This is insane.

This is INSANE.

This is a blatantly obvious sign of the impending doom of the U.S. Dollar and all fiat currencies.

*This is as important as anything you will read this year*

The United States Treasury issues bonds and other investment securities.

They call these, “treasuries.”

The U.S. Treasury issues treasuries when the U.S. Federal Government spends past their budget, resulting in a “budgetary deficit.” The sale of treasuries makes up for the loss.

The treasuries are sold and tacked on as debt. This is the substance of the big $34 trillion debt number in the United States.

Key point: The U.S. Federal Government has been in a budgetary deficit in 49 of the last 53 years, with the last surplus year being in 2001.

But yet, even in that 2001 “budgetary surplus” year, the total debt amount increased.

Why?

Because a whole bunch of debt from years past came due.

The U.S. Treasury issues their treasuries with time periods of ownership ranging from 4 weeks to 30 years.

So, in 2001, the government had debt coming due that was issued to investors in 1971, as well as 1981, 1991, 1994, 1996, 1998, 1999, and the previous year.

The debt that was due in 2001 exceeded the budgetary surplus (debt issuance is not a part of the budget), thus, the government had to issue new debt to pay off the old debt, adding on further to the debt total.

Key point: The U.S. Treasury, which is part of the U.S. Federal Government, has to sell new debt to new investors to pay off the old debt from old investors. This is because of 1) the constant budgetary deficits and 2) the debt from years past coming due.

