🧵Thread on @gabriel_zucman's claim that billionaires pay a lower tax rate than the average American, as published in yesterday's @nytimes.

The short version: Zucman manipulates his data to fit a pro-tax political narrative. You can see this by comparing to his own earlier work.

The short version: Zucman manipulates his data to fit a pro-tax political narrative. You can see this by comparing to his own earlier work.

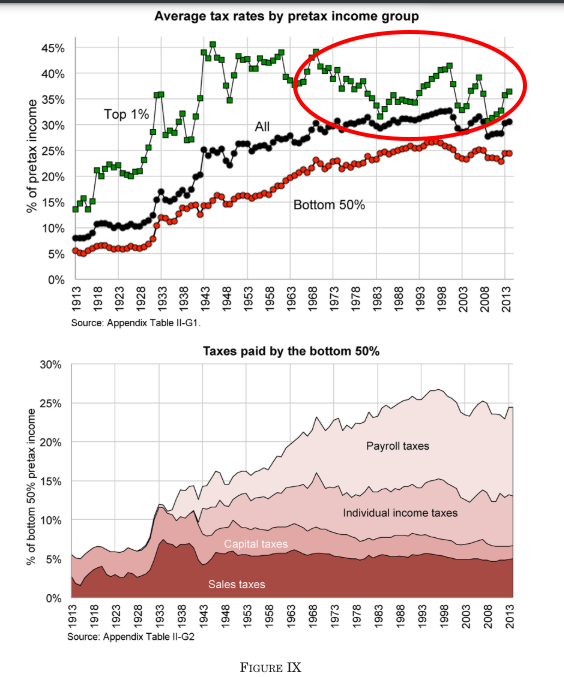

In 2018 Zucman (along with Piketty and Saez) published an article in the prestigious Quarterly Journal of Economics, estimating the avg effective tax rate on top income groups. They argued that the gap between top and bottom earner tax rates had closed due to payroll taxes.

But they also noticed something interesting when you look at the average effective tax rate paid by the wealthiest 1% of earners. It had only slightly decreased between the 1960s and the present!

Even more stunning, this pattern also held when you restricted the data to only the ultra-wealthy. Here is Zucman's 2018 series for the top 0.001%, which is basically billionaires.

They paid 44% in 1940. By 2014, that had only dropped a little. It sat at 40%.

They paid 44% in 1940. By 2014, that had only dropped a little. It sat at 40%.

A few months after his QJE article, Zucman realized he had a problem. He had been arguing that tax cuts in the 80s were responsible for rising inequality, and that we needed a new wealth tax.

But his own effective tax rate data undermined this case!

gabriel-zucman.eu/files/saez-zuc…

But his own effective tax rate data undermined this case!

gabriel-zucman.eu/files/saez-zuc…

So what did Zucman do?

Quite simply, he changed the way he calculated effective tax rates to make them fit his story.

The blue line is his 2018 published QJE version. The orange line is the recalculation, which he touted in the New York Times yesterday.

Quite simply, he changed the way he calculated effective tax rates to make them fit his story.

The blue line is his 2018 published QJE version. The orange line is the recalculation, which he touted in the New York Times yesterday.

As you can see, there's a drastic difference in effective tax rates for the same exact income group of ultra-wealthy billionaires. Zucman's old stats showed the rate dropping from 44% to 40% between 1962-2014.

His new version showed a change from 54% to just 23.5% in same years.

His new version showed a change from 54% to just 23.5% in same years.

So what changed? The answer is how Zucman allocates corporate tax incidence.

This is a complex empirical subject, but for 60+ years economists have recognized that the corporate tax burden does not entirely fall on the person who nominally owns the shares jstor.org/stable/1828856

This is a complex empirical subject, but for 60+ years economists have recognized that the corporate tax burden does not entirely fall on the person who nominally owns the shares jstor.org/stable/1828856

Zucman's 2018 QJE article followed the conventional approach that economists use to allocate corporate tax incidence. And that gave them the results we saw above.

In 2019, when Zucman began advising @senwarren, he needed a new story to justify tax hikes. Instead of peer review, he went to @_cingraham of the Washington Post with a new set of numbers and his now-famous claim about billionaire tax rates.

washingtonpost.com/business/2019/…

washingtonpost.com/business/2019/…

Zucman executed this change by sleight of hand. In October 2019 - with no announcement - he deleted the old replication file for his QJE paper from his @UCBerkeley website and replaced it with the new numbers. He only restored the old file after he was caught & heavily criticized

Comparisons of the old and new data files revealed the discrepancy in the two sets of numbers. I was the first to find it, but many others on twitter subsequently noticed the same thing. Here's my October 2019 tweet on the discovery:

But the question remained as to why the two versions diverged in such pronounced ways. When the excel files were compared, an answer soon emerged: Zucman had completely jettisoned his old way of allocating corporate tax incidence from the QJE article.

The main difference between the QJE data file and th WaPo/NYT version is that he now allocated all corporate tax incidence to shareholders. The rich own more stocks & corp taxes are below top marginal income tax rates, creating an illusion that billionaire rates drop over time.

After he was caught, Zucman needed to rationalize his new approach to corporate tax incidence. He started putting out powerpoint slides that completely jettisoned the Harberger assumptions from the QJE & instead fully assigned corp incidence to shareholders

gabriel-zucman.eu/files/SaezZucm…

gabriel-zucman.eu/files/SaezZucm…

This new approach calls for a bold rejection of over 60 years of empirical economic literature on corp tax incidence in favor of a new, untested, and extremely heterodox approach. It's the sort of thing that needs vetted by economists, not "peer review" by a NYT editor.

There are more problems with Zucman's approach. His NYT chart not only claims that billionaire taxes dropped - it also claims that taxes on the bottom 50% of earners have dramatically increased since the 1960s. But have they?

Zucman's claim about taxes on the poor is historically implausible, because the introduction of the Earned Income Tax Credit (EITC) in 1975 and subsequent expansions of it have generally relieved the federal tax burden on the poor. Yes, payroll taxes have offset in other direction. But EITC is huge.

Here are the CBO's figures on how the EITC has evolved over time. It provides a dramatic tax-reducing benefit to the bottom 50% of earners, and beyond.

So why don't we see this effect in Zucman's NYT chart?

Because he intentionally excludes the EITC as a tax credit.

So why don't we see this effect in Zucman's NYT chart?

Because he intentionally excludes the EITC as a tax credit.

To summarize, Zucman's "stunning graph" in the NYT is a result of two acts of data manipulation.

1. He suppresses the true effective tax rate on the rich over time by misallocating corporate tax incidence to them.

2. He simultaneously inflates the rate for the poor by excluding EITC

1. He suppresses the true effective tax rate on the rich over time by misallocating corporate tax incidence to them.

2. He simultaneously inflates the rate for the poor by excluding EITC

Addendum: since Zucman's associate @MortenStostad is defending his exclusion of the EITC, let's take a closer look.

Here is how Zucman rationalizes this unusual decision:

Here is how Zucman rationalizes this unusual decision:

@MortenStostad There are several problems with Zucman's approach.

1. As he admits, excluding EITC runs counter to the longstanding convention of the CBO, which includes it in tax rate calculations, and the IRS, which administers it as an integrated part of the income tax system.

1. As he admits, excluding EITC runs counter to the longstanding convention of the CBO, which includes it in tax rate calculations, and the IRS, which administers it as an integrated part of the income tax system.

@MortenStostad 2. Instead, Zucman makes a tendentiously argued case that EITC should be treated as a transfer akin to Social Security, and therefore omitted from tax rates.

But exactly nobody who receives EITC sees it as anything other than a tax measure, fully integrated into their filings.

But exactly nobody who receives EITC sees it as anything other than a tax measure, fully integrated into their filings.

@MortenStostad 3. If Zucman's aim is to accurately measure the tax burdens that people actually shoulder, then excluding the tax-integrated EITC is - by definition - an act of deception. Accounting pedantry is not a valid rationale to misrepresent the tax rates that people actually pay.

@MortenStostad 4. There's a larger issue of the mismatch between Zucman's tax analysis, which *intentionally* excludes tax policy measures to benefit the poor, and his advocacy of further tax policy measures for the poor as if they did not already exist.

5. The EITC was expanded over time in conjunction with several successive tax rate changes, meaning Zucman's exclusion of it skews those tax rate changes between 1975-present by only showing rate increases. This gives an illusion that those rate changes did not have offsets that absolutely exist.

• • •

Missing some Tweet in this thread? You can try to

force a refresh