Guide:

"How to draw down a $200k RESP over a 4 year university program"

Let's say you front loaded your RESP, and years later you have $200k.... how do you get the money out?

Thread👇

"How to draw down a $200k RESP over a 4 year university program"

Let's say you front loaded your RESP, and years later you have $200k.... how do you get the money out?

Thread👇

If you are wondering what front loading a RESP is, then check it out here:

Now we are looking at the other side.... You've had success in your child's RESP, how do you get the money out without penalties?

Now we are looking at the other side.... You've had success in your child's RESP, how do you get the money out without penalties?

https://x.com/AaronHectorCFP/status/1787188396248731967

1st - a quick primer on the 2 types of post secondary RESP withdrawals:

1st.. Educational Assistance Payments (EAP).

This is the combined total of the lifetime investment returns + Gov't grants.

EAPs are taxable to the beneficiary (ie. student) when withdrawn.

1st.. Educational Assistance Payments (EAP).

This is the combined total of the lifetime investment returns + Gov't grants.

EAPs are taxable to the beneficiary (ie. student) when withdrawn.

Then there are Post-Secondary Education (PSE) withdrawals.

These are your contributions into the RESP.

These are tax-free when withdrawn.

These are your contributions into the RESP.

These are tax-free when withdrawn.

Limits...

EAPs are subject to $8k in first 13 weeks of a full time program ($4k if part time).

After the first 13 weeks there is an annual EAP limit. If you stay under the limit you don't need to worry about your FI asking for verification as to why the dollar amount is reqd.

EAPs are subject to $8k in first 13 weeks of a full time program ($4k if part time).

After the first 13 weeks there is an annual EAP limit. If you stay under the limit you don't need to worry about your FI asking for verification as to why the dollar amount is reqd.

The EAP limit is indexed annually. For the year 2024 it is $28,122.

The location of this website has bounced around a cpl of times over the last cpl of years... but as of today it is here: canada.ca/en/revenue-age…

The location of this website has bounced around a cpl of times over the last cpl of years... but as of today it is here: canada.ca/en/revenue-age…

There are no limits on PSE withdrawals... so long as you have a beneficiary in a qualifying educational program.

If you have $200k in your RESP, let's assume the composition is:

- $50k PSE (contributions)

- $150k EAP (growth + grants)

- $50k PSE (contributions)

- $150k EAP (growth + grants)

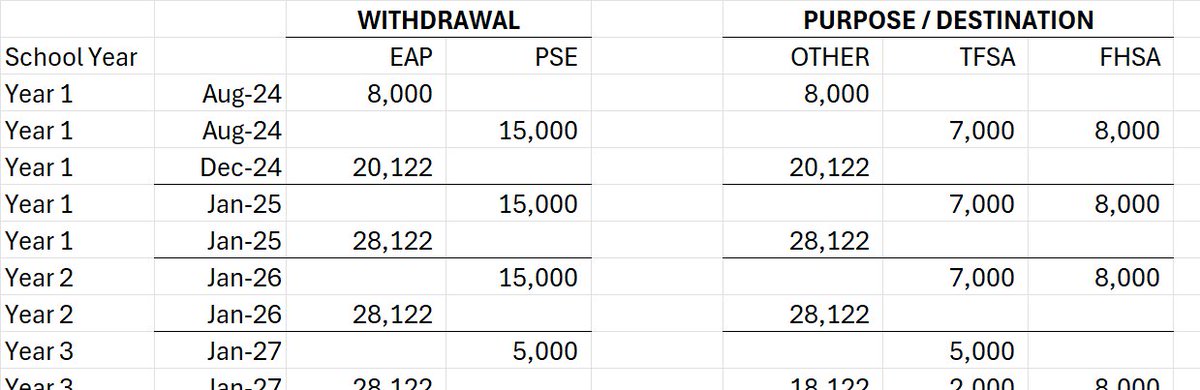

Post Secondary Year 1 (student is 18):

August (Fall Semester, Year 1):

$15,000 withdrawn as PSE. That is used to fund the student's TFSA ($7k) and FHSA ($8k).

$8,000 withdrawn as EAP. Pay for tuition / books / whatever.

August (Fall Semester, Year 1):

$15,000 withdrawn as PSE. That is used to fund the student's TFSA ($7k) and FHSA ($8k).

$8,000 withdrawn as EAP. Pay for tuition / books / whatever.

December (Year 1)

Now it's been more than 13 weeks.

- $20,122 withdrawn as EAP (the balance to get to the EAP threshold of $28,122 for 2024)

Now it's been more than 13 weeks.