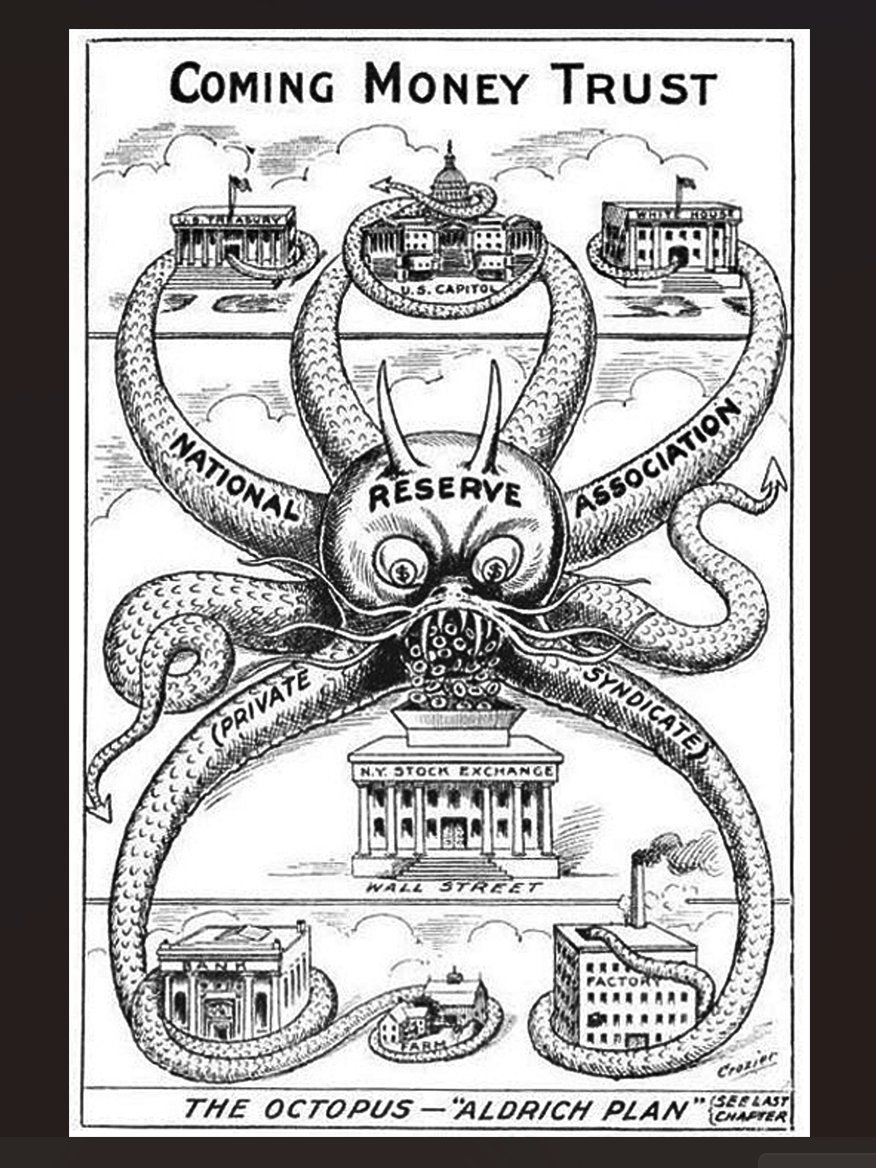

Key point: Being that the definition of a Ponzi scheme is, “An investment scheme where new investor money is used to pay off old investors.” …The U.S. Federal Government is running a Ponzi scheme. To the tune of $34.7 trillion, and counting.

Trillion is just a word. Let’s make sure we note the significance.

A *billion* seconds ago was 1993 (31 years ago).

A *trillion* seconds ago was 30,000 B.C.

And then multiply that trillion by 34.7.

That’s the scale of the United States debt bill.

But WAIT. It gets worse.

Key point: The U.S. Treasury always has to have buyers of its debt, because if they don’t, they won’t be able to pay off 1) their deficit spending and 2) the old debt coming due (and the interest on the debt). If they fail to pay those off, the Government would default and collapse.

Well, then, who buys all the U.S. Government debt?

Key point: The largest buyer and owner of the U.S. Federal Government debt is THE U.S. FEDERAL GOVERNMENT THEMSELVES.

Don’t trust, verify:

TAKE A SECOND TO CONTEMPLATE HOW INSANE THAT IS.

The U.S. Government spends in a budgetary deficit, then issues treasuries to pay for the spending, then, at a bigger rate than anybody else, buys the treasuries to cover the loss. An unbelievable Ponzi scheme.

The U.S. Government is the director of the Ponzi scheme, the old investor, and the new investor. A true masterclass.

But how do they do this? They have a money printer. It's that simple. The debt might as well not be real.

Key point: The United States is not the only country that runs this playbook. 182 of the 222 countries in the world are in budgetary deficits. The Ponzi scheme is everywhere.

The U.S. is the kingpin of the modern monetary world. They are the head honcho, the high priest, the big cheese.

The current global financial economy is built on the backs of the United States.

There would be a massive problem if the United States had debt buyer troubles.

In short, an increasing amount of investors are growing scared of the United Stages debt situation, turning them away from the purchasing of U.S. Treasuries.

Recent headlines:

“Treasury bond auction runs into weak demand amid fears that soaring US debt will overwhelm Wall Street” -October 12, 2023

“30-Year Treasury Auction Breaks Bad, Sinks Stock Market” -November 9, 2023

“World to Drown in U.S. Debt; Moody’s Downgrades Country’s Debt” -November 17, 2023

“5-Year Treasury Auction was a Dud” -January 24, 2024

“Treasury's $16 billion auction of 20-year bonds produces 'very ugly' results” -February 21, 2024

"Highest Treasury Yields of Year Fail to Tempt Buyers to Auction" -April 11, 2024.

With lower demand, and as quote tweeted below, the U.S. Treasury is starting a "treasury buy back operation," aimed to, as they say, "improve liquidity in the treasury market."

What's really happening is that the Treasury is using their money printer to directly buy the treasuries they are issuing, ensuring those low demand treasury auctions don't continue. This causes inflation in the money supply, which is a dangerous outcome.

Here's where the cookie crumbles:

The United States central bank, the Federal Reserve, has a 2% inflation target. Inflation has not been at 2% recently, and, in fact, has been accelerating higher for three months in a row.

The Federal Reserve has set high interest rates, currently at 5.25%, as a method of discouraging borrowing, spending, and taming inflation.

But it's not working. And there's a bigger problem.

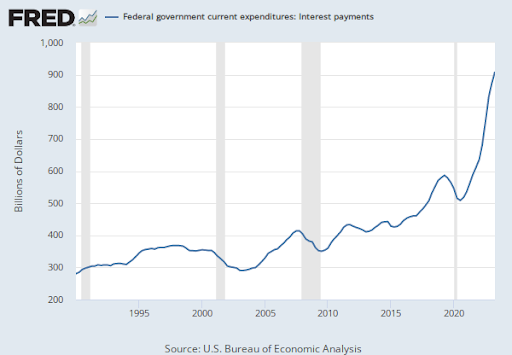

Key point: The U.S. Federal Government pays interest to investors that own the treasuries, and this interest is part of the budget. Higher interest payments = more federal spending = bigger budgetary deficits = more debt issuance = higher supply of treasuries = lower demand = less buyers = Treasury printing = higher inflation = higher interest rates = higher interest payments.

A catastrophic feedback loop.

The interest paid out by the Federal Government has spiked in recent years:

The United States Dollar is screwed.

The Federal Reserve has set high interest rates to tame inflation, but that's not working. High interest rates are causing bigger interest payments, causing larger budgetary deficits.

This is causing the U.S. Treasury to issue more debt, which investors are getting scared of (because of runaway inflation and compounding debt levels), which is now causing the Treasury to print money and provide "liquidity" to stabilize the treasury market, adding fuel to the inflation fire once more.

The Federal Reserve can further raise interest rates to cool inflation, but that would increase interest payments and deficit spending, requiring even more debt issuance and "liquidity," which fuels inflation. An increase in interest rates could also cause a massive recession or depression, which would grind the economy to a halt, which would mean that the government is taking in less tax revenue, while still spending exorbitantly on entrenched government programs and stimulus, which would only increase budgetary deficits and debt issuance once more.

The Federal Reserve can lower interest rates, but that would immediately cause an uptick in inflation, as people are encouraged to borrow and spend with lower interest rates, which would then force the Fed to raise interest rates again.

The Federal Reserve can admit defeat and raise their inflation target to 3 or 4%, but that would signal that the system is failing, which would cause a further loss of confidence, which would result in less treasury buyers, resulting in more inflation, and would create demand for higher interest rates (because treasury investors want to keep up with inflation), which, again, causes bigger interest payments and so forth.

This is a debt spiral.

There is no way out.

You are witnessing it live. These are years that will go down in the all-time history books.

Every fiat currency has failed, and for the same reason. Turning on the money printer is too tempting.

Don't forget, the U.S. Government will never let the treasury market fail, because that would result in an automatic default on the debt and an unbelievably chaotic avalanche of collapse.

They will always turn to the money printer to bail things out. The Treasury will continue to print more money to keep the system afloat, as evidenced by their upcoming "buy back operation." But inflation is the fatal flaw.

The Ponzi scheme is in its final chapter. The endgame is here.

The inflation train has left the station, and it's never coming back.

Covid put the ruin into hyperdrive. Inflation ran away, now it cannot be tamed. It is feeding on itself, and will continue to do so, over and over, gradually, then suddenly.

And then, poof. It's gone.

Worthlessness.

If you haven't noticed, the U.S. Dollar has been heading toward the "worthless" direction for quite some time.

It is inevitable. The U.S. Dollar, and all fiat currencies, will die.

The Phoenix will then rise from the ashes.

An innovative, specifically designed, global, unprintable, unable to be manipulated, verifiable, instantaneous, digital monetary system will emerge, unchained from the grasp of bankers and governments, once and for all.

...and the world was fixed.

Fix the money, fix the world.

#Bitcoin

This is INSANE.

This is a blatantly obvious sign of the impending doom of the U.S. Dollar and all fiat currencies.

*This is as important as anything you will read this year*

The United States Treasury issues bonds and other investment securities.

They call these, “treasuries.”

The U.S. Treasury issues treasuries when the U.S. Federal Government spends past their budget, resulting in a “budgetary deficit.” The sale of treasuries makes up for the loss.

The treasuries are sold and tacked on as debt. This is the substance of the big $34 trillion debt number in the United States.

Key point: The U.S. Federal Government has been in a budgetary deficit in 49 of the last 53 years, with the last surplus year being in 2001.

But yet, even in that 2001 “budgetary surplus” year, the total debt amount increased.

Why?

Because a whole bunch of debt from years past came due.

The U.S. Treasury issues their treasuries with time periods of ownership ranging from 4 weeks to 30 years.

So, in 2001, the government had debt coming due that was issued to investors in 1971, as well as 1981, 1991, 1994, 1996, 1998, 1999, and the previous year.

The debt that was due in 2001 exceeded the budgetary surplus (debt issuance is not a part of the budget), thus, the government had to issue new debt to pay off the old debt, adding on further to the debt total.

Key point: The U.S. Treasury, which is part of the U.S. Federal Government, has to sell new debt to new investors to pay off the old debt from old investors. This is because of 1) the constant budgetary deficits and 2) the debt from years past coming due.

Key point: Being that the definition of a Ponzi scheme is, “An investment scheme where new investor money is used to pay off old investors.” …The U.S. Federal Government is running a Ponzi scheme. To the tune of $34.7 trillion, and counting.

Trillion is just a word. Let’s make sure we note the significance.

A *billion* seconds ago was 1993 (31 years ago).

A *trillion* seconds ago was 30,000 B.C.

And then multiply that trillion by 34.7.

That’s the scale of the United States debt bill.

But WAIT. It gets worse.

Key point: The U.S. Treasury always has to have buyers of its debt, because if they don’t, they won’t be able to pay off 1) their deficit spending and 2) the old debt coming due (and the interest on the debt). If they fail to pay those off, the Government would default and collapse.

Well, then, who buys all the U.S. Government debt?

Key point: The largest buyer and owner of the U.S. Federal Government debt is THE U.S. FEDERAL GOVERNMENT THEMSELVES.

Don’t trust, verify:

TAKE A SECOND TO CONTEMPLATE HOW INSANE THAT IS.

The U.S. Government spends in a budgetary deficit, then issues treasuries to pay for the spending, then, at a bigger rate than anybody else, buys the treasuries to cover the loss. An unbelievable Ponzi scheme.

The U.S. Government is the director of the Ponzi scheme, the old investor, and the new investor. A true masterclass.

But how do they do this? They have a money printer. It's that simple. The debt might as well not be real.

Key point: The United States is not the only country that runs this playbook. 182 of the 222 countries in the world are in budgetary deficits. The Ponzi scheme is everywhere.

The U.S. is the kingpin of the modern monetary world. They are the head honcho, the high priest, the big cheese.

The current global financial economy is built on the backs of the United States.

There would be a massive problem if the United States had debt buyer troubles.

In short, an increasing amount of investors are growing scared of the United Stages debt situation, turning them away from the purchasing of U.S. Treasuries.

Recent headlines:

“Treasury bond auction runs into weak demand amid fears that soaring US debt will overwhelm Wall Street” -October 12, 2023

“30-Year Treasury Auction Breaks Bad, Sinks Stock Market” -November 9, 2023

“World to Drown in U.S. Debt; Moody’s Downgrades Country’s Debt” -November 17, 2023

“5-Year Treasury Auction was a Dud” -January 24, 2024

“Treasury's $16 billion auction of 20-year bonds produces 'very ugly' results” -February 21, 2024

"Highest Treasury Yields of Year Fail to Tempt Buyers to Auction" -April 11, 2024.

With lower demand, and as quote tweeted below, the U.S. Treasury is starting a "treasury buy back operation," aimed to, as they say, "improve liquidity in the treasury market."

What's really happening is that the Treasury is using their money printer to directly buy the treasuries they are issuing, ensuring those low demand treasury auctions don't continue. This causes inflation in the money supply, which is a dangerous outcome.

Here's where the cookie crumbles:

The United States central bank, the Federal Reserve, has a 2% inflation target. Inflation has not been at 2% recently, and, in fact, has been accelerating higher for three months in a row.

The Federal Reserve has set high interest rates, currently at 5.25%, as a method of discouraging borrowing, spending, and taming inflation.

But it's not working. And there's a bigger problem.

Key point: The U.S. Federal Government pays interest to investors that own the treasuries, and this interest is part of the budget. Higher interest payments = more federal spending = bigger budgetary deficits = more debt issuance = higher supply of treasuries = lower demand = less buyers = Treasury printing = higher inflation = higher interest rates = higher interest payments.

A catastrophic feedback loop.

The interest paid out by the Federal Government has spiked in recent years:

The United States Dollar is screwed.

The Federal Reserve has set high interest rates to tame inflation, but that's not working. High interest rates are causing bigger interest payments, causing larger budgetary deficits.

This is causing the U.S. Treasury to issue more debt, which investors are getting scared of (because of runaway inflation and compounding debt levels), which is now causing the Treasury to print money and provide "liquidity" to stabilize the treasury market, adding fuel to the inflation fire once more.

The Federal Reserve can further raise interest rates to cool inflation, but that would increase interest payments and deficit spending, requiring even more debt issuance and "liquidity," which fuels inflation. An increase in interest rates could also cause a massive recession or depression, which would grind the economy to a halt, which would mean that the government is taking in less tax revenue, while still spending exorbitantly on entrenched government programs and stimulus, which would only increase budgetary deficits and debt issuance once more.

The Federal Reserve can lower interest rates, but that would immediately cause an uptick in inflation, as people are encouraged to borrow and spend with lower interest rates, which would then force the Fed to raise interest rates again.

The Federal Reserve can admit defeat and raise their inflation target to 3 or 4%, but that would signal that the system is failing, which would cause a further loss of confidence, which would result in less treasury buyers, resulting in more inflation, and would create demand for higher interest rates (because treasury investors want to keep up with inflation), which, again, causes bigger interest payments and so forth.

This is a debt spiral.

There is no way out.

You are witnessing it live. These are years that will go down in the all-time history books.

Every fiat currency has failed, and for the same reason. Turning on the money printer is too tempting.

Don't forget, the U.S. Government will never let the treasury market fail, because that would result in an automatic default on the debt and an unbelievably chaotic avalanche of collapse.

They will always turn to the money printer to bail things out. The Treasury will continue to print more money to keep the system afloat, as evidenced by their upcoming "buy back operation." But inflation is the fatal flaw.

The Ponzi scheme is in its final chapter. The endgame is here.

The inflation train has left the station, and it's never coming back.

Covid put the ruin into hyperdrive. Inflation ran away, now it cannot be tamed. It is feeding on itself, and will continue to do so, over and over, gradually, then suddenly.

And then, poof. It's gone.

Worthlessness.

If you haven't noticed, the U.S. Dollar has been heading toward the "worthless" direction for quite some time.

It is inevitable. The U.S. Dollar, and all fiat currencies, will die.

The Phoenix will then rise from the ashes.

An innovative, specifically designed, global, unprintable, unable to be manipulated, verifiable, instantaneous, digital monetary system will emerge, unchained from the grasp of bankers and governments, once and for all.

...and the world was fixed.

Fix the money, fix the world.

#Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh