Here is my Rivian Q1 2024 earnings deep dive.

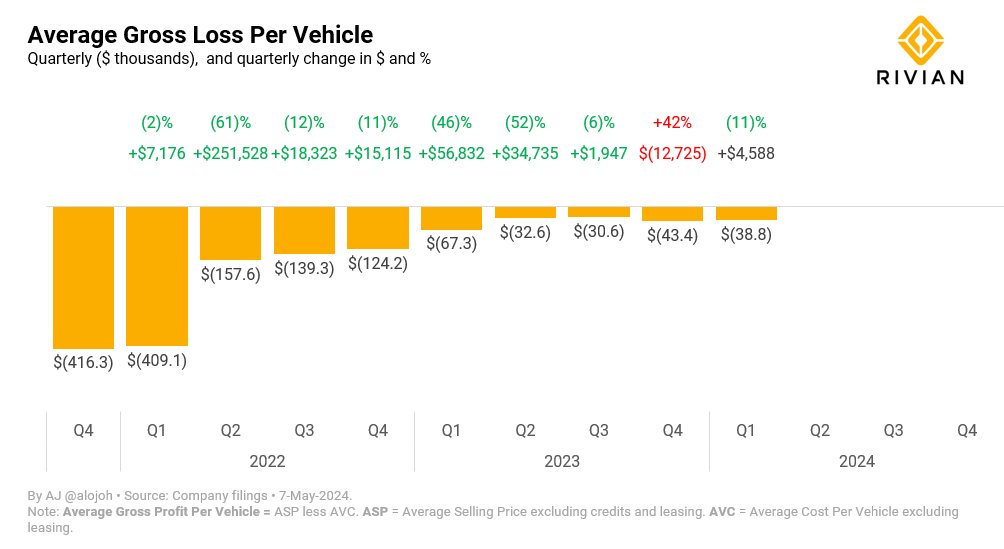

Verdict: Further escalating cash burn, resources dropping below $8B, lack of operational profitability/cost improvements, and lackluster 2024 guidance. Rivian loses $39K per vehicle sold (gross).

1. Free Cash Flow significantly worsened to negative $1,523 million representing the 3rd consecutive quarter demonstrating widening cash burn.

Verdict: Further escalating cash burn, resources dropping below $8B, lack of operational profitability/cost improvements, and lackluster 2024 guidance. Rivian loses $39K per vehicle sold (gross).

1. Free Cash Flow significantly worsened to negative $1,523 million representing the 3rd consecutive quarter demonstrating widening cash burn.

