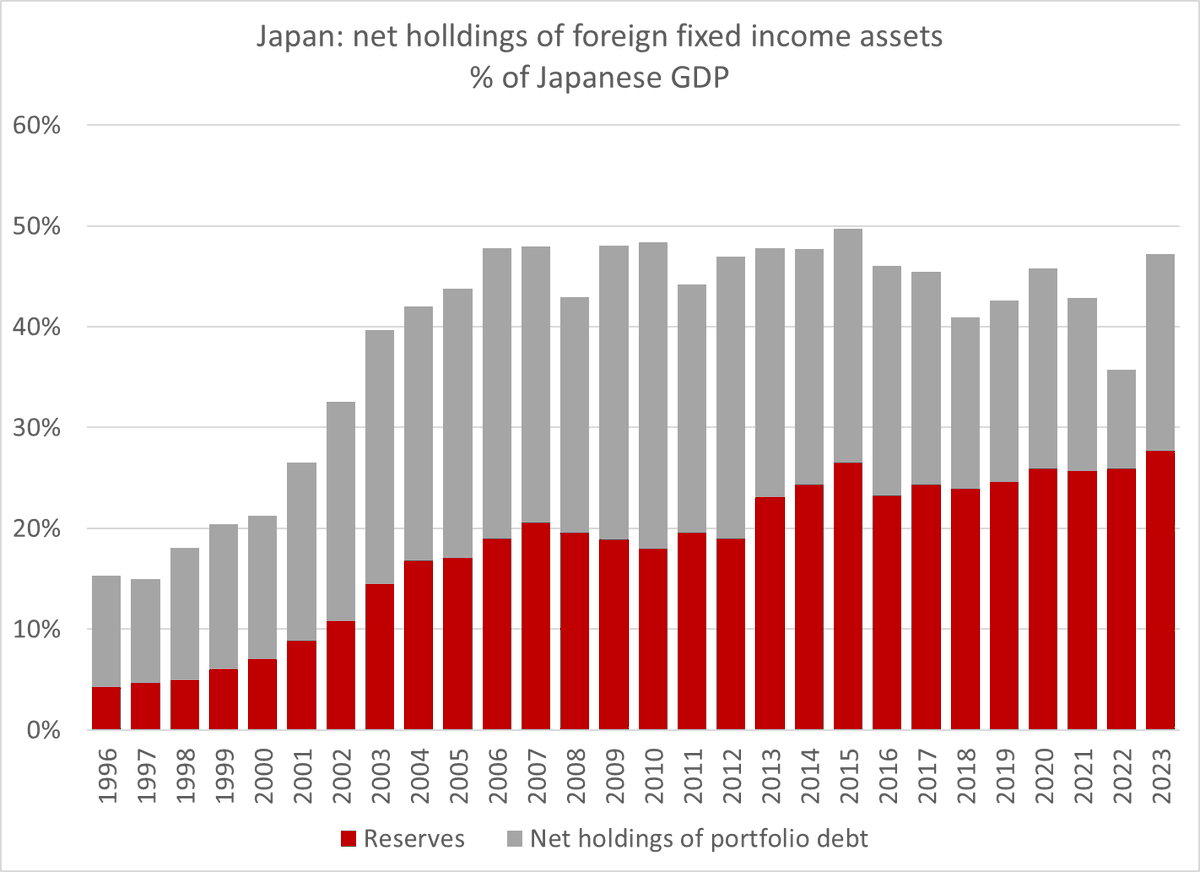

There seems to be an asymmetry around a lot of commentary around intervention. Dollar sales generate a lot more attention that dollar purchases (and the compounding of interest income on accumulated assets)

2/

2/

Japan's fx reserves are now (thanks to yen weakness) around 30% of GDP, up from 20% back in 2012 -- more than a country with access to the Fed' swap line needs (especially given the foreign portfolio of the GPIF)

3/

3/

There is of course a bit of tension between the BoJ's reflation via low rates policy/ reluctance to raise rates too quickly (or completely exit from long-term purchases) and the MoF's concern about a big and fast move down ...

4/

4/

But unless you are a purist who believes that intervention (And for that matter the details of the portfolio management decisions of the big Japanese institutions) has absolutely no impact, Japan has two policy instruments to try to achieve two objectives.

5/

5/

And intervention has positive global spillovers in my view (it helps limit pressure on the yuan and won to depreciate further) and helps with Japan's public debt (selling dollars bought at 80 at 160 = big capital gain) ...

6/

6/

It may not work, for a host of reasons (the impact of the rate differential on Japan's long-term investors who are reducing their hedge ratios and taking more fx risk over time, the carry on short-term long dollar/ short yen positions, a relatively open financial account ...)

7/

7/

But it doesn't seem to have any significant downsides (unless you are sitting on a long dollar position) -- Japan after all is intervening to try to prevent the yen from returning to its real value back in the 1960s, before Toyota was a global auto powerhouse ..

