1/8 In this thread, we will dive into the intricacies of Free Cash Flow Yield.

A powerful compass that guides us toward treasures in the market.

With FCF Yield as our companion, we'll uncover the treasures of profitability and unlock their potential for wealth creation.

🧵⬇️

A powerful compass that guides us toward treasures in the market.

With FCF Yield as our companion, we'll uncover the treasures of profitability and unlock their potential for wealth creation.

🧵⬇️

2/8 Similar to the earnings yield, FCF yield helps investors find companies generating good returns on the cash investing in them. Some investors prefer FCF yield to earnings yield as they believe it represents the true earning power of a company.

3/8 To calculate FCF Yield, you divide the company's free cash flow per share by its market price per share, and then express the result as a percentage. The formula can be represented as follows:

💸FCF Yield = (Free Cash Flow per Share / Market Price per Share) * 100

💸FCF Yield = (Free Cash Flow per Share / Market Price per Share) * 100

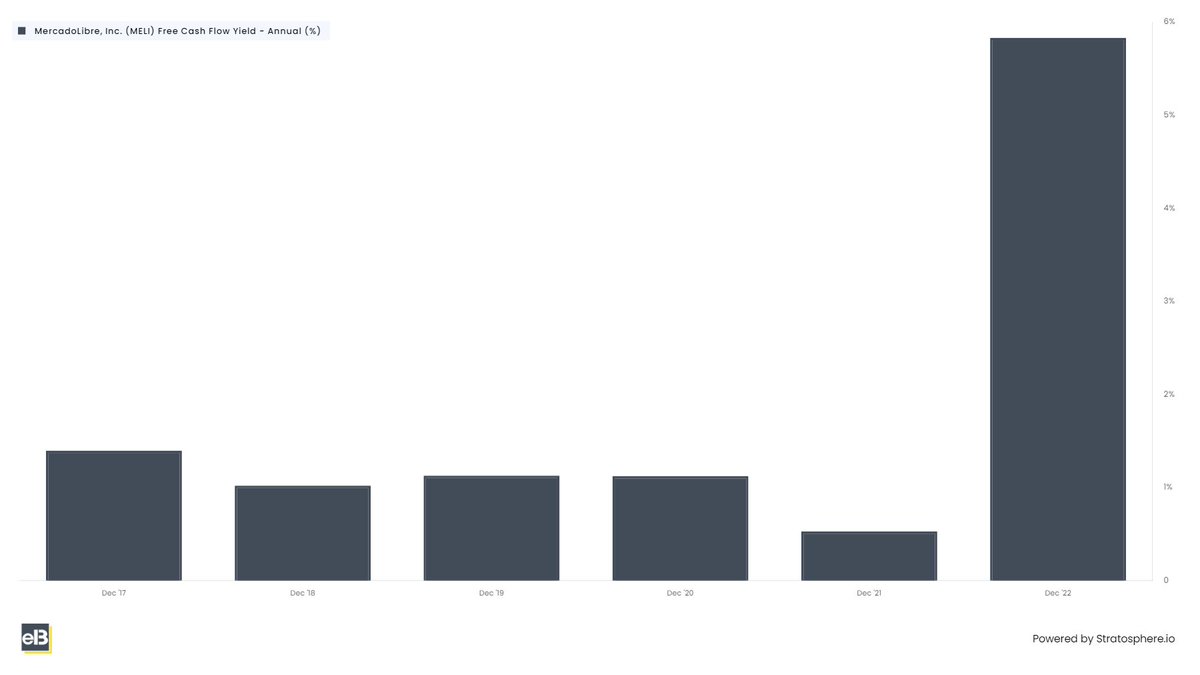

4/8 To use our example from above, $MELI, we see:

Free Cash Flow per share = $72.1

Current market price = $1359

FCF Yield = $72.1 / $1359 = 5.3%

Simple huh?

Free Cash Flow per share = $72.1

Current market price = $1359

FCF Yield = $72.1 / $1359 = 5.3%

Simple huh?