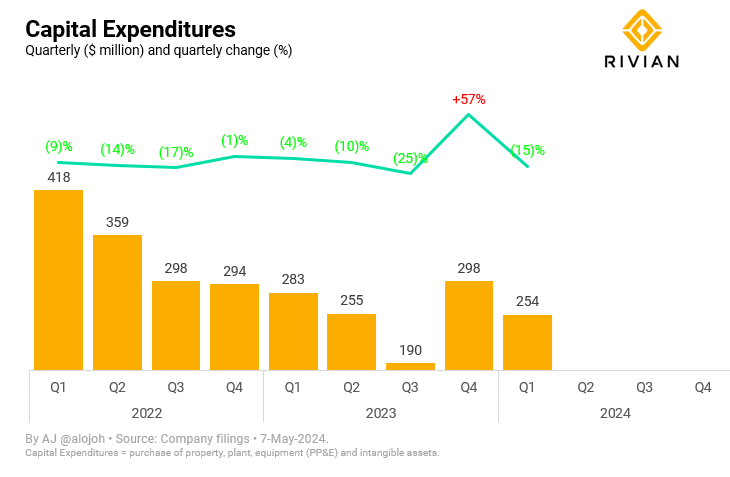

2. Cash burn increased despite a significant (15%) reduction in investments (capital expenditures) to just $254 million.

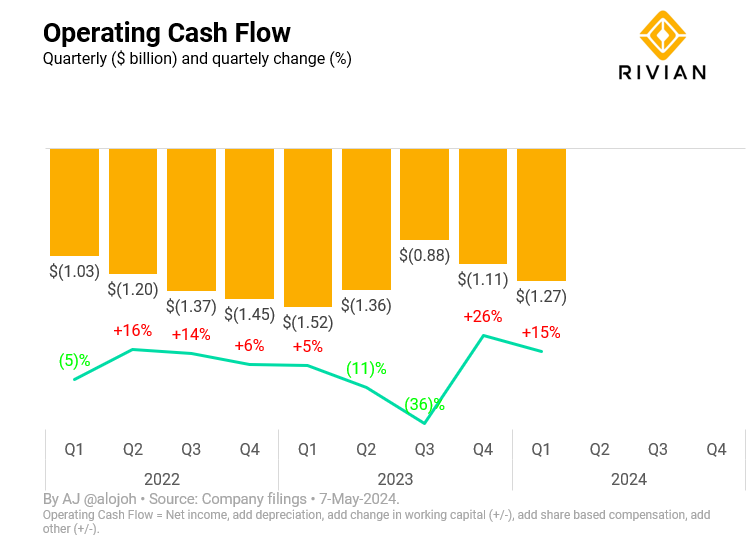

3. Poor free cash flow was partial due to the still very weak operating cash flow which worsened by 15% to negative $1.3 billion.

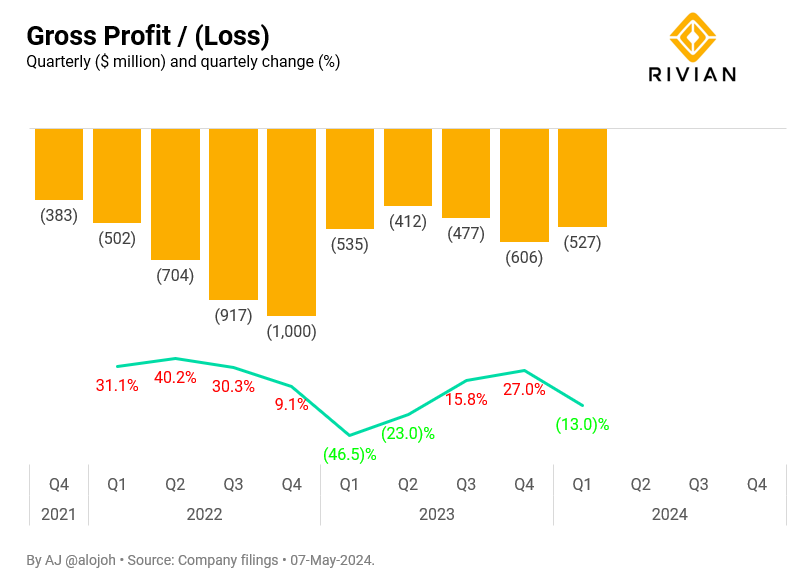

4. A significant driver of the weakening operational cash generation was the weakening operational profitability. Although gross losses reduced (13%) to $527M,...

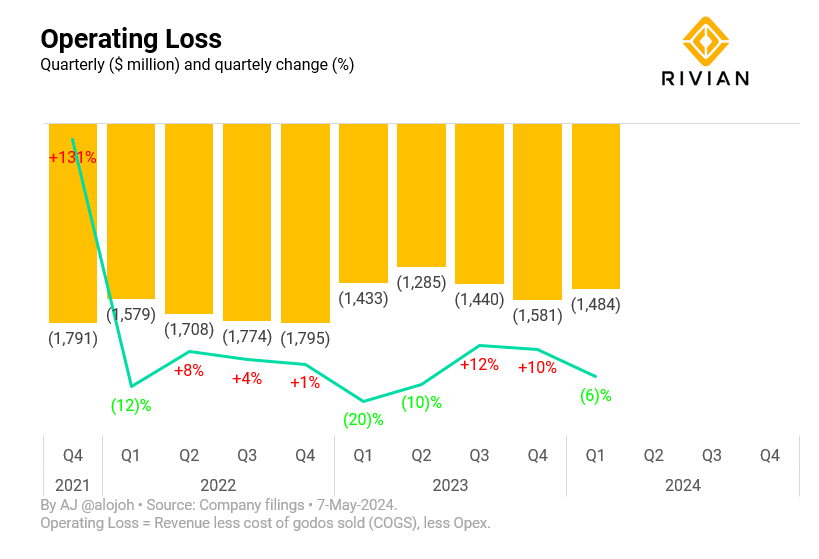

7. ...only moderate improvements in terms of operating profitability: Operating losses reduced from $1,581 million to $1,484 million.

8. As a result, Rivian's operating margin worsened again to negative 123%, the second consecutive month.

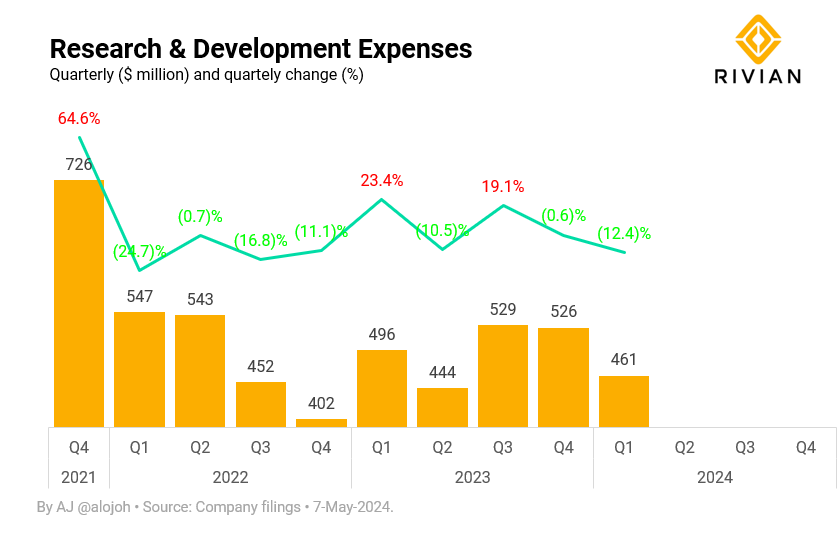

9. Rivian failed to improve operating profitability despite a significant reduction in R&D spending (12.4% less) to $461 million.

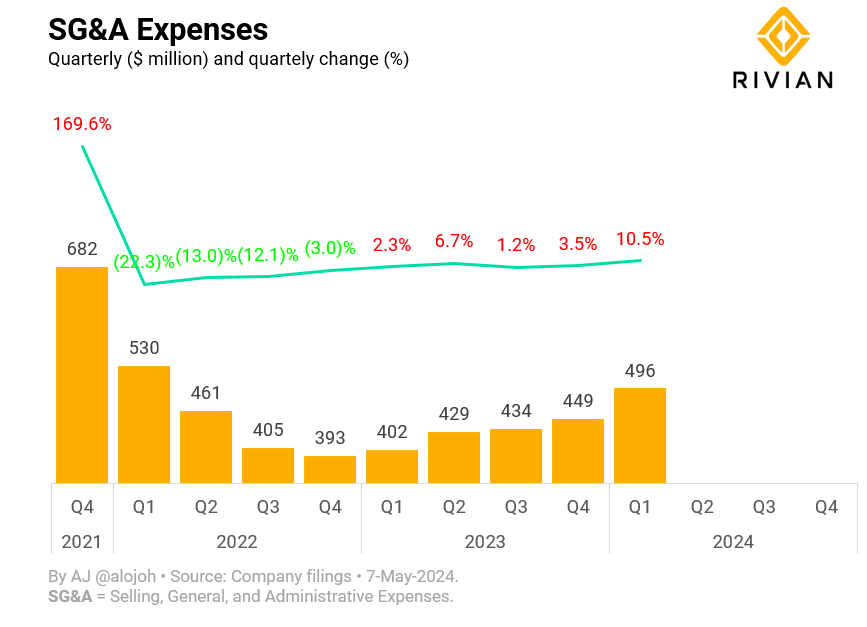

10. Additionally, Rivian's overhead expenses increased significantly - as was expected - from Rivian's announced layoffs. For reference: Tesla sells over 30x more vehicles than Rivian but Tesla's SG&A spending is only about 3x of Rivian's!.