8/

8/

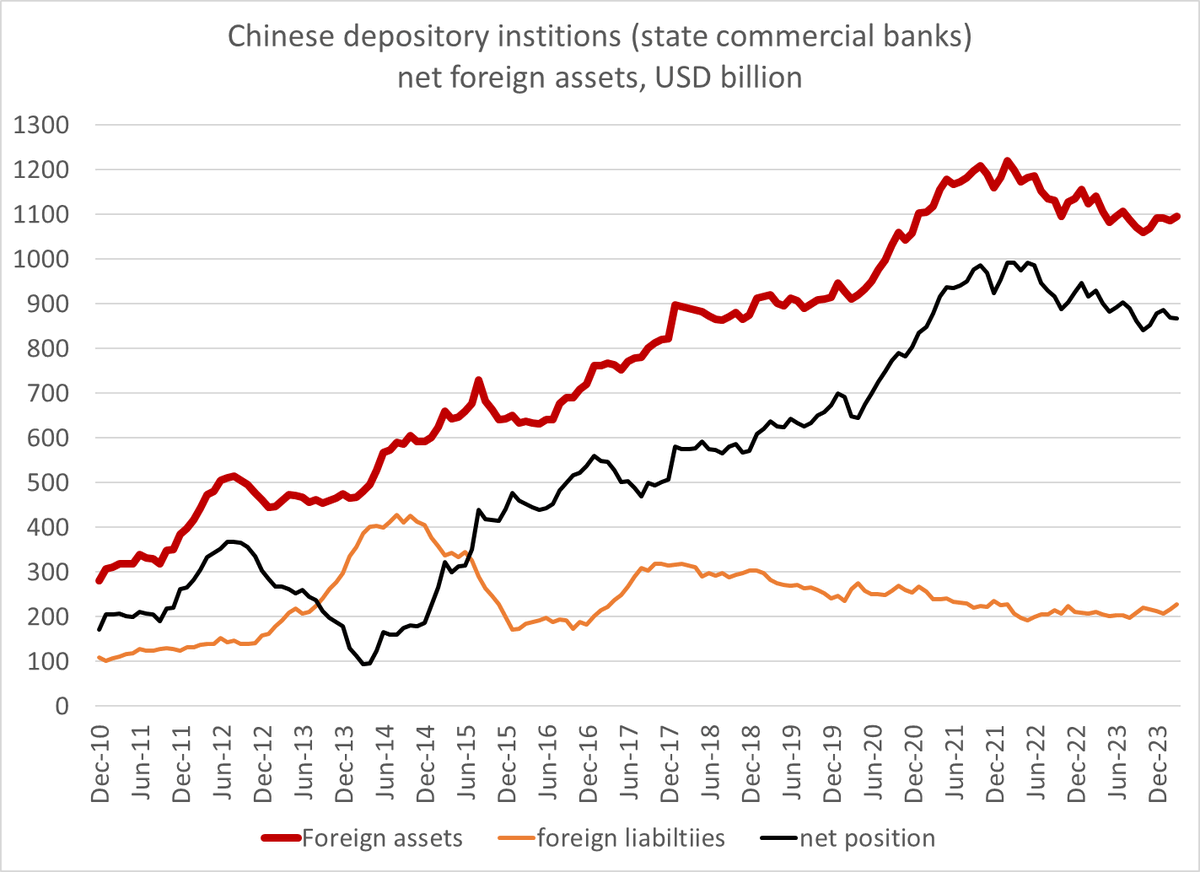

The more general point is that we don't in practice live a world where many important currency pairs apart from the dollar-euro float cleanly -- & in a world of some fx management, dollar sales cannot be viewed 100% differently than dollar purchases (it you have the reserves)

9/

9/

If you count the GPIF, Japan's government was pretty steadily adding to its dollar assets through 2020, and it hasn't even made a dent in that stash in recent years

10/

10/

It may well be the case that ultimately Japan can only support the yen-- given Fed expectations -- at even the current depressed levels by adjusting its monetary policy. But Japan has used the MoF/ GPIF balance sheet as a independent tool in the past --

11/

11/

It doesn't seem strange for me for it to do so now in the opposite direction.

Plus, as @RajaKorman has noted, Japan has a lot of other policy tools in its cupboard (regulators could start demanding big regulated/ public financial institutions close their open fx positions)

12/

Plus, as @RajaKorman has noted, Japan has a lot of other policy tools in its cupboard (regulators could start demanding big regulated/ public financial institutions close their open fx positions)

12/

@RajaKorman Am I sure that Japan's public authorities can introduce two way risk into the market and limit further yen weakness? Of course not, the rate differential is big.

Does Japan have more tools that most think available here? Absolutely!

Does Japan have more tools that most think available here? Absolutely!

@RajaKorman as an aside, those of us who have studied all the ways governments intervene through the backdoor (generally to hold their currency down) may have a greater appreciation of the full toolkit here ...

• • •

Missing some Tweet in this thread? You can try to

force a refresh