1. Big tribute to Charlie Munger. The entire 30 minute starting video is about Charlie. It’s amazing what he has done for the investment community

2. Berkshire Hathaway trims its stake in Apple by 13%

2. Berkshire Hathaway trims its stake in Apple by 13%

3. Insurance is still an excellent business. Ajit is doing an amazing job

4. Q1 was good for Berkshire Hathaway. The company keeps compounding at attractive rates

4. Q1 was good for Berkshire Hathaway. The company keeps compounding at attractive rates

5. Every time you see the word EBITDA, you should replace it by bullsh*t earnings

6. Berkshire earns more than $100 million per day currently

6. Berkshire earns more than $100 million per day currently

7. Succesful investing is all about having a few very big winners

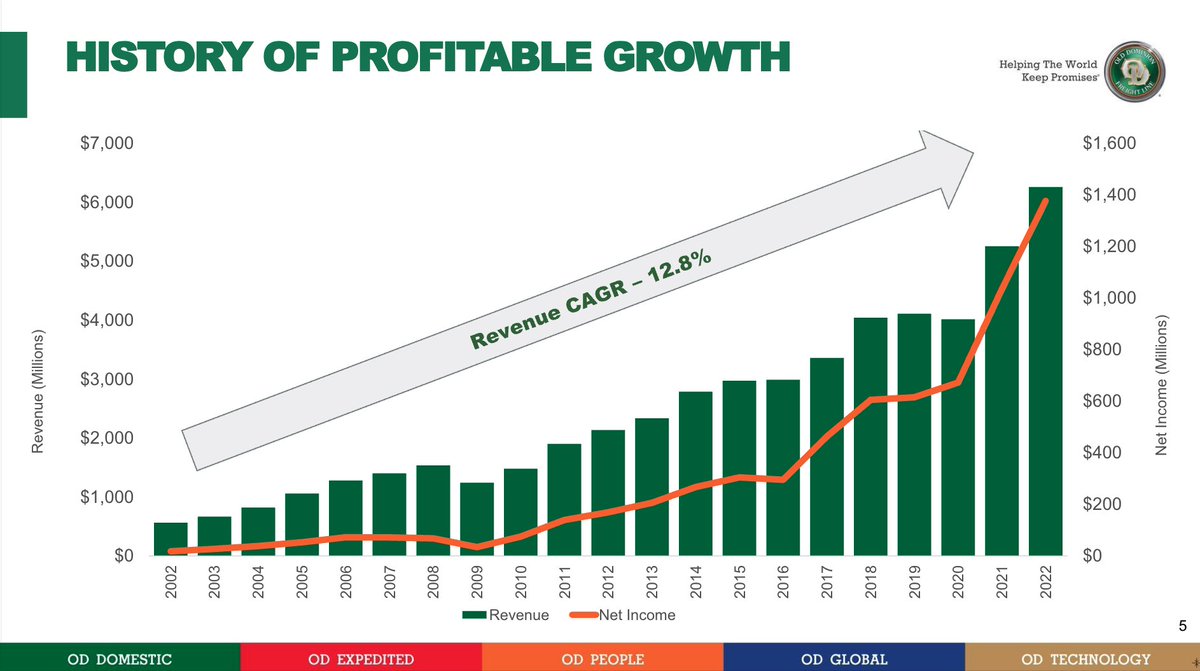

8. The power of compounding is the most underrated power in the world

8. The power of compounding is the most underrated power in the world

9. Berkshire Hathaway will keep buying backs shares in the years to come

10. Don’t check stock prices daily

10. Don’t check stock prices daily

11. Coca Cola and American express will probably never be sold

12. Apple will (probably) remain the largest position of Berkshire Hathaway in the years to come

12. Apple will (probably) remain the largest position of Berkshire Hathaway in the years to come

13. Always look at a stock like a business.

14. Don’t try to time the market

14. Don’t try to time the market

15. The market is there to serve you. Use it to your advantage

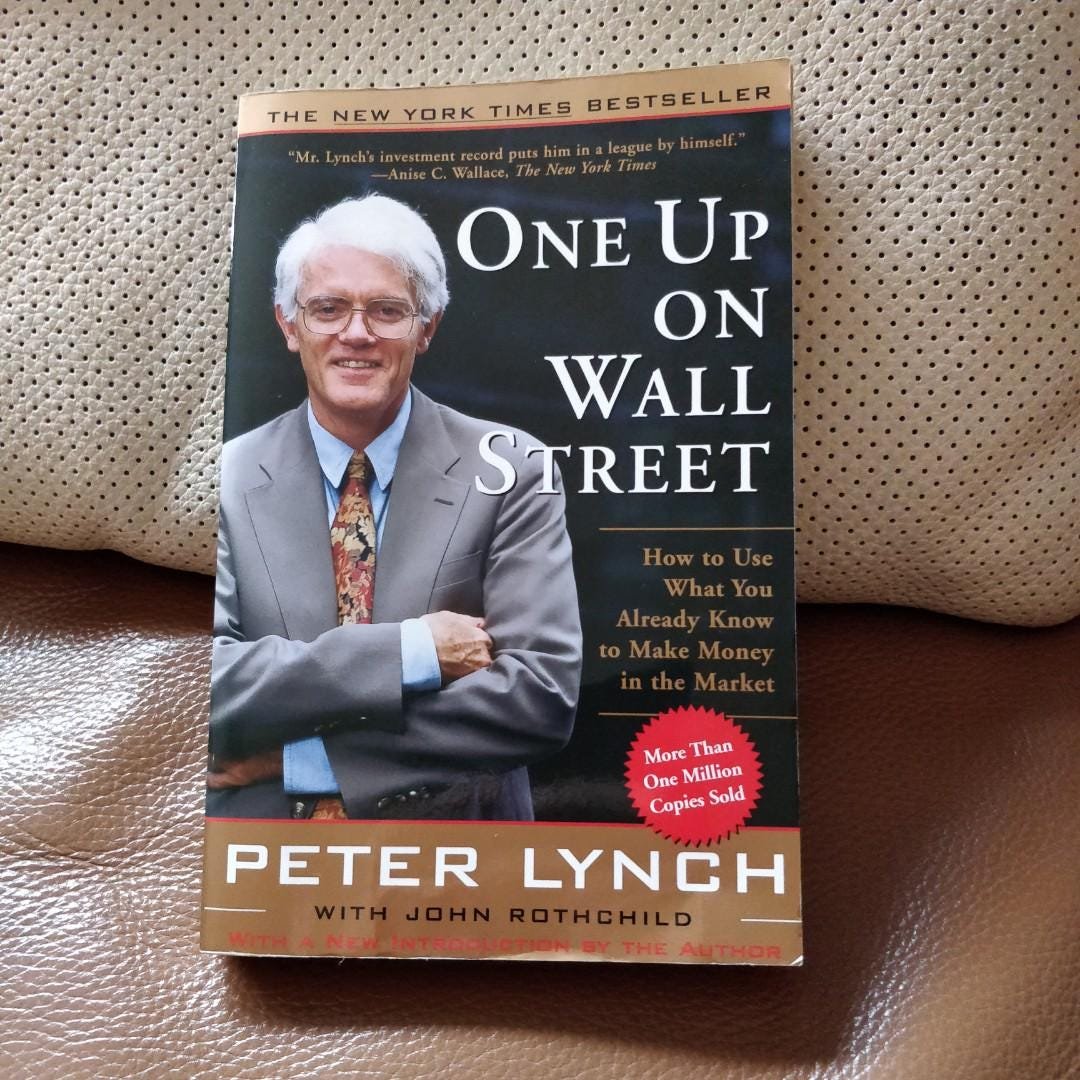

16. The Intelligent Investor from Benjamin Graham is the best investment book ever

16. The Intelligent Investor from Benjamin Graham is the best investment book ever

17. Higher taxes are quite likely in the future according to Buffett

18. Berkshire Hathaway ‘s primary investments will always be in the United States

18. Berkshire Hathaway ‘s primary investments will always be in the United States

19. Anyone who says size doesn’t hurt performance is selling

20. Charlie’s two best ideas were probably BYD and Costco

20. Charlie’s two best ideas were probably BYD and Costco

21. Buffett’s feels extremely good about is exposure to Japan

22. The best time to sell a wonderful company is (almost) never

22. The best time to sell a wonderful company is (almost) never

23. “I don’t know anything about Artificial Intelligence.” - Warren Buffett

24. Geico is still an amazing business. The company is making progress in its data analytics

24. Geico is still an amazing business. The company is making progress in its data analytics

25. Geico has lower costs than virtually any insurance company

26. “Charlie was the best Partner I could have very imagined.” - Warren Buffett

26. “Charlie was the best Partner I could have very imagined.” - Warren Buffett

27. Always surround yourself with people you look up to and trust

28. “During our entire partnership, Charlie never lied to me even once.” - Warren Buffett

28. “During our entire partnership, Charlie never lied to me even once.” - Warren Buffett

29. If there would be no risk there would be no insurance business. Insurance is still a very attractive business despite climate risk

30. Never bet against America

30. Never bet against America

31. Always stay within your circle of competence

32. “We will never find another Ajit” - Warren Buffett talking about succession for Ajit in the insurance business

32. “We will never find another Ajit” - Warren Buffett talking about succession for Ajit in the insurance business

33. Insurance is the most important business for Berkshire Hathaway

34. Hire for integrity, intellect, and hard work. Skills can be taught

34. Hire for integrity, intellect, and hard work. Skills can be taught

35. Be a lifelong learning machine

36. Every investor makes mistakes. It’s about how you handle them

36. Every investor makes mistakes. It’s about how you handle them

37. “All I Want To Know Is Where I'm Going To Die So I'll Never Go There.” - Charlie Munger

38. Cybersecurity insurance is a risky business. Berkshire stays away from it right now

38. Cybersecurity insurance is a risky business. Berkshire stays away from it right now

39. Think on the long term. You can’t create a baby in one month by making 9 women pregnant

40. The opportunities in the US are basically limitless. It’s an amazing gift

40. The opportunities in the US are basically limitless. It’s an amazing gift

41. Find a job you would take when you don’t get paid for at all

42. Start with the end in mind. Make (investment) decisions based on what would make you happy at your dead bed

42. Start with the end in mind. Make (investment) decisions based on what would make you happy at your dead bed

43. It takes character to sit there with all that cash and do nothing. I didn't get to where I am by going after mediocre opportunities

44. The best way to be successful in life is to outwork everyone

44. The best way to be successful in life is to outwork everyone

45. Loads of opportunities in India. However, Warren thinks Berkshire has no advantage in this market

46. Capital allocation is by far the most important task of management

46. Capital allocation is by far the most important task of management

47. You want to invest in companies where managers own a significant stake in the business themselves

48. “Anyone who wants to retire at 65 would be disqualified as potential CEO for Berkshire” - Warren Buffett

48. “Anyone who wants to retire at 65 would be disqualified as potential CEO for Berkshire” - Warren Buffett

49. Greg Abel will (probably) become the next CEO of Berkshire Hathaway

50. Berkshire has every tool available to remain a great business over the next few years and decades

50. Berkshire has every tool available to remain a great business over the next few years and decades

51. As an investor you should go where competition is weak. Competition is weaker in smaller companies

52. Cut your losses as soon as possible and let your winners run

52. Cut your losses as soon as possible and let your winners run

53. The key unique thing about Berkshire Hathaway is its excellent culture

54. The best thing a human being can do is help another human being know more

54. The best thing a human being can do is help another human being know more

55. Warren Buffett will continue to give back to society. Charity is a beautiful thing

56. When Greg Abel becomes the CEO, he will have the end responsibility for all capital allocation decisions

56. When Greg Abel becomes the CEO, he will have the end responsibility for all capital allocation decisions

57. Take a simple idea and take it seriously

58. The current capital allocation strategy will remain intact over the next few years: buy wonderful companies at a fair price

58. The current capital allocation strategy will remain intact over the next few years: buy wonderful companies at a fair price

59. Excess cash will always be saved in US treasuries

60. Investing is simple, but not easy

60. Investing is simple, but not easy

61. Listen to people with opposing views and ideas

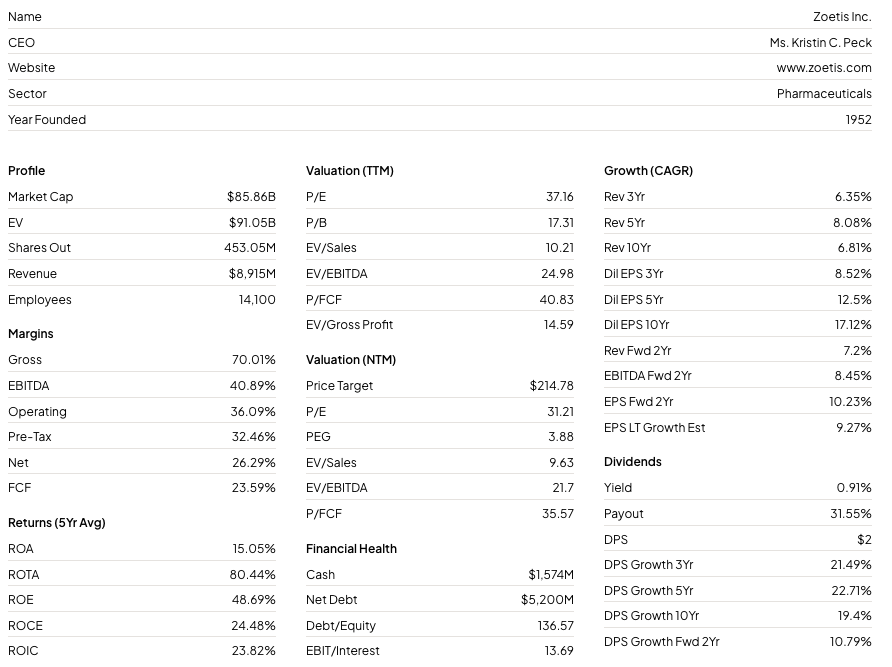

62. The best businesses have a high ROIC and plenty of reinvestment opportunities

62. The best businesses have a high ROIC and plenty of reinvestment opportunities

63. All intelligent investing is value investing

64. Great managers have one thing in common: they allocate capital well

64. Great managers have one thing in common: they allocate capital well

65. Charlie and I made plenty of mistakes in the past. It’s inherent to investing

66. The future is per definition uncertain. That’s why you want to use a margin of safety

66. The future is per definition uncertain. That’s why you want to use a margin of safety

67. To lead a productive live, do what you love

68. The best time to sell a wonderful company is (almost) never

68. The best time to sell a wonderful company is (almost) never

69. Investing is a game of opportunity costs

70. Understanding consumer behavior is crucial to make investment decisions

70. Understanding consumer behavior is crucial to make investment decisions

71. Those who keep learning keep rising in life

72. Nobody knows how stock prices will evolve in the short term

72. Nobody knows how stock prices will evolve in the short term

73. We try to minize our exposure to commodities and cyclical businesses

74. “I am smarter than I was a couple of years ago.” - Warren Buffett

74. “I am smarter than I was a couple of years ago.” - Warren Buffett

75. The railroad segment of Berkshire is still a beautiful business.

76. The favorite holding period of Berkshire is forever

76. The favorite holding period of Berkshire is forever

77. Railroads are absolutely essential for the country. If you should them down, there would be incredible negative effects

78. We love to own companies active in monopolies and oligopolies

78. We love to own companies active in monopolies and oligopolies

79. To find great investment ideas, skim trough thousands of investment ideas

80. With a million of $ you can generate a return of 50% per year if you invest in the small cap space

80. With a million of $ you can generate a return of 50% per year if you invest in the small cap space

81. Investors should be honest against themselves. Know your strengths and weaknesses

82. Never underestimate the power of incentives

82. Never underestimate the power of incentives

83. In investing, there are different paths that lead to Rome

84. In the very long term, the stock market always goes up

84. In the very long term, the stock market always goes up

85. Understanding the psychology of human behavior is crucial

86. You get very rich by understanding the irrationality of Mr. Market

86. You get very rich by understanding the irrationality of Mr. Market

87. Everyone should read Poor Charlie’s Almanack

88. Having the right heroes in your life is crucial

88. Having the right heroes in your life is crucial

89. To get what you want, you have to deserve what you want

90. Invert. Always invert. Turn the problem upside down

90. Invert. Always invert. Turn the problem upside down

• • •

Missing some Tweet in this thread? You can try to

force a refresh