Warren Buffett is amazing

I am rereading his latest annual letter at the airport of Omaha

Here are a few key takeaways👇🏼

I am rereading his latest annual letter at the airport of Omaha

Here are a few key takeaways👇🏼

1. On capital allocation and managers

You want to invest in companies led by exceptional CEOs which manage to allocate capital well.

"Berkshire directs capital allocation at these subsidiaries and selects the CEOs who make day-by-day operating decisions. "

You want to invest in companies led by exceptional CEOs which manage to allocate capital well.

"Berkshire directs capital allocation at these subsidiaries and selects the CEOs who make day-by-day operating decisions. "

2. Think like an owner

As an investor, you own a part of the companies you invest in.

"That point is crucial: Charlie and I are not stock-pickers; we are business-pickers."

As an investor, you own a part of the companies you invest in.

"That point is crucial: Charlie and I are not stock-pickers; we are business-pickers."

3. Use volatility to your advantage

The best time to invest is when other investors are very fearful.

"One advantage of our publicly-traded segment is that – episodically – it becomes easy to buy pieces of wonderful businesses at wonderful prices."

The best time to invest is when other investors are very fearful.

"One advantage of our publicly-traded segment is that – episodically – it becomes easy to buy pieces of wonderful businesses at wonderful prices."

4. Let your winners run

"In August 1994 Berkshire completed its purchase of the 400 million shares of Coca-Cola we now own. The total cost was $1.3 billion. The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million."

"In August 1994 Berkshire completed its purchase of the 400 million shares of Coca-Cola we now own. The total cost was $1.3 billion. The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million."

5. Share buybacks can create a lot of value

Today, a lot of companies are buying back their own shares. Share buybacks only can create value when the stock is undervalued.

"Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect."

Today, a lot of companies are buying back their own shares. Share buybacks only can create value when the stock is undervalued.

"Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect."

6. Always have some cash

"Berkshire will always hold a boatload of cash and U.S. Treasury bills. We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses."

"Berkshire will always hold a boatload of cash and U.S. Treasury bills. We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses."

7. Never make forecasts

Always think on the long term. Nobody can predict what the stock market will do next week, month, or year.

"Near-term economic and market forecasts are worse than useless."

Always think on the long term. Nobody can predict what the stock market will do next week, month, or year.

"Near-term economic and market forecasts are worse than useless."

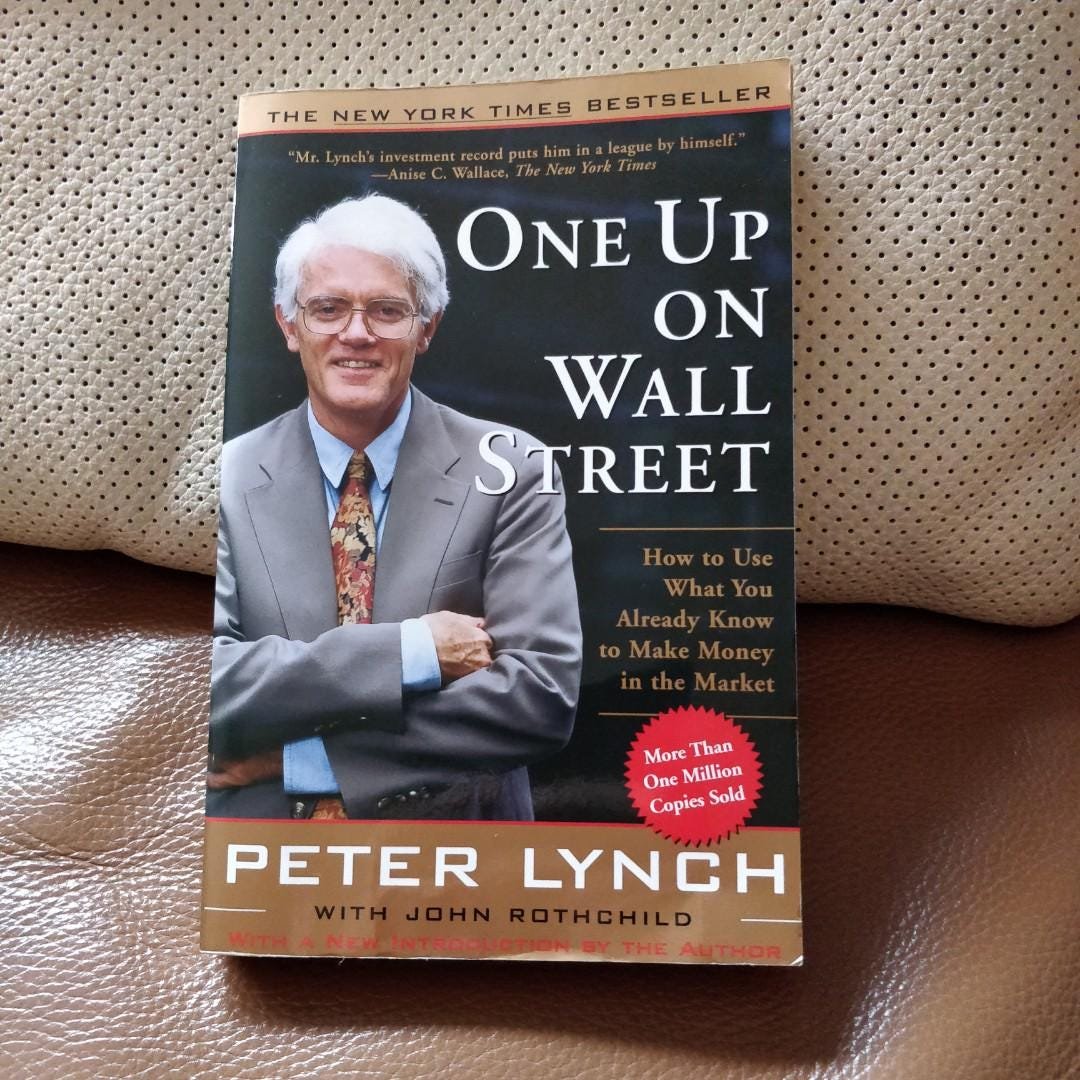

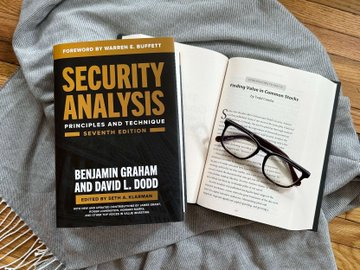

8. Find a great mentor

Via the internet and books you can learn from the best investors in the world for free. Use it to your advantage.

"Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says."

Via the internet and books you can learn from the best investors in the world for free. Use it to your advantage.

"Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says."

9. Be patient

Investors make money for themselves. Speculators make money for their brokers.

"The world is full of foolish gamblers, and they will not do as well as the patient investor."

Investors make money for themselves. Speculators make money for their brokers.

"The world is full of foolish gamblers, and they will not do as well as the patient investor."

10. Invest in assets

If you aren't making money while you sleep, you'll work until you die.

"A great company keeps working after you are not; a mediocre company won’t do that."

If you aren't making money while you sleep, you'll work until you die.

"A great company keeps working after you are not; a mediocre company won’t do that."

11. Never use leverage

There are only three ways a smart person can go broke: liquor, ladies and leverage.

"There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous."

There are only three ways a smart person can go broke: liquor, ladies and leverage.

"There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous."

12. Keep learning

The best investors keep learning new things every single day.

"You have to keep learning if you want to become a great investor. When the world changes, you must change."

The best investors keep learning new things every single day.

"You have to keep learning if you want to become a great investor. When the world changes, you must change."

The end.

Want more? Here's a list with 10 stocks to own forever: compounding-quality.ck.page/555535a3d1

Want more? Here's a list with 10 stocks to own forever: compounding-quality.ck.page/555535a3d1

• • •

Missing some Tweet in this thread? You can try to

force a refresh