1/9

I've been asked about my stance on yields. Do I still think the 10-year yield is going to 5.00%—5.50%?

Yes

But I also took a neutral stance a few weeks ago.

75% of the move is over.

🧵

I've been asked about my stance on yields. Do I still think the 10-year yield is going to 5.00%—5.50%?

Yes

But I also took a neutral stance a few weeks ago.

75% of the move is over.

🧵

2/9

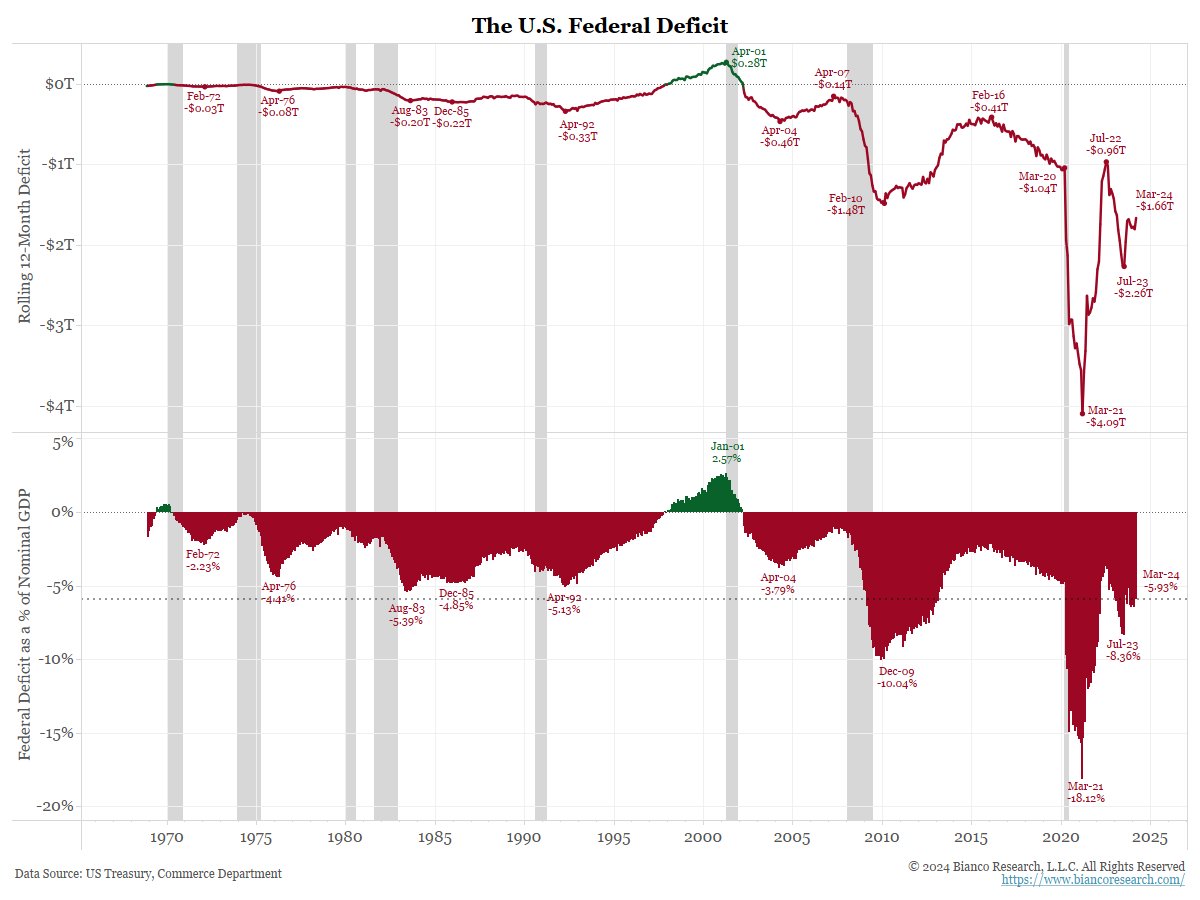

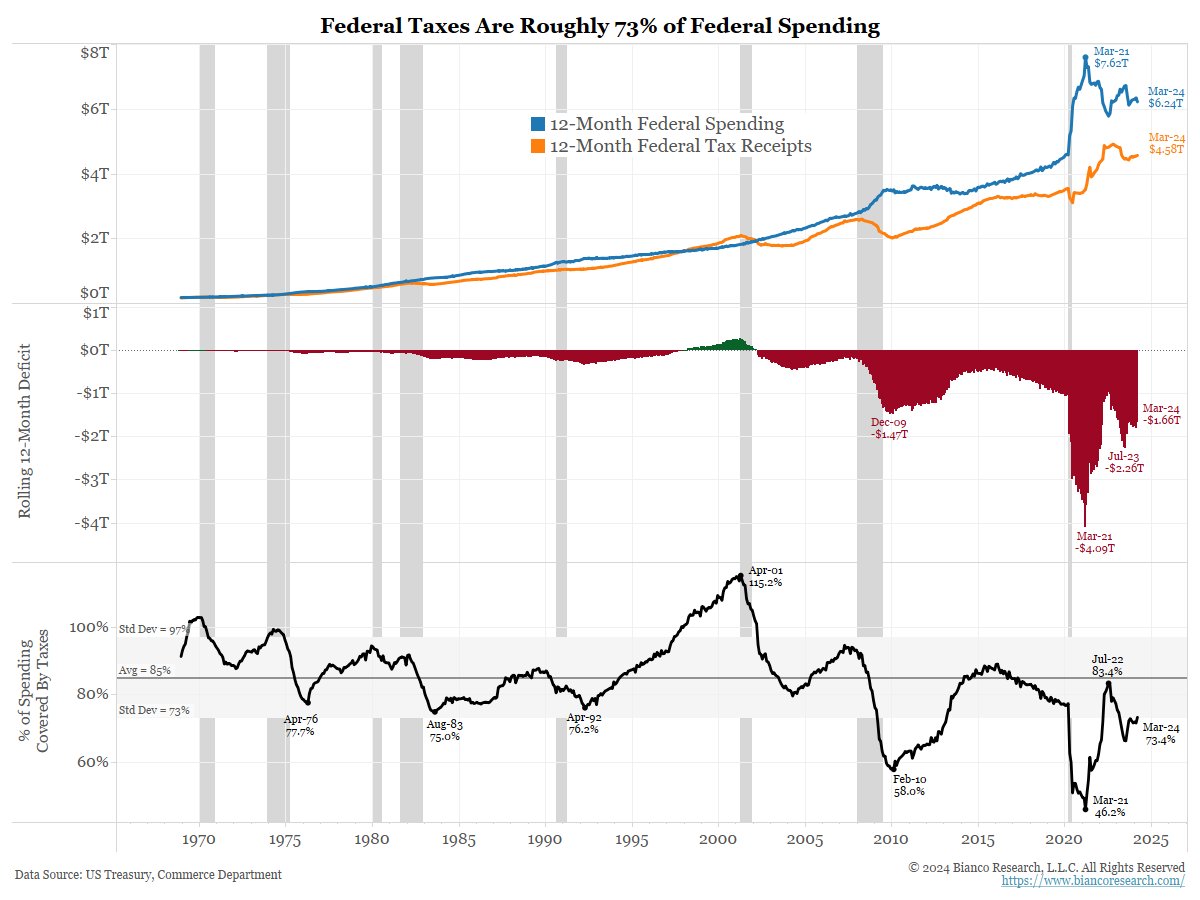

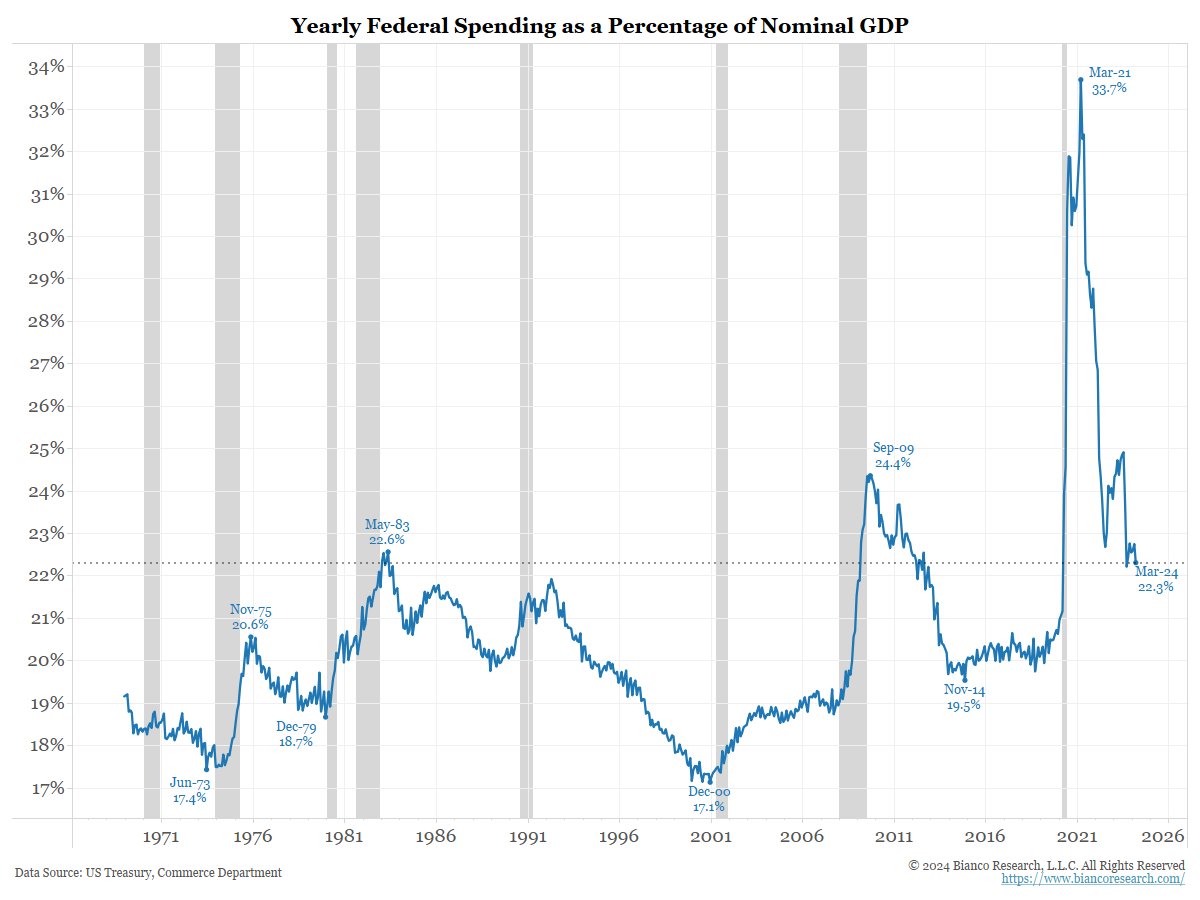

Where did 5.00% - 5.50% come from.

The belief is that the 40-year bond bull market is over (in 2020), and a multi-year bond bear market is continuing.

So, 5.00% - 5.50% is a higher high than the 5% peak of last October, as would be expected in a bear market.

Where did 5.00% - 5.50% come from.

The belief is that the 40-year bond bull market is over (in 2020), and a multi-year bond bear market is continuing.

So, 5.00% - 5.50% is a higher high than the 5% peak of last October, as would be expected in a bear market.

3/9

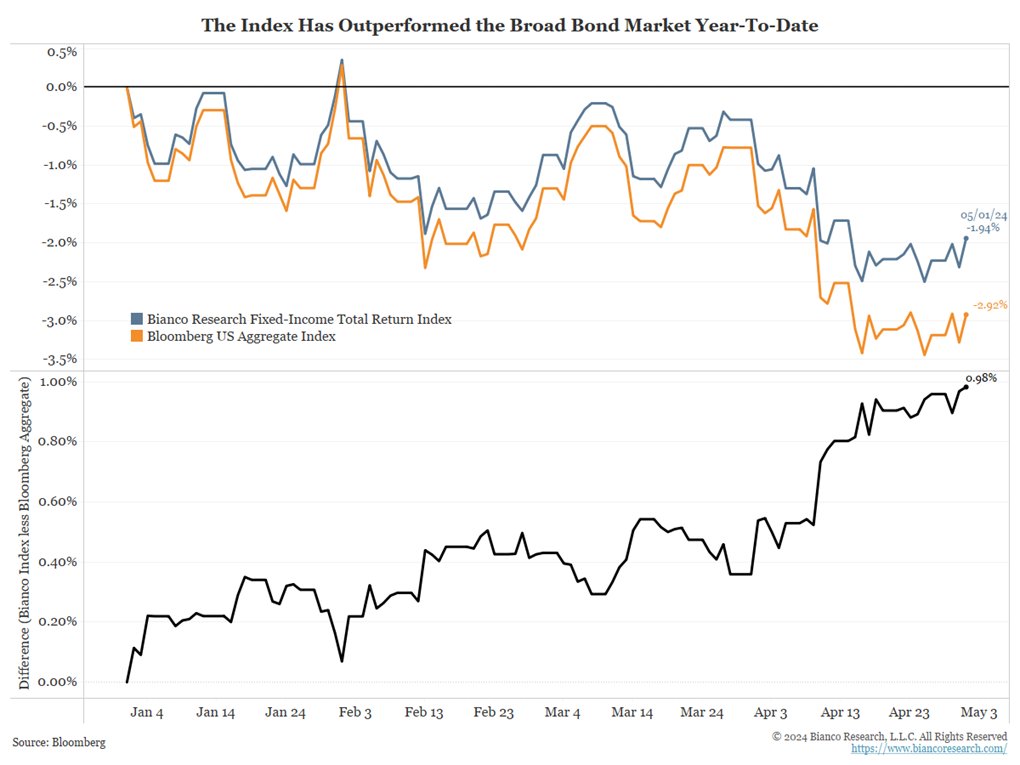

That said, we did move our Index to neutral duration from being short since late last year. 75% of the move is over.

Recall we manage the Bianco Research Total Return Index. The ETF $WTBN tracks our Index (similar to SPY tracks SPX)

Explained here

biancoadvisors.com/may-2024-index…

That said, we did move our Index to neutral duration from being short since late last year. 75% of the move is over.

Recall we manage the Bianco Research Total Return Index. The ETF $WTBN tracks our Index (similar to SPY tracks SPX)

Explained here

biancoadvisors.com/may-2024-index…

4/9

Our index was 98 basis points ahead of the Bloomberg US Aggregate Index (bottom panel) through the end of April.

biancoadvisors.com

Our index was 98 basis points ahead of the Bloomberg US Aggregate Index (bottom panel) through the end of April.

biancoadvisors.com

5/9

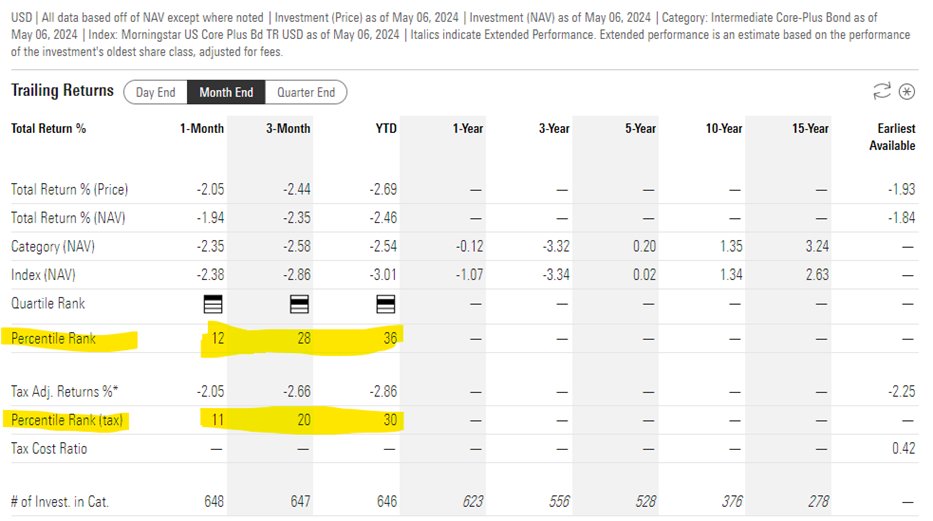

And here is how $WTBN is performing relative to its peers, as calculated by Morningstar.

morningstar.com/etfs/xnas/wtbn…

And here is how $WTBN is performing relative to its peers, as calculated by Morningstar.

morningstar.com/etfs/xnas/wtbn…

6/9

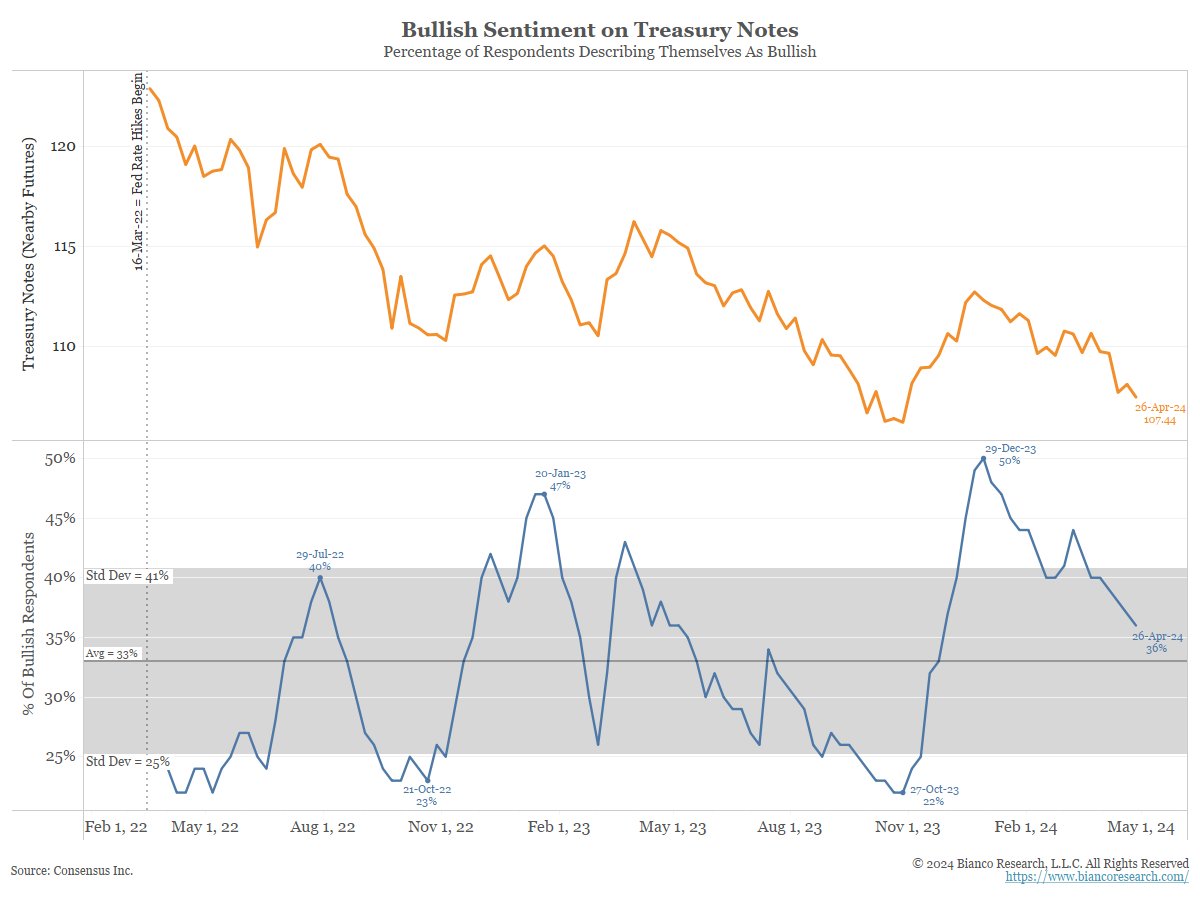

So if we moved to neutral, why still thinking that 5.00% - 5.50% is still possible.

No capitulation yet

Consensus Inc. surveys brokerage house reports. They divide them into two piles: bullish and "not bullish."

The chart started when the Fed began hiking rates.

So if we moved to neutral, why still thinking that 5.00% - 5.50% is still possible.

No capitulation yet

Consensus Inc. surveys brokerage house reports. They divide them into two piles: bullish and "not bullish."

The chart started when the Fed began hiking rates.

7/9

So, the chart above has never been above 50% bullish, as bonds have been in a huge bear market.

That said, the current reading of 36% is slightly above the average of 33% since March 2022.

So, the thinking is 5.00% - 5.50% produces an extreme reading, then get long bonds.

So, the chart above has never been above 50% bullish, as bonds have been in a huge bear market.

That said, the current reading of 36% is slightly above the average of 33% since March 2022.

So, the thinking is 5.00% - 5.50% produces an extreme reading, then get long bonds.

8/9

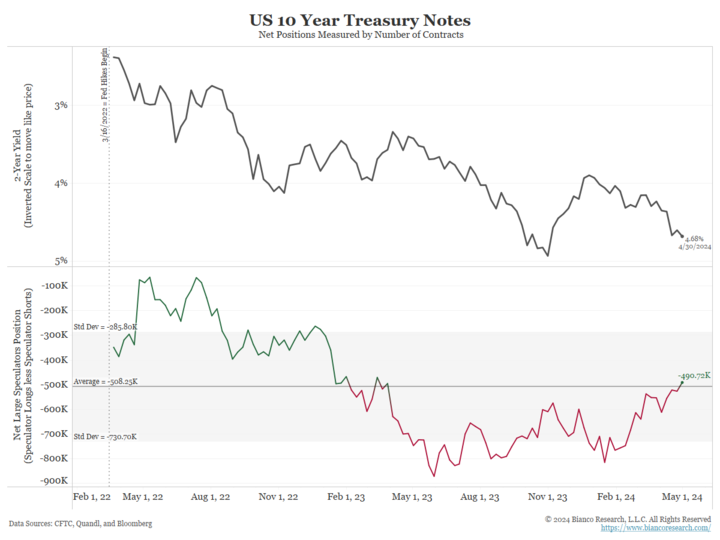

Ditto the CoT report. Net Large Trader (Speculator) positions are on their average since the Fed started hiking in March 2022.

(Specs = holds 1,000 contracts and does not trade in cash mkt)

Move to 5.00% - 5.50%, and my guess is a capitulation, then get a long duration.

Ditto the CoT report. Net Large Trader (Speculator) positions are on their average since the Fed started hiking in March 2022.

(Specs = holds 1,000 contracts and does not trade in cash mkt)

Move to 5.00% - 5.50%, and my guess is a capitulation, then get a long duration.

9/9

We are close enough to the end of this rise, so we moved neutral.

I expect a 10-year yield move to 5.00%—5.50% to produce extreme sentiment and set up a decent bond rally.

Will discuss more when/if we get above 5.00%.

We are close enough to the end of this rise, so we moved neutral.

I expect a 10-year yield move to 5.00%—5.50% to produce extreme sentiment and set up a decent bond rally.

Will discuss more when/if we get above 5.00%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh