After Uday Kotak's Exit,

Kotak Bank has seen regulatory action from the RBI and top management exit🤯🤯

What is happening at Kotak Bank?

The Bank just reported its numbers

A thread🧵on the results of Kotak Mahindra Bank and what lies ahead?

Lets go👇

Kotak Bank has seen regulatory action from the RBI and top management exit🤯🤯

What is happening at Kotak Bank?

The Bank just reported its numbers

A thread🧵on the results of Kotak Mahindra Bank and what lies ahead?

Lets go👇

Loan Growth:-

🏦Loan growth at 20%

🏦Cosumer loans grew at 20%

🏦Corporate loans grew at 20%

🏦Unsecured loans are growing very fast for Kotak

🏦Loan growth at 20%

🏦Cosumer loans grew at 20%

🏦Corporate loans grew at 20%

🏦Unsecured loans are growing very fast for Kotak

Deposit Growth:-

🏦Depsoit growth at 13%

🏦Term deposits grow at 35%

🏦Cost of funds at 4.13%

Deposit growth is slower for Kotak Bank

🏦Depsoit growth at 13%

🏦Term deposits grow at 35%

🏦Cost of funds at 4.13%

Deposit growth is slower for Kotak Bank

Asset Quality:-

🏦Gross NPAs fall to 1.39%

🏦Slippages at 1305cr

🏦PCR at 75.9%

Asset quality remains robust for the bank

🏦Gross NPAs fall to 1.39%

🏦Slippages at 1305cr

🏦PCR at 75.9%

Asset quality remains robust for the bank

Capital Adequacy:-

The Bank is adequately capitalized

TIER-1 Ratio at 19.6%.

In fact, the bank also declared a dividend

The Bank is adequately capitalized

TIER-1 Ratio at 19.6%.

In fact, the bank also declared a dividend

Action By the RBI:-

RBI IT department inspected CBS and online banking systems and found frequent outages.

As a result,

Kotak Mahindra Bank will now cease to onboard customers from online and mobile banks

RBI also bans new onboarding of credit cards .

RBI IT department inspected CBS and online banking systems and found frequent outages.

As a result,

Kotak Mahindra Bank will now cease to onboard customers from online and mobile banks

RBI also bans new onboarding of credit cards .

Update from the Bank on the action taken:-

The Bank is taking steps for further steps to strengthen the IT systems

The Bank is taking steps for further steps to strengthen the IT systems

Impact Of RBI action on Kotak Mahindra Bank?

Kotak is anyway not aggressive on Credit cards.

Total loans outstanding on credit cards is just 3-4% of the total book.

The slowdown in loans from 811 will be a real hit for the bank

80-99% of new PL, credit card, and business lending (in volume terms) was done digitally.

Net not a very big hit for the bank

However, the reputation damage to Kotak is big.

Kotak prided itself on being world-class bank on compliance.

Given these deficiencies,

The premium will wane away for Kotak.

At a time when the bank is undergoing a transition.

This compliance embargo from RBI will be a real challenge for the new management.

Kotak is anyway not aggressive on Credit cards.

Total loans outstanding on credit cards is just 3-4% of the total book.

The slowdown in loans from 811 will be a real hit for the bank

80-99% of new PL, credit card, and business lending (in volume terms) was done digitally.

Net not a very big hit for the bank

However, the reputation damage to Kotak is big.

Kotak prided itself on being world-class bank on compliance.

Given these deficiencies,

The premium will wane away for Kotak.

At a time when the bank is undergoing a transition.

This compliance embargo from RBI will be a real challenge for the new management.

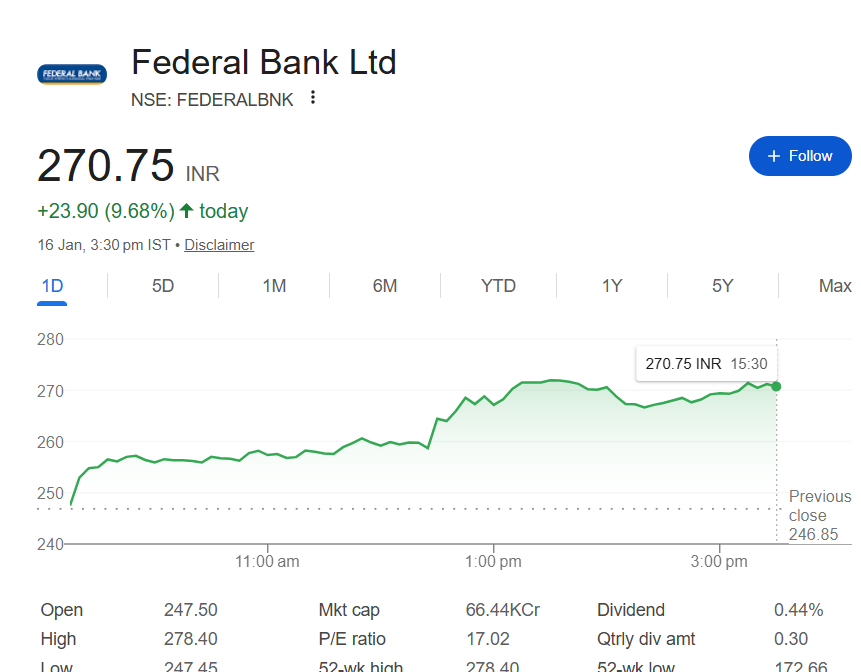

Exit of Top Management?

After Uday Kotak

KVS Manian exited from the bank(mostly going to head federal bank)

Uday Kotak's entire team is now coming off

It remains to be seen how the new management leads the bank from these tough times

After Uday Kotak

KVS Manian exited from the bank(mostly going to head federal bank)

Uday Kotak's entire team is now coming off

It remains to be seen how the new management leads the bank from these tough times

Valuation:-

Kotak now trades at 2.29x P/B

Which is now lowest in its history.

But the Uday Kotak premium is now going away for the bank

Kotak now trades at 2.29x P/B

Which is now lowest in its history.

But the Uday Kotak premium is now going away for the bank

Conclusion:-

Kotak's results are nothing to complain about.

Growth is good

Asset quality is stable

They have strong capital and a superb franchise.

However the stability of top management and the response to RBI's embargo remain a jey monitorable for the bank

Kotak's results are nothing to complain about.

Growth is good

Asset quality is stable

They have strong capital and a superb franchise.

However the stability of top management and the response to RBI's embargo remain a jey monitorable for the bank

Keep following me -@AdityaD_Shah as I write daily to make you aware around:

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

Disclaimer:-

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

• • •

Missing some Tweet in this thread? You can try to

force a refresh