- $20,122 withdrawn as EAP (the balance to get to the EAP threshold of $28,122 for 2024)

January (Winter Semester, Yr 1):

- $15,000 withdrawn as PSE.

That is used to fund the student's TFSA ($7k) and FHSA ($8k). Yes, again... it's a new calendar year.

- $28,122 withdrawn as EAP (or whatever the new EAP limit is for the next year)

- $15,000 withdrawn as PSE.

That is used to fund the student's TFSA ($7k) and FHSA ($8k). Yes, again... it's a new calendar year.

- $28,122 withdrawn as EAP (or whatever the new EAP limit is for the next year)

January (Winter Semester, Yr 2):

- $15,000 withdrawn as PSE.

That is used to fund the student's TFSA ($7k) and FHSA ($8k). Yes, again... it's a new calendar year.

- $28,122 withdrawn as EAP.

- $15,000 withdrawn as PSE.

That is used to fund the student's TFSA ($7k) and FHSA ($8k). Yes, again... it's a new calendar year.

- $28,122 withdrawn as EAP.

January (Winter Semester, Yr 3)

- $5,000 withdrawn as PSE (max remaining)...used to partially fund the student's TFSA ($5k).

- $28,122 withdrawn as EAP. Part of this should be used to fund the TFSA ($2k remaining) and FHSA ($8k).

- $5,000 withdrawn as PSE (max remaining)...used to partially fund the student's TFSA ($5k).

- $28,122 withdrawn as EAP. Part of this should be used to fund the TFSA ($2k remaining) and FHSA ($8k).

January (Winter Semester, Yr 4):

- $28,122 withdrawn as EAP.

Part of this should be used to fund the TFSA ($7k) and FHSA ($8k).

- $28,122 withdrawn as EAP.

Part of this should be used to fund the TFSA ($7k) and FHSA ($8k).

The student's FHSA is now fully funded ($40k lifetime).

The student also has $35k in their TFSA.

Plus growth.

The student also has $35k in their TFSA.

Plus growth.

February (or whenever it makes sense for you)

Balance of account as an EAP, in our example... $9,390 (would be more with some modest interest/growth in the RESP during the school years)

But wait... we've already withdrawn the max EAP limit for this year.

Balance of account as an EAP, in our example... $9,390 (would be more with some modest interest/growth in the RESP during the school years)

But wait... we've already withdrawn the max EAP limit for this year.

Then we'll need a good reason to request an excess EAP, won't we? But no worries...

A car down payment.

A car for the student qualifies for an excess EAP w/d so long as the student uses it to drive to and from school.

A car down payment.

A car for the student qualifies for an excess EAP w/d so long as the student uses it to drive to and from school.

That's how to withdraw a $200,000 RESP over a 4 year school program...

To summarize....

To summarize....

$125k of EAP was used to pay for tuition / books / car / computers / rent / whatever.

The remaining $25k of EAP, plus the entire $50k of PSE withdrawals were used to fund the student's TFSA and FHSA.

The remaining $25k of EAP, plus the entire $50k of PSE withdrawals were used to fund the student's TFSA and FHSA.

The student's taxable income from the EAP withdrawals...

Calendar Yr 1 : $28,122

Calendar Yr 2 : $28,122

Calendar Yr 3 : $28,122

Calendar Yr 4 : $28,122

Calendar Yr 5 : $28,122

With some tuition credits, estimate $1,500 to $2k of tax payable by the student each year... Not bad

Calendar Yr 1 : $28,122

Calendar Yr 2 : $28,122

Calendar Yr 3 : $28,122

Calendar Yr 4 : $28,122

Calendar Yr 5 : $28,122

With some tuition credits, estimate $1,500 to $2k of tax payable by the student each year... Not bad

The student's FHSA is now fully funded ($40k lifetime).

The student also has $35k in their TFSA.

Plus growth.

And a partially paid for car.

The student also has $35k in their TFSA.

Plus growth.

And a partially paid for car.

Not to mention you had about $27k to pay for school and books and rent for each of the 4 school years (that's after paying the student's tax bills).

That also assumes the student is saving all $40,000 of FHSA deductions for the future.

They'll make better use of those soon once they are in the workforce and in a higher tax bracket 😉

They'll make better use of those soon once they are in the workforce and in a higher tax bracket 😉

Your child is set up for success and you've launched them into adulthood, with a huge head start.

Well done, mom/dad.

Well done, mom/dad.

If you feel like you know someone who this might help, then please share the first post (link below). Thanks!

https://x.com/AaronHectorCFP/status/1788196751821738360

• • •

Missing some Tweet in this thread? You can try to

force a refresh