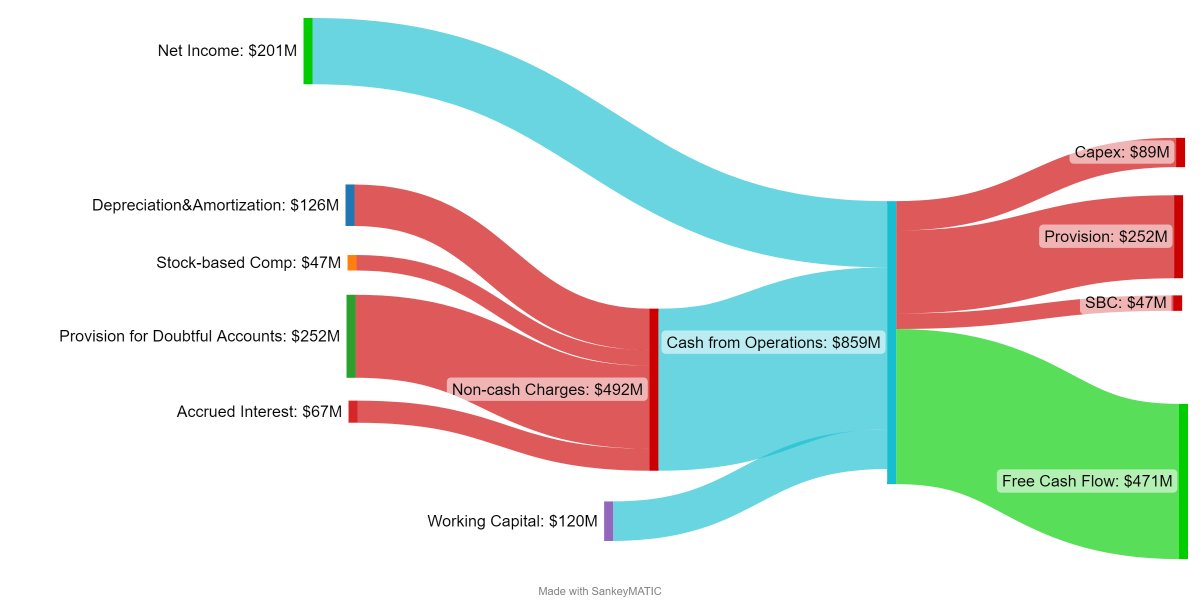

5/8 Free cash flow represents the cash generated by a company after deducting its operating expenses, capital expenditures, and taxes. The surplus cash can be used for various purposes, such as reinvestment in the business, debt reduction, dividend payments, or share buybacks.

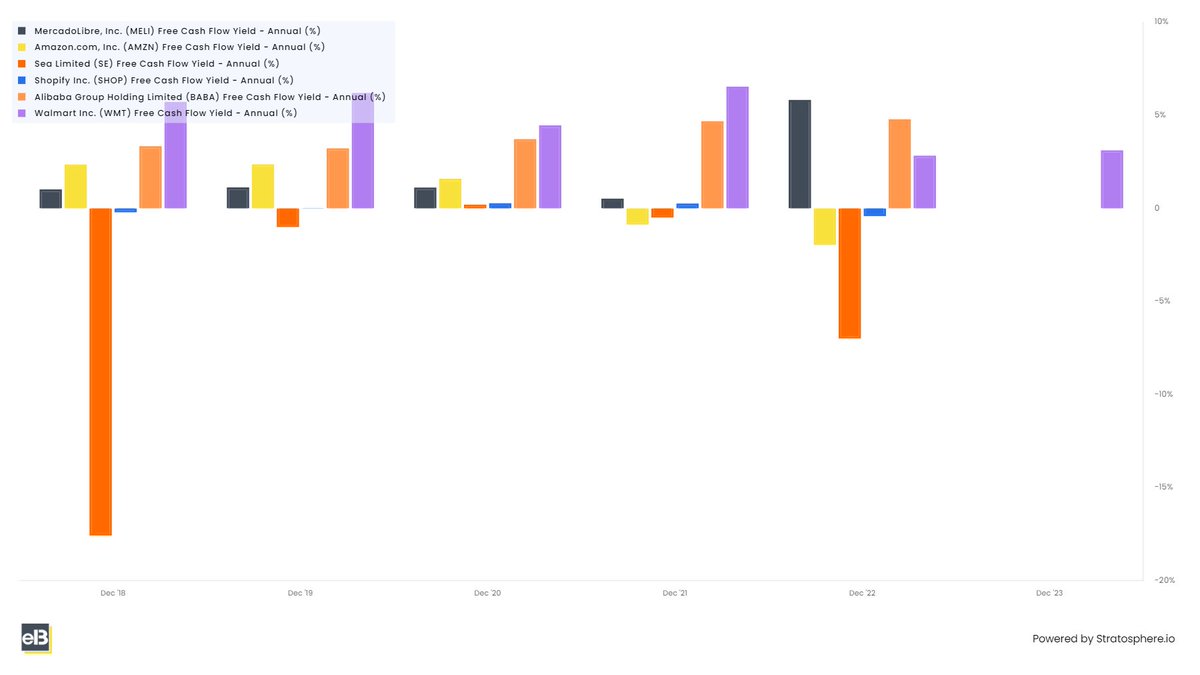

6/8 The FCF Yield ratio helps investors evaluate a company's financial health and profitability. Below is a list of some of the leading e-commerce players and their FCF yields:

$MELI - 5.30%

$AMZN - (1.97%)

$SE - (7%)

$SHOP - (0.42%)

$BABA - 4.15%

$WMT - 3.12%

$MELI - 5.30%

$AMZN - (1.97%)

$SE - (7%)

$SHOP - (0.42%)

$BABA - 4.15%

$WMT - 3.12%

7/8 A ⬆️ FCF Yield suggests that the company generates substantial free cash flow relative to its market value, indicating potential undervaluation or an attractive investment opportunity. A lower FCF Yield may indicate lower profitability or overvaluation.

8/8 It's important to note that we FCF Yield should with other metrics and qualitative analysis to understand a company's financial situation comprehensively. Comparisons with industry peers and historical performance can provide valuable context when interpreting FCF Yield.

• • •

Missing some Tweet in this thread? You can try to

force a refresh