Passion for personal finance, innovative ideas & the well being of my clients. Opinions/posts are my own. Private Wealth Advisor @ CWB Wealth, President @ IAFP

How to get URL link on X (Twitter) App

If you are wondering what front loading a RESP is, then check it out here:

If you are wondering what front loading a RESP is, then check it out here: https://x.com/AaronHectorCFP/status/1787188396248731967

First, it’s important to understand a couple of basics about how RESPs work.

First, it’s important to understand a couple of basics about how RESPs work.

https://twitter.com/AaronHectorCFP/status/1777022106653331819I'm now going to build a hypothetical portfolio.

https://twitter.com/Moneywithbilz/status/1657864184451813378

https://twitter.com/AaronHectorCFP/status/1645610804161691649?s=20Can you attach a monetary value to RRSP contribution room?

For the diehards who have read my posts all week - thank you! It’s time for the last one in this series.

For the diehards who have read my posts all week - thank you! It’s time for the last one in this series.

Good Friday everyone!

Good Friday everyone!

Are you ready for your third lesson?

Are you ready for your third lesson? https://twitter.com/AaronHectorCFP/status/1643206793601118212?s=20

https://twitter.com/AaronHectorCFP/status/1643569176710373376?s=20

Are you ready for your second lesson? If you missed yesterday’s post, make sure you check out. Some of the lessons there are going to be useful today.

Are you ready for your second lesson? If you missed yesterday’s post, make sure you check out. Some of the lessons there are going to be useful today. https://twitter.com/AaronHectorCFP/status/1643206793601118212?s=20

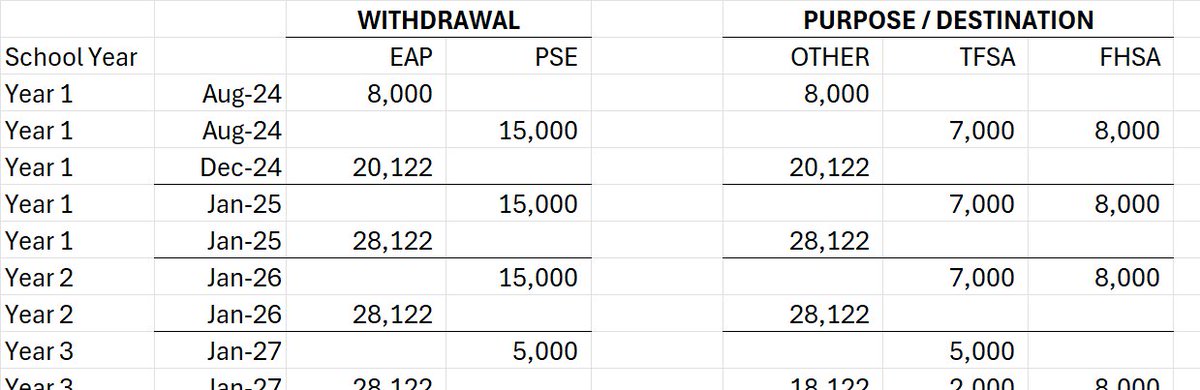

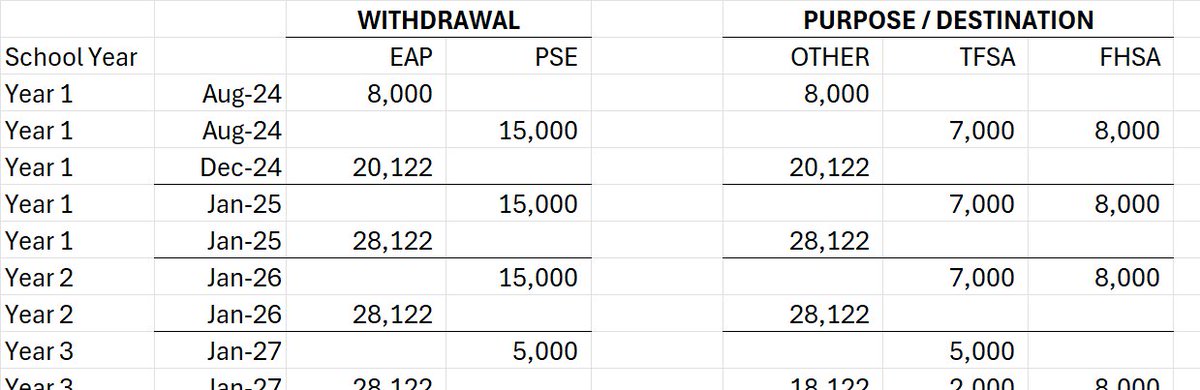

With many personal financial topics, planning ahead is important.

With many personal financial topics, planning ahead is important.