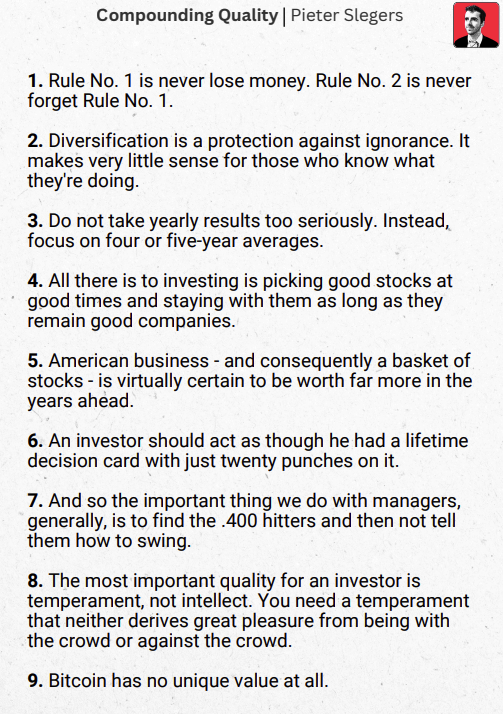

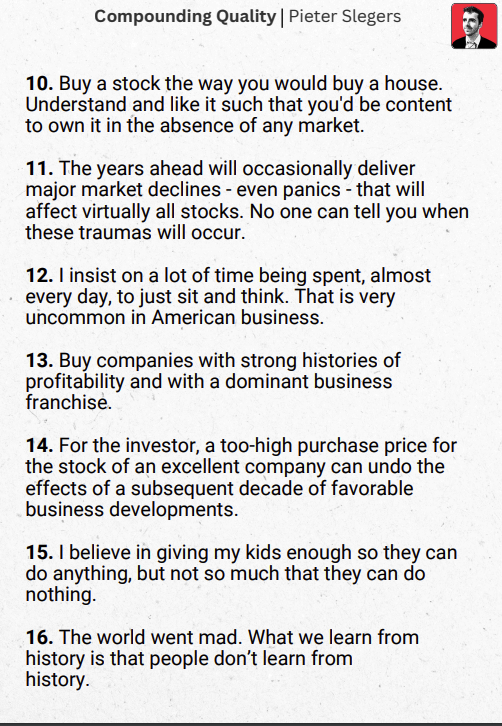

Warren Buffett calls him the smartest man he knows:

Charlie Munger.

Together they have built an empire of more than $700 billion.

Here are his 10 best ideas:

Charlie Munger.

Together they have built an empire of more than $700 billion.

Here are his 10 best ideas:

1. “Knowing what you don’t know is more useful than being brilliant.”

Most people spend their lives wrestling with the consequences of poor decisions. But the truth is it’s much easier to avoid stupidity than try to be smart.

Admit you know nothing.

Most people spend their lives wrestling with the consequences of poor decisions. But the truth is it’s much easier to avoid stupidity than try to be smart.

Admit you know nothing.

Compounding Quality

@QCompounding

·

May 3, 2023

Warren Buffett calls him the smartest man he knows:

Charlie Munger.

Together they have built an empire of more than $700 billion.

Here are his 10 best ideas:

Image

Compounding Quality

@QCompounding

·

May 3, 2023

1.

@QCompounding

·

May 3, 2023

Warren Buffett calls him the smartest man he knows:

Charlie Munger.

Together they have built an empire of more than $700 billion.

Here are his 10 best ideas:

Image

Compounding Quality

@QCompounding

·

May 3, 2023

1.

“Knowing what you don’t know is more useful than being brilliant.”

Most people spend their lives wrestling with the consequences of poor decisions. But the truth is it’s much easier to avoid stupidity than try to be smart.

Admit you know nothing.

Compounding Quality

Most people spend their lives wrestling with the consequences of poor decisions. But the truth is it’s much easier to avoid stupidity than try to be smart.

Admit you know nothing.

Compounding Quality

2. “A majority of life’s errors are caused by forgetting what one is really trying to do.”

We set goals, pursue them, then get distracted.

To achieve something meaningful, you need to stay the course.

Set a north star and keep it front of mind. Remove ego from the equation.

We set goals, pursue them, then get distracted.

To achieve something meaningful, you need to stay the course.

Set a north star and keep it front of mind. Remove ego from the equation.

3. “Mimicking the herd invites regression to the mean.”

If you do the same as everyone else, you’ll get the same results.

Following society’s standards traps you in them.

Be bold. Go against the grain.

If you do the same as everyone else, you’ll get the same results.

Following society’s standards traps you in them.

Be bold. Go against the grain.

4. “To get what you want, you have to deserve what you want.”

Naval once said the world is an efficient place.

You can’t control results, but you can control your:

· Character

· Work ethic

· Willingness to learn

Earn what you want.

Naval once said the world is an efficient place.

You can’t control results, but you can control your:

· Character

· Work ethic

· Willingness to learn

Earn what you want.

5. “The fundamental algorithm of life – repeat what works.”

It’s easy to overcomplicate success.

But the truth is everything you do creates feedback. Smart people listen.

When something goes poorly, do less.

When something goes well, do it much more.

It’s easy to overcomplicate success.

But the truth is everything you do creates feedback. Smart people listen.

When something goes poorly, do less.

When something goes well, do it much more.

6. “Those who keep learning, will keep rising.”

Most people stop learning at 18. Munger is still going at 98.

Knowledge is an asset that compounds over time.

The more you know, the better you think. Better choices, great consequences.

Schedule time to study.

Most people stop learning at 18. Munger is still going at 98.

Knowledge is an asset that compounds over time.

The more you know, the better you think. Better choices, great consequences.

Schedule time to study.

7. “You don’t have to be brilliant, only a little bit wiser than the other guys, on average, for a long time.”

Berkshire Hathaway is valued at $710 billion

Buffet and Munger’s approach?

Rationality and patience.

It isn’t a sexy approach, but the results sure as hell are.

Berkshire Hathaway is valued at $710 billion

Buffet and Munger’s approach?

Rationality and patience.

It isn’t a sexy approach, but the results sure as hell are.

8. “The best thing a human being can do is help another human being know more.”

The best way to live your life is in service to other people. Especially now with the online opportunities.

Be generous with your ideas. Share what you know and help others win.

The best way to live your life is in service to other people. Especially now with the online opportunities.

Be generous with your ideas. Share what you know and help others win.

9. “We insist on a lot of time being available almost every day to just sit and think.”

We live at a time of constant input. Everyone wants to maximise every moment for productivity.

But life is cause and effect.

Decisions are the key to success. Time to think is the priority.

We live at a time of constant input. Everyone wants to maximise every moment for productivity.

But life is cause and effect.

Decisions are the key to success. Time to think is the priority.

10. “You must know the big ideas in the big disciplines and use them routinely.”

Principles from:

· Maths

· Physics

· Biology

· Philosophy

· Engineering

All have a profound impact on life.

Study mental models. Build a toolkit. Treat your mind like your greatest asset.

Principles from:

· Maths

· Physics

· Biology

· Philosophy

· Engineering

All have a profound impact on life.

Study mental models. Build a toolkit. Treat your mind like your greatest asset.

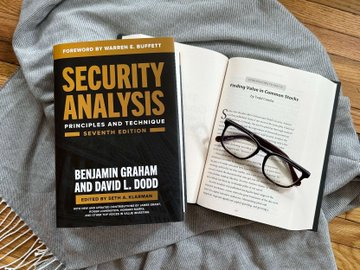

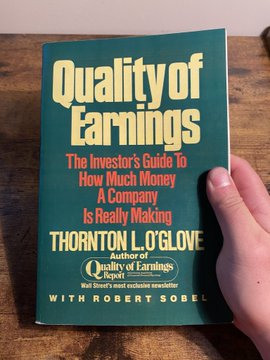

BONUS The Art of Quality Investing

A book that outlines the entire investment philosophy of Compounding Quality

It's available on Amazon

A book that outlines the entire investment philosophy of Compounding Quality

It's available on Amazon

Can't get enough?

Here's my free course with 50 great investing visuals: compounding-quality.ck.page/e1d0d78891

Here's my free course with 50 great investing visuals: compounding-quality.ck.page/e1d0d78891

• • •

Missing some Tweet in this thread? You can try to

force a refresh