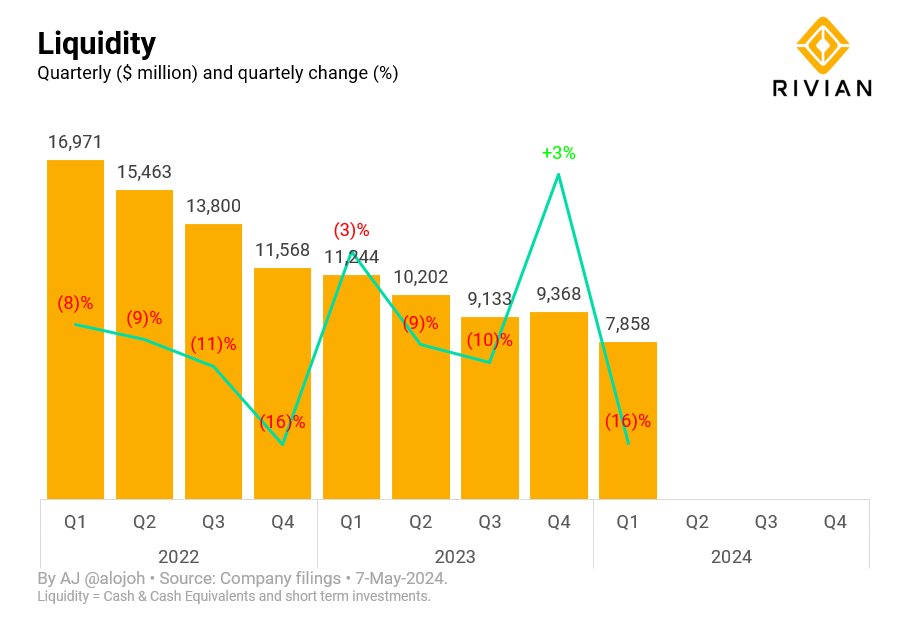

14. As a result of the operational losses and further inventory increases, Rivian's financial resources dropped for the first time below $8.0 billion despite substantial capital raises during 2023.

15. Rivian's long term debt balance remained unchanged in Q1 2024 after a significant increase in Q4 2023 to $4.4 billion.

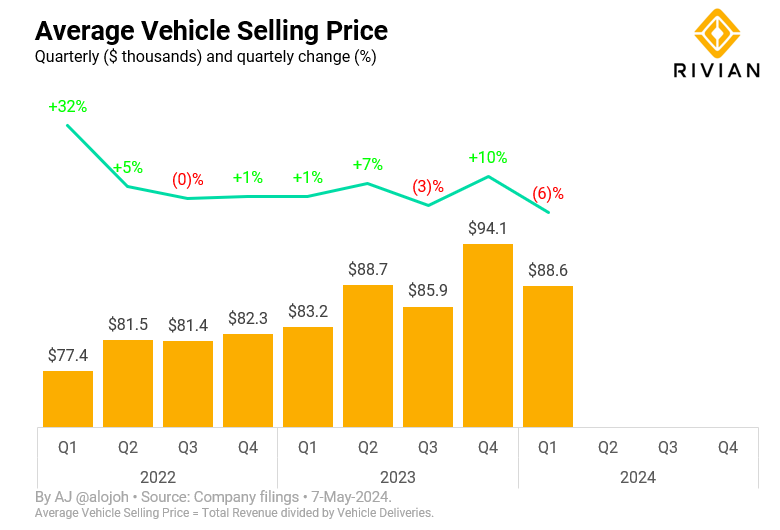

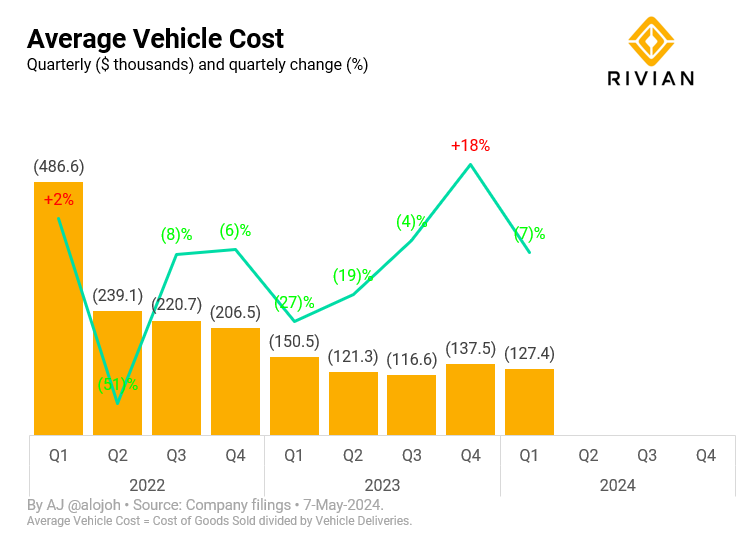

16. Due to Rivian's rather high vehicle production cost of $127,400, which decreased by only 7% qoq, and...

18. ...was unable to materially lower per-vehicle losses: at the current rate, it would take rivian >2 years to achieve $1 in profit per vehicle sold.

19. Rivian maintained a weak vehicle sales guidance for 2024 of 57,000 vehicles, implying an ex-growth scenario for Rivian's current line